This article was first published on Deythere.

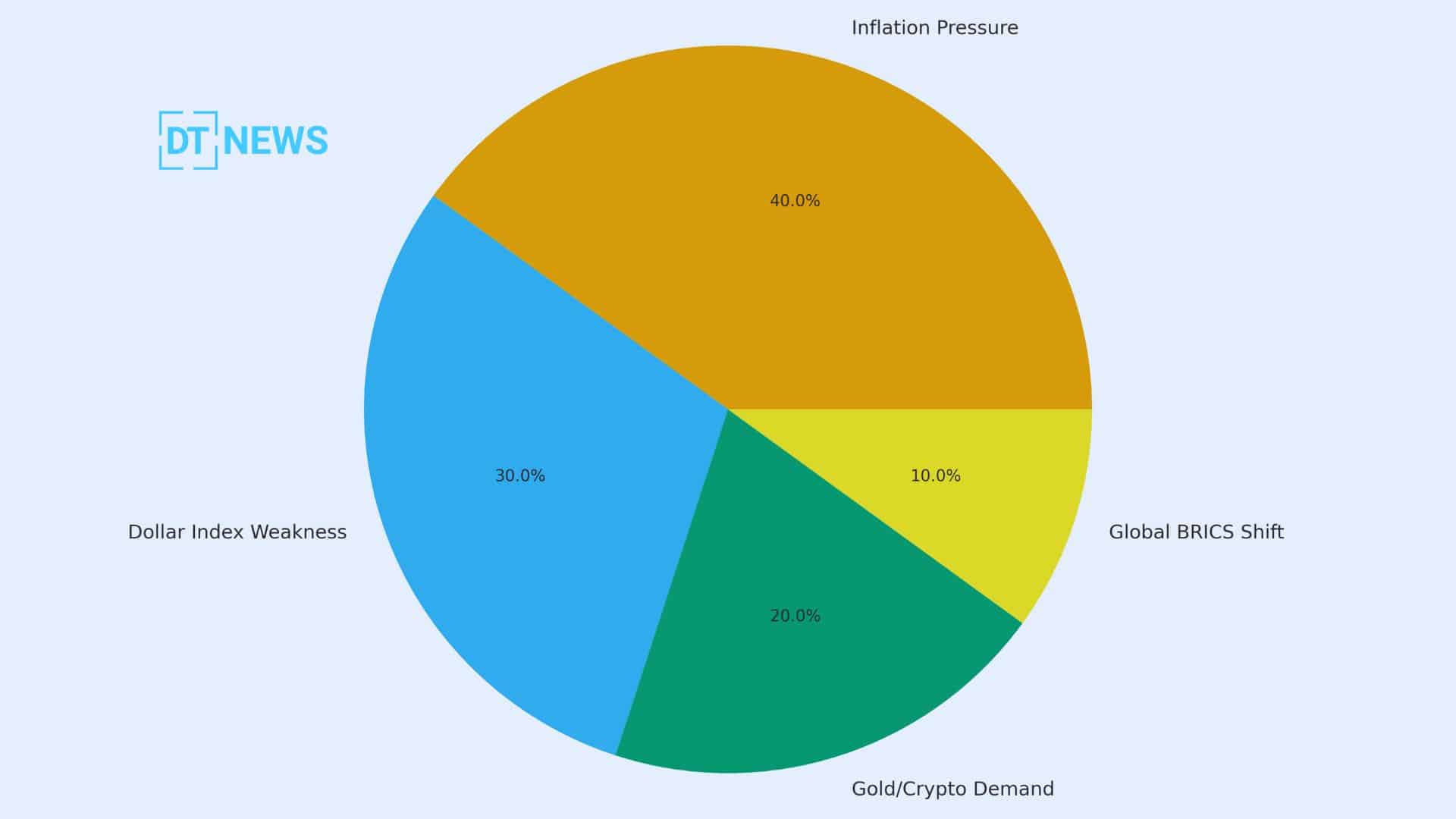

Fears over a potential U.S. dollar collapse are mounting as the latest inflation data showed U.S. prices climbing quicker than forecast.

Labor cost pressures escalated further for the quarter and year in September 2025, with the year-over-year increase in the quarterly data measure of compensation per hour rising to a new high. With the dollar tumbling, more savers are asking if cash can still protect value in the long run.

Among the most outspoken has been Rich Dad Poor Dad author Robert Kiyosaki, who reiterated his warning last month that U.S. dollar holders could end up “the biggest losers” if inflation continues to eat into purchasing power.

His message, repeated for years across his platforms, is that inflation serves as a silent tax on savers and adds to people’s financial frailty.

Inflation Keeps Steady Pressure on Savers

Inflation has bounced around, but other than that it’s been quite stable over 2025. Month-over-month CPI data have come in between 2.3% and 3.0%, indicating consistent price pressure in the system. Energy prices surged, housing stayed expensive, and transportation kept straining budgets. Gasoline in particular saw notable increases over recent months.

This environment reinforces Kiyosaki’s claim that “a weak dollar destroys the middle class first.”

Each year of steady inflation pushes ordinary families further behind, as their savings lose buying power faster than wages can keep pace.

Dollar Index Reflects Global Weakness

The U.S. Dollar Index (DXY), which measures the dollar against major global currencies, offers the same narrative. Analysts forecast a 12-13% decline from early-year peaks into October. By the end of October, it was just below 99 and on a weakening path for the global demand of the greenback.

The falling dollar and the continuous inflation are signs of a currency crash in the making, according to Kiyosaki. He often cautions that such a backdrop could speed the exodus from fiat money and drive more investors toward alternative assets.

Why Investors Turn Toward Gold and Crypto

With the dollar weakening, so does the interest in non-fiat store of value. Gold has moved steadily higher and was around 0.5% higher with spot prices of US$1,788 per ounce on December 8, as international buyers seized on cheaper US dollar signs (it’s priced in greenbacks).

There has also been interest in cryptocurrencies, including Bitcoin and Ether. Kiyosaki is advocating for these assets as well as gold and silver, which he refers to as “a hedge against the currency drop in value” today. Cryptocurrencies are subject to volatility, but given they are not tied to a central bank policy, act as an attractive proposition during uncertain monetary times.

BRICS and Global Shifts Add to the Fear

Kiyosaki has also pointed to growing global interest in alternatives to the dollar. He referenced reports suggesting BRICS nations may consider a gold-backed currency often referred to as the “UNIT.” Although no official confirmation exists, the idea underscores ongoing global fatigue with dollar dominance.

For Kiyosaki, such developments signal a long-term trend toward de-dollarization, U.S. Dollar Collapse Fears Mount as Inflation Hits 3%, one that average savers cannot afford to ignore.

Rising Wealth Concentration Reinforces His Point

Kiyosaki recently highlighted UBS data showing 2,900 billionaires now control $15.8 trillion in wealth, up from 2,700 billionaires holding $14 trillion the previous year. To him, this widening gap illustrates how inflation and weakening fiat money favor asset holders while penalizing cash savers.

Conclusion

A complete U.S. dollar collapse may not be certain, but high inflation coupled with a weakening dollar in a world that is shopping for alternatives to the U.S. currency has brought back discussions on long-term fiscal safety.

Kiyosaki adds that individuals need to continue diversifying into gold, silver, Bitcoin and ether to shelter against continued dollar debasement.

Investors of late seem more willing to rethink how they store value in an age of monetary uncertainty that will only continue the closer we get to 2025.

Glossary of Key Terms

U.S. Dollar Index (DXY): An index that tracks the value of the dollar relative to a basket of other major currencies.

CPI: Consumer Price Index, a measure of how the price level within an economy is changing for everyday consumer goods and services.

Inflation Rate: The rate at which consumer prices increase over time, reducing the purchasing power of your income if it doesn’t keep up.

Fiat Currency: A type of money that a government has declared to be legal tender, but it is not backed by a physical commodity such as gold and exists as value because the governing body says that it does.

FAQs about U.S. Dollar Collapse

1. Could the U.S. dollar actually collapse?

Not quite, but continuous inflation and a weaker Dollar Index forecast long-term weakness.

2. Why does Robert Kiyosaki say you shouldn’t have cash?

He also thinks inflation erodes purchasing power, so that savers lose value over time.

3. Why are gold and crypto in the spotlight?

They are alternative stores of value less dependent on central bank policy and rising inflation.

4. Some of the BRICS nations are working on a new gold backed currency?

There are a few rumours and whispers of conversations, but only that, as far as the official position of BRICS Governments is concerned.