The crypto market has been a grind for long-term investors, especially in the altcoin space. Exhausted by months of low volatility and unclear macro signals, many retail participants are sitting on the sidelines. But under the surface, a new risk-on sentiment may be gaining steam—fueled by movement in traditional equity markets and encouraging Bitcoin price action.

According to Dey There, the stage for a potential summer crypto rally is quietly being set.

Risk Appetite Returns: Russell 3000 Tells the Story

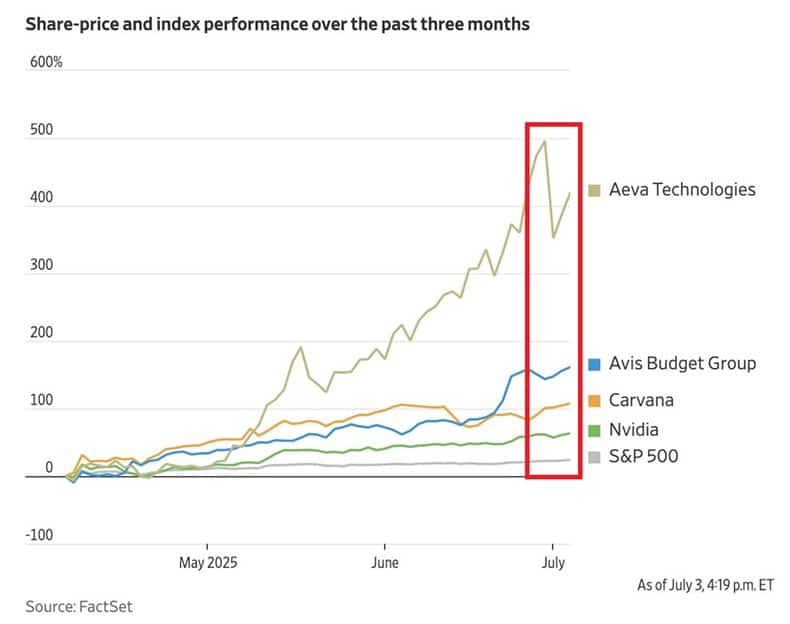

One of the clearest early indicators of renewed market optimism comes from traditional finance. The Kobeissi Letter recently pointed to a resurgence in speculative equity plays, particularly within the Russell 3000 Index.

Data from Bespoke Investment Group reveals a surprising trend: of the 14 Russell 3000 stocks that tripled in price since the April 8 market bottom, 10 belong to unprofitable companies. As of late June, 858 loss-making stocks within the index had rallied an average of 36%, outperforming profitable ones.

Standouts include Avis Budget Group, up 161%, and Carvana, which gained 108%. This speculative frenzy—reminiscent of the 2021 meme stock era—could be an early sign that crypto markets, historically correlated with risk assets, are next in line for a breakout.

Meanwhile, gold dipped nearly 1% today, often interpreted as a shift away from fear-driven safe havens and toward higher-risk opportunities.

Bitcoin Leads the Charge

Bitcoin (BTC) has reclaimed the $108,000 level and recently surged past $109,000 following the U.S. market open. Analysts attribute this strength to positive geopolitical sentiment, including EU-U.S. reconciliation efforts and optimism around August negotiations.

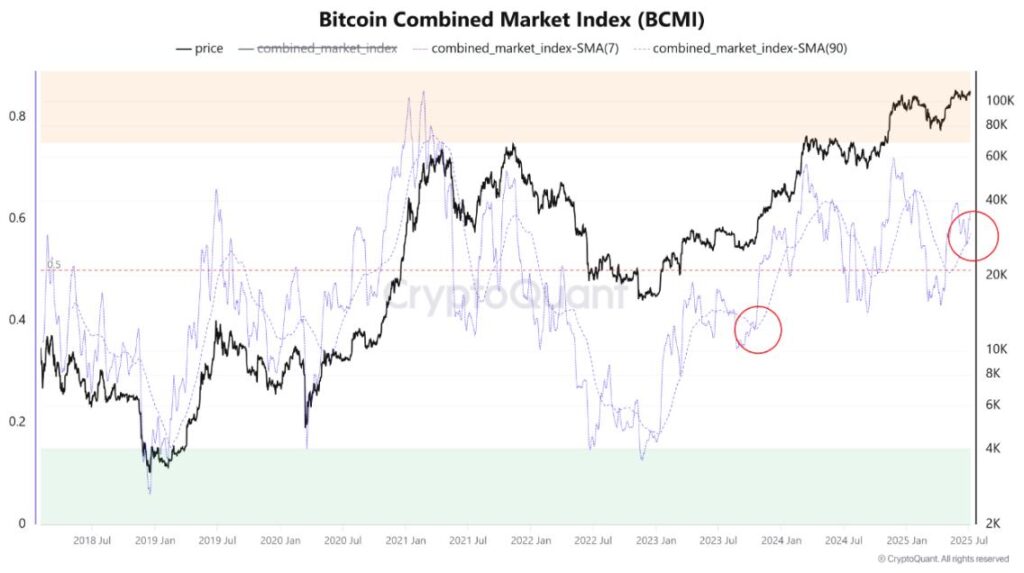

Technical analysts are also turning bullish. Carl Moon shared an updated BCMI chart, noting strengthening momentum. Trader Jelle believes Bitcoin has already broken out of a bullish pennant pattern and could be headed for a new high, with a target of $150,000.

Veteran analyst Michaël van de Poppe echoed the sentiment, stating:

“It feels like the calm before the storm. Volatility in BTC and ETH is at historic lows, which often precedes a major move—and I believe that move will be to the upside. People are still traumatised by the bear market and aren’t ready for a full-blown rally.”

Altcoin Sentiment: Down But Not Out

While short-term traders have found success in recent months, altcoin holders have struggled with fatigue. Many projects remain in consolidation or retracement, but renewed risk appetite in equities—and a strong Bitcoin—could serve as catalysts for recovery.

If the Federal Reserve signals a rate cut in its late-July meeting, analysts believe August could see the emergence of a true “summer bull run,” with altcoins finally catching up to BTC’s resilience.

Sources:

- The Kobeissi Letter (July 2025 Market Analysis)

- Bespoke Investment Group

- Carl Moon Technical Charting