Institutional crypto adoption has turned what people hoped would be a big bull market into one of the quietest ones. At one point, $BTC went up to a new high, but traders still said the market felt slow and dull.

- What Does Institutional Crypto Adoption Really Mean?

- Why does this bull run feel restrained?

- How did major institutions become the driving force?

- What role did meme coins play in this transformation?

- How did global economics shape this subdued cycle?

- Have Bitcoin and Ethereum Really Thrived in This Bull Run?

- What lessons are traders learning from this market shift?

- Is this the price of progress or the start of a new era?

- Conclusion

- Glossary

- Frequently Asked Questions About Institutional Crypto Adoption

The usual excitement that used to drive crypto is missing now. The market seems more serious and controlled, and many investors find it tiring.

What Does Institutional Crypto Adoption Really Mean?

Institutional crypto adoption means that large banks and investment firms are starting to become active players in digital assets. Rather than engaging in short-term trading, they are investing through Bitcoin and Ethereum ETFs, custodian services, and long-term holdings.

The result of their entry has turned the crypto markets more steady and organized, but it feels less lively for small traders. The 2025 bull run does not feel as lively or have the same energy as other bull runs in the past, and a lot of the energy comes from large traders and funds.

Bitcoin has performed well, but for almost all altcoins, they have not nearly performed as well and there is not similar excitement. The narrative around the crypto markets has matured, as the focus has switched to stable growth instead of wild speculation.

Why does this bull run feel restrained?

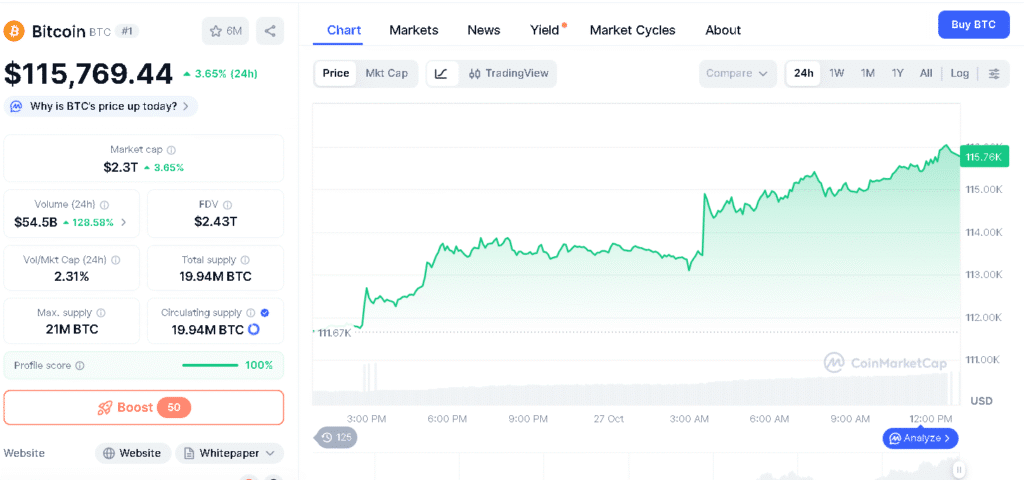

At first, the market looks strong when you see the numbers. $BTC has grown a lot since its 2023 lows, showing that people still trust digital assets.

But many small traders who once made big market moves are now gone. Experts say this change shows how institutional crypto adoption has brought order to the market and turned excitement into professionalism.

How did major institutions become the driving force?

In the past, big financial companies were unsure about joining the crypto market, but now they are taking the lead. Firms such as BlackRock, Fidelity, and Goldman Sachs are treating crypto as a serious part of their business.

They have put money into ETFs, tokenized assets, and safe storage services that make the system stronger. Experts say institutional crypto adoption has made crypto an accepted part of global finance, but it has also taken away some of the freedom and excitement that used to define it.

What role did meme coins play in this transformation?

In 2024 and early 2025, meme coins drew massive attention across the crypto space. New tokens surfaced almost every week, climbing fast on excitement and falling just as sharply.

Many retail traders lost savings while chasing sudden profits, leading to fading confidence in the space. This growing disappointment encouraged more investors to turn toward institutional crypto adoption, seeking security and trust over risky, joke-based trading.

How did global economics shape this subdued cycle?

Economic policy played a major role in shaping market behavior. Under President Trump, higher tariffs and firm interest rates made it harder for money to move freely.

This slowed speculative activity and made investors more careful with their decisions. Experts say these conditions encouraged institutional crypto adoption, as it matched the shift toward regulated and long-term financial strategies.

Have Bitcoin and Ethereum Really Thrived in This Bull Run?

Even with a volatile market, Bitcoin and Ethereum remain the top-performing digital assets of this cycle. $BTC has sustained its value and earned the trust of investors over time, while $ETH has benefited from the increased use case with smart contracts and institutional products.

Analysts believe that institutional crypto adoption has solidified both coins as a sound base to stand on for long term investments instead of being treated as different speculative instruments.

Where many altcoins have been decimated or have faded in interest, the durability of Bitcoin and Ethereum is a reflection of trust that they have driving utility and purpose for much longer than their price change on the global market.

What lessons are traders learning from this market shift?

For many traders, this market cycle feels more about holding on than making quick gains. The easy money of earlier years has given way to careful planning and long-term thinking.

Institutional crypto adoption has added more order and regulation, but it has also changed how people feel about the market. What was once driven by risk and creativity now looks more controlled, where patience matters more than excitement.

Is this the price of progress or the start of a new era?

People have mixed opinions about how this change has shaped the market. Some say institutional crypto adoption has helped crypto grow up by adding safety, recognition, and long term trust.

Others feel it has taken away the creativity and close community that once made the space different. No matter the view, this shift marks a new stage where digital assets are defined more by stability than by hype.

Conclusion

Institutional crypto adoption has given the 2025 bull market a very different look. The wild rallies and dramatic crashes of earlier years have faded, replaced by slow and steady movement.

Bitcoin now represents this calmer phase, showing progress built on trust instead of hype. The pace may be slower, but it suggests that the market’s real power now comes from consistency and staying power.

Glossary

Retail Investors: Everyday people trading crypto on their own, often in smaller amounts.

Bull Run: A strong upward phase when crypto prices rise steadily over time.

Bitcoin ETF: A stock market fund that lets people invest in Bitcoin without directly buying it.

Market Shift: A noticeable change in how crypto market moves

Quiet Bull Market: A slow, steady rise in prices without the usual buzz or excitement.

Frequently Asked Questions About Institutional Crypto Adoption

How is institutional adoption changing the crypto market?

It is making the market more stable but less exciting for small traders.

Why is Bitcoin getting more attention from institutions?

Bitcoin is getting more attention as it is seen as safer and more reliable than other coins.

Why are altcoins not doing well in this bull market?

Altcoins are falling because most big investors are focusing on Bitcoin and Ethereum.

What is happening with meme coins in 2025?

Meme coins are rising and falling very fast, giving quick profits but also big losses.

Why do people call this bull market a “quiet” one?

The Bull market is quiet as prices are going up slowly without too much hype or excitement.