After seven days of strong inflows, the tide turned on October 22 with the first outflows from U.S. spot Bitcoin exchange-traded funds (ETFs). During this period, over $2.6 billion in inflows were recorded. However, Ark and 21Shares’ ARKB fund saw significant outflows, resulting in a total net outflow of $79 million.

Inflows Turn into Outflows After Seven Days

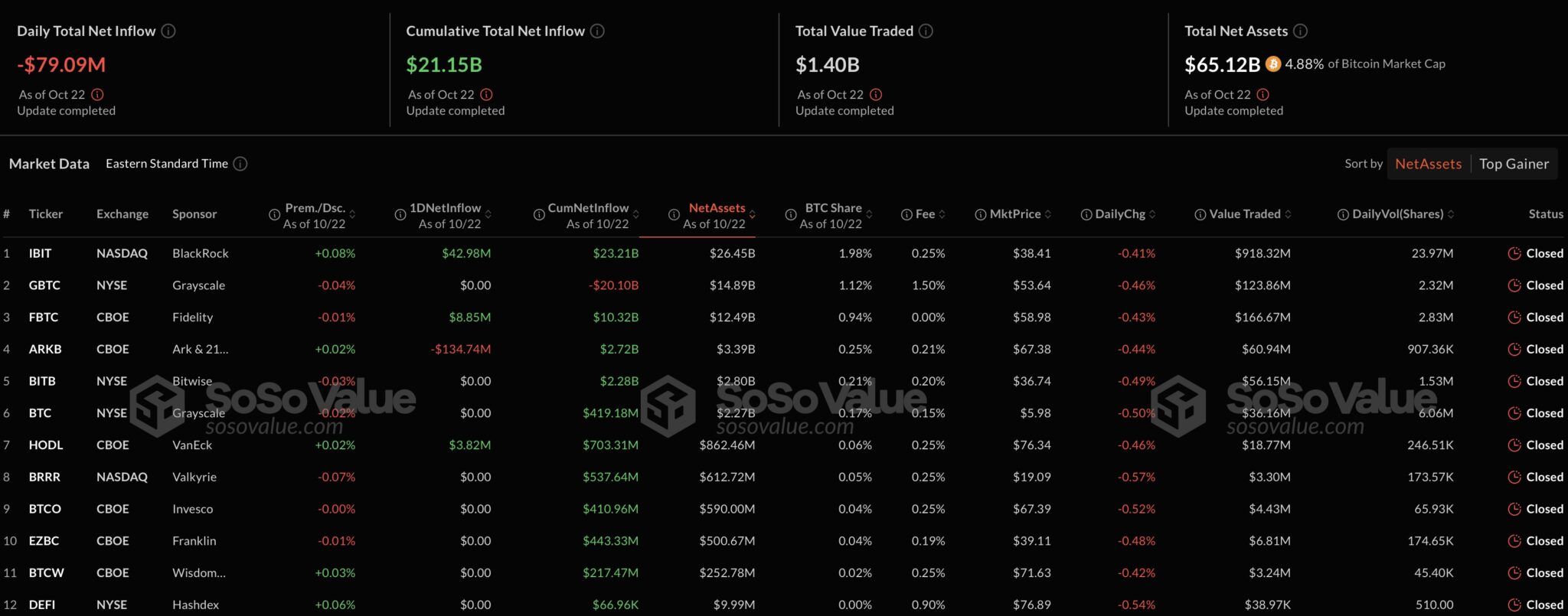

According to SoSoValue data, U.S. spot Bitcoin ETFs experienced a total net outflow of $79.09 million on October 22. All the outflows came from Ark and 21Shares’ ARKB fund. In contrast, BlackRock’s IBIT fund saw a net inflow of $42.98 million, Fidelity’s FBTC fund recorded $8.85 million in net inflows, and VanEck’s HODL fund saw a $3.82 million inflow. The other eight funds reported zero flows for the day.

As a result, the total net inflows for the 12 spot ETFs decreased to $21.15 billion. Daily trading volume also fell, dropping from $1.76 billion the previous day to $1.4 billion.

These outflows came just after a seven-day period of strong inflows, during which U.S. spot Bitcoin ETFs accumulated $2.67 billion in total. BlackRock’s IBIT fund alone accounted for $1.5 billion of these inflows during this time.

On the same day, Bitcoin’s price experienced a slight dip, trading at $67,132 after falling by 0.38% from a high of $69,400. While investor interest remains high, the outflows on October 22 sparked some uncertainty in the market.

Spot Ethereum ETFs Also See Some Activity

Alongside the Bitcoin ETFs, spot Ethereum ETFs showed some movement as well. On October 22, there was a total net inflow of $11.94 million, all of which came from BlackRock’s ETHA fund. The other eight Ethereum ETFs reported net zero inflows.

The total trading volume for Ethereum ETFs was $118.4 million, a drop from the previous day’s $163.18 million. At the time of writing, ETH was down 0.99%, trading at $2,611. Since their launch, spot Ethereum ETFs have seen a total net outflow of $488.85 million.