This article was first published on Deythere.

- The Governance Vote and Approval

- Mechanics Behind the Token Burn

- Effects on Tokenomics and Supply Figures

- Market and Community Response

- Latest Hyperliquid (HYPE) Price Predictions Table

- Conclusion

- Glossary

- Frequently Asked Questions About Hyperliquid Token Burn

- What is the Hyperliquid burn proposal that was approved in December 2025?

- What makes these burn tokens burned?

- Why was the governance vote needed?

- Did the token burn require a blockchain transaction?

- References

Hyperliquid, the decentralized finance (DeFi) protocol characterized by its lightning-fast perpetual markets and aggressive tokenomics model, has made a move towards the economic structure of its native asset HYPE.

The governance validators have overwhelmingly approved a proposal to officially recognize 37 million HYPE tokens as permanently burned , which subtracts a substantial amount of the token’s supply from both circulating and total numbers.

The Governance Vote and Approval

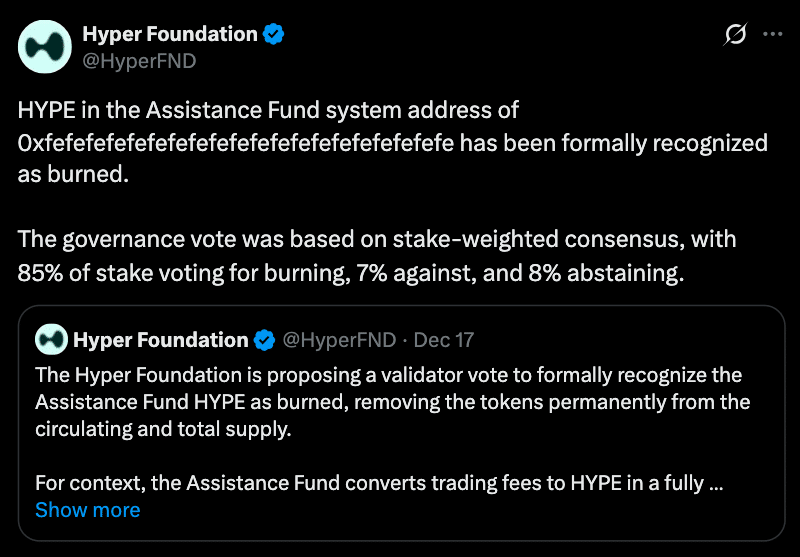

A stake-weighted governance process was completed by Hyperliquid validators in which approximately 85% of the participants voted to have the tokens held in the Assistance Fund permanently classified as burned.

The governance motion began in mid-December after the Hyper Foundation published a plan to exclude about 37 million HYPE tokens, valued at nearly $912 million at current prices, from circulating supply and total supply calculations.

According to the design of the system, these tokens were already locked in an account with no private key and therefore can’t be accessed. But before the votes, they were still included in official supply figures.

The burn approval finalizes their removal and removes the ambiguity around the token’s economic state by increasing supply transparency.

Mechanics Behind the Token Burn

The Hyperliquid token burn is unlike other token burns as the tokens were already functionally locked. The 37 million HYPE sat in an Assistance Fund system address without a private key, meaning, under the current protocol rules, there was no way for the foundation or its validators to move them unless those protocol rules were fundamentally changed.

This situation caused many in the market to treat the tokens as de facto burned well before any vote took place.

The governance for this approval took place between December 17 and December 24, with validators signaling initial votes by December 21st and delegating stake in order to support validator positions before the final tally.

Effects on Tokenomics and Supply Figures

The authorized Hyperliquid token burn effectively eliminates a figure of more than 10% from the total circulating supply or official counts of HYPE. Analysts monitoring the burn said the removal of these tokens now officially makes supply closer to actual market reality, potentially impacting investor sentiment and environmental comparisons.

Before the governance approval, the assistance fund balance had been steadily growing through periodical buybacks paid by HYPE trading fees. The foundation spent an average of about 1.5 million per day on buys, buying almost 498k tokens in just the past week.

Market and Community Response

The governance approval has been met with mixed reactions from the Hyperliquid community and general crypto industry. Official news immediately after the vote count showed the 85% validator support and stressed the importance of governance in determining token supply systems.

The Community response online has generally been split between those who see the burn as a step towards better tokenomics and those who view it as largely a governance cosmetic change.

An analysis of market data shows a mixed price response around the time of the approval. With HYPE tumbling the past couple of weeks, Hyperliquid is attempting to slow the slide down with the burn, reducing the circulating supply by 11-13%. The logic is to reduce sell-side pressure after the token plummeted from nearly $50 to around $24.

The burn, which was approved by a vast governance vote, follows months of consistent buybacks. Early indications suggest some relief; fewer tokens are making their way onto exchanges and buyers have outnumbered, for the first time in weeks, sellers.

If this rotation is retained and demand gains momentum, HYPE may rebound toward $30 and maybe even $50. If not, then the risk down is still there, and $20 remains a weak level of support.

Latest Hyperliquid (HYPE) Price Predictions Table

| Source | Year Covered | Predicted Low | Predicted Average / Mid | Predicted High | Notes |

| CoinPedia | 2026 | $25 | $50 | $90 | The forecast includes a potential breakout if demand increases, with resistance around $32.50 influencing short-term moves. |

| CoinLore | 2026 | $19.66 | $58.78 | $58.78 | Based on technical trend analysis projecting max $58.78 for 2026. |

| CoinDataFlow | 2026 | $10.34 | $20.96 | $31.59 | Shows a wide range of outcomes, from conservative to moderate growth. |

| OKX Price Prediction Tool | 2026 | – | ~$25.09 | – | Year-end estimate based on gradual annual growth assumption. |

| Weex Crypto Wiki | 2026 | $19.85 | ~$37.36 | $54.87 | Forecast assumes broader crypto adoption and HYPE utility expansion. |

Conclusion

The Hyperliquid token burn has trimmed up tokenomics and matched up statistics of real on-chain values. The decisive validator approval with about 85 percent support shows community consensus on the topic of supply transparency and long-term economic design.

The practical implications of the move were null as these tokens were already not redeemable anyway. This has set an example for how protocol economics can be optimized through on-chain governance, and as proof of concept that the ecosystem is capable, through DAO, to evolve our token models for the better.

Glossary

Hyperliquid token burn: Assets that have been removed from circulating supply through a governance process (preventing them from being accessed at any point in the future).

The Assistance Fund: an address in Hyperliquid protocol, where trading fees are exchanged for HYPE and stored; tokens there are locked without a private key.

Validator vote: A protocol-upgrading decision made in a proof-of-stake system implemented by network stakers, based on the size of their stakes.

Circulating supply: The sum of all tokens in the market that aggregators record.

Total supply: The total amount of tokens that will ever be available, as well as those not in circulation.

Frequently Asked Questions About Hyperliquid Token Burn

What is the Hyperliquid burn proposal that was approved in December 2025?

The Hyperliquid community, using a validator governance vote, agreed that 37M HYPE tokens (previously held on the inaccessible Assistance Fund address), are now officially taken out of circulating and total supply count by being considered as burned and forever gone.

What makes these burn tokens burned?

The HYPE tokens were, in fact, already relatively inaccessible, which isn’t the case for on-chain burn transactions. The governance vote made their exclusion from top up supply counts official, to reflect economic reality.

Why was the governance vote needed?

Even though these tokens were locked, they were still counted within the supply. The vote guarantees that the supply metrics are, in fact, proportional to their unavailability.

Did the token burn require a blockchain transaction?

No. Since the HYPE were already in an address with no private key, there was no on-chain transaction required. The vote merely alters accounting and governance status.

References

CryptoNewsZ

AMBCrypto

CryptoNews

MEXC

The Defiant

CoinMarketCap

AInvest