This article was first published on Deythere.

- HYPE’s Recent Action And Market Background

- Bull, Base, Bear Cases For HYPE Price Prediction

- Technical Signals and On-Chain Drivers

- Expert HYPE Price Prediction

- What It Means for Traders and Long-Term Investors

- Conclusion

- Glossary

- Frequently Asked Questions About HYPE Price Prediction

- How do the price works for token unlocks?

- Can HYPE reach $90 in 2026?

- Is the token being impacted by institutional demand?

- Does broader crypto sentiment matter?

- References

As the crypto market wades through volatility in early 2026, Hyperliquid’s native token HYPE is being watched by investors. Given the recent market behavior, HYPE has been seen defending the key support near and reacting to protocol upgrades and supply events.

Now, traders and analysts are trying to look out for HYPE price predictions, identify where the token could go next, especially given how quickly trading volume, token unlocks and technical setups have changed.

HYPE’s Recent Action And Market Background

In late January of 2026, Hyperliquid cut its planned February token unlocks by an 88% estimate, reducing the potential selling pressure and fueling a HYPE rally in which prices soared about 50% from lows.

This was a conscious supply shock as the tokenomic structure changed to reduce expected token issuance from millions to transparently lower and this gave markets reasonable space to soak up supply without overly downward pressure.

On-chain activity around the same time indicated strong interest in HYPE. Whale accumulation and an increase in trading volume driven by all-time high commodities trading on Hyperliquid’s HIP-3 derivative markets, helped push prices higher and reinforce the narrative behind institutional interest in the token if its utility proposition held true.

Community buzz increased in early February when Hyperliquid launched HIP-4, an upgrade to the protocol that introduced prediction markets and outcome trading.

HYPE soared over 10%, showing how new products added to the network can have an effect on price action. But some traders observed a pullback after the initial rally, noting a “buy the rumor, sell the news” trend that is common in crypto markets.

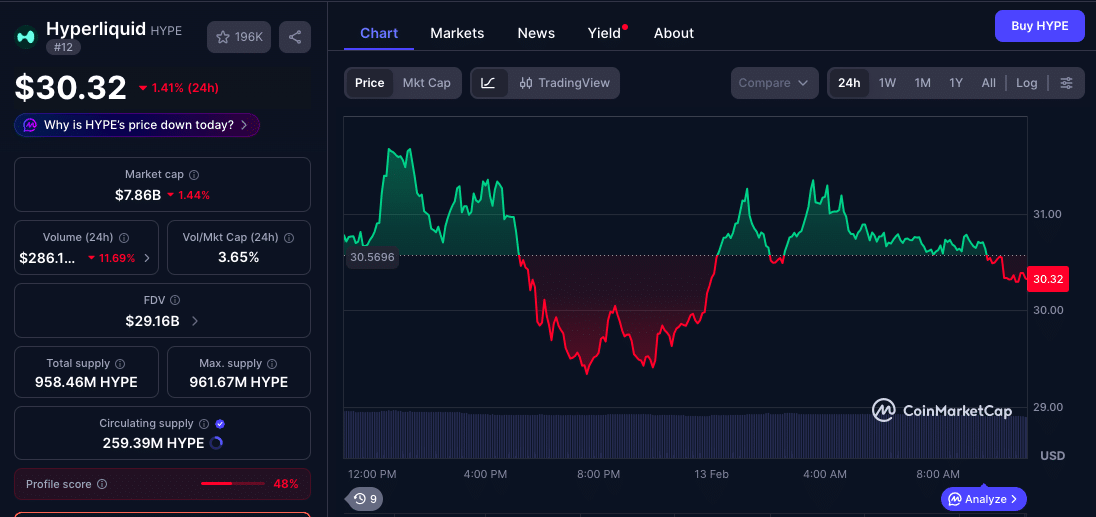

A wider array of crypto prices, meanwhile, continues to be volatile. As of mid-February 2026, Bitcoin dipped and rebounded around key levels, contributing to mixed sentiment across altcoins including HYPE.

Bull, Base, Bear Cases For HYPE Price Prediction

In a bull scenario, HYPE is powered by institutional adoption and deeper on-chain demand. Ongoing expansion of the commodities market and decentralized derivatives could drive even greater demand for HYPE. With token unlock cuts and automatic buyback mechanisms helping to drive reduced supply, bulls argue that some upside momentum can take these altcoins toward multi-week or even multi-month highs given an overall friendlier market condition.

The base HYPE price prediction assumes that HYPE trades in an area that accommodates both its utility and market uncertainty. Prices may consolidate around the $28-$32 level following large unlock events and mixed sentiment, punctuated by spikes related to product announcements or sudden increases in volume.

Such range-bound trading is consistent with the market having acted this way in similar periods of low liquidity and strong volatility.

In the bear case, broader crypto market weakness and negative sentiment could overshadow any positive catalysts. If both prediction markets and the larger derivatives segments continue to lag, or if unlock events overwhelm demand, HYPE might drop existing support levels below and probe lower floors established in previous months.

Technical Signals and On-Chain Drivers

HYPE price action and technical analysis reveal a sharp reversal off trendline support around $28-$30 region, showing buyers stepping into lower levels of value, something traders usually view as an indication of base building ,not breakdown.

Lower transaction fees, and increasing trade volume provide another context. The low cost can encourage traders and supporters to hold coins for longer periods of time, and trade them more often, potentially increasing liquidity and volatility, things that bullish traders equate to supportiveness in prices.

Meanwhile, the token unlock dynamics remain crucial. Large unlocks can flood the market with supply and stifle price performance, but Hyperliquid’s decision to minimize planned unlocks this month has taken some pressure off that area and now acts as support factor for price.

Expert HYPE Price Prediction

The following HYPE price predictions and forecasts are provided by external resources which track short-term and mid-term Hype Finance market trends.

| Source | 2026 Price Forecast | Interpretation |

| CoinCodex | $22.88 (near-term dip) | Short-term projected pullback due to volatility and resistance levels. |

| CoinLore | $32.86 – $96.64 | Projected range for 2026, reflecting potential rally and volatility. |

| MEXC News | Low $25 – High $90 | Broader range indicating average to optimistic scenario in 2026. |

This range suggests that expert predictions are mixed, due to volatility and the ongoing uncertainty in emerging DeFi tokens like HYPE.

What It Means for Traders and Long-Term Investors

Looking at the recent HYPE price prediction, traders and investors are tracking a few indicators for HYPE in order to gauge the latest momentum.

First, demand reactions tied to protocol upgrades like the surge after HIP-4 for prediction markets, point to HYPE’s value as a utility token within its ecosystem.

The second is that institutional involvement, in commodities trading and on Hyperliquid’s protocols, could create a bid under price levels at which selling starts, which would help soften sell-offs.

This is backed up by healthy open interest in the derivatives markets.

But the wider volatility of the crypto space, as seen by fluctuations in Bitcoin, continues to have an impact on altcoins such as HYPE.

Conclusion

The 2026 HYPE price prediction is riddled with a wide range of variability, from short-term pulls below support to potential rallies if institutional activity and on-chain demand strengthen.

Predictions from experts are mixed, but most believe that the price of HYPE may be unstable as per changing market conditions. Tokenomics adjustments such as reduced unlocks and actual utility improvements, have led to a situation where upside and downside can each be rationalized.

And as with everything in crypto, price action will not be dictated only by what’s happening within the industry, but also by macro sentiment that carries wider markets.

Glossary

Token unlock: The scheduled distribution of new tokens in circulation, which can affect the price through supply.

Open interest: The amount of value represented by a futures or options on derivatives that are still active, typically an indicator of trader activity.

Trendline support: A type of technical analysis that is used to show price levels where historically a stock has met buying resistance.

Frequently Asked Questions About HYPE Price Prediction

How do the price works for token unlocks?

Large unlock events can increase circulating supply, exerting downward pressure on price if demand doesn’t absorb the new tokens.

Can HYPE reach $90 in 2026?

If the demand and technical conditions meet, according to some expert predictions, the market might see a trigger high around $90.

Is the token being impacted by institutional demand?

Yes. Increased activity on derivatives and commodities markets supported by Hyperliquid introduces a structural use case with the potential to exert price effects.

Does broader crypto sentiment matter?

Absolutely. Bitcoin and top-altcoin volatility are determining trader attitudes everywhere.

References

AMBCrypto

Cryptopolitan

Digital Journal

CoinCodex

KuCoin

CoinLore