Updated on 26th October, 2025

- New context that matters in 2025

- What the linked report adds to the playbook

- Pre-listing detection in 2025, boiled down

- Layer 1: On-chain reality check

- Layer 2: Market structure and inventory risk

- Layer 3: Exchange policy breadcrumbs

- Reading social data without getting faked out

- Launchpads, incubators, and the mid-tier bridge

- What the data says about post-listing behavior

- Risk, stated plainly

- A practical workflow a desk can run every week

- Newsy wrinkle to keep on the radar

- Conclusion

- Frequently Asked Questions

- Glossary of long key terms

The big idea, plainly stated

Catching a token before it lists on a top exchange is part research, part patience, and part pattern recognition. The edge comes from mastering the plumbing that precedes a listing, not from chasing rumors.

Traders who blend on-chain data, social momentum, and exchange policy breadcrumbs stand a much better chance of identifying credible candidates early. That is exactly where pre-listing detection becomes a repeatable process, not a lucky break.

New context that matters in 2025

The landscape shifted. Major U.S. venues now publish clearer listing processes and technical standards. One leading exchange describes a formal Digital Asset Support Group vote and standards across legal, compliance, and security. That tells readers the bar is procedural, not purely promotional. Updates released in September underline an application flow that can take hours to months, depending on complexity.

On the other side, a global exchange has iterated its intake funnel with programs such as Innovation Zone, Launchpool, and newer vetting tracks. Public posts in 2025 emphasize user protection, disclosures, and long-term quality, which helps analysts read what gets fast-tracked.

The takeaway is simple. Pre-listing detection in 2025 is less about wild guesswork and more about cross-checking a project against what the venues already say they want.

When a chief executive states, “our goal is to list every asset where it is legal to do so,” the quote is not marketing noise. It is signal that policy and compliance shape the pipeline more than hype cycles. It also hints at why some popular assets wait in line if they do not satisfy jurisdictional or technical requirements.

Meanwhile, debate around listing standards on other venues flares up every few months, often after founders share experiences on X. That chatter, plus official posts reiterating security and compliance expectations, gives researchers an extra channel to cross-validate claims. Pre-listing detection is stronger when public statements and project behavior rhyme.

What the linked report adds to the playbook

The linked piece lays out a modern scouting workflow that blends social discovery, launchpad calendars, on-chain holder growth, and watchlists for mid-tier exchange activity that tends to precede top tier listings.

The core message is that transparency on public ledgers, plus structured community monitoring, can surface legitimate candidates well before the broader market wakes up. That is practical. Pre-listing detection works best when the inputs are measurable and the noise is filtered.

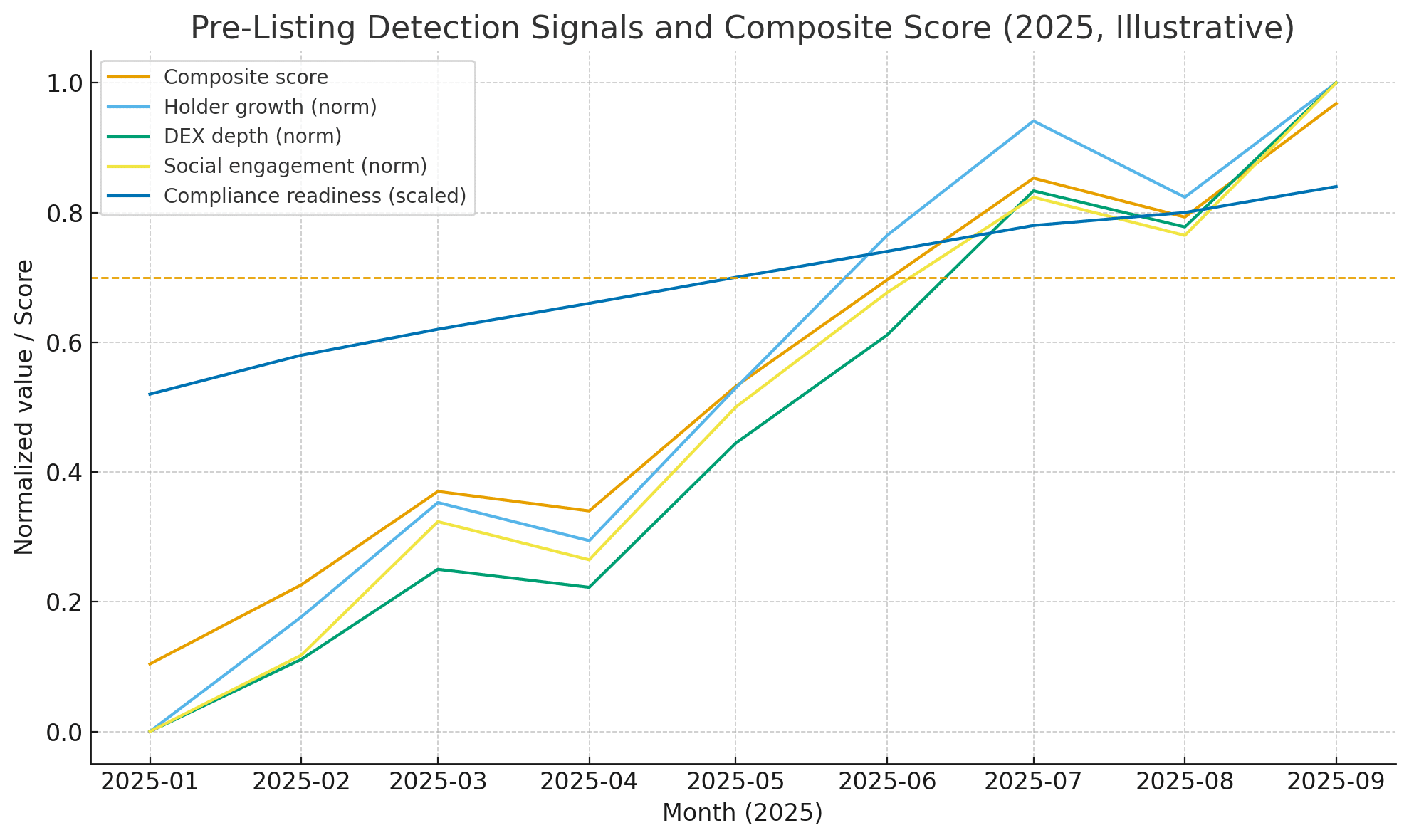

Pre-listing detection in 2025, boiled down

Pre-listing detection is a three-layer filter. First, confirm there is real user activity on-chain. Second, confirm that liquidity and token economics can support a larger audience. Third, map the asset to the known listing preferences of target venues. If all three align, the odds rise.

Layer 1: On-chain reality check

Projects that graduate to the big stage leave trails. Wallet growth that accelerates over consecutive weeks, unique holders that do not cluster into a handful of addresses, and consistent active addresses around real transactions point to authentic demand.

The linked guide suggests watching block explorers and analytics dashboards for holder growth and volume bursts around new pairs. Pair that with flows linked to known funds to see whether smart money is climbing in, not just airdrop seekers. Pre-listing detection thrives on this bottom-up evidence.

Layer 2: Market structure and inventory risk

Headline narratives fade if markets cannot absorb size. Deep liquidity on a major DEX, clean spreads, and steady fee capture on pairs that already face outside order flow are building blocks. If liquidity providers can keep tight ranges without daily whiplash, that is another green light. Pre-listing detection is not only about who is talking. It is about whether a new audience can actually trade without breaking the book.

Layer 3: Exchange policy breadcrumbs

Public listing pages outline decision gates that are surprisingly concrete: technical security, legal posture, market integrity, and integration overhead. Assets that fit existing token templates or popular virtual machine standards often move faster because the engineering cost is low.

A project that ships clean audits and shows a clear roadmap tends to rank higher. When a venue’s blog says the standards apply to every asset and the application is free and merit-based, it narrows the rumor mill. Pre-listing detection uses those stated criteria as a checklist, not a wish list.

Reading social data without getting faked out

The community still sees early. X threads, Discord AMAs, and early developer updates often precede formal announcements. The trick is to separate organic conviction from synthetic buzz.

The linked report highlights using topic filters and minimum engagement thresholds to strip away bot storms. Analysts can then cross-reference with repo activity and contract interactions to confirm that talk lines up with building. That is where pre-listing detection earns its keep.

Launchpads, incubators, and the mid-tier bridge

Historically, listings on mid-tier venues serve as proving grounds. If a token handles real demand, keeps uptime, and does not trigger exploit chatter, it often graduates. Public posts from large venues describe how their incubators and innovation arenas tilt toward projects with strong use cases, security, and transparent governance.

Smart researchers watch this bridge closely. Pre-listing detection that tracks incubator cohorts, liquidity programs, and staking events will almost always get better entries than headline-chasing.

What the data says about post-listing behavior

Independent market research has documented the so-called listing effect for years. Volatility spikes. Liquidity deepens. Long-tail assets usually experience stronger whipsaws than large caps. That pattern is consistent with a market that reprices attention and unlocks new venues for hedging and custody.

Recent research also shows that some venues lean into rapid-fire additions to serve retail demand, which can influence mix and quality. None of this guarantees a moonshot, but it sets expectations. Pre-listing detection should plan for both the pop and the fade.

Risk, stated plainly

The chase has risks. Security events, fake presales, and rug pulls remain part of the landscape. The linked guide cautions readers to validate contract code and to diversify sizing on speculative names. In practice, that means never treating a pending listing as a thesis all by itself. Pre-listing detection is a map, not a promise.

A practical workflow a desk can run every week

An editorial desk or research team can standardize the hunt. Start with a weekly scrape of social engagement for sectors that rotate into favor, such as AI, real world assets, or decentralized physical infrastructure.

Cross-check candidates with holder growth and fresh pair volumes. Compare contract audits and look for red flags in token distribution. Then run each candidate through the stated listing standards of target venues, noting integration complexity and jurisdictional risk. The best pre-listing detection setups usually survive that final compliance screen.

“our goal is to list every asset where it is legal to do so.” That line captures the expansion drive of U.S. venues and explains why regulatory clarity speeds up the pipeline. On the global side, official posts emphasize that listing routes exist to protect users and prioritize quality over short-term attention.

The contrast is useful. Pre-listing detection that respects both philosophies will find opportunities across regions without fighting house rules.

Newsy wrinkle to keep on the radar

Broader market structure changes can bend the path to discovery. In September, U.S. regulators approved generic listing standards for certain commodity-based exchange traded products across major exchanges.

That decision is separate from token listings, but it can funnel fresh attention toward crypto baskets and themes. Attention drives discovery. Discovery creates the conditions for earlier secondary listings. Smart pre-listing detection teams monitor these macro catalysts because they pull liquidity and research toward new corners of the market.

Conclusion

The smartest approach to spotting potential listings is boring in the best way. Verify growth on-chain. Verify that liquidity and fee mechanics can support real trading. Verify that the project fits what the venue says it can list.

Add the human layer by listening to credible voices and reading the room without falling for astroturf. If every box checks out, pre-listing detection gives editors and traders a fair head start. It is patient work. It is repeatable. It is how professionals find the next ticker before the rest of the feed catches on.

Frequently Asked Questions

How early can a researcher reasonably identify a credible candidate

Weeks in advance if the signals line up. Holder growth, authentic social traction, clean token economics, and alignment with published listing standards are strong early tells. The most reliable pre-listing detection cases pass the compliance checklist before the rumor cycle gets loud.

Do mid-tier exchange listings predict top tier listings

Not always, but they are useful rehearsals. If uptime holds, liquidity looks healthy, and security chatter stays quiet, graduation odds improve. This is where pre-listing detection shifts from speculation to measured conviction.

Does a venue really try to list everything that is legal

Executives have said exactly that, with the caveat that legal, compliance, and technical standards must be met. That is why popular assets sometimes wait. Pre-listing detection benefits from reading the fine print.

Can AI meaningfully help with scouting

Yes. Natural language tools can triage social chatter, summarize white papers, and highlight anomalies in on-chain flows. These tools augment researchers. They do not replace diligence. The linked guide explains how to use them responsibly. Pre-listing detection gets faster, not lazier, with AI.

Glossary of long key terms

Digital Asset Support Group Vote

An internal governance step at a U.S. exchange where a cross-functional team evaluates whether an asset meets standards across legal, compliance, and technical security before listing. This stage formalizes what used to be a black box.

Innovation Zone

A listing venue inside a global exchange that houses novel or higher-risk assets with enhanced disclosures and user warnings. It allows experimentation while managing risk to the broader marketplace.

Launchpool and Incubation Programs

Mechanisms that distribute tokens to stakers or accelerate early projects under a venue’s umbrella. These programs can signal internal conviction about future listings if a project meets security and compliance bars.

Generic Listing Standards for Commodity ETPs

A framework approved by U.S. regulators that streamlines exchange traded product listings tied to commodities, potentially including crypto baskets. While not the same as token listings, it can reshape investor attention and flows.

On-chain Holder Growth

A transparent metric that tracks the increase in unique wallets holding a token over time. Sustained growth across real users is a foundational input to pre-listing detection.