This article was first published on Deythere.

- What Are Liquidity Pools?

- How Liquidity Pools Work

- Why do Liquidity Pools Matter for DeFi?

- Uses of Liquidity Pools

- Risks of Liquidity Pools

- Expert Analysis and Latest Trends

- Conclusion

- Glossary

- Frequently Asked Questions About Liquidity Pools

- What is a liquidity pool?

- How do liquidity pools allow for trading?

- What is impermanent loss?

- What do LP tokens represent?

- Are liquidity pools safe?

- References

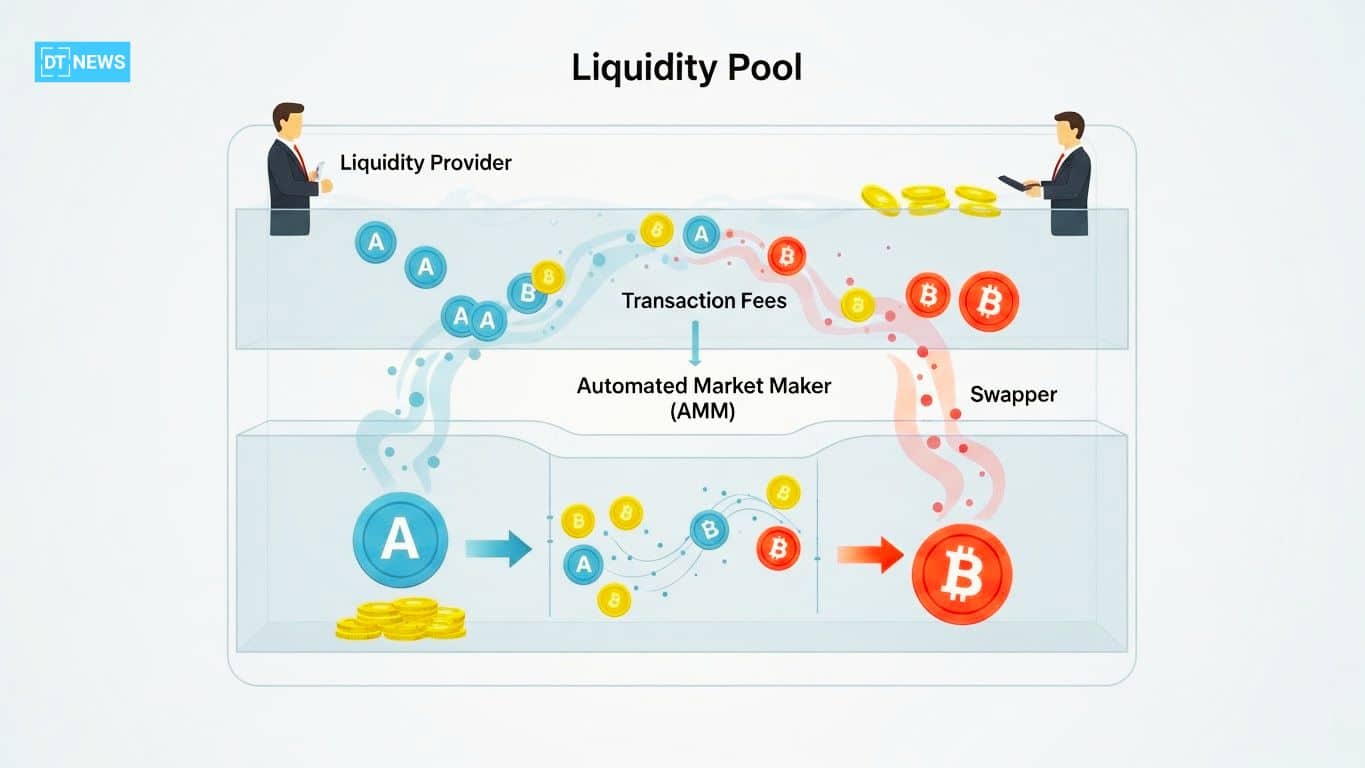

Liquidity Pools are the basis for automated trading in Decentralized Finance. They are crowdsourced pools of cryptocurrencies locked in smart contracts that allow traders to swap assets without a traditional order book or intermediary.

Essentially, a liquidity pool is a smart contract bucket filled with two or more tokens. These pools are filled by the users called liquidity providers (LPs) who deposit their crypto assets into them and receive a part of the trading fees in exchange.

Liquidity pools also support around-the-clock trading so DeFi may continue uninhibited, making digital markets more liquid and efficient.

What Are Liquidity Pools?

At its core, a liquidity pool is simply a smart-contract-based pool of one or more tokens that provides the necessary liquidity for some designated trading pair or DeFi application.

Decentralized exchanges, as opposed to centralized exchanges where buyers and sellers are matched directly, often use Automated Market Makers (AMMs) which draw liquidity directly from pools.

For instance, Uniswap’s AMM allows anyone to trade ETH for USDC at any time by tapping a common relationship pool between ETH and USDC.

This pool is always liquid since it has been prefunded by users. Anyone can create a new pool for the token pair by providing an equal value of both tokens and other users can make trades against it.

As one source clarifies, liquidity pools are crowdsourced assets that provide liquidity on a particular DEX by locking up your crypto assets in a smart contract when used to make transactions on a decentralized exchange.

The crucial insight is that users, not a central market maker, provide the money. When traders make a trade via the pool, smart contracts recalculate token ratios and prices by means of math formulas.

In exchange for providing liquidity, LPs are given LP tokens that represent their portion of the pool. These LP tokens are often tradeable or stakable elsewhere in DeFi. When a provider wishes to remove their stake, they need to redeem (burn) the LP tokens and price back in their previous assets and fee earnings.

Liquidity pools are user-funded smart contracts which replace order books, enabling permissionless, instant trades.

How Liquidity Pools Work

The process and the rules of liquidity pools are fairly simple, run by smart contracts:

Providing Liquidity: Liquidity Users (LPs) deposit two (or more) tokens of equal value into a pool. An LP in an ETH–USDC pool, for example, could put in $500 worth of ETH and $500 of USDC. The pool now holds both the ASSET1 and ASSET2 in reserve. In exchange, the provider gets LP tokens which represent their proportional share of the pool.

Automated Pricing (AMM Formula): Liquidity pools leverage automated market maker algorithms in order to price trades according to the token ratios. The original Uniswap works by preserving the product of the two token balances (x * y = k), so when someone buys ETH with USDC, they add up USD and remove some amount of ETH, thus changing the ratio; this will cause that price of the currency pair to drop relative to the larger pool AMM equation, which is effectively buying more higher priced asset.

There are different formulas in stablecoin pools or other designs, but the basic idea is as follows: Prices adjust according to some sort of algorithm so that there’s always a some liquidity around.

Trading Against the Pool: Traders no longer match orders; instead they trade tokens directly with the pool. To exchange USDC for ETH, the trader deposits (sends) USDC to the pool and receives at that point in time some amount of ETH. After the swap, the pool holds more USDC and less ETH and prices adjust appropriately to what supply and demand suggest.

Fees and Rewards: Each trade made through the pool is subject to a small fee (such as 0.3% on many platforms). These fees are pooled and would be distributed among LPs proportionately.

When an LP exits, he gets back his deposited capital along with a proportion of the fee he earned while supplying liquidity. And some protocols are even offering LPs extra rewards (in governance tokens or yield-farming incentives) for staking their LP tokens.

LP Tokens: When a user joins the pool and contributes liquidity, they will receive special LP tokens. These tokens represent how much of the pool they own. They can also typically be deployed for other DeFi applications (for example, staked in yield farms to earn more). When one redeems their LP tokens, they get their original deposit back as well as the fees that have been accumulated.

These mechanisms ensure that pools always provide crypto market liquidity while they keep token prices in balance and reward providers.

The more tokens are locked in a pool, the deeper the liquidity, and as a result, the smoother trading experience the users will achieve.

Why do Liquidity Pools Matter for DeFi?

In traditional markets, low liquidity is a problem since there might be no counterpart to the trade. Without a buyer or seller, a person might face slippage or a price difference between the expected sale price and the one a person receives.

Liquidity pools ensure that there is always a counterpart to the trade.

The most critical features of liquidity pools are: Continuous Liquidity, Lower Slippage, Decentralized Market-Making, Efficient Price Discovery, Bootstrapping New Markets, enabling new tokens to gain liquidity quickly.

By providing liquidity, individuals can earn passive income through fees and token rewards, which is a unique way for holders to put idle assets to work.

As an overview points out, liquidity pools provide the much-needed speed, convenience and liquidity to the DeFi ecosystem. They replaced the order-book model on DEXs.

Before AMMs and pools, DEXs suffered from poor liquidity and user experience; pools solved this by giving users an incentive to supply assets into them and earn fees.

Nowadays, liquidity pools are at the heart of nearly every major DeFi service be it token swaps or lending and have become fundamental within the cryptocurrency finance ecosystem.

Uses of Liquidity Pools

Liquidity pools support a variety of DeFi use cases beyond mere token swaps. Some common uses include:

Decentralized Exchanges (DEXs): Pools are the foundation of AMM DEXs. For example Uniswap, SushiSwap and PancakeSwap all use such pools for every trading pair. Liquidity in these pools means faster trades and lower price impact.

Lending and Borrowing: Protocols such as Compound and Aave pool resources to match lenders with borrowers. Deposited funds represent liquidity against which others can borrow, and the interest and fees paid for that are shared with depositors.

Stablecoin Swaps: Specialized pools (like on Curve Finance) maintain large reserves of closely pegged assets (DAI/USDC/USDT). Due to concentrated liquidity, they provide very low slippage for trading one stablecoin for another.

Synthetic Assets and Derivatives: Some platforms use pools of collateral to mint synthetic tokens (e.g. Synthetix pooled staking). Automated options or futures trading can also be based on liquidity pools.

Yield Farming: A large number of DeFi projects provide token distribution as an incentive for the liquidity pool. Providers can also farm with staked LP tokens. This leads to symbiotic systems: users provide liquidity and are rewarded with governance or platform tokens.

Cross-Chain Bridges: There are new protocols that make use of liquidity pools on separate blockchains to facilitate swaps between chains. For instance, Flare Network’s USDT0 pool instantly moved funds across chains by activating liquidity pools on each chain. Cross-chain pools are increasingly becoming a major innovation to link fractured crypto markets.

Other DeFi Services: Additionally, liquidity pools also achieve specific use cases such as on-chain insurance (pooling for risk capital), gaming (creation of asset pools used in in-game economy) and fractionalized NFTs(pools which represent shared ownership of an NFT).

Below is a table for some of the most common uses for a liquidity pool and examples of how they might be utilized:

| DeFi Use Case | Role of Liquidity Pools | Example Platforms |

| Token Swaps (DEX) | Provide continuous trade liquidity for asset pairs | Uniswap, SushiSwap |

| Lending/Borrowing | Pool funds from lenders; borrowers draw from pools | Compound, Aave |

| Stablecoin Exchange | Deep pools for low-slippage stablecoin-to-stablecoin swaps | Curve Finance |

| Yield Farming | Pool rewards tokens to LPs, boosting returns | Yearn.finance, Harvest |

| Synthetic Assets | Collateral pools for minting derivatives | Synthetix |

| Cross-Chain Swaps | Bridge pools across chains for seamless transfers | Thorchain, Flare DEX |

| Insurance and Gaming | Risk and asset pools for coverage or game mechanics | Nexus Mutual, Axie |

These cases illustrate how liquidity pools support a variety of DeFi functions by means of locking assets and algorithmically matching trades.

The capacity to pour assets into multiple applications is a principal reason why liquidity pools have revolutionized finance.

Risks of Liquidity Pools

Although there are many benefits that liquidity pools offer, they also come with certain risks for participants.

Impermanent Loss: Unquestionably the biggest risk, impermanent loss is when the value of deposited tokens moves relative to when it was added. For instance, if one supplies ETH and USDC into a pool and the price of ETH doubles, then the AMM will rebalance it so that the pool has more USDC in it than before and thus less ETH.

When the user exits, they have less ETH (the higher valued asset) than if they had left both tokens outside the pool.

This “loss” is impermanent as it goes away if prices come back to where they started, but if prices move far away from that, then the fees earned won’t make up for it.

In other words, if the pooled assets swing extremely from one price to another, such violent swings can actually leave LPs worse off than passive holders.

Smart Contract Vulnerabilities: Pools are just code. The smart contracts can have bugs, and exploits on them can be used to suck funds dry. There are numerous examples in history, e.g. is the 2020 Harvest Finance hack / flash-loan which drained $33.8m from a liquidity pool contract. Even audited protocols are not without risk, so when it comes to trusting assets, users need be careful.

Rug Pulls and Scams: Some pools may be set up with the intent to defraud. For example, a scammer can launch the token, create a pool, lure liquidity and then pull the rug by draining all of its funds. Notable cases (like AnubisDAO in 2021) resulted in investors being defrauded of tens of millions through malicious pools. Always do you your own research and vet projects before adding liquidity.

Market and Volatility Risk: The value of Pool assets can change rapidly in a market crash. High slippage and losses could be incurred when a large trade is executed. When a pool gets too far out of balance or peg breaks (in the case of stable pools) liquidity can dry up and impermanent loss rises sharply.

Opportunity Cost: Deposit liquidity funds cannot be made use of elsewhere (or simply staked in a cold wallet) whilst they are locked into a pool. If another asset does better, or if better return arises somewhere else, LPs experience forgone gains.

To reduce the risks, experts advise the use of long-term operator pools, distribution across several pools, and pumping only a part of the assets in any one pool.

Some DeFi protocols additionally provide for impermanent loss protection or insurance that can remunerate LPs in extreme scenarios.

Nonetheless, anyone who becomes an LP needs to be aware of these trade-offs. Liquidity provision is not without risk, and there may be occasions when one would have gotten more value if they held the assets instead of providing liquidity in the case of impermanent loss.

Expert Analysis and Latest Trends

According to recent developments, DeFi continues to see liquidity pools evolve. One major trend is the increase in cross-chain liquidity. With so many blockchains, new bridges and pool networks allow users to swap tokens across chains without having to rely on centralized exchanges.

This might mean a liquidity pool on one chain aiding trades on another, which increases the overall efficiency of capital.

In the case of SparkDEX, their TVL explosion came courtesy of a cross-chain stablecoin (USDT0) and integration with Flare Network, simple testimony to the style in which pool development begets growth.

Another trend is liquidity concentration and customization. New AMMs ( Uniswap v3) enable LPs to focus their capital in certain price regions, making the use of their money more efficient. In other words, LPs can customize how their liquidity behaves rather than spread it out equally.

This adds potential returns (more fees from specific price zones) but also can increase the risks of impermanent loss if prices move out of range.

Pools are also influenced by institutional and regulatory demand. As more crypto ETFs and professional money comes in, on-chain liquidity needs to rise to the level of transparency and security that even institutions can feel comfortable sticking their toes into it.

Liquidity pools have also started engaging with off-chain assets (tokenized stock, real world assets), expanding their purview and attracting the attention of regulators.

Overall, experts view liquidity pools as a technology that has gotten more mature but is also continuing to innovate. They are still the pillar of the DeFi ecosystem, providing decentralized trading and yield generation; however, users need to be warned and informed.

Conclusion

Liquidity pools are user-funded smart contract pools that allow for support in decentralized trading and finance. They enable rapid token exchanges and passive income for providers by relying on automated market makers instead of standard order books.

However, it should also be noted that they come with their own risks ,chiefly impermanent loss and smart contract bugs. As the market shifts, liquidity pools are constantly changing, linking various blockchains and providing new incentives that drive interest.

Glossary

Liquidity Pool: Tokens locked in a smart contract that can be used to exchange with or lend to others on a decentralized basis. Instead of relying on the order-book matching methods, it offers algorithmic pricing and provides liquidity for token swaps at all times.

Liquidity Provider: A user who contributes tokens in Exchange for a future return. In exchange, the LP makes trading fees commensurate with their input and receives LP tokens as evidence of holding a share.

Automated Market Maker (AMM): A system that mathematically prices assets in a pool. AMMs enable trading without order books by updating prices whenever a trade takes place (e.g., Uniswap’s “constant product” formula).

Impermanent Loss: A loss that an LP may suffer as a result of fluctuation in the market prices of pooled tokens.

DEX (Decentralized Exchange): An exchange platform that works without a central intermediary, often with liquidity pools allowing token swaps (e.g., Uniswap, SushiSwap).

Frequently Asked Questions About Liquidity Pools

What is a liquidity pool?

A liquidity pool is a smart contract that includes a pair of tokens (or even more) deposited by users. It supplies liquidity for others to trade those tokens on decentralized exchanges.

How do liquidity pools allow for trading?

Pools use automated market-maker algorithms. Traders can exchange tokens directly with the pool, which updates prices dynamically as a function of supply and demand, meaning that a trade can take place without requiring another side to the transaction.

What is impermanent loss?

Impermanent loss occurs when the price of tokens in a pool changes after participants deposit them. If the price of one token rises, the pool will rebalance and one might end up with fewer of that rising token than if they’d just been holding it.

What do LP tokens represent?

When participants provide assets to a pool, they receive LP tokens, which represent their share in the pool. To withdraw their money and earnings as fees, they will need to burn (redeem) these tokens. Transferability means the LP tokens are often used for yield farm.

Are liquidity pools safe?

The pools themselves are safe as they are constructed on audited smart contracts, although it isn’t without risk. Losses can also be the result of smart-contract bugs, catastrophic price swings (impermanent loss) or outright scams (rug pulls). Stick to established protocols and spread your capital.