This article was first published on Deythere.

- Unrest and Economic Decline in Iran

- Bitcoin Withdrawals Spike During Unrest

- Crypto Ecosystem Expansion Amid Crisis

- Bitcoin as Hedge and Financial Escape

- Conclusion

- Glossary

- Frequently Asked Questions About Iran Bitcoin Withdrawals

- Why are Iranians pulling Bitcoin out of exchanges?

- What does the fall of the rial mean for ordinary Iranians?

- What does cryptocurrency use look like in Iran?

- Who else is deploying crypto in Iran?

- How does Bitcoin help in protests?

- References

Iranian citizens have begun withdrawing Bitcoin from exchanges and moving it to personal wallets as a nationwide protest movement against economic collapse grips the country.

The protests, which began in late December 2025, have escalated through January 2026 leading to a crippling rial depreciation, internet blackouts and worsening economic turmoil.

Chainalysis reports a clear rise in Iran Bitcoin withdrawals from Iranian trading platforms to private, self-custodied wallets.

Unrest and Economic Decline in Iran

The protests that prompted the recent spike in Bitcoin withdrawals started on Dec. 28, 2025, when bazaar merchants, shopkeepers, and urban workers across Tehran and other Iranian cities shut their shops and took to the streets to protest against high inflation, collapsed currency prices, and economic mismanagement.

The unrest quickly turned into nationwide demonstrations against the government, with people chanting for economic stability and political change.

As the protests spread, Iran’s leaders imposed one of the most severe internet blackouts in years on Jan. 8, 2026, shutting down virtually all mobile and broadband networks nationwide in a bid to control communication and information. Over 2,000 protesters have been reportedly killed, and the government continues to initiate major internet blackouts in an attempt to quell the unrest.

The official exchange rate of Iran’s currency, the rial, had tumbled to over 1 million rials per U.S. dollar by January, rendering the national currency in effect useless for cross-border trade and savings.

This collapse intensified the frustrations and sped up the quest for alternative stores of value beyond a crippled financial system.

Bitcoin Withdrawals Spike During Unrest

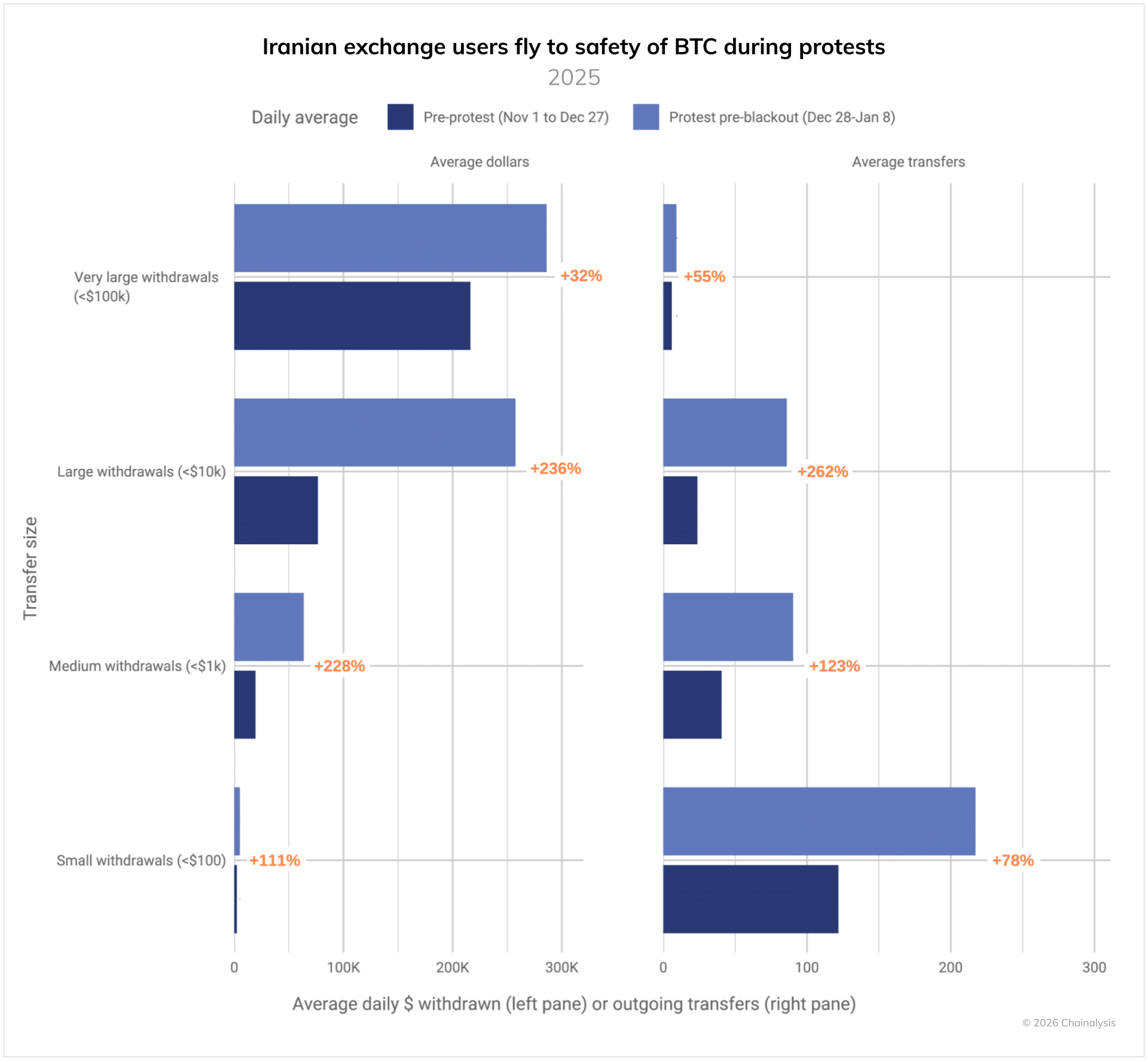

According to the most recent Chainalysis report on Iranian crypto activity, there has been a sharp rise in Bitcoin being withdrawn from domestic exchanges and transferred to unknown personal wallets since the protests began in late December 2025.

The firm recorded growth in daily transfers and total value moved on-chain directly correlated to the timeline of unrest and monetary collapse.

“The flight to safety effects that we document in the report are largely confined to BTC, suggesting that in a time of crisis, that is the preferred safe haven asset for civilians in Iran,” said Chainalysis analyst Eric Jardine.

Crypto Ecosystem Expansion Amid Crisis

Iran’s overall crypto economy is believed to have reached $7.78 billion in 2025, up from its previous levels, due to domestic turmoil and financial insecurity, which led to increased trading and on-chain engagement.

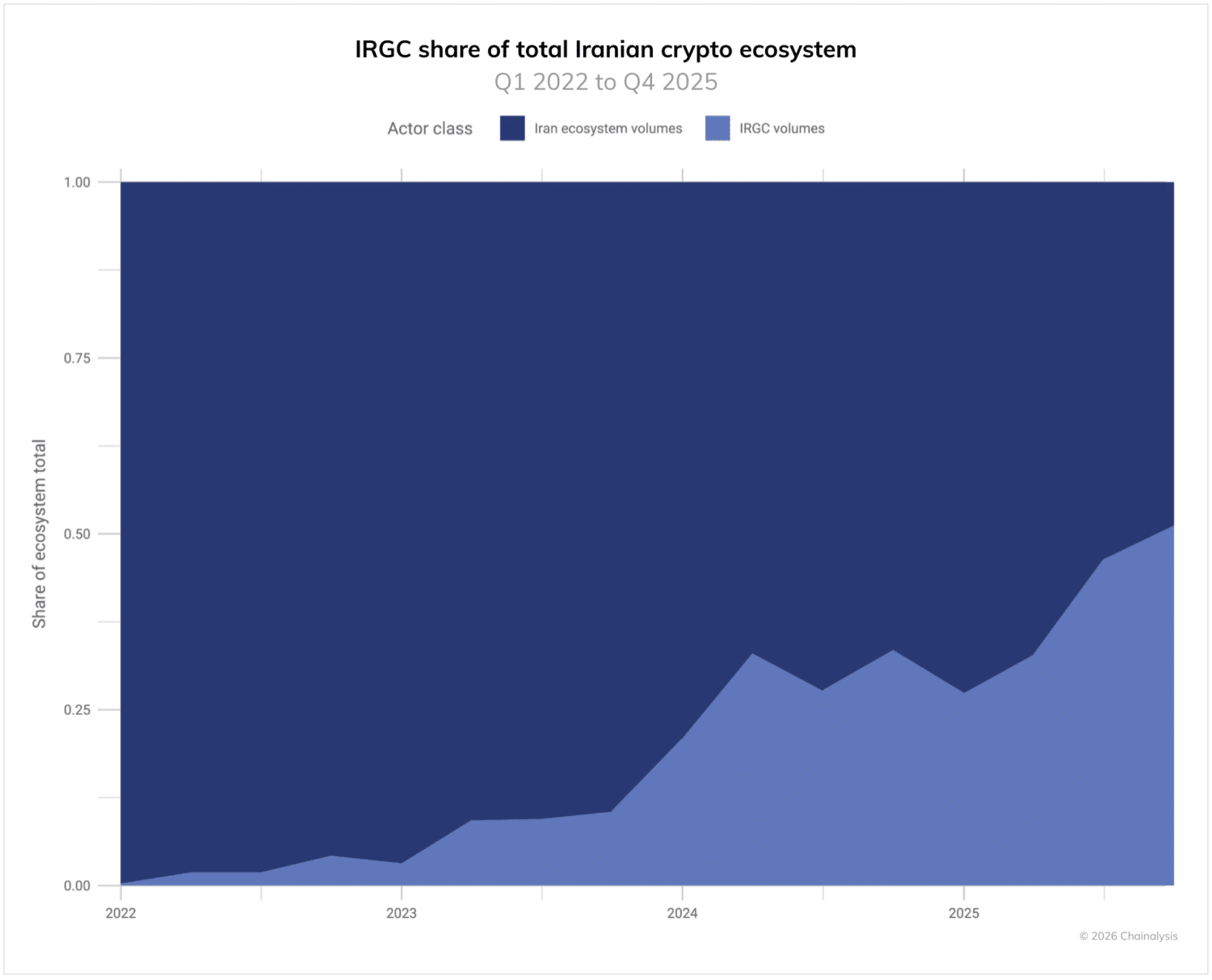

According to blockchain data, addresses tied to the Islamic Revolutionary Guard Corps (IRGC) were responsible for more than 50 percent of all crypto value received in Iran during the fourth quarter of 2025.

These addresses processed more than $3 billion in on-chain transactions over the year, and played a meaningful role in generating the country’s digital financial footprint.

Crypto analytics firms have been monitoring this swelling number of state-affiliated addresses and have observed their growth in recent quarters.

Bitcoin as Hedge and Financial Escape

The slide of the rial has reduced the purchasing power for ordinary Iranians and sent many of them searching for other alternatives to store their money.

With a capped supply and borderless design, Bitcoin is logically appealing to those finding themselves in front of inflation and currency debasement.

Chainalysis actually describes this behavior as a “rational response” to the crash in the value of the rial which is now almost worthless when compared with major currencies such as the euro.

Unlike traditional assets, Bitcoin can be withdrawn, if desired, to the recipient’s possession directly and self-custodied by the holder without the need for an intermediary bank or other state-mandated infrastructure.

For many Iranians in the middle of this extended internet blackout, while on the receiving end of economic repression, this liquidity and optionality is invaluable, offering a means to preserve wealth and still have access to global financial networks.

Conclusion

As Iran reaches its third week of nationwide protests and economic meltdown, there has been a recorded mass movement toward self-custody of digital assets.

Sharp declines in rial purchasing power, internet outages nationwide, and the increasing dominance of state-affiliated actors such as the IRGC have sped Bitcoin’s adoption as both a hedge and tactical option to maintain liquidity and financial independence.

Verified data from Chainalysis indicates that Iranians are removing their BTC from exchanges at rates far greater than before the unrest.

While Iran’s geopolitical and economic dynamics can be difficult to navigate, the surge in Bitcoin withdrawals to personal wallets speaks volumes about the changing profile of cryptocurrency as an emergency tool that provides financial options when traditional systems break down.

Glossary

Bitcoin: A decentralized digital money supply on a fixed quantity, often used as hedge against inflation and financial instability.

Self-custody: The practice of holding cryptocurrency in one’s own wallet, where one controls the private keys, rather than on an exchange.

Exchange withdrawal: Moving a cryptocurrency from a centralized exchange to a private wallet.

Rial: National currency of Iran

Islamic Revolutionary Guard Corps (IRGC): A powerful, state-backed military and economic organization in Iran that increasingly wields influence on cryptocurrency activities.

Frequently Asked Questions About Iran Bitcoin Withdrawals

Why are Iranians pulling Bitcoin out of exchanges?

Iranians are withdrawing Bitcoin to personal wallets to avoid exchange restrictions, maintain control during internet shutdowns, and preserve value amid extreme rial depreciation.

What does the fall of the rial mean for ordinary Iranians?

With the rial now hovering over 1million per dollar, purchasing power has diminished and citizens are looking to other assets as a hedge, such as Bitcoin.

What does cryptocurrency use look like in Iran?

Unrest, economic instability as well as heightened on-chain activity have helped the country’s crypto industry reach an estimated $7.78 billion by 2025.

Who else is deploying crypto in Iran?

State-linked institutions such as the IRGC made up approximately half of Iran’s total crypto value received in late 2025.

How does Bitcoin help in protests?

Iranians can use Bitcoin’s censorship resistance and maintain self-custody so they can move money outside of their state-ordained financial infrastructure, especially during internet shutdowns.