As AI, virtual reality, and metaverse infrastructure continue to evolve, Render (RNDR) has carved a niche by offering decentralized GPU rendering. With the increasing demand for cloud rendering services by studios, NFT creators, AI labs, and developers, Render’s native token RNDR has surged into the spotlight as a Web3 infrastructure backbone.

- Latest News: Render Partners With Apple’s Vision Pro and Expands AI GPU Network

- Render Price Prediction for 2025

- Render Price Prediction for 2026

- Render Price Prediction for 2027

- Investor Takeaway: Is RNDR a Long-Term Winner?

- Conclusion: Render’s Road to Relevance and Riches

- FAQs

- Is Render (RNDR) a good long-term investment?

- Will Render benefit from the AI boom?

- Can RNDR reach $20+ by 2027?

- Is RNDR used beyond metaverse projects?

- Glossary of Key Terms

In this article, we dive into RNDR’s updated fundamentals, institutional developments, and projected Render prices for 2025, 2026, and 2027, with structured price tables and quarterly forecasts for crypto investors planning long-term.

Latest News: Render Partners With Apple’s Vision Pro and Expands AI GPU Network

Render has recently made headlines for expanding its rendering capabilities in the AI sector. In Q2 2025, Render integrated with Apple’s Vision Pro SDK, allowing developers to access decentralized GPU rendering for spatial computing apps. Additionally, the platform is onboarding over 15,000 GPUs across its network to meet demand from AI inference workloads and LLM training.

Notably, Venture capital investment into decentralized AI and GPU infrastructure has exploded, with Render receiving a new $40M funding round led by Multicoin Capital and Pantera in May 2025. These trends strengthen RNDR’s real-world utility, a critical driver of Render price in upcoming cycles.

Render Price Prediction for 2025

In 2025, Render is expected to benefit from:

Increased integration into AI applications

Cross-chain expansion beyond Ethereum and Solana

Onboarding of institutional GPU providers

Experts project that RNDR could face volatility mid-year due to macroeconomic tightening but regain momentum in Q4 as GPU demand grows for AI and metaverse ecosystems.

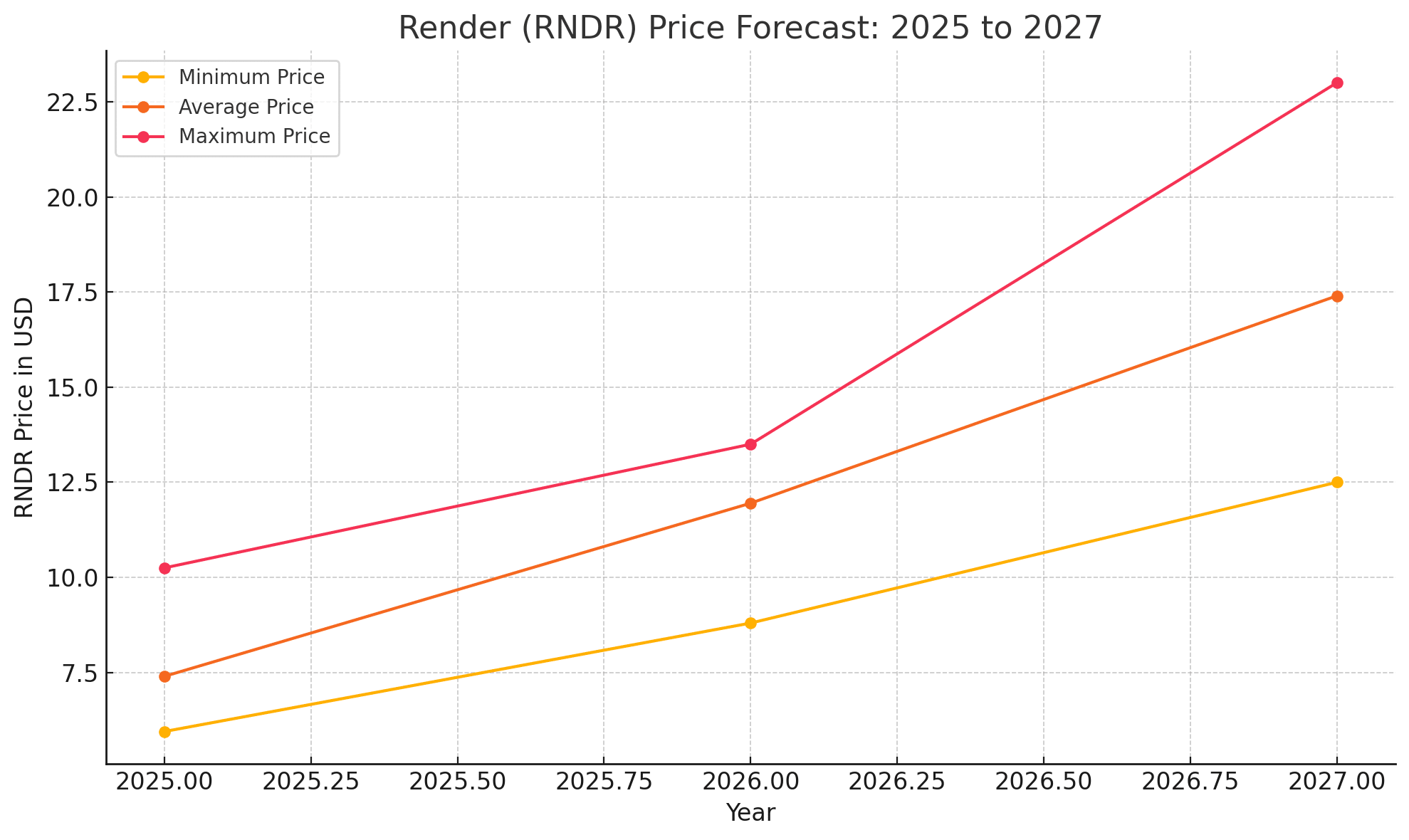

Render Price Forecast 2025 Table (Quarterly)

| Quarter | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| Q1 2025 | $6.20 | $6.85 | $7.40 |

| Q2 2025 | $5.95 | $6.60 | $7.10 |

| Q3 2025 | $6.80 | $7.30 | $8.50 |

| Q4 2025 | $8.10 | $9.00 | $10.25 |

Yearly Summary:

Average Render price in 2025 is projected around $7.40, with a bullish close at $9.00–$10.25 by year-end if GPU expansion milestones are met.

Render Price Prediction for 2026

Render’s fundamentals are expected to strengthen in 2026, backed by:

Increased adoption in VR game engines and AI training

Mainnet upgrades improving render node efficiency

Strategic partnerships with media studios and AI labs

The token may follow a more accumulative pattern, consolidating before a new macro bull run by 2027.

Render Price Forecast 2026 Table (Quarterly)

| Quarter | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| Q1 2026 | $9.10 | $9.70 | $10.80 |

| Q2 2026 | $8.80 | $9.30 | $10.50 |

| Q3 2026 | $9.50 | $10.20 | $11.60 |

| Q4 2026 | $10.80 | $11.95 | $13.50 |

Yearly Summary:

Average RNDR price in 2026 could range between $9.30–$11.95, with long-term holders positioning for the next cycle.

Render Price Prediction for 2027

By 2027, the global demand for AI rendering, VR content, and decentralized GPU solutions may push Render into the Web3 utility mainstream.

Potential bullish drivers include:

Onboarding of Fortune 500 clients (film, gaming, biotech)

RNDR becoming collateral in DeFi or AI compute markets

Supply tightening due to locked nodes and staking

Render Price Forecast 2027 Table (Quarterly)

| Quarter | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| Q1 2027 | $12.50 | $13.40 | $15.00 |

| Q2 2027 | $14.20 | $15.60 | $17.10 |

| Q3 2027 | $16.00 | $17.40 | $19.50 |

| Q4 2027 | $18.50 | $20.25 | $23.00 |

Yearly Summary:

RNDR may reach an average of $17.40, with top targets nearing $23.00 by the end of 2027 if mass GPU onboarding and AI market saturation unfold.

Investor Takeaway: Is RNDR a Long-Term Winner?

Render is quietly becoming one of the most fundamentally aligned tokens in the AI + Web3 race. While short-term volatility remains, its decentralized GPU marketplace, cross-industry relevance, and rising demand from AI infrastructure make RNDR a compelling candidate for long-term portfolios.

Long-term investors seeking exposure to both AI growth and Web3 decentralization could view RNDR as a “digital picks and shovels” play, much like how Nvidia powers AI today, Render could be the decentralized Nvidia of tomorrow.

Conclusion: Render’s Road to Relevance and Riches

Render (RNDR) stands at the intersection of AI, decentralized computing, and the future of immersive content, a trifecta of megatrends that are just beginning to scale. With strategic integrations, institutional funding, and a rapidly growing GPU network, RNDR isn’t just another altcoin; it’s building the backbone of the decentralized digital economy.

While short-term fluctuations may occur, Render’s long-term fundamentals position it as one of the most compelling infrastructure tokens in the Web3 and AI sectors. RNDR price may prove to be a top-tier asset through 2025, 2026, and 2027 for investors seeking future-proof exposure in the next wave of crypto utility.

FAQs

Is Render (RNDR) a good long-term investment?

Yes, its role in GPU rendering for AI, VR, and metaverse tech provides strong fundamentals.

Will Render benefit from the AI boom?

Absolutely. Render enables decentralized AI rendering, making it key to the infrastructure layer.

Can RNDR reach $20+ by 2027?

If GPU onboarding and AI integrations continue, $20–$23 is achievable in 2027.

Is RNDR used beyond metaverse projects?

Yes, it’s being adopted in AI, healthcare rendering, virtual production, and gaming.

Glossary of Key Terms

RNDR – The native utility token of the Render Network used to pay for rendering jobs and compensate GPU providers.

Decentralized GPU Rendering – A distributed computing model where idle GPU power is rented out to process 3D and AI tasks.

AI Inference – The process of using a trained AI model to make predictions — GPU-intensive and growing rapidly.

Vision Pro – Apple’s advanced spatial computing headset, now integrated with decentralized render protocols.

Web3 Infrastructure – Foundational services (like storage, computing, and rendering) running on blockchain technology.