The Hong Kong Monetary Authority (HKMA) has unveiled an ambitious blueprint that could redefine the financial landscape. Dubbed the “Fintech 2030” strategy, the initiative aims to merge traditional banking systems with cutting-edge financial technologies, particularly focusing on real-world asset (RWA) tokenization.

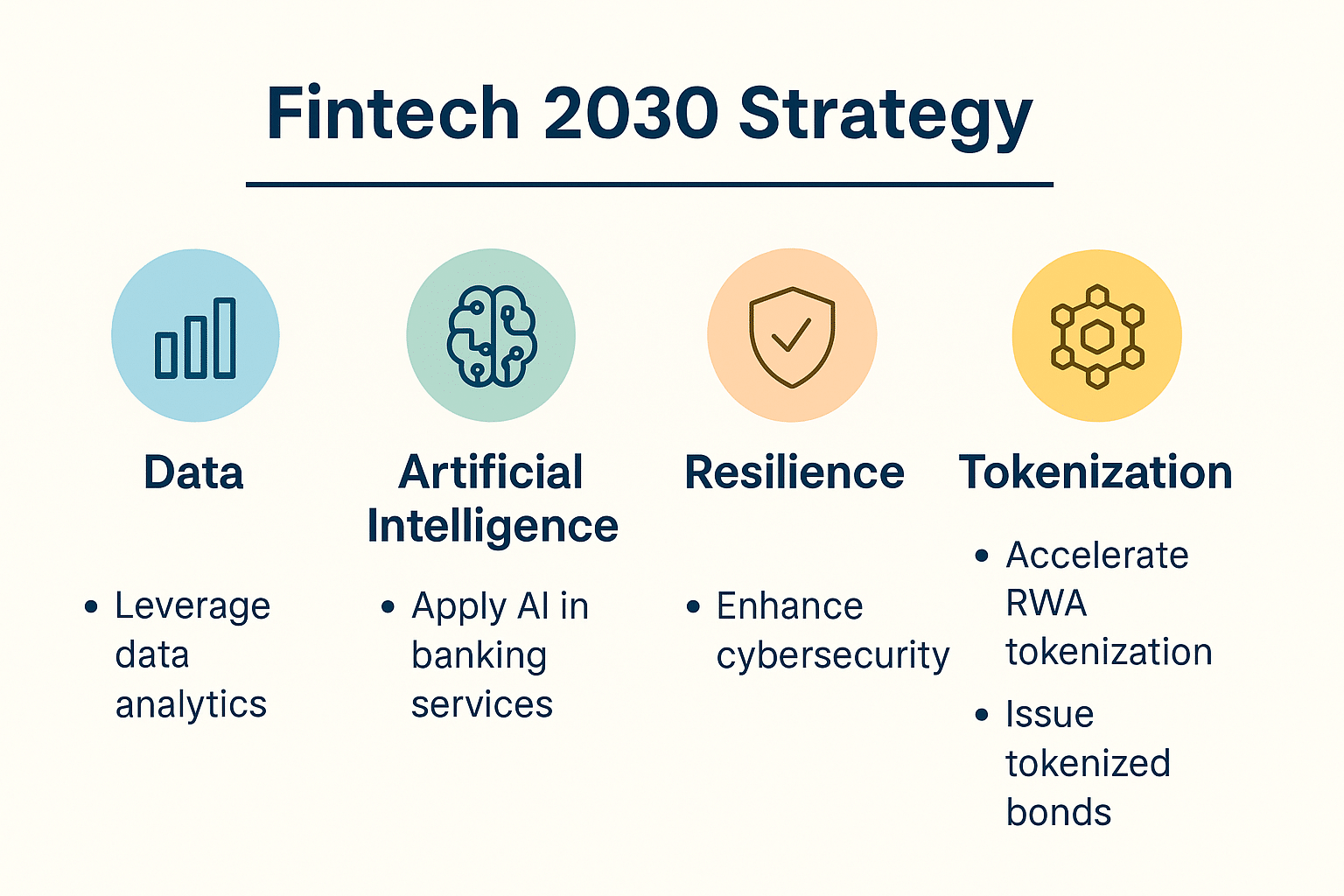

The HKMA is positioning Hong Kong as a frontrunner in fintech leadership. Its approach, structured around four pillars, Data, Artificial Intelligence, Resilience, and Tokenization, introduces forty initiatives designed to guide the city’s financial system toward a digital-first future.

The Push Toward Real-World Asset Tokenization

Among the pillars, Tokenization stands out as a cornerstone of this strategy. The HKMA plans to “lead by example” by issuing tokenized government bonds and exploring the digital representation of Exchange Fund papers. These initiatives aim to transform how financial instruments are issued, traded, and settled across digital platforms.

The effort reflects a global shift toward on-chain representation of tangible assets like securities, bonds, and commodities. By enabling fractional ownership and transparent settlement through blockchain, RWA tokenization bridges the gap between traditional finance and decentralized technology.

For investors and institutions alike, this evolution may open the door to 24/7 trading and cross-border liquidity, while maintaining the oversight regulators demand. The HKMA’s efforts could serve as a global benchmark for secure, compliant digital asset markets.

Integrating Digital Money and Settlement Layers

The HKMA’s strategy does not stop at tokenization. It envisions a future where digital money, such as the e-HKD, tokenized deposits, and regulated stablecoins, plays an integral role in settlement systems.

The authority’s “Project Ensemble” will test how these forms of digital currency interact within tokenized ecosystems. The initiative could help streamline cross-border payments, lower transaction costs, and strengthen Hong Kong’s standing as a digital finance hub.

The broader implication is clear: blockchain-based settlement layers could become the new backbone of financial operations, improving efficiency and transparency across markets.

Artificial Intelligence as a Financial Partner

Artificial Intelligence (AI) forms another vital pillar in the Fintech 2030 framework. The HKMA plans to integrate AI-driven systems that enhance financial accessibility, responsiveness, and personalization while maintaining transparency and accountability.

AI adoption in financial services is expected to improve risk management, fraud detection, and customer experience. Combined with the tokenization of RWAs, it creates a digital ecosystem where data and assets move fluidly yet securely.

Strengthening Hong Kong’s Global Fintech Role

Hong Kong has long been recognized as a global financial center, but the Fintech 2030 strategy signals a move toward a digital reinvention. By combining policy, infrastructure, and innovation, the HKMA is attempting to create fertile ground for fintech startups, institutional adoption, and regulatory collaboration.

Industry observers believe this roadmap could attract international projects seeking regulatory clarity in digital asset issuance and settlement. With tokenization expected to grow into a multi-trillion-dollar industry by the end of the decade, Hong Kong’s early positioning could pay substantial dividends.

Conclusion

The HKMA’s Fintech 2030 strategy is more than a policy announcement. It is a vision for a digitized financial system that integrates blockchain, AI, and digital money into its foundation. By placing real-world asset tokenization at its core, Hong Kong is not just adapting to technological change but shaping its direction.

If executed effectively, the strategy could propel the region into the forefront of global fintech innovation, inspiring other jurisdictions to follow suit.

Frequently Asked Questions

What is the HKMA’s Fintech 2030 strategy?

It is a long-term plan introduced by the Hong Kong Monetary Authority to enhance the financial ecosystem using data, AI, tokenization, and resilience frameworks.

How does real-world asset tokenization work?

It converts traditional assets like bonds, securities, and commodities into blockchain-based tokens that represent ownership or value, allowing for easier transfer and settlement.

What is the e-HKD?

The e-HKD is Hong Kong’s pilot digital currency, aimed at enabling blockchain-based payments and settlement across the financial sector.

What is Project Ensemble?

Project Ensemble is the HKMA’s pilot initiative to test tokenization and digital settlement mechanisms in collaboration with private sector partners.

Glossary of Key Terms

Real-World Asset Tokenization: The process of converting physical or traditional financial assets into digital tokens recorded on a blockchain.

Exchange Fund Papers: Short-term debt instruments issued by the Hong Kong Monetary Authority to manage liquidity in the financial system.

Tokenized Deposits: Bank deposits represented as digital tokens that can be transferred or settled on blockchain networks.

Regulated Stablecoins: Digital currencies pegged to stable assets like fiat currencies and governed under financial regulatory frameworks.

Artificial Intelligence (AI): Computer systems designed to perform tasks requiring human-like intelligence, such as data analysis, learning, and decision-making.

Blockchain Settlement Layer: A digital infrastructure enabling real-time, transparent, and immutable transaction settlements across financial markets.