The race to bring more digital assets into mainstream investing has taken another bold turn. Hashdex submitted a filing to expand its Nasdaq Crypto Index US ETF to include Solana (SOL), Cardano (ADA), and XRP.

This marks the first major attempt to test newly adopted U.S. Securities and Exchange Commission rules that allow for broader listings of crypto-based products. The move has put Altcoin ETFs squarely in the spotlight, raising hopes that traditional investors will soon gain diversified exposure beyond Bitcoin and Ethereum.

New SEC Standards Ignite ETF Expansion

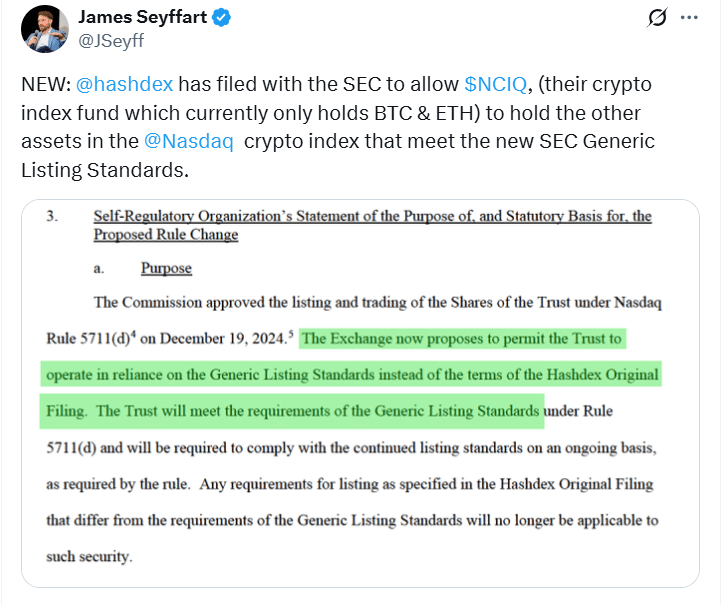

Earlier this month, the SEC approved generic listing standards that let exchanges list crypto commodity-based trusts without lengthy one-off reviews. This breakthrough means fund managers can now pursue baskets of assets under streamlined guidelines.

For Hashdex, that means building a product that more closely reflects the Nasdaq Crypto Index, which currently weighs Bitcoin at over 70%, Ethereum around 15%, and allocates smaller slices to Solana, XRP, and Cardano.

Industry analysts believe this framework could unleash a wave of Altcoin ETFs that diversify investor portfolios. Bloomberg’s James Seyffart noted on X: “This is a huge step forward. Hashdex is the first mover, but others will follow. Altcoin ETFs could finally become a reality in the U.S.” His comment underscores the growing sentiment that the SEC is moving from a defensive stance toward cautious acceptance of digital asset products.

Institutional Interest in Altcoin ETFs Grows

The prospect of Altcoin ETFs has stirred enthusiasm among institutional investors who are eager for regulated products with exposure beyond Bitcoin and Ethereum. By adding SOL, ADA, and XRP, Hashdex aims to reflect the broader crypto market in a way that appeals to pensions, funds, and asset managers.

Supporters argue that these altcoins bring distinct value propositions. Solana is praised for its speed and scalability in decentralized finance. Cardano emphasizes sustainability and peer-reviewed development. XRP is favored for cross-border settlement. By combining them into a regulated ETF, Hashdex is betting on investor appetite for diversity.

Regulators are still cautious, but the door is opening. A research note from a Wall Street firm observed that “Altcoin ETFs are the natural next step. If liquidity and custody standards are met, demand could be massive.”

Global Context Fuels Momentum

The U.S. move comes as Europe and Asia advance their own tokenized funds. Europe’s MiCA framework has already paved the way for structured crypto products, while Asian regulators are experimenting with tokenized bonds and stablecoin-linked funds. If the Hashdex filing succeeds, the U.S. could leapfrog into a leadership role, capturing flows that might otherwise migrate overseas.

At the same time, competitive pressure is mounting. Other asset managers are expected to file similar applications in the coming weeks, hoping to launch their own Altcoin ETFs. Analysts note that once one product gains traction, the floodgates could open.

Risks Remain for Altcoin ETFs

Despite optimism, there are hurdles. Custody of multiple tokens introduces operational complexity. Tracking error between the ETF and the underlying index remains a challenge, especially in volatile markets. Skeptics argue that Altcoin ETFs could amplify risks by exposing traditional investors to tokens with less liquidity than Bitcoin or Ethereum.

Still, advocates counter that a regulated wrapper reduces risks compared to unregulated exchanges. By holding assets in a transparent, rule-based structure, Altcoin ETFs could enhance security while providing broader exposure.

Conclusion

The Hashdex filing is more than a paperwork milestone. It signals the arrival of a new era where Altcoin ETFs are no longer theoretical but a tangible pathway for investor participation. Solana, Cardano, and XRP now sit on the front line of that shift.

With regulators softening their stance and institutions watching closely, the stage is set for a transformation in how digital assets are held, traded, and trusted. Whether the market embraces these products wholeheartedly or cautiously tests the waters, one thing is clear: Altcoin ETFs are moving from concept to reality.

FAQs about Hashdex Altcoin ETFs

Q1: What are Altcoin ETFs?

Altcoin ETFs are exchange-traded funds that hold cryptocurrencies other than Bitcoin, allowing investors to have regulated exposure to diverse tokens.

Q2: Why is Hashdex’s filing important?

It is the first attempt to expand a U.S.-listed crypto ETF under new SEC rules to include Solana, Cardano, and XRP.

Q3: How do new SEC standards help?

The standards simplify the approval process, allowing exchanges to list crypto-based ETFs under generic guidelines instead of one-off reviews.

Q4: What risks do Altcoin ETFs carry?

They face tracking error, custody complexities, and liquidity risks, but a regulated structure helps mitigate some of these challenges.

Glossary

ETF (Exchange-Traded Fund): A regulated investment fund that trades on stock exchanges, holding a basket of assets.

Altcoin: Any cryptocurrency other than Bitcoin, including Ethereum, Solana, Cardano, and XRP.

Liquidity: The ease of buying or selling an asset without significantly affecting its price.

Tracking Error: The difference between an ETF’s performance and its underlying index.

Custody: Secure storage of assets, particularly important for cryptocurrencies.

MiCA: Europe’s regulatory framework for markets in crypto-assets, offering clarity for digital asset products.