A Bold Step Into Blockchain Infrastructure

With the debut of the Google Layer 1 blockchain, a strong new player has joined the fight to reshape financial infrastructure. The new platform, created as a neutral, enterprise-focused ledger, is intended to handle tokenized assets, settle payments, and provide 24/7 assistance to worldwide institutions. Early pilots have proved its capacity to manage collateral and margin settlements at a lower cost than older systems.

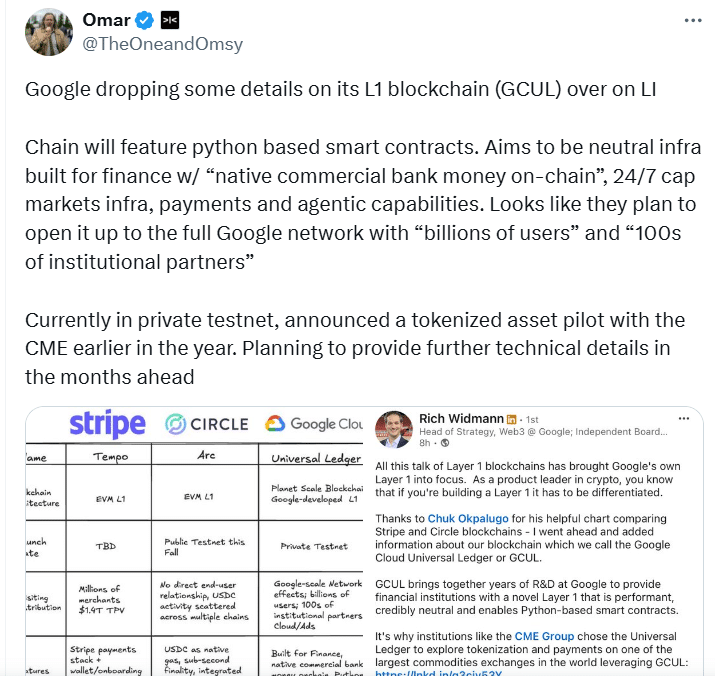

Analysts believe the move is more than just another business experiment. It represents a genuine attempt to connect the existing financial system with blockchain-based infrastructure. The Google Layer 1 blockchain intends to attract developers and organizations seeking performance without excessive complexity by providing Python-based smart contracts and constant transaction prices.

Designed as a neutral ledger for global finance

Unlike the proprietary chains developed by other payment giants, this platform is positioned as a neutral hub. This implies that banks, fintechs, and even rivals might potentially build on the same base. According to industry analysts, this technique has the potential to avoid vendor lock-in, which has plagued other private financial networks.

A top official participating in the deployment told X that the Google Layer 1 blockchain is designed for everyone, not just one company’s goods. “The goal is neutrality, stability, and trust.” This posture has already piqued the interest of entities looking into tokenizing assets ranging from sovereign bonds to commercial bank money.

Competing in a crowded market

The debut comes as other corporations roll out their own blockchain systems. One network is developing Arc, a system based on stablecoins and capital markets. Another is promoting Tempo, a high-performance chain aimed for routine payments.

Against this context, the Google Layer 1 blockchain prioritizes scale and neutrality, drawing on decades of cloud infrastructure knowledge to facilitate global adoption.

Critics say the permissioned system raises worries about centralization. Some community members on social media questioned whether a blockchain owned by a corporation could ever be genuinely decentralized.

Despite these reservations, institutions are more concerned with stability and compliance than with completely open networks, implying that the initiative may succeed where others have failed.

Why Does It Matter for Payments and Settlements?

The pilot program with a large global exchange group has already demonstrated how this method may speed collateral resolution while lowering expenses. Traditional settlement cycles, which were previously tied to weekdays and banking hours, can now run continually. This feature alone has the potential to increase liquidity in financial markets by billions.

Blockchain experts have noted that the Google Layer 1 blockchain has tokenization capabilities. This implies that financial assets such as stocks, bonds, and even real-world currencies may be issued and maintained on the blockchain.

When combined with solid APIs for developers and predictable transaction costs, the platform is positioned as a solution to long-standing inefficiencies in global banking.

Conclusion

The release of the Google Layer 1 blockchain marks a new chapter in how significant organizations may use digital ledgers. Its emphasis on neutrality, scalability, and tokenized assets distinguishes it as a formidable contender in a rising industry.

However, the argument regarding centralized and permissioned control has yet to be addressed. As pilots grow and full implementation approaches, the world will discover if this project reshapes payments or becomes yet another business experiment.

Glossary

Layer 1 Blockchain – A base-level blockchain that operates independently with its own consensus mechanism.

Tokenization – The process of issuing digital tokens that represent real-world assets.

Smart Contract – A programmable agreement executed automatically on a blockchain.

Permissioned Blockchain – A blockchain where only approved participants can validate or access transactions.

Settlement – The process of completing financial transactions and transferring funds or assets.

Collateral – Assets pledged to secure a financial contract, often used in derivatives trading.

FAQs for Google Layer 1 Blockchain

Q1: What is the Google Layer 1 blockchain designed for?

It is designed for payments, settlements, and tokenized assets, with a focus on institutions.

Q2: How does it differ from other blockchains?

It is positioned as a neutral ledger open to many institutions, unlike proprietary networks.

Q3: When will it be available for global use?

Pilot programs are ongoing, with broader deployment expected by 2026.

Q4: What risks are associated with it?

Concerns remain about centralization and the permissioned nature of the system.