The global gold market has reached an unprecedented height, crossing the $30 trillion mark and reinforcing its dominance as the ultimate store of value. This surge in valuation comes amid turbulent financial conditions and renewed geopolitical tensions that have pushed investors toward traditional safe-haven assets.

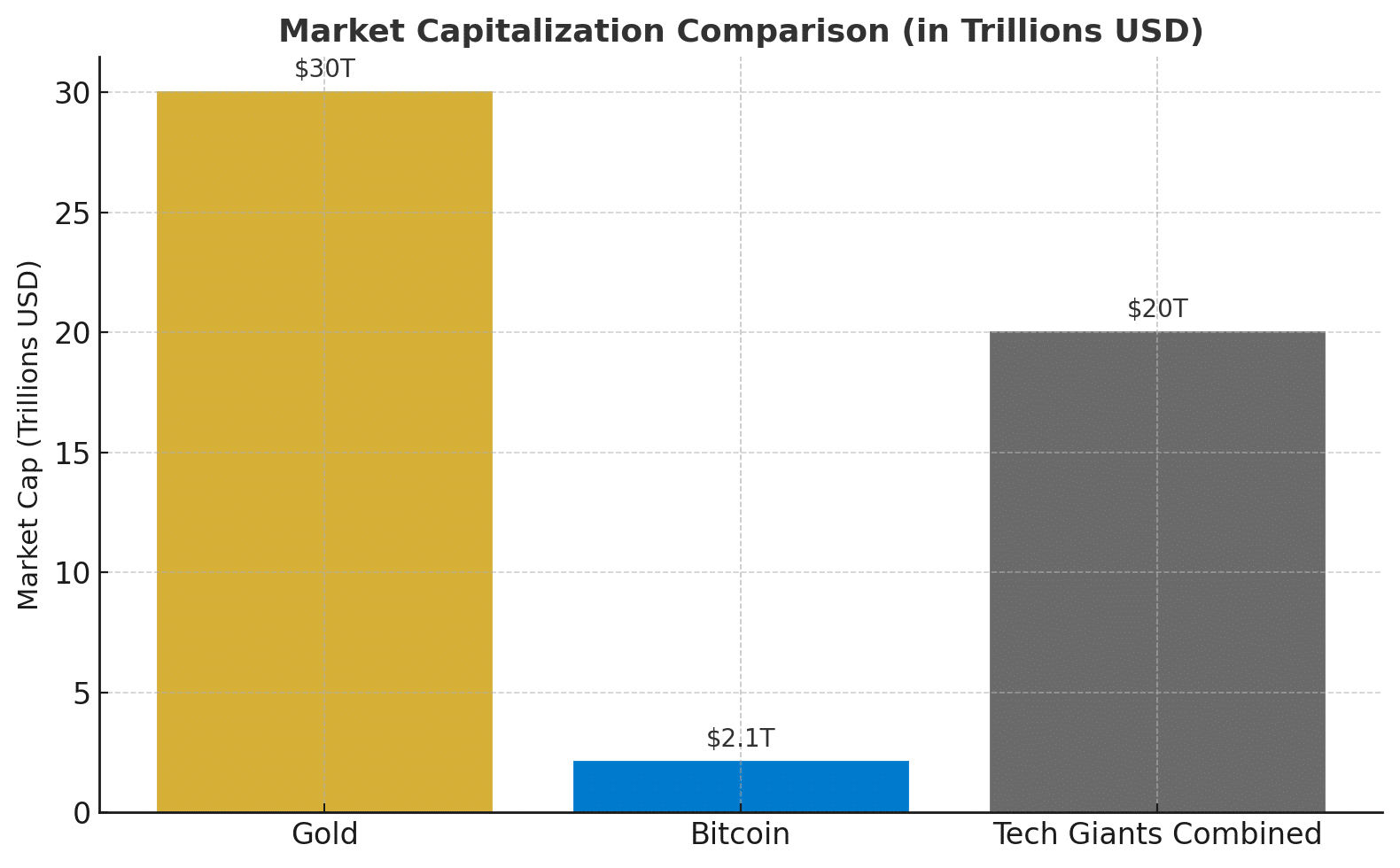

Gold’s price recently climbed to around $4,357 per ounce, marking one of its steepest yearly gains in decades. The metal’s market cap now stands nearly fifteen times higher than Bitcoin’s, which currently sits at approximately $2.1 trillion. Even the combined value of the world’s leading technology firms, often referred to as the “Magnificent Seven,” trails behind, collectively valued near $20 trillion.

The Drivers Behind Gold’s Record Rally

The sharp rise in gold’s value is being fueled by a mix of macroeconomic forces and global unease. Inflation remains sticky in major economies, central banks continue expanding liquidity, and escalating trade frictions between the United States and China have injected more uncertainty into global markets. Investors are turning to gold market as a hedge against the erosion of fiat currency value and potential market shocks.

Economist Joe Consorti explained on X that,

“Gold’s strength reflects a market deeply worried about currency debasement and political risk. The scale of flows into hard assets this year is historic.”

Analysts have also noted a pattern of capital rotation. Historically, when gold experiences such rapid expansion, digital assets like Bitcoin often follow with a delayed surge. This theory, known as the “post-gold rotation,” suggests that as the precious metal stabilizes, risk-tolerant capital seeks new returns in alternative stores of value.

Bitcoin and the Shadow of Gold

Bitcoin’s market performance, though positive in 2025, appears subdued in comparison. The world’s largest cryptocurrency has gained roughly 16 percent year-to-date, significantly lagging behind gold’s 64 percent rise. While Bitcoin advocates continue to brand it as “digital gold,” the recent divergence highlights how traditional investors still lean on time-tested assets during instability.

Market strategist Merlijn the Trader posted, “Global M2 money supply keeps climbing, gold market is exploding, and Bitcoin is sleeping. This divergence never lasts. The catch-up rally will be brutal.” His remark captures the sentiment of many crypto traders who believe that Bitcoin may soon attract a share of the capital currently locked in gold.

Meanwhile, some analysts believe Bitcoin’s muted response is a reflection of its correlation to equities. During periods of high geopolitical stress, digital assets tend to mirror stock movements rather than move independently. The challenge for Bitcoin now lies in breaking free from this behavioral pattern and reclaiming its “hedge” narrative.

A Clash Between Legacy and Innovation

The growing gap between gold and Bitcoin underscores a broader financial debate. Gold market represents centuries of established trust and tangibility, while Bitcoin offers a modern, decentralized alternative that thrives on transparency and borderless access. Despite their philosophical differences, both assets now occupy parallel roles as hedges against inflation and currency debasement.

Crypto market analyst Adam Cochran noted,

“When liquidity tightens, people revert to what they know. But every new cycle, a larger group of investors starts seeing Bitcoin as the new form of gold market.”

His observation points to a generational divide in investment psychology, where younger investors increasingly favor digital assets for their portability and programmability.

The Long-Term View

While gold market’s dominance is clear, its meteoric rise could eventually create an opening for Bitcoin. Once the metal’s momentum slows, investors looking for asymmetric upside may reallocate capital toward crypto markets. If that shift occurs, Bitcoin could witness renewed institutional attention similar to the surge that followed the approval of major exchange-traded funds earlier this year.

At the same time, the ongoing expansion of global money supply, rising public debt, and weakening faith in fiat systems continue to set the stage for alternative assets to thrive. In that sense, gold’s rally may not be a competitor to Bitcoin’s story but rather a prelude to its next chapter.

Conclusion

Gold’s climb to a $30 trillion market cap highlights how traditional wealth stores still dominate in times of uncertainty. Yet, beneath this shine, Bitcoin’s potential remains intact. The next major move may not be about the gold market or Bitcoin alone, but about how the world redefines value itself in an age where both legacy and innovation shape the future of finance.

FAQ about gold market

Why did gold’s market cap surge to $30 trillion?

The rise was driven by inflation concerns, geopolitical tensions, and investors shifting toward safe-haven assets amid economic uncertainty.

How does gold compare to Bitcoin in market value?

Gold’s market cap is roughly fifteen times larger than Bitcoin’s, solidifying its position as the dominant store of value globally.

Will Bitcoin follow gold’s rally?

Analysts suggest Bitcoin could experience a delayed surge once gold stabilizes, as capital rotates toward higher-risk, higher-reward assets.

What does this mean for traditional markets?

Gold’s dominance signals declining confidence in fiat currencies and a move toward tangible and digital assets that store value outside traditional systems.

Glossary of Key Terms

Market Capitalization: The total value of an asset calculated by multiplying its current price by the total number of units in circulation.

Safe-Haven Asset: An investment expected to retain or increase value during times of market turbulence or economic instability.

Capital Rotation: A shift of investment capital from one asset class to another, often from defensive to growth-oriented markets.

Monetary Supply (M2): A measure of money supply that includes cash, checking deposits, and easily convertible near money within an economy.

Inflation Hedge: An asset, such as gold or Bitcoin, used to protect against the declining purchasing power of currency over time.

Store of Value: An asset that maintains its value over time without depreciating significantly, used for preserving purchasing power.