This article was first published on Deythere.

- Bitcoin Sell-Off Deepens Amid ETF Outflows and Leverage Unwinds

- Silver Markets Shocked by Rising Margins and Liquidations

- Macro Pressure and Inflation Warnings Add to the Fragility of the Market

- Cross-Asset Correlation: Crypto Meets Traditional Markets

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin and Silver Market Stress

Markets have experienced widespread market turbulence in February as Bitcoin’s drop and a sharp decline in the price of silver combined to form what traders called Bitcoin and silver market stress.

The chaos came as institutional investors reduced leverage and macro factors intensified pushing both assets into accelerated selling and triggering margin pressures across global exchanges.

The interplay between cryptocurrency outflows and heightened margin demands in the commodities space has drawn attention from traditional finance and crypto communities alike.

It has opened a window into how interconnected markets are now, even when under stress. The events indicate widespread demand reluctance and increasing macroeconomic pressures.

Bitcoin Sell-Off Deepens Amid ETF Outflows and Leverage Unwinds

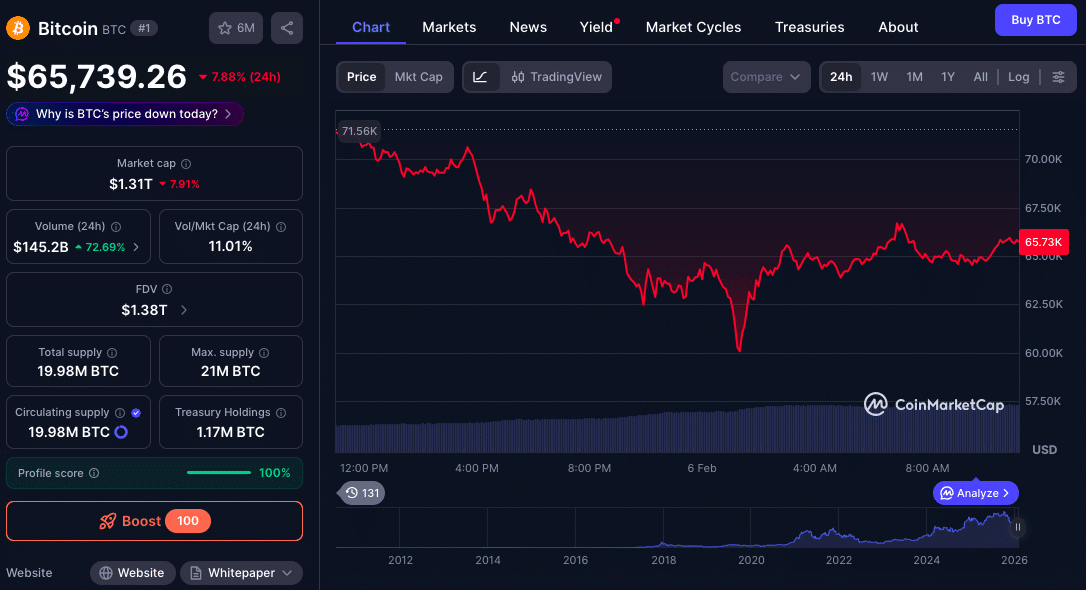

Bitcoin has suffered heavy losses in early February with the cryptocurrency dropping below psychological barriers as risk assets shook. Since Jan 28, Bitcoin’s price had continued to take a step lower with pauses for effect, followed by yet another break and another fast dip.

Falling from a peak, Bitcoin went below the high of $80,000 before losing the low $80,000s and breaking into the $70,000s and now fighting to cling onto the higher skirts of $60,000.

Large net outflows from spot Bitcoin exchange-traded funds (ETFs) were among the most visible signs of eroding demand.

Data up till late January and early February showed volatile Bitcoin ETF flows, which saw huge outflows for several days. These included net outflows of nearly $817.8 million and $509.7 million on January 29 and 30, respectively, followed by a brief inflow of $561.8 million on February 2, and then new outflows of $270 million on February 3 shortly before selling intensified once again.

Outside of the ETF figures, macro pressures have also added strain on Bitcoin. Market reports suggest that leveraged crypto positions have unwound as traders re-evaluate risk against inflation and tightening liquidity.

Institutional demand, which had been solid through late 2025, has wavered recently amid concern over macroeconomic headlines ranging from inflation prints to central bank messages that have weighed on risk-on assets.

This has resulted in Bitcoin acting more like high-beta risk assets, trading with equities and responding violently to changes in liquidity perceptions and the pricing of risk.

Silver Markets Shocked by Rising Margins and Liquidations

Even as crypto markets were squeezed, traditional commodities also felt the pinch. Silver, which had seen multi-decade highs late in 2025, suffered from a sell-off after CME Group increased margin requirements on futures contracts.

CME’s March 2026 silver futures margin rose sharply in late December and into January 2026, after switching from a fixed dollar market requirement to one that is percentage-based, which automatically escalates with price movements.

The consequence was traders being driven to liquidate causing the price of silver to crash down almost 10% intraday during a recent trading session after margin requirements increased from 15% to 18% of notional contract value.

Spot silver was not left out of the volatility, as it moved briefly around $64.09 per ounce during the market stress.

Macro Pressure and Inflation Warnings Add to the Fragility of the Market

The tightening in cryptocurrency and commodities came amid increased macroeconomic uncertainty.

Recent central bank commentary confirmed that inflation remains a favored area of focus, with the Federal Reserve maintaining its policy stance and acknowledging that rate cuts are not imminent despite slowing growth. This has kept markets in a semi-crippled state where risk assets are moving more on inflation expectations and liquidity.

Analysts have noted that markets are responding to inflation warnings from established institutions, and that in general broader economic pressures like increasing trade costs and labor market dynamics are also being underpriced by current market valuations.

The convergence of tightening policy expectations and higher macro uncertainty has brought up a generalized risk-off reaction across asset classes. These macro forces have boosted the U.S. dollar, placing pressure on risk-on assets like Bitcoin and silver.

At times of dollar strength, assets priced in dollars frequently come under downward pressure as money rotates there for perceived safety and conventional markets become more appealing from a yield point of view.

Cross-Asset Correlation: Crypto Meets Traditional Markets

Perhaps the most notable feature of the recent market stress has been the cross-asset correlation between Bitcoin and more traditional assets such as silver and equities.

In past times, crypto markets and commodities have tended to move independently of one another, but this recent episode shows how financial stress can weave together otherwise unrelated markets.

In particular, the margin-driven sell-offs in silver triggered by CME’s risk management measures have led to forced selling in crypto as leveraged positions were opened due to ETF flows and macro uncertainty.

When margin pressures arise, whether in futures markets or through weak demand in regulated investment products, the consequences sound across risk assets and commodities together.

Conclusion

The Bitcoin and Silver market stress of February has shown how interconnected modern financial markets have become. The fall in Bitcoin, which was triggered by large outflows from exchange-traded funds and failing demand signals, coincided with steep margin hikes on silver futures that led to commodity-wide liquidation of positions.

In combination with persistent macroeconomic pressures and fears of inflation, these issues have caused stress on both crypto and traditional markets.

While investors and institutions go through this market volatility and economic uncertainty, the extent of the cross-asset class interconnections is revealing how global financial pressure can produce synchronized selling that goes beyond just an asset class.

Glossary

Bitcoin silver market stress: the collective distress seen in both Bitcoin and Silver markets, influenced primarily by ETF outflows, margin hikes, leverage unwinds and macroeconomic tensions.

Spot Bitcoin ETF flows: the daily net movement of capital into and out of regulated Bitcoin exchange-traded funds, serving as an indicator of investor demand.

Margin requirements: collateral amounts that traders must deposit to hold futures positions.

Forced liquidation: when traders can no longer meet the higher margin requirements and their positions are automatically sold by exchanges or brokers.

U.S. dollar strength: means the dollar has risen in value against other currencies and/or assets, which is potentially bad for risk assets.

Frequently Asked Questions About Bitcoin and Silver Market Stress

What caused the recent market stress in Bitcoin and silver?

A combination of heavy Bitcoin ETF outflows, increased margins on silver futures contracts by the CME Group and macroeconomic signals that reinforced concerns about inflation combined to drive down both markets in tandem.

What is the impact of margin hikes on silver prices?

When exchanges such as CME increase the amount of collateral required to open a position, traders need to post more collateral in order to maintain that position. If they cannot, Liquidation occurs and selling pressure increases and pushes prices lower.

Why do flows to Bitcoin ETFs matter?

Flows in and out of ETFs are an important measure of institutional demand. Sustained outflow activity can destabilize and reinforce the bear market trend.

Were macroeconomic factors at work, too?

Yes, persistent fears of inflation, changing dollar dynamics and expectations for monetary policy caused market uncertainty and led to declining demand for risk assets.