This article was first published on Deythere.

The stablecoin loophole in the GENIUS Act is one of the hottest financial policy debates happening right now in the United States. Community banks, national bank lobbyists and banking associations have increasingly had the same criticisms, accusing crypto exchanges and payment platforms of taking advantage of a loophole in the 2025 law’s wording.

They contend that this loophole allows stablecoin reward programs that basically replicate interest, even though the law was intended to block stablecoins from offering yield.

What the GENIUS Act Was Meant to Accomplish

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) was enacted into the U.S in July 2025 to establish the first federal framework for payment stablecoins.

Its core mission was to make certain that stablecoins operated only as payment mechanisms and did not qualify as savings products that compete with insured bank deposits.

As a condition of obtaining a license under the law, stablecoin issuers are required to hold full reserves in cash or other high-quality liquid assets that qualify as permissible investments for money market funds by asset managers such as U.S. Treasury bills.

They’re also required to submit periodic attestation of their reserves and follow anti-money-laundering regulations and consumer protection requirements. Perhaps most importantly, the Act prohibits stablecoin issuers from paying interest or a yield directly to holders, something banks backed as a measure to safeguard traditional deposit arrangements.

Why Banks Say There’s a Loophole

Even though it’s all there in black and white, community banks and the American Bankers Association argue that the language of the law doesn’t go far enough to prevent issuer-paid yield on stablecoins as they are offered through crypto exchanges and their affiliates.

Banks argue that while a stablecoin issuer could follow the ban, an exchange has the ability to provide “rewards” or incentives for those who deposit stablecoins on its platform.

From the customer’s point of view, these rewards are interest or yield that is paid, whether or not it comes from the exchange’s revenue or marketing budget, as opposed to being explicitly on behalf of the issuer.

This gap is what bankers call the GENIUS Act stablecoin loophole.

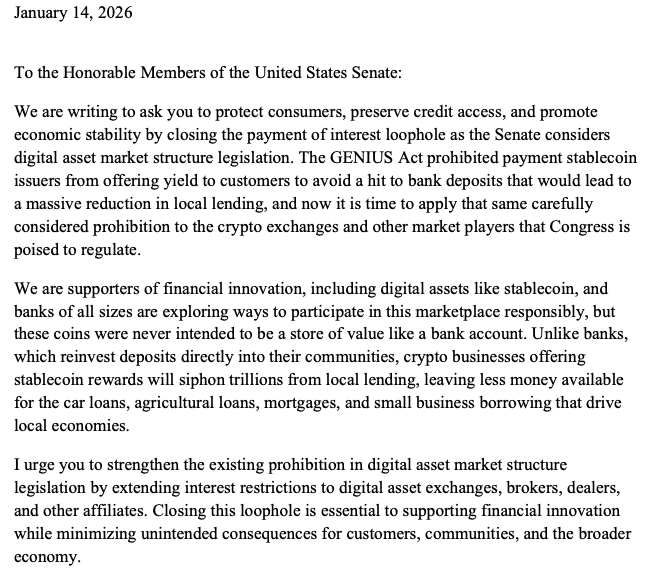

Hence, the American Bankers Association’s Community Bankers Council wrote to the U.S. Senate calling on lawmakers to tighten the framework.

They cautioned that third-party mortgage programs effectively generate yield and might drain deposits from traditional banks, particularly small community lenders whose local deposits fund mortgages and small business loans.

Community Banks Versus Large Banks

Community banks stress that they are particularly at risk of deposit outflows compared with the larger national banks. Big banks can tap into wider wholesale funding markets, whereas smaller lenders rely more heavily on local retail deposits to finance lending to households and businesses.

Bankers have warned that if depositors were to redirect substantial money into yield-like stablecoin rewards, the supply of credit locally could be jeopardized.

Estimates embraced by the banking lobbyists put it as high as $6.6 trillion in deposits that could be unloaded from banks to accrue interest, although the exact figure remains debated.

How Crypto Companies and Industry Groups Are Fighting Back

Crypto firms and industry groups say the fears are overblown and fueled in part by misunderstanding. The Blockchain Association and the Crypto Council for Innovation have said that the GENIUS Act’s ban was not supposed to apply at all to exchanges or affiliates, only stablecoin issuers.

They argue that banning third-party reward schemes could inhibit innovation and restrict consumer choice in digital payments.

Big platforms like Coinbase have publicly said that since they don’t “issue” stablecoins like USDC or PYUSD, so offering rewards through their own arrangements doesn’t break the statute.

Some critics contend the programs are akin to old-fashioned airline loyalty points rather than interest, while supporters say Congress intentionally left room for legal incentives tied to usage or engagement.

The discussion has even affected crypto regulatory negotiations in Congress. One draft crypto market structure bill introduced in January 2026 contains provisions that would prevent interest payments to holders of stablecoins but still allow “activity-based rewards,” like payments or loyalty rewards.

This indicates an effort to reconcile banking fears with crypto industry stances, though both the language and timing remain uncertain.

Latest Policy and Legislative Moves

The stablecoin reward dispute is now impacting legislation outside the original GENIUS Act. Bank lobbyists are actively pressing the U.S. Senate to fix this by closing the loophole and expanding it so that it is not only issuers but exchanges, brokers, dealers and other intermediaries.

They say the extension is needed to shield consumers and maintain credit availability in local communities.

In Congress, debates are also occurring about calls to demand clear reporting of which entities pay out such stablecoin rewards and how those programs are funded, rather than banning them altogether.

Some policy proposals further consider restricting only the balance-based incentives that are closely akin to interest payments on deposits, while permitting usage-related incentives that are linked with real payment transactions.

The dispute has caused legislatures to grind to a halt or slow. Crypto firms like Coinbase also came out this week, withdrawing support for parts of the Senate’s crypto bill, arguing that proposed limits on stablecoin rewards would do more harm than good.

Conclusion

The GENIUS Act stablecoin loophole is now a focus of discussion in U.S. financial regulation.

Designed to govern payment stablecoins and prohibit issuer-paid yield, the language of the law has been criticized by community banks as not being effective enough to stop similar rewards programs from third parties such as exchanges.

Banks say those loopholes could siphon deposits away from local banks and shrink credit. Crypto companies, however, claim the statute was never meant to prohibit legal activity by intermediaries and that stricter restrictions could stifle innovation and consumer choices.

As of now, Congress faces ongoing negotiations and continued pressure from both banking and crypto sectors.

Glossary

GENIUS Act: A U.S. federal law passed in 2025 that regulates payment stablecoins and prevents issuer-paid yield.

Stablecoin issuer: The legal entity that is responsible for the issuance of a stablecoin, including the holding of required reserves.

Stablecoin reward: Rewards provided by exchanges or platforms for users who hold their stablecoins, such as interest.

Deposit flight: Withdrawal of funds from bank deposits to other forms of financial instruments.

Affiliate: A partner or agent of a stablecoin issuer or exchange.

Frequently Asked Questions About GENIUS Act Stablecoin Loophole

What is the stablecoin loophole in GENIUS Act?

That would be the argument that, while the GENIUS Act prohibits stablecoin issuers from offering yield, it does not explicitly prohibit third parties like exchanges from providing those rewards, which banks in turn say they mimic interest.

Why are community banks concerned?

Community banks worry that depositors will move money into reward-bearing stablecoins, draining local deposits that bankroll loans and credit in their communities.

Are crypto exchanges concerned they may be breaking the law?

Crypto companies argue that they are not on the hook because they are not technically the issuers of stablecoins, and reward programs pay revenue-based, not issuer-paid interest.

How might Congress close the loophole?

Some potential approaches include applying the ban on stablecoin yield to distribution partners, insisting upon clear risk disclosures on reward funding or allowing only certain forms of activity-based incentives.

Reference