According to sources, the GENIUS Act stablecoin impact has caused a huge rise in digital asset transactions, with on-chain stablecoin volume hitting a record high of $1.5 trillion in July. The clear rules brought in by the act, along with the strong performance of the crypto market, are changing how stablecoins are used around the world.

- How Did the GENIUS Act Fuel This Stablecoin Surge?

- What Role Did Crypto Price Rallies Play?

- Are Financial Giants Like JPMorgan and Meta Getting Involved?

- Which Stablecoins Benefited Most?

- Conclusion

- FAQs

- 1. What is the GENIUS Act stablecoin impact?

- 2. When was the GENIUS Act signed into law?

- 3. Which stablecoin saw the highest volume in July?

- 4. What was Tether’s $USDT volume in July?

- 5. How did $BTC and $ETH influence stablecoin use in July?

- 6. What is Meta testing after the Act?

- Glossary

- Sources

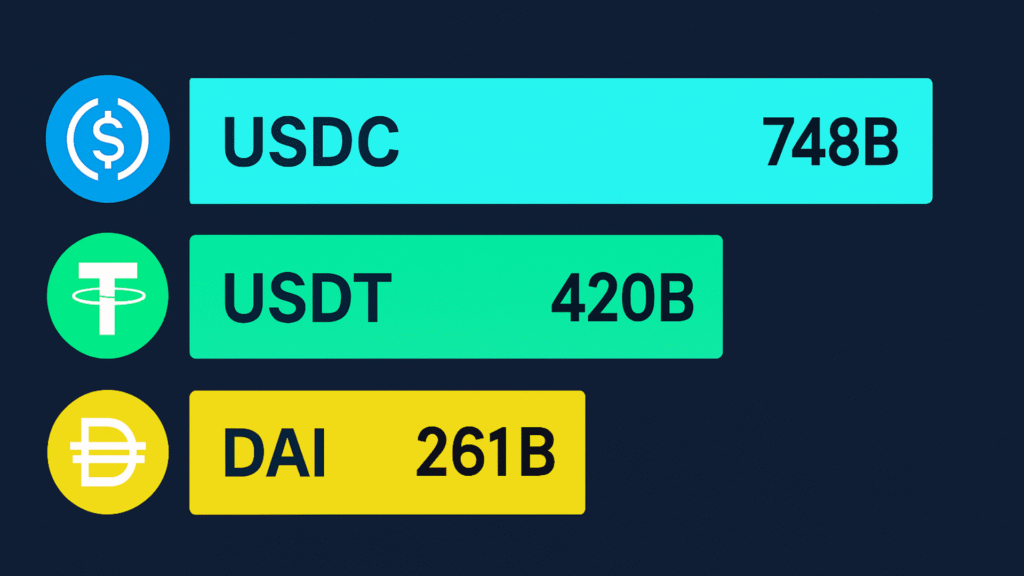

This milestone is a major moment in stablecoin history, as both big financial institutions and everyday investors are moving toward safer and more regulated digital currencies. Circle’s USDC was the top performer, handling nearly $748 billion in July, almost half of the total.

Tether’s $USDT came next with $420 billion, and the decentralized DAI followed with $261 billion, making them the top three stablecoins by volume.

How Did the GENIUS Act Fuel This Stablecoin Surge?

The big jump in stablecoin activity is closely linked to the GENIUS Act stablecoin impact. The act, signed into law on July 18, brought clear rules for digital dollar versions. It requires stablecoins to keep enough reserves and puts them under the watch of the Federal Reserve, important steps to build trust in the market.

“This law has completely changed how big companies view stablecoins,” said Linda Zheng, senior analyst at BlockTower Capital. “Earlier, many stayed away because the rules were confusing. Now that things are clearer, they’re getting involved much faster.”

The stablecoin volume reached $1.5 trillion in July, which is nearly 20% more than June’s total of $1.26 trillion. This also beat the previous record of $1.4 trillion set back in August 2024.

What Role Did Crypto Price Rallies Play?

Bitcoin’s jump to over $123,000 and Ethereum’s rise close to $4,000 in July helped set the stage for the GENIUS Act stablecoin impact. As investors locked in their profits, many shifted their money into more stable assets like $USDC and $USDT. This move is seen by many as a way to protect profits.

Crypto economist Arjun Malik said, “As the crypto market grew, investors started taking profits, and stablecoins became a safe place to park their money. The GENIUS Act made the timing just right.”

It wasn’t just about keeping money safe; it was also about easy access. Stablecoins gave investors quick, on-chain access to their funds, allowing smooth use in DeFi platforms, crypto exchanges, and large-scale trades.

| Key Metric | Brief Details |

| Enactment Date | July 18, 2025 |

| July 2025 Volume | $1.5 trillion |

| Regulation | First federal stablecoin law; strict licensing & reserves |

| Reserve Backing | 1:1 in US dollars & Treasury bills |

| Authorized Issuers | Banks, licensed non-banks |

| Compliance | Monthly reports, audits, AML |

| Market Impact | Boosted use by banks, tech giants, payment platforms |

| Transaction Benefits | Fast, secure, 24/7 blockchain payments |

| US Dollar Effect | Supports Treasury demand & dollar dominance |

| Risks | Wallet fragmentation, stability concerns if unmanaged |

| Effective Date | By Jan 18, 2027 or within 120 days post rules |

Are Financial Giants Like JPMorgan and Meta Getting Involved?

The GENIUS Act stablecoin impact isn’t just about rising transaction numbers; it’s also changing how big companies think.

Major firms like JPMorgan and Meta are now looking into using stablecoins for international payments and other financial services.

JPMorgan’s blockchain team reportedly tested $USDC transfers on its private network in mid-July, saying the GENIUS Act provided “clearer compliance pathways” that made such trials possible.

Similarly, sources close to Meta revealed that the company is testing stablecoin-based remittance systems on its digital platforms, suggesting it has bigger goals in global financial services.

“The GENIUS Act made us feel secure about moving ahead,” said a Meta employee. “We’re no longer working under unclear rules.”

Which Stablecoins Benefited Most?

Circle’s $USDC was the most affected by the GENIUS Act stablecoin impact, handling about $748 billion in July, almost half of all stablecoin transactions. Both traders and big companies are now choosing $USDC more often because it follows strict rules and is seen as more reliable.

Tether’s $USDT stayed strong with $420 billion in transactions, while DAI, the decentralized stablecoin backed by Ethereum, reached $261 billion. This is a significant number, especially as more people are showing interest in decentralized finance (DeFi) options.

These numbers highlight the GENIUS Act stablecoin impact on a wide range of assets, affecting both centralized and decentralized stablecoins alike.

Conclusion

Based on the latest research, the GENIUS Act stablecoin impact is both quick and long-lasting. It helped push July’s $1.5 trillion in stablecoin transactions and is building trust with big companies and regulators.

With clear rules and rising global use, stablecoins like $USDC, $USDT, and DAI are moving from crypto circles into mainstream finance. As more countries look at similar laws, the GENIUS Act stablecoin impact could be seen as a major turning point for the whole industry.

Summary

The GENIUS Act stablecoin impact caused stablecoin transactions to hit a record $1.5 trillion in July. Circle’s $USDC saw the most use with $748 billion in volume, while Tether’s $USDT reached $420 billion, and DAI followed with $261 billion.

The growing stablecoin activity was also supported by higher Bitcoin and Ethereum prices, which added to the momentum. $BTC and $ETH’s price jump also played a part. Experts believe the GENIUS Act stablecoin impact is a big step toward wider use.

Stay ahead of the stablecoin shift, track market moves, and expert insights in real time on our platform.

FAQs

1. What is the GENIUS Act stablecoin impact?

It triggered a $1.5 trillion surge in stablecoin transaction volume in July.

2. When was the GENIUS Act signed into law?

July 18, 2025.

3. Which stablecoin saw the highest volume in July?

Circle’s $USDC with $748 billion.

4. What was Tether’s $USDT volume in July?

$420 billion.

5. How did $BTC and $ETH influence stablecoin use in July?

Price rallies led to move profits into stablecoins.

6. What is Meta testing after the Act?

Stablecoin-based remittance systems on its platforms.

Glossary

Profit Parking – Strategy of moving gains from crypto into stable assets like stablecoins.

Federal Reserve Oversight – The U.S. central bank is now supervising stablecoin reserves and rules.

DAI – Controlled by code, backed by crypto, owned by no one.

$USDC – A fully backed stablecoin by Circle, known for its strong compliance.

Remittance System – A method for sending money digitally across borders.