Gemini has officially landed in Australia, this time with boots on the ground and a government seal of approval. The exchange, known for pushing regulated crypto services worldwide, has launched its new local entity, Gemini Intergalactic Australia Pty Ltd, after gaining registration from AUSTRAC, the country’s financial intelligence agency.

For years, Australian traders could use Gemini’s global platform, but it always felt a little distant. Now, with AUSTRAC approval in hand, Gemini can operate as a fully compliant digital currency exchange within the country, meaning users will finally be able to deposit, withdraw, and trade directly in Australian dollars.

Saad Ahmed, Gemini’s Head of Asia-Pacific, described the move as “a natural next step” in an expanding regional strategy. Speaking at a crypto industry event in Singapore, Ahmed said the goal was simple: “Build something tailored for Australians, not just repurpose what works in the U.S.”

Why AUSTRAC Registration Matters

For anyone new to how crypto licensing works in Australia, AUSTRAC sits at the center of it. Every exchange offering digital currency services locally must register with the agency, which enforces anti-money-laundering (AML) and counter-terrorism financing (CTF) rules.

Getting on AUSTRAC’s registry isn’t just a checkbox exercise, it signals operational legitimacy. Without that approval, an exchange cannot lawfully provide crypto-to-fiat services. In Gemini’s case, the new Australian entity ensures that all activity, from customer onboarding to fiat conversion, follows strict compliance frameworks.

Industry watchers note that the timing couldn’t be better. Australia’s government is tightening oversight, planning to require crypto firms to hold an Australian Financial Services License (AFSL) in the near future. Gemini’s early AUSTRAC registration positions it one step ahead in meeting those upcoming rules.

A Local Arm for a Global Exchange

With AUSTRAC backing, Gemini will roll out AUD payment rails, local banking integrations, and faster deposits and withdrawals. It’s a big shift from the previous setup, where users had to route funds internationally, often waiting days for settlements.

James Logan, appointed as Gemini’s Head of Australia, said in a press statement that “localization and transparency are at the heart of this launch.” Logan added that Gemini will prioritize features Australians actually need, speed, simplicity, and security, before exploring more complex products like staking or derivatives.

While the company has not revealed an exact rollout calendar, insiders say the local exchange will start with spot trading and custodial services, gradually adding advanced options after ongoing coordination with AUSTRAC and other regulators.

A Bet on Australia’s Crypto Growth

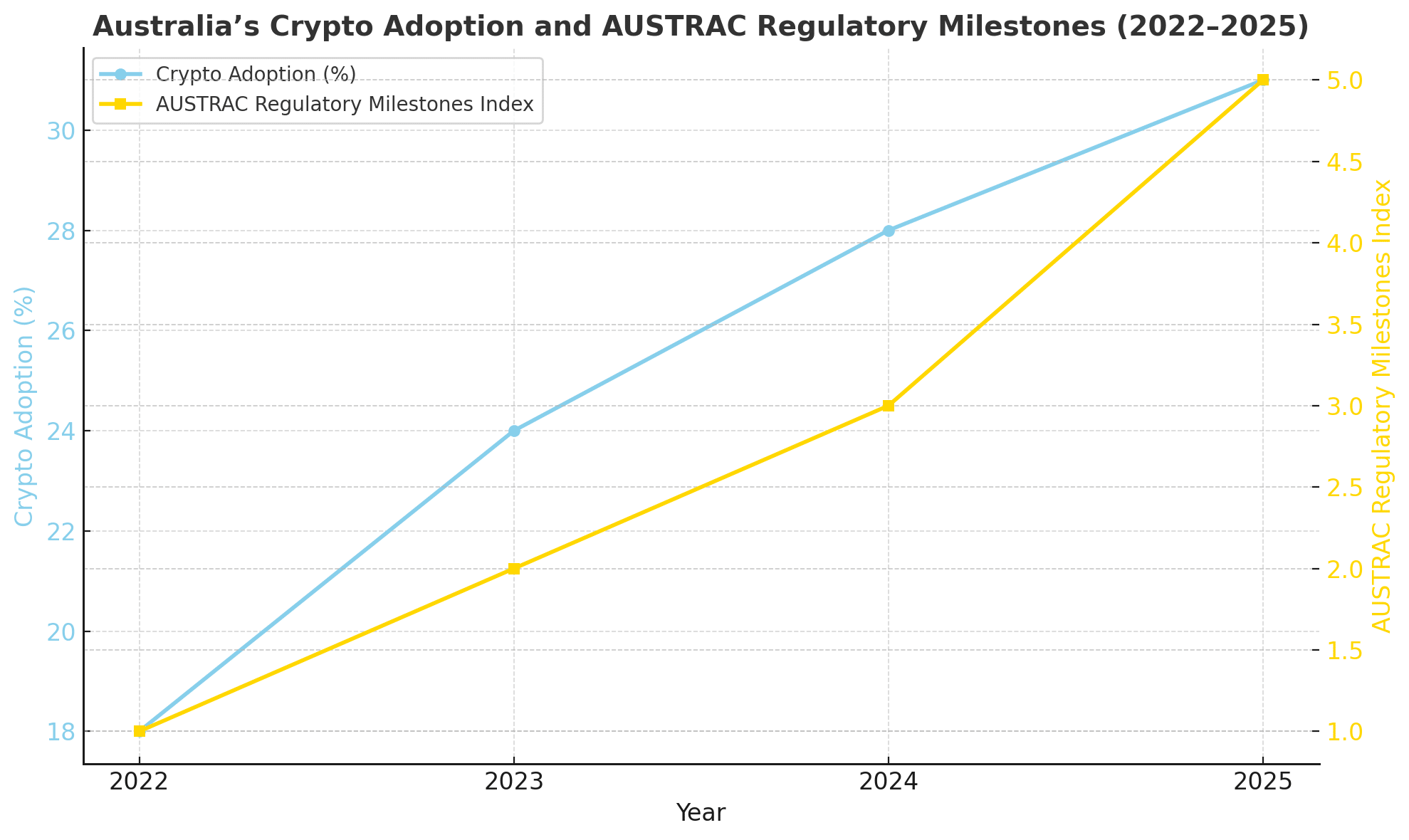

Australia’s crypto participation has been quietly booming. Roughly one in three Australians now owns digital assets, according to multiple 2025 surveys. Against that backdrop, Gemini’s decision to plant local roots appears well-timed.

Ahmed pointed out that Gemini’s compliance-first approach aligns perfectly with Australia’s cautious but progressive stance. “Regulators here, especially AUSTRAC, have been firm but fair,” he said. “That kind of environment attracts serious players.”

Local analysts agree. They argue that Gemini’s arrival adds pressure on domestic exchanges to strengthen compliance and innovation. “When a brand with Gemini’s global reputation comes in under AUSTRAC’s watch, it raises the bar for everyone,” one Sydney-based crypto researcher remarked.

A Different Kind of Expansion

While many crypto companies are scaling back amid volatile markets, Gemini is quietly building licensed footprints. The exchange already holds European approvals under MiCA and now adds Australia to its growing list of regulated markets. Each move reinforces its image as a long-term, compliance-driven exchange rather than a fast-moving speculator.

For Australian users, AUSTRAC’s oversight brings peace of mind. It ensures Gemini must adhere to strict data, reporting, and security protocols, a welcome change after years of uncertainty around offshore platforms.

Conclusion

Gemini’s Australian launch may look like a single headline, but it carries deeper meaning. With AUSTRAC at the regulatory helm, Gemini’s entry blends credibility with opportunity. It shows that serious crypto exchanges are ready to operate within frameworks, not outside them.

As crypto adoption accelerates across Australia, this new chapter could set a precedent: innovation and compliance don’t have to be rivals. They can, under the right guidance, move in lockstep, just as Gemini and AUSTRAC now do.

Frequently Asked Questions

1. What is AUSTRAC?

It is Australia’s financial intelligence agency overseeing anti-money-laundering compliance for financial institutions, including crypto exchanges.

2. Why is AUSTRAC registration important?

It legally allows crypto firms like Gemini to operate within Australia while ensuring customer protection and regulatory oversight.

3. Will Gemini offer all features from its U.S. platform in Australia?

Not right away. Gemini plans a gradual rollout, focusing on AUD trading and secure custody before adding advanced tools.

4. How does this affect Australian traders?

It gives them a compliant, locally operated platform under AUSTRAC supervision, improving accessibility and trust.

Glossary of Key Terms

AFSL: Australian Financial Services License, a proposed requirement for crypto exchanges.

AML/CTF: Legal frameworks ensuring financial integrity and transparency.

Custodial Services: Platforms holding digital assets securely on behalf of clients.

Fiat Integration: Enabling direct trading between cryptocurrencies and traditional currencies like AUD.