A long and messy chapter in crypto may soon be over. The long-awaited Gemini and SEC Settlement is moving forward, with both sides reaching a resolution in principle over the exchange’s Earn lending program.

The deal could finally bring relief to customers who saw nearly $900 million in funds locked up and may also define how regulators treat crypto lending products in the future.

Why the Settlement Matters

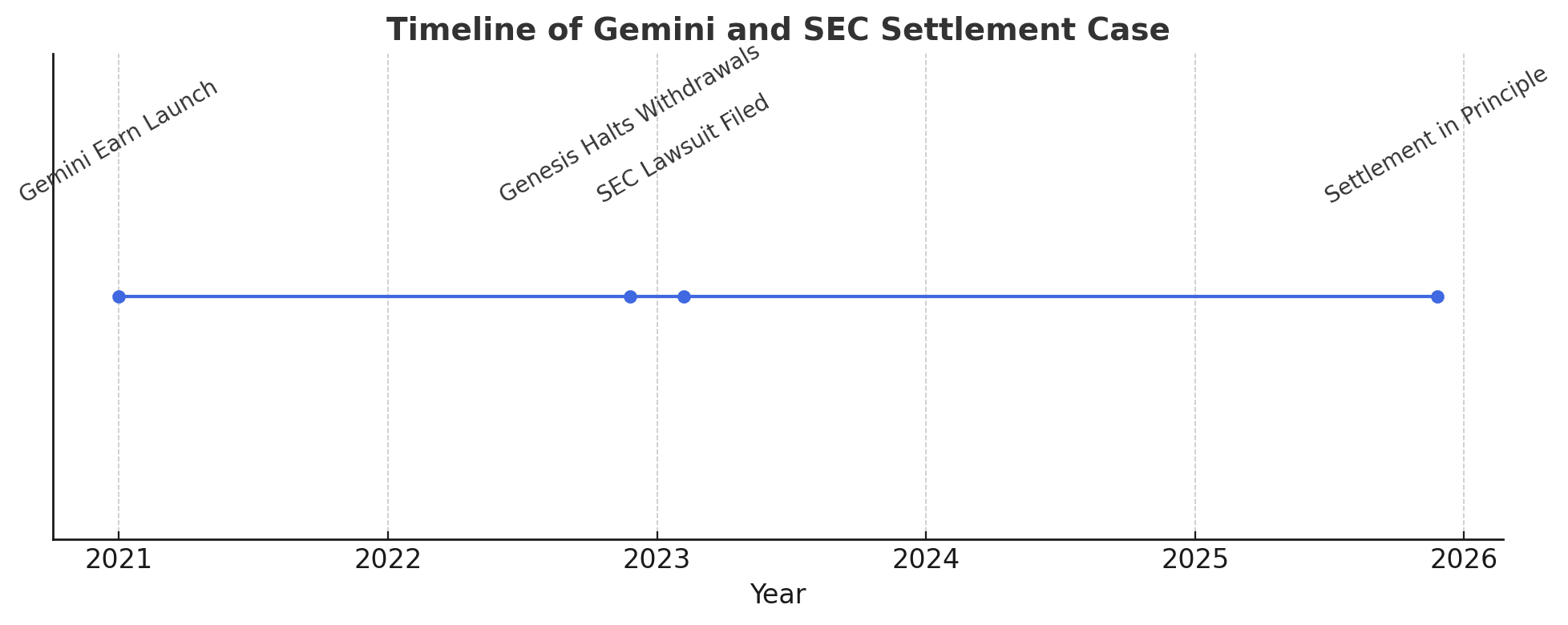

The conflict centers on Gemini’s Earn program, which let customers lend out their crypto in return for interest. The SEC argued it was effectively an unregistered securities offering, leaving investors without the legal protections they deserved. When Genesis, Gemini’s partner, froze withdrawals in late 2022, thousands of users suddenly found their assets stuck.

The Gemini and SEC Settlement is designed to close this painful chapter. While the exact financial details are still being worked out, the framework suggests restitution for customers and penalties for the company, with the aim of restoring trust in the system.

Leadership Voices on the Agreement

Gemini’s co-founder, Cameron Winklevoss, recently struck an optimistic tone. On X, he wrote, “We are pleased to move toward a resolution that provides clarity for our customers and accountability in the industry.” His words reflect the company’s push to rebuild confidence and move past the controversy.

The SEC, for its part, has signaled that enforcement will not slow down. Chair Gary Gensler has said repeatedly, “Crypto lending platforms must play by the same rules that protect investors in traditional markets.” The Gemini and SEC Settlement underscores that message: innovation is welcome, but it won’t escape the reach of securities laws.

What It Means for Investors

For customers, this settlement is more than headlines. It could mean progress toward unlocking funds that have been out of reach for nearly two years. Analysts note that Gemini has already agreed to return more than $1 billion under a separate state deal, showing that repayment is a priority.

The broader takeaway is just as important. The Gemini and SEC Settlement may set the tone for how other exchanges handle yield-bearing products. If lending services are treated like securities, they will need proper registration, disclosures, and investor protections. That could make the industry safer but also limit the freewheeling lending products that once defined crypto’s high-yield culture.

Bigger Picture: Regulation Meets Reality

The timing is striking. Gemini has just gone public in an IPO, raising $425 million and securing a valuation of $3.3 billion. Closing the Gemini and SEC Settlement now gives the exchange a cleaner slate as it positions itself for growth in the regulated financial world.

For the wider industry, the message is clear: the era of regulatory gray zones is closing. As one legal analyst noted, “This settlement sends a signal that compliance is no longer optional—it’s the price of playing in mainstream finance.” Other firms will likely adjust their lending products before regulators force their hand.

Conclusion

The Gemini and SEC Settlement is more than just a legal truce, it’s a milestone for crypto’s evolution. By addressing frozen customer funds and clarifying rules around lending, it points toward a future where trust and transparency matter as much as innovation.

For customers, the hope is simple: get their money back. For the industry, the lesson is clear: the rules are catching up, and everyone has to play by them.

FAQs about Gemini and SEC Settlement

Q1: What is the Gemini and SEC Settlement about?

It resolves the SEC’s lawsuit over Gemini’s Earn program, which regulators said was an unregistered securities offering.

Q2: How much money is involved?

Roughly $900 million in customer assets were frozen when Genesis halted withdrawals in 2022.

Q3: What does this mean for Earn customers?

The settlement increases the likelihood that funds will be repaid and gives clarity on how similar products must operate going forward.

Q4: Why does this case matter for the whole industry?

The Gemini and SEC Settlement may force other exchanges to register their lending products, pushing crypto finance closer to traditional rules.

Glossary

Unregistered Securities Offering: Selling investment products without legal approval or disclosure.

Earn Program: Gemini’s lending product that froze $900M when Genesis collapsed.

Frozen Assets: Customer funds that cannot be accessed due to a counterparty failure.

IPO (Initial Public Offering): When a company sells shares publicly for the first time.

Regulatory Compliance: Following the rules set by financial regulators like the SEC.