U.S. firms and institutions are preparing to establish their own US dollar-backed stablecoins, fueled by the recently approved GENIUS Act. This law establishes the first federal framework for regulating payment stablecoins. It provides clarity, but businesses must still navigate considerable legal and technological challenges.

Why Companies Want In, and What’s Keeping Them Back

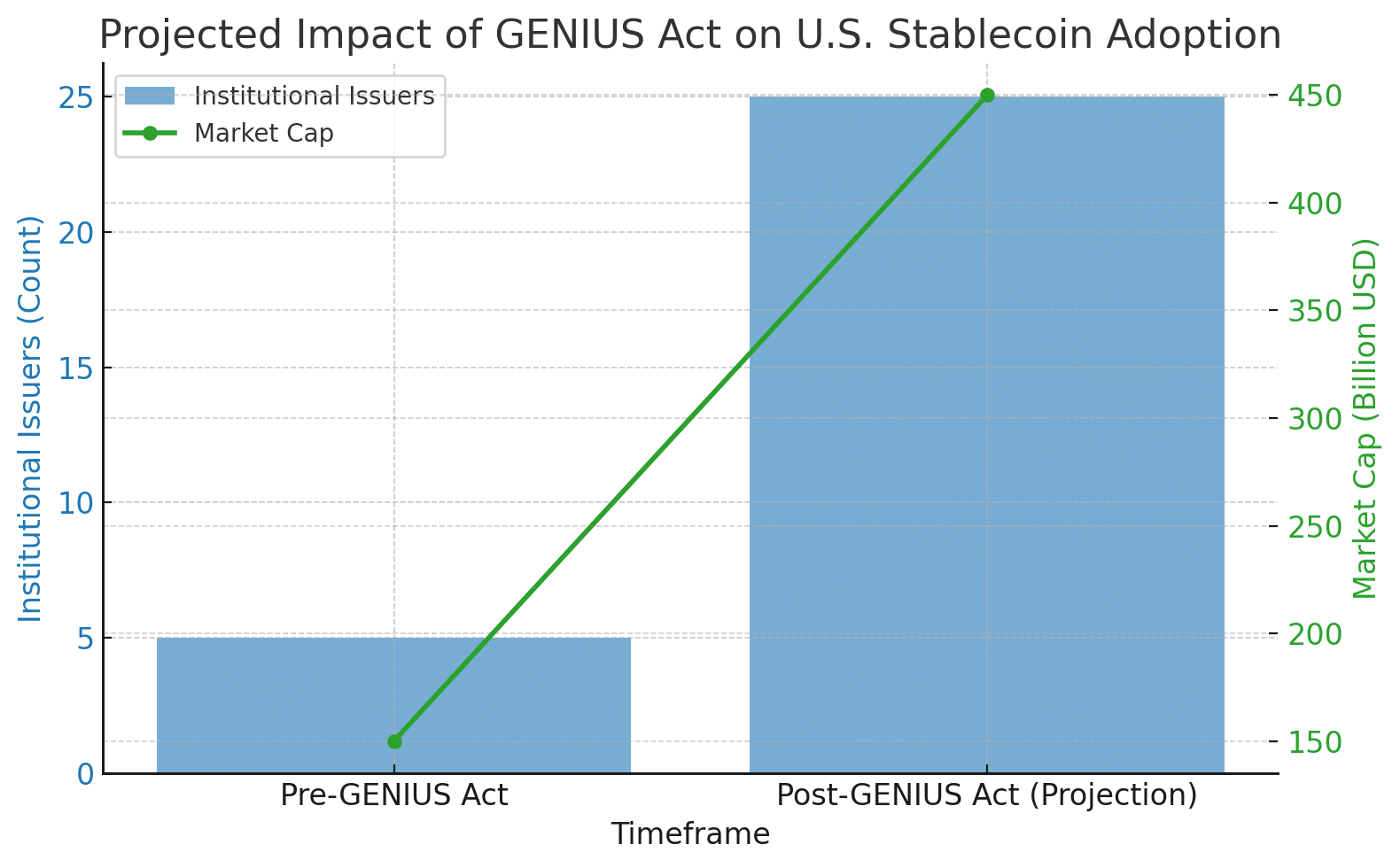

The passing of the GENIUS Act removed a significant barrier to institutional entrance into stablecoins. Now, big actors, including financial institutions, payment providers, and technology companies, are considering releasing their own dollar-backed tokens. This approach addresses the rising need for quick, low-cost alternatives to traditional cross-border payments.

However, the process of issuance is far from clear. The rule requires issuers to retain 1:1 reserves—in cash or ultra-safe assets, such as short-term Treasuries, and declare reserve compositions periodically.

Strong compliance and audit procedures provide traditional banking firms with a competitive advantage. Nonbank enterprises, on the other hand, confront severe regulatory constraints as well as the necessity of developing infrastructure to ensure continual transparency.

How the GENIUS Act Ensures Consumer Trust

The GENIUS Act establishes a rigorous compliance framework. It requires that only authorized issuers, bank subsidiaries, or nonbanks sanctioned by regulators may mint these stablecoins.

It classifies issuers as financial institutions under the Bank Secrecy Act and prioritizes anti-money laundering and fraud restrictions, even for international issuers achieving identical norms. This monitoring system strikes a compromise between the need for innovation and consumer safety.

What Analysts Say: Optimism with a Side of Caution

Experts see the law as a watershed moment for cryptocurrency’s mainstream credibility. Still, the research mentions persistent hazards. Stablecoins, especially fully backed ones, can nevertheless depeg or endure liquidity shocks during significant market stress.

Some economists worry about systemic implications, such as upsetting short-term Treasury markets during fast stablecoin development. For students and financial experts, this indicates that stablecoin supply must be accompanied by rigorous liquidity planning and risk management.

Real-World Signals: Institutions eyeing their own stablecoins

Following the GENIUS Act, numerous prominent organizations, including large banks and payment platforms, are racing to register stablecoins. The law’s clarity has sparked comparable interest by significant players considering the future of payments.

However, developing a stablecoin takes more than just governmental clearance. It entails creating scalable blockchain infrastructure, assuring real-world convertibility, and administering digital payments on a financial scale. This is a watershed point in the evolution of traditional banking and blockchain technology.

Conclusion

The GENIUS Act is a watershed event in US financial law, outlining a clear path for institutional stablecoin issuance. While large companies prepare to issue their own coins, success is dependent on satisfying tight reserve, regulatory, and technical standards.

This development elicits both excitement and caution. Financial students and cryptocurrency aficionados may identify the historic movement toward blockchain-based payments. Meanwhile, analysts and developers should keep in mind that daring in innovation must be accompanied with safety precautions.

This ongoing tale is about how blockchain and traditional finance may collaborate responsibly on a large scale.

FAQs

1. What is the GENIUS Act?

The GENIUS Act is the U.S.’s first federal law regulating stablecoins, setting rules for issuance, backing, and oversight by approved issuers.

2. Who can issue stablecoins under this law?

Only permitted payment stablecoin issuers—like bank subsidiaries and state- or OCC-approved nonbanks—can legally issue stablecoins in the U.S.

3. What are the key reserve requirements?

Issuers must maintain 1:1 backing with liquid, low-risk assets like U.S. dollars or short-term Treasury bills and must audit reserves monthly.

4. Why are institutions rushing to launch stablecoins?

Stablecoins offer faster, cost-efficient settlements and new payment mechanisms that attract firms seeking a digital edge amid clear regulations.

5. What risks remain despite the law?

Risks include liquidity strain, de-pegging in volatile markets, potential Treasury market impact, and hurdles for nonbank issuers in compliance and infrastructure.

Glossary

GENIUS Act: U.S. federal law regulating the issuance of payment stablecoins backed 1:1 by liquid assets.

Payment Stablecoin: A digital token designed for payments, with fixed value relative to a currency (e.g., USD).

Permitted Issuer: Authorized entity (e.g., bank subsidiary) allowed to issue stablecoins under the law.

Reserve Backing: Assets held to fully back stablecoins, ensuring value stability.

AML/KYC Compliance: Anti-money-laundering and know-your-customer procedures required under the law.

Depeg: When a stablecoin loses its fixed value relationship with its underlying asset.