This article was first published on Deythere.

- What Eric Balchunas Reported: The ETF Wave Has Arrived

- Why Spot Altcoin ETFs Are Relevant

- Regulatory Momentum Is Aligning

- What Altcoins Are Topping the Charts?

- Conclusion

- Glossary

- Frequently Asked Questions About Spot Altcoin ETFs

- What altcoins will have spot ETF?

- What is “spot” in spot altcoin ETFs?

- Why is this surge in ETFs occurring now?

- Who is behind these ETFs?

- When will these ETFs trade?

- References

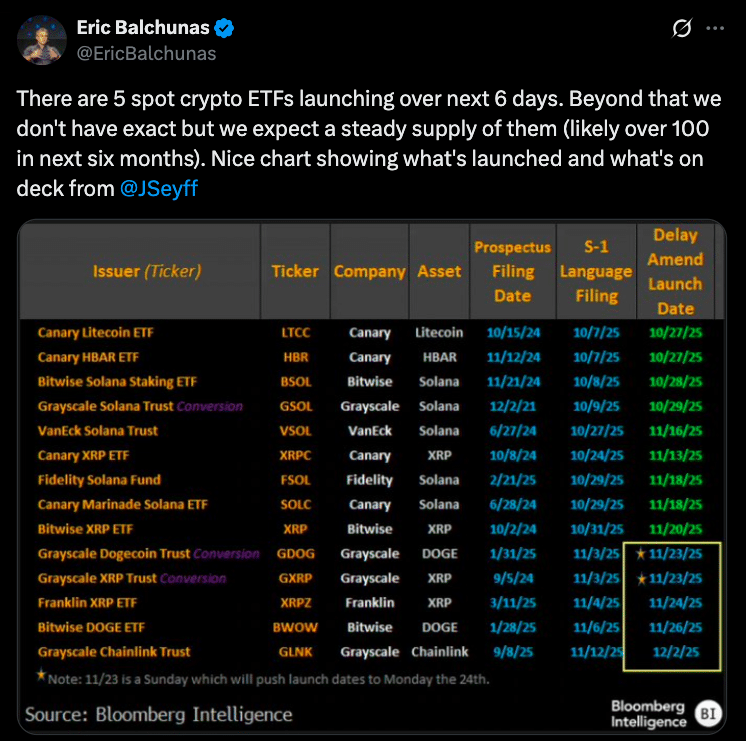

Big changes could be coming to the ETF space as five spot altcoin ETFs are set to launch within the next six days, according to Eric Balchunas, Bloomberg’s ETF analyst.

However, unlike futures ETFs, which follow the price of the asset based on derivatives, spot ETFs will track the literal crypto asset. It means institutions and retail investors can potentially now get regulated exposure to Altcoins like XRP, Dogecoin, and Chainlink without themselves holding the tokens.

What Eric Balchunas Reported: The ETF Wave Has Arrived

“There are 5 spot crypto ETFs launching over next 6 days,” Balchunas announced on social media, indicating a quick rollout of altcoin funds.

He also projected that over the next six months, more than 100 altcoin ETFs might follow.

These are not vague predictions. According to the same report, some of these ETFs include GDOG (Dogecoin), Grayscale/Franklin’s XRP ETF, and LINK ETF by Grayscale.

Why Spot Altcoin ETFs Are Relevant

Spot ETFs are very different from futures-based ETFs. Unlike derivative contracts, which are linked to the price of an asset, spot ETFs own the tokens themselves so that investors can receive direct exposure to its price performance.

This makes them especially useful for altcoins, where many think the long-term value is dependent more on their use cases rather than speculation.

Investors can gain access to high growth altcoins in a regulated environment without worrying about the logistics of managing their own private keys. For institutions, it is a way to get exposure to crypto under their existing regulatory frameworks.

Regulatory Momentum Is Aligning

This optimism for the spot altcoin ETFs is due to changing regulations.

Because the SEC has adopted generic listing standards, this means 19b-4 applications are going to become less crucial, one of the major hurdles for an altcoin ETF, Balchunas added.

Earlier, some altcoins were seen as riskier due to category disputes. But news sources point out that asset managers as Grayscale and Bitwise are seeking to register spot ETFs for Solana, XRP, Dogecoin and more via the new streamlined process.

Balchunas and his colleague James Seyffart now give quite high approval odds to some of these altcoin ETF proposals.

What Altcoins Are Topping the Charts?

Specifically, top-tier altcoins are reportedly on the frontline for ETF listings, according to Balchunas.

His approval-odds tracker features Solana (SOL), XRP, Dogecoin (DOGE), Litecoin (LTC), Cardano (ADA) and Polkadot (DOT).

In previous reports, the chances of these altcoins being approved was said to be as high as 90-95%.

In a previous Catenaa interview, analysts gave 95% probability that markets see Solana, XRP and Litecoin ETFs by the end of 2025.

This high likelihood indicates a rapidly approaching regulated altcoin market.

Conclusion

Eric Balchunas believes that five spot altcoin ETFs are about to launch in six days.

This could mean the beginning of a transformative change in how altcoins can be accessed by mainstream finance.

As these ETFs see the light of day, they will offer regulated, physical access to leading altcoins, something that would lower the entry barriers for both retail and institutional investors high and low.

Glossary

Spot ETF: An exchange-traded fund that physically holds the basic crypto, not derivatives.

Altcoin: A cryptocurrency that is not Bitcoin.

19b-4: A form that must be filed with the SEC for certain ETFs to be able to request approval.

Generic listing requirements: A new regulation to streamline ETF listing requirements.

Approval odds: The likelihood that a requested ETF gets regulatory clearance.

Frequently Asked Questions About Spot Altcoin ETFs

What altcoins will have spot ETF?

Eric Balchunas suggested the likes of Solana (SOL), XRP and Dogecoin (DOGE) would also be in the running.

What is “spot” in spot altcoin ETFs?

“Spot” is a way of saying the ETF tracks (or “holds”) the real cryptocurrency asset, as opposed to derivatives or futures of it.

Why is this surge in ETFs occurring now?

There are generic listing standards adopted by the SEC to lower barriers to regulation, along with strong institutional demand.

Who is behind these ETFs?

Balchunas cited issuers like Grayscale and Bitwise in his announcement.

When will these ETFs trade?

They will begin trading within six days, said Balchunas, adding that the specific ETF tickers and which exchange they’ll list on have yet to be determined.