The markets are tense, and not just because a Federal Reserve rate cut could be days away. President Donald Trump has reignited efforts to remove Governor Lisa Cook from the central bank’s board.

The move comes at a delicate moment, with investors, traders, and crypto enthusiasts hanging on every signal from the Fed. What was already a high-stakes policy meeting has now turned into a test of the Fed’s independence, and the outcome could shake digital asset markets worldwide.

Trump’s Legal Push and the Fed’s Credibility

Trump’s team argues Cook should be removed “for cause,” pointing to mortgage filings in 2021 where she allegedly claimed two properties as her primary residence. Cook insists the allegations are politically motivated.

A federal judge has blocked her removal for now, ruling that past conduct may not meet the legal standard. But Trump has appealed, pushing for an emergency ruling that could sideline her before the Fed votes.

The clash is about more than one governor. It raises questions about whether the central bank can make policy free from political pressure. As hedge fund manager Ken Griffin warned, “Politicizing the Fed risks undermining the very foundation of stable markets.” For investors, trust in the Fed’s independence is as important as the decisions it makes.

Why the Rate Cut Matters for Crypto

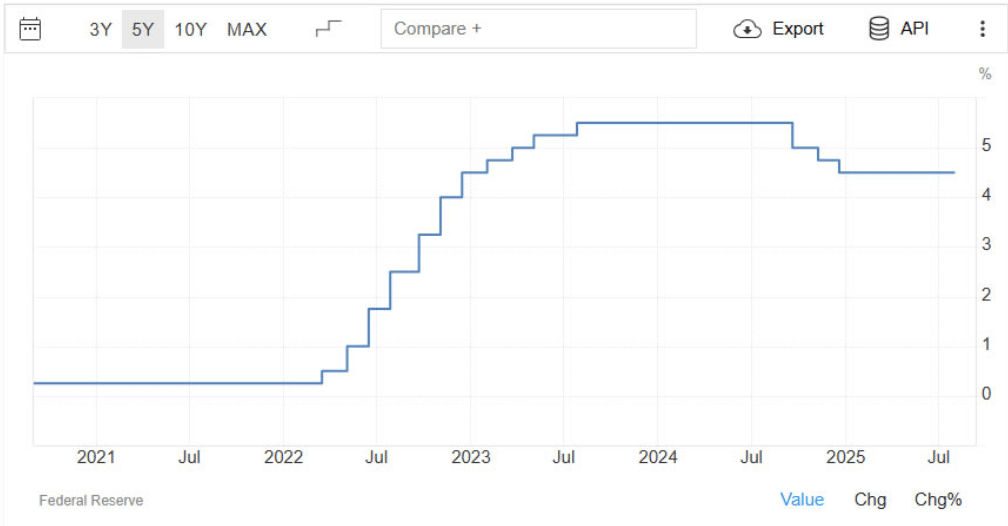

At the heart of this storm is the Fed’s likely move to ease borrowing costs. A Federal Reserve rate cut tends to weaken the dollar, push bond yields lower, and boost appetite for risk assets. Crypto has thrived under such conditions in the past. When money is cheaper to borrow, capital often rotates into Bitcoin, Ethereum, and other digital assets seeking higher returns.

One analyst on X put it bluntly: “If the Fed cuts, liquidity flows. Bitcoin is built for moments like this.” Traders are already pricing in the move, but the political fight over Cook has created fresh uncertainty. If the cut is delayed or perceived as compromised, crypto markets could face a wave of volatility.

Key Market Indicators to Watch

For crypto traders, the Federal Reserve rate cut is just one piece of the puzzle. Technical and market indicators are telling their own story. Bitcoin is facing resistance near $116,000 and finding support around $110,000. A breakout above resistance could fuel a sharp rally, while a break below support risks a slide.

Volume patterns are another clue. Strong buying volume confirms conviction, while weak volume on rallies hints at fading momentum. Liquidity and market depth also matter. If whales unload coins in shallow markets, prices can swing wildly.

Meanwhile, derivatives markets are flashing signals, with rising open interest suggesting traders are preparing for big moves. And the ETH/BTC ratio remains a key gauge of altcoin sentiment. If Ethereum gains ground, it often sparks broader shifts in market behavior.

Political Theater Meets Market Reality

The attempt to remove Cook has spilled beyond legal filings and into market psychology. Senators backing Trump argue the case is about accountability. Others see it as an attempt to tilt the Fed ahead of a sensitive decision. The Justice Department’s involvement, including subpoenas tied to the mortgage claims, has only added fuel to the fire.

For crypto markets, perception is everything. If the Fed is seen as politically vulnerable, trust could waver. That uncertainty may ironically strengthen Bitcoin’s appeal as a hedge against institutional instability. In that sense, the battle over Cook could become an indirect driver of crypto demand, even as the Federal Reserve rate cut dominates headlines.

Conclusion

The fight over Lisa Cook’s seat on the Fed board could not have come at a more pivotal moment. With the Fed poised for a possible Federal Reserve rate cut, politics is colliding with policy in ways that matter deeply to markets.

For crypto traders, the message is clear: watch the Fed, but don’t ignore the signals from supply, liquidity, and technical indicators. Whether the cut goes through smoothly or gets clouded by political drama, Bitcoin and digital assets are positioned to react fast. The stage is set for a volatile finish to the year.

FAQs about the Trump Federal Reserve rate cut

1. Why is Trump targeting Lisa Cook now?

He claims mortgage filings from 2021 justify her removal. Cook denies any wrongdoing and calls it political.

2. What does a Federal Reserve rate cut mean for Bitcoin?

Lower borrowing costs push investors toward risk assets, often fueling demand for crypto.

3. What risks does this legal fight pose?

It threatens the perception of Fed independence, which could unsettle global markets.

4. Which crypto signals matter most right now?

Resistance at $116,000, trading volume, liquidity, derivatives activity, and the ETH/BTC ratio.

Glossary

Federal Reserve rate cut: A reduction in U.S. interest rates that often boosts appetite for risk assets.

Resistance Level: A price point where selling blocks upward movement.

Support Level: A floor where buying prevents further decline.

Liquidity: How easily assets can be traded without major price swings.

Derivatives: Futures and options contracts tied to an asset’s value.

ETH/BTC Ratio: A measure of Ethereum’s performance compared to Bitcoin.