This article was first published on Deythere.

The Fed rate decision is becoming the main point of focus as December approaches. Traders watch every signal closely, since the outcome could guide market behavior through the final stretch of the year. Even a slight shift in tone can influence risk sentiment, especially in crypto, where liquidity changes often show immediate impact.

According to the source, easing inflation and slower job growth continue to influence expectations. Investors follow each update to understand where officials stand before the upcoming meeting.

Economic Indicators Shape Expectations

Recent economic data support a softer outlook. Reports shared by an established financial outlet show cooling consumer activity and moderate price growth.

A market strategist noted that policymakers are trying to balance inflation control with economic stability, a comment shared through a trusted economic analysis platform.

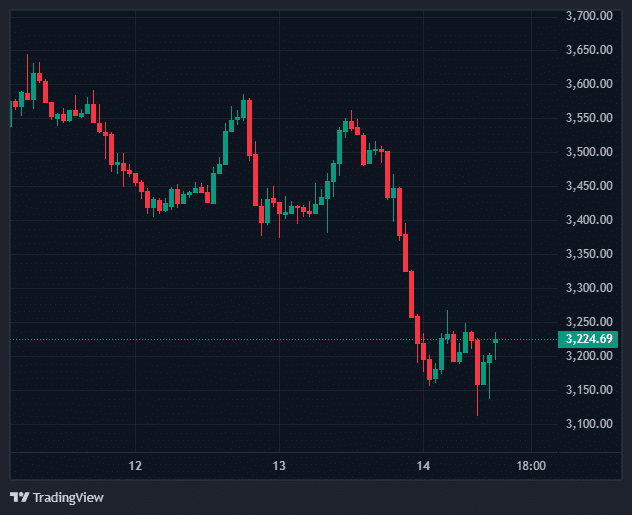

Bitcoin trades around $92,400, while Ethereum trades near $ 3,224. Both assets show healthier inflows compared with early autumn. Traders link this improvement to expectations surrounding the Fed rate decision, which may adjust liquidity conditions.

Fed Rate Decision Could Influence Crypto’s Year-End Behavior

A shift in policy often sets the tone for risk assets. Lower interest rates make borrowing easier and can reduce the appeal of safe instruments. Analysts told respected financial sources that a softer stance could support a broad year-end market rally.

Bitcoin dominance stays above 54 percent. Solana trades near $159, while XRP holds close to $0.62. History shows that periods of easing often lead to more vigorous trading activity, and many expect a similar move this winter if the Fed’s rate decision signals a change.

Activity on X shows traders sharing charts and projections that reflect early optimism. Many expect volatility to rise if liquidity improves, especially in the altcoin space.

Bond Yields And Credit Markets Respond Early

Government bond yields continue to decline as expectations build ahead of the Fed’s rate decision. Data from a trusted global markets tracker shows steady declines in two-year Treasury yields this month.

Lower yields often spread through credit markets, making financing slightly easier for businesses. This shift can support risk assets, including crypto.

Market tables shared by analysts show modest improvements in corporate credit conditions in November. Traders link these movements to growing confidence that policy may ease heading into December.

Market Behavior Shifts As December Nears

Market desks also report more stable trading volumes as uncertainty eases. Numerous crypto analytics platforms indicate consistent inflows into key exchanges, commonly signaling that traders are gearing up for potential price fluctuations.

This change generally occurs when the Fed rate decision is imminent, since many prefer to modify their positions prior to the announcement instead of after the market responds.

Conclusion

The Fed rate decision will guide the final weeks of the year and shape how traders position themselves across multiple markets, as cooling inflation, reduced hiring pace, and changing bond yields collectively indicate a potential more accommodative stance.

Nothing is settled yet, but investors follow every update as December approaches. A policy change could help lift sentiment and strengthen activity across crypto and traditional markets.

Glossary Of Key Terms

- Rate Cut: A central bank adjustment that reduces borrowing costs.

- Liquidity: The ease with which assets move through markets.

- Yield: The return from bonds or interest-based products.

- Risk Assets: Investments that show higher volatility, such as crypto.

FAQs About Fed Rate Decision

1. Will a rate cut help crypto?

Lower rates often increase liquidity, which supports digital assets.

2. Why does the December meeting matter?

It arrives during a season that often encourages more vigorous market activity.

3. Which markets react first?

Crypto and equities usually move before bond markets settle.

4. Is a December cut confirmed?

No. Officials will review inflation and labor data before deciding.