The crypto market is in a frenzy of speculation as talk of a probable Federal Reserve rate decrease dominates headlines. Traders are rushing into Bitcoin, Ethereum, and Solana, but economists caution that the Fed rate cut impact on the crypto market may not be as positive as expected. Instead, overconfidence might pave the way for a dramatic reversal.

While there is some excitement about the likelihood of looser monetary policy, history suggests that when discussion reaches a fever pitch, markets frequently swing the opposite way. Cryptocurrency is no exception, with the stakes never greater.

Bitcoin: Whales, Trendlines, and Reality Check

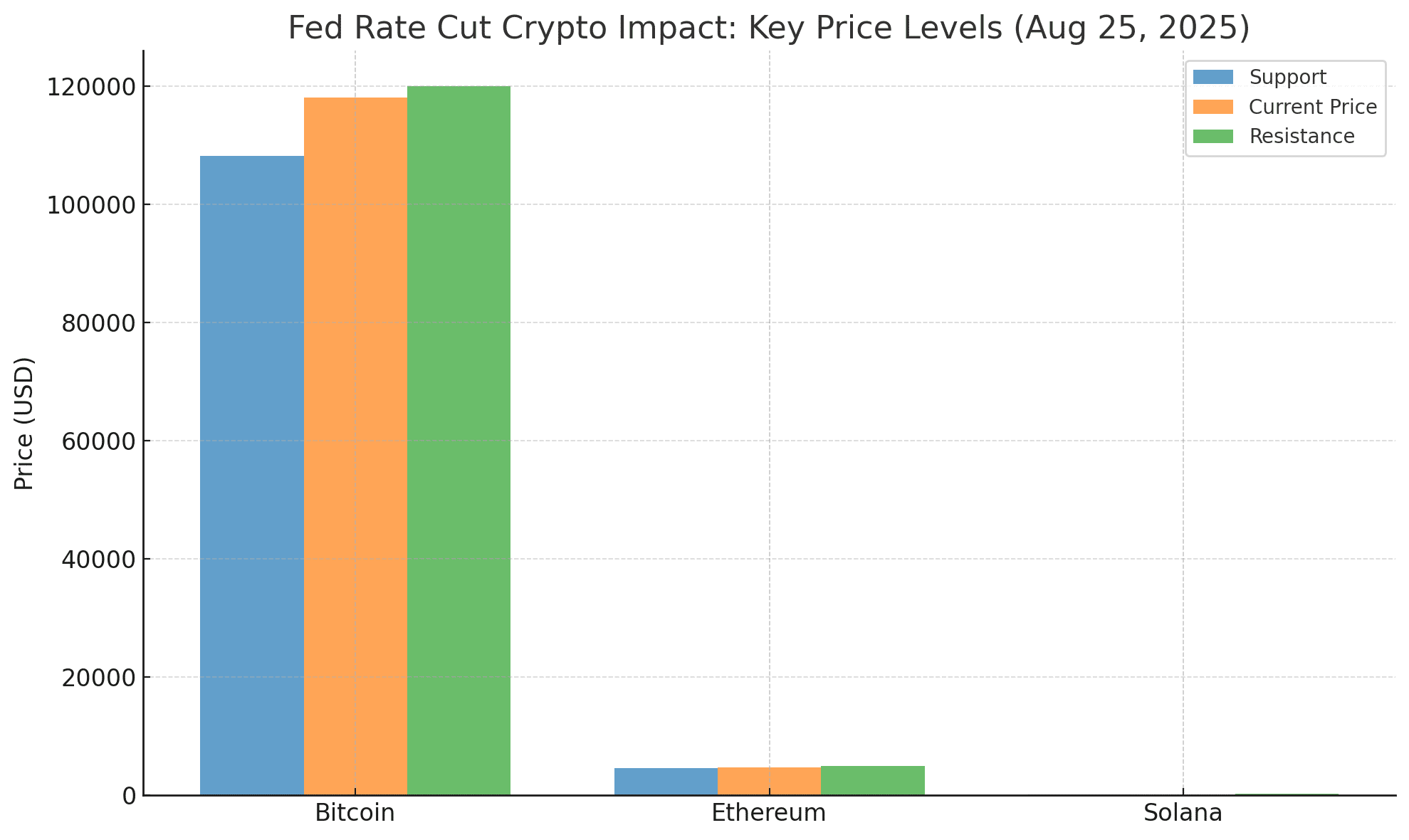

Bitcoin’s rise above $120,000 had investors rejoicing, but flaws are beginning to appear. The world’s largest cryptocurrency just dropped below a significant rising trendline, indicating possible weakness. If buyers fail to maintain momentum, technical indicators indicate that downside objectives range from $108,200 to $103,800.

Adding to the anxiety, over 70,000 BTC has been transferred to exchanges, a typical indicator that whales are planning to pay out. This behavior might exacerbate the impact of the Fed rate cut decrease on the crypto market, turning what many expected to be a bullish leap into a bearish surprise. As one expert stated on X, “Every time the crowd expects the Fed to deliver an easy win, markets love to punish that optimism.”

Ethereum Bull’s Eye $5K, but data raises alarms

Ethereum is a trader’s darling, trading at $4,740, barely shy of the $5,000 psychological barrier. However, the figures reveal a more complex situation. Ethereum’s short-term MVRV (Market Value to Realized Value) is close to 15%, which has traditionally been a red flag for declines. Its long-term MVRV is much higher, at 58.5%, implying that investors are making a lot of money and may be ready to cash out.

The Fed rate cut influence on cryptocurrency is especially important for Ethereum, considering its position in DeFi and staking. While lower interest rates may increase risk appetite, ETH’s overextended stance may leave it vulnerable to a dip before another effort to set records.

Solana’s breakout or breakdown? The Battle for $215

Solana has excelled with a comeback above $200, trading at $205 as it approaches a breakthrough objective of $215. A strong advance over that level might open the door to $230, while failing would risk a return below $190. Institutional interest in Solana’s DeFi ecosystem is growing, but it, like its contemporaries, is susceptible to changes in global monetary policy.

With emotion so closely related to rate-cut prediction, Solana’s next big move may depend on whether reality matches expectations. The Fed rate cut influence on crypto may turn this momentum play into either the market’s hero or its latest casualty.

Euphoria or trap? Why Traders Should Remain Alert

The larger market is a typical example of “buy the rumor, sell the news.” Social mood surrounding “Fed,” “rate,” and “cut” has hit its highest point in almost a year, fuelling what Santiment analysts call “excessive euphoria.” If the Federal Reserve delays a decrease or makes a lesser move than predicted, the consequences might be severe.

Still, long-term fundamentals for cryptocurrency remain solid, with ETF inflows, sovereign acceptance, and institutional infrastructure all expanding. However, a short-term strategy based entirely on central bank conjecture may expose investors to the more severe impact of the Fed rate cut on crypto.

Conclusion

The speculation about the Fed’s future action has become one of the most talked-about drivers in cryptocurrency. Bitcoin, Ethereum, and Solana are all at critical points, but overblown expectations may transform optimistic fantasies into gloomy nightmares.

The impact of the Fed rate cut decrease on cryptocurrency may not be the easy surge that many expect, it might begin with turmoil before offering long-term gains. Savvy investors will keep one eye on the charts and the other on emotions, weighing opportunity vs caution.

FAQs on Fed rate cut

What is the Fed rate cut crypto impact?

It’s the effect that Federal Reserve interest rate cuts or even speculation about cuts have on cryptocurrency prices and market sentiment.

Why is Bitcoin vulnerable right now?

Whale inflows to exchanges and a break of key trendlines suggest Bitcoin could face a correction if optimism cools.

Can Ethereum still reach $5,000 soon?

Yes, but its high profit levels (MVRV ratios) mean profit-taking could delay that milestone in the short term.

Is Solana bullish or bearish?

If Solana breaks above $215, it could target $230, but failure may bring a retracement toward $190.

Glossary of Key Terms

MVRV Ratio: A measure of how much profit holders are sitting on compared to their purchase price.

Psychological Barrier: A round-number price level that traders treat as important support or resistance.

Trendline: A chart indicator connecting price points to identify patterns and momentum.

Buy the Rumor, Sell the News: A trading strategy where prices rise on expectations but fall once events actually occur.

Liquidity: The ease with which assets can be bought or sold without major price changes.

Sources/References