This article was first published on Deythere.

Ethereum developers are shaping a 2026 network upgrade known as Glamsterdam, and the early picture is not about flashy slogans. It is about making the chain feel smoother under load, making rollups cheaper to run, and tightening the rules around how blocks get built. If 2025 was about proving rollups can carry real volume, 2026 looks like the year Ethereum tries to make that rollup-first design feel cleaner, faster, and more predictable.

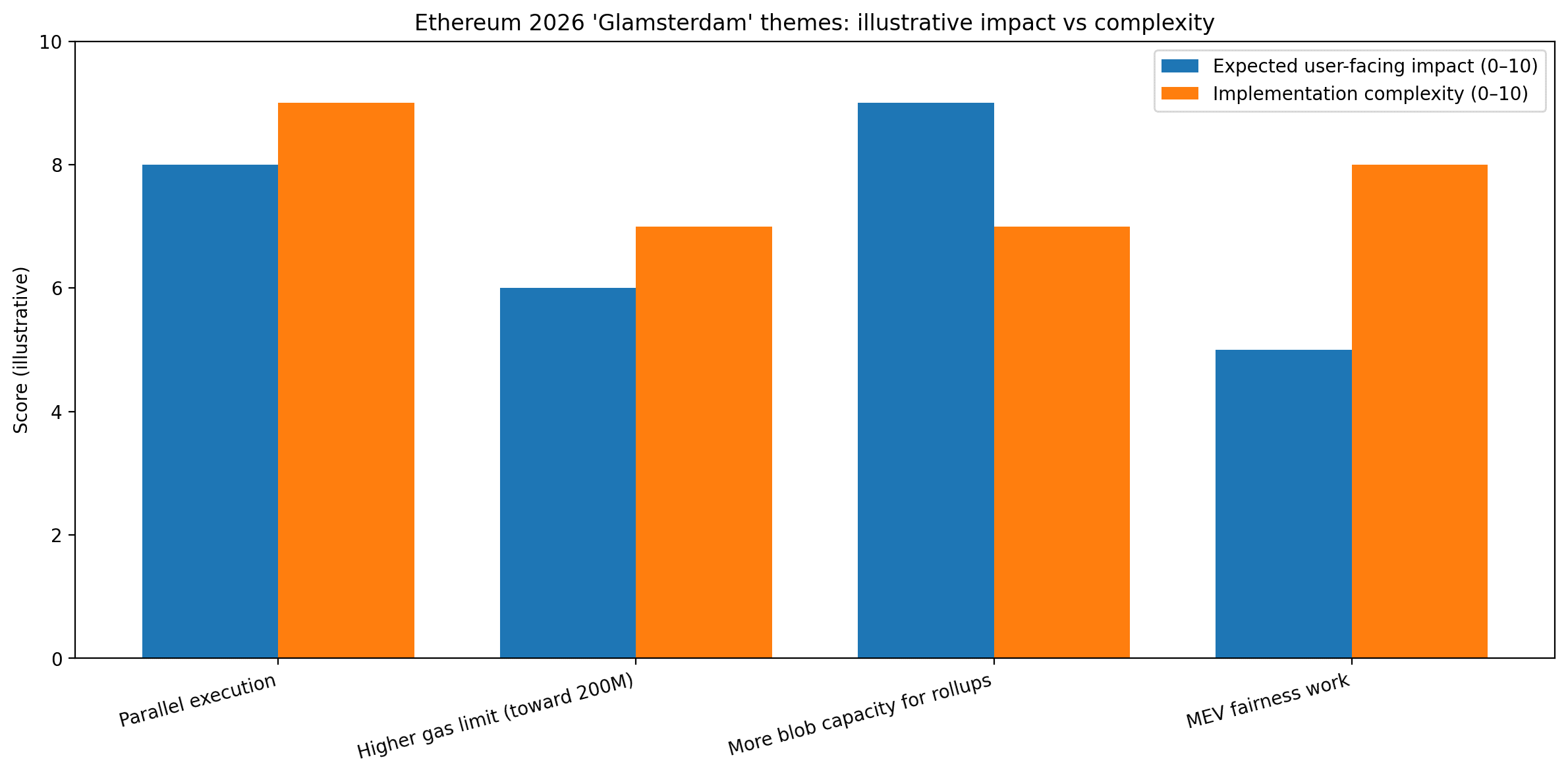

Glamsterdam has been linked to three themes that keep appearing in developer and industry coverage: parallel transaction processing, a much higher gas limit target, and expanded data “blobs” that feed Layer 2 systems. A separate track focuses on MEV, the hidden tax that shows up when transaction ordering becomes a profit game inside block building.

Parallel execution: the speed upgrade people actually notice

The simplest way to understand parallel execution is to picture a busy checkout line that suddenly opens more registers. Ethereum today still processes many actions in a more sequential way, and that creates friction when demand spikes.

Parallel processing aims to let independent transactions run at the same time, which can lift throughput without asking every user to move off the mainnet entirely. Coverage tied to the 2026 roadmap describes this as near-perfect or perfect parallel processing as a design goal, which is a bold claim, but the direction is clear even if the final form changes.

For traders and builders, the indicator to watch is not a headline, it is progress in test environments and client implementations, because parallel execution only matters if it lands safely and does not introduce new edge case failures.

The 200M gas target: capacity rises, tradeoffs come with it

Glamsterdam has also been associated with a gas limit target of 200M, compared with figures around 60M discussed in recent reporting. Gas limit is basically the work budget per block, so a higher limit can fit more activity and soften the worst congestion moments. It does not magically make fees cheap, because demand still sets the price, but it can reduce the frequency of painful fee spikes during peak hours.

There is a real tradeoff here that tends to get lost on social media. Higher capacity can increase the load on nodes, and Ethereum’s long-running challenge is scaling without turning validation into a hobby only data centers can afford. That is why gas discussions usually show up alongside other work meant to keep nodes viable, including improvements in data availability design.

More blobs for rollups: where fee relief tends to come from

For everyday users, the most practical impact may come through blob expansion. Blobs are the data lanes rollups use to post compressed transaction data back to Ethereum, and when blob space is tight, rollups compete and costs rise. When blob capacity expands, rollups typically get room to breathe, and the cost of using popular Layer 2 networks can fall.

Some coverage also mentions a target of shifting roughly 10% of activity toward ZK rollups, which fits Ethereum’s broader idea that validators should increasingly verify proofs rather than re-execute everything the same way. Even if the percentage changes, the intent is consistent: Ethereum wants the base layer to act like a secure court of record while rollups do more of the day-to-day execution.

MEV fairness: cleaning up the plumbing behind execution

Glamsterdam is also being discussed as an upgrade that tackles MEV fairness through proposals such as enshrined proposer builder separation and block level access lists. In plain terms, these ideas try to reduce harmful transaction ordering games and make block construction more transparent and less prone to manipulation. The scope is still being debated, but the fact that MEV is treated as core protocol work, not just an external tooling problem, is a meaningful signal about Ethereum’s priorities.

Conclusion

Glamsterdam is shaping up as a 2026 upgrade that aims to make Ethereum faster in a way users can feel, cheaper for rollups in a way wallets can measure, and fairer in a way markets can trust. Nothing is final until code ships, but the roadmap direction is not subtle: more parallelism, more capacity, more rollup friendly data, and tighter rules around block building.

For ETH holders and builders, the sensible move is to watch testnet milestones, blob fee trends, and MEV related developer decisions, rather than treating any single number as a guaranteed outcome.

FAQs

What is Glamsterdam in Ethereum terms?

Glamsterdam is a planned Ethereum network upgrade targeted for 2026, with reporting linking it to parallel execution, higher gas limits, expanded blob capacity for rollups, and MEV fairness work.

Will a 200M gas limit mean permanently low fees?

A higher gas limit can reduce congestion pressure, but fees still respond to demand, and scaling changes must balance performance with node and validator requirements.

Glossary of key terms

Gas limit means the maximum total computation allowed in a block, which influences how much activity fits on chain per block.

Blobs are data containers designed to help rollups publish transaction data more efficiently, often affecting Layer 2 fees.

MEV is value captured through transaction ordering and block building, which can impact execution quality and perceived fairness.

References