Ethereum’s market narrative got new traction this week as reports verified a big Ethereum whale gathering event worth more than $115 million. Two freshly formed wallets got thousands of ETH from an institutional broker, fuelling rumors about further institutional engagement in the second-largest cryptocurrency.

Analysts believe that these adjustments are more than simply statistics; they are also about trust, confidence, and long-term planning.

Ethereum Whale Transfers Signal Market Confidence

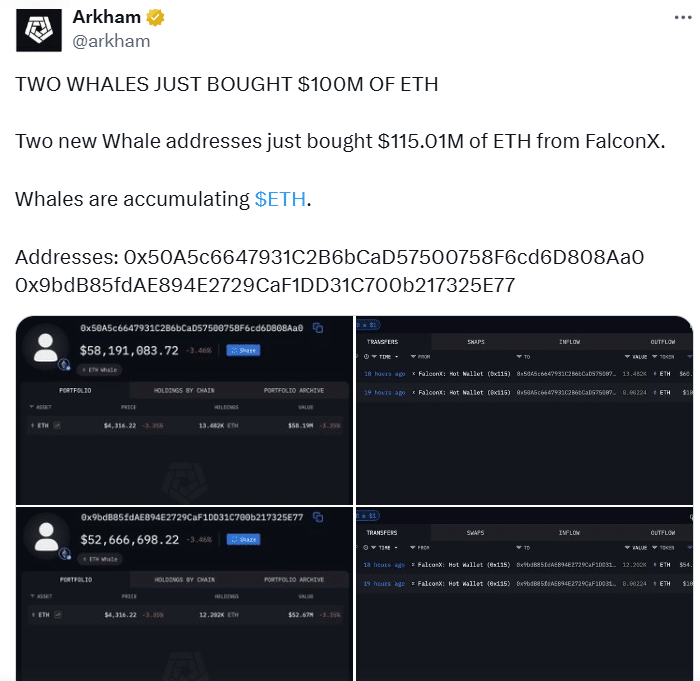

On August 19, blockchain data revealed that two new wallets were financed with over 25,000 ETH, worth about $115 million. The funds came from a huge institutional platform, implying that either a single large corporation or a group of coordinated investors is responsible for the transfer.

The magnitude and timing generated controversy among the trade community. One market expert stated, “This type of Ethereum whale buildup is seldom random. It often represents a structured play with either staking, liquidity provision, or long-term holding in mind.”

| Date | Event Description | ETH Amount | Estimated Value (USD) | Market Signal |

|---|---|---|---|---|

| Aug 19, 2025 | Two wallets funded via institutional broker | 25,684 | ~$115M | Large accumulation, bullish undertone |

| Aug 11, 2025 | Whale withdraws ETH from exchange after profit | 8,745 | ~$25M | Long-term intent, reduced supply |

| July 2025 | Institutional wallets increase holdings | 1.1M+ | ~$4.7B | Broad accumulation trend |

| June 2025 | Whale purchase triggered rally speculation | 115,465 | ~$300M+ | Anticipated breakout momentum |

Institutional players enhance exposure

The FalconX-linked movement is part of a wider Ethereum whale accumulating pattern that has been seen since early summer. Institutions and major investors have added more over 1.1 million ETH to their holdings, totaling roughly $5 billion at current prices.

Another case was a corporate customer purchasing almost 32,000 ETH in a single three-hour period, increasing their weekly total to around 145,000 ETH. These developments demonstrate that Ethereum is increasingly viewed as a vital asset for financial stability and innovation.

Market Effect of Whale Activity

Large transfers of this size frequently alter attitudes. When whales remove ETH from exchanges, it decreases liquidity and indicates a holding strategy. If demand stays stable, this might lead to greater upward pressure on prices. Community comments are optimistic, with one trader observing, “Whales are starting to get bullish on ETH, even as retail sentiment stays cautious.”

Such changes also lessen the likelihood of rapid sell-offs, as coins in cold storage are less likely to enter the open market soon. Analysts predict that the recent Ethereum whale buildup might provide the groundwork for a continuous advance to the $4,000-$5,000 level by early 2026, provided macroeconomic circumstances continue to be favorable.

A Growing Institutional Narrative

Ethereum’s attraction stems from both its market position and its expanding use cases, which range from decentralized banking to business blockchain applications. The consistent stream of whale purchases indicates that these foundations have been recognized.

While volatility remains a persistent concern, institutional investors appear to be wagering that Ethereum’s value proposition will improve over time. This ongoing accumulation of Ethereum whale indicates that the network’s future is inextricably related to institutional capital flows.

Conclusion

The $115 million whale buy demonstrates Ethereum’s rising popularity as an institutional asset. These movements, together with billions of dollars in broader accumulation, help to construct a narrative of confidence, scarcity, and long-term growth. For investors and traders, the message is clear: tracking Ethereum whale accumulation is critical for determining market direction.

FAQs

Q1: What does Ethereum whale accumulation mean?

It refers to large investors or institutions purchasing and holding significant amounts of ETH, often signaling confidence.

Q2: Why do whales withdraw ETH from exchanges?

Whales often transfer holdings to private wallets for security and long-term storage, reducing liquid supply.

Q3: How much ETH was involved in the latest buy?

Two new wallets received 25,684 ETH, valued at roughly $115 million.

Q4: How does whale activity affect Ethereum’s price?

By reducing supply on exchanges, whale accumulation can support bullish price momentum if demand continues.

Q5: Is Ethereum whale accumulation always positive?

While often bullish, it can also add volatility if whales suddenly sell. Investors should remain cautious.

Glossary

Cold Storage: Secure offline storage method used to reduce hacking risks.

On-Chain Data: Blockchain-recorded data that provides insights into transactions and holdings.

Liquidity: The availability of ETH on exchanges for trading.

Institutional Adoption: Entry of professional investors and firms into Ethereum markets.

Market Sentiment: Overall attitude of investors toward Ethereum at a given time.