This article was first published on Deythere.

The Ethereum staking ecosystem has reached notable levels of magnitude. Data from on-chain sources suggest that more than 36 million ETH has been deposited to the Beacon Chain, representing almost 30% of the total circulating supply.

- Staking Surge Caused by Institutional Demand

- Impact on Liquidity: Lockups and Entry Queues

- Yield Dynamics Behind the Surge

- Network Metrics and Market Signals

- Emerging Governance and Strategic Decisions

- Conclusion

- Glossary

- Frequently Asked Questions: Ethereum Staking Surge

- What’s Fueling the Ethereum Staking surge?

- How much ETH is staked at the moment?

- Why is ETH locking liquidity down?

- What is the validator entry queue indicate?

- Is the staking yield high?

- References

Meanwhile, institutional players such as BitMine Immersion Technologies are ramping up their bets sharply, causing the market to face an unwanted liquidity crisis. As a result, a portion of ETH is now immovable for weeks, with supply-dependent impacts on price elasticity and liquidity metrics.

Staking Surge Caused by Institutional Demand

Ethereum’s staking model involves locking ETH to perform validation duties in return for protocol incentives. Recent data confirms that the aggregate staked ETH on the Beacon Chain has risen above 36M as of this writing, or approximately 30% of Ethereum’s circulating supply with a total market value exceeding $118B at current prices.

This level of staking is mostly driven by institutional demand and BitMine is currently the largest corporate ETH staker. On-chain data shows BitMine had staked around 1.53 million ETH, which is worth over $5 billion, an immense individual bet holding almost 4% of all the staked ETH in the network.

According to market data, BitMine currently holds over 4 million ETH or over 3.4% of the circulating supply, with a large portion dedicated to staking operations.

Impact on Liquidity: Lockups and Entry Queues

The first and most direct technical impact of this massive staking is liquidity. When ETH enters staking, it’s no longer fungible until the network has handled both activation and withdrawals. This system has a built-in friction that serves to decrease the “effective float” of ETH, or the amount available for trading.

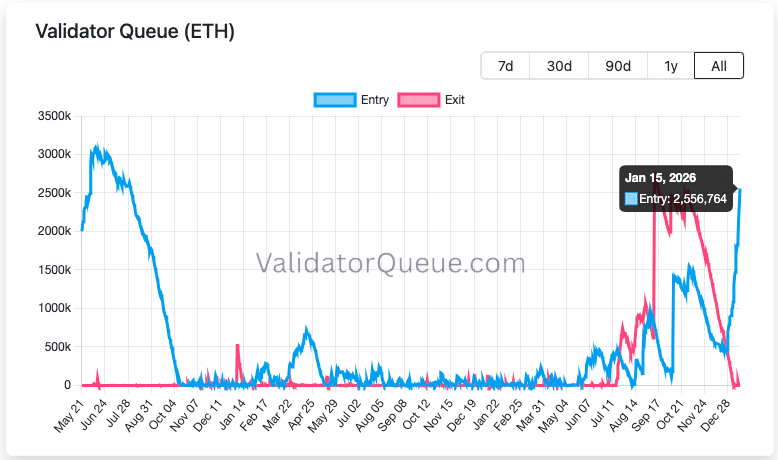

Staking demand has so surged that the Ethereum validator entry queue stands at over 2.3M ETH with 40+ days to go before new validators are activated (the longest wait time in almost three years).

This implies that even if holders wanted to sell, a very large portion of ETH is “temporarily” illiquid. Such liquidity tightening can amplify price swings, as the spot price of ETH is determined on the margin by the amount of available tradable liquidity and not total supply.

Yield Dynamics Behind the Surge

Staking ETH earns a protocol reward, and institutional parties can look at those rewards as a productive income stream rather than passive holdings.

Currently, staking reward rates for ETH are in the low to mid-single digits annualized. The higher the amount of capital that flows into the staking pool, the more diluted this yield becomes, due to Ethereum proof-of-stake consensus reward distribution mechanics.

Even modest yields are profitable for big corporate treasuries compared to normal assets. That has pushed companies like BitMine to stack ETH and stake at scale tightening free float as protocol distributions compound on increasingly larger bases.

Network Metrics and Market Signals

On-chain data reveals that Ethereum now supports about 900,000 active validators working to secure the network.

On top of the entry queue pressures, the validator exit queue is still historically low, suggesting little in terms of selling pressure from existing stakers.

Given this combination of high entry demand, low exit pressure and large institutional stakes, it reinforces the impression that ETH is being viewed less as a trading asset and more as a long-term productive asset, at least among sophisticated holders.

Emerging Governance and Strategic Decisions

Though pressing staking surges remain a point, internal corporate decisions might lead to additional accumulation in the future. For instance, BitMine’s shareholder vote on increasing authorized equity could restructure its funding capabilities to acquire more ETH.

That vote centers on expanding authorized shares, a step management argues will prevent capital constraints as the firm scales its ETH treasury approach, but dissent could slow future staking growth.

Conclusion

With 36 million ETH locked on Beacon Chain, nearly 30% of the circulating supply, and big institutional staking, led by BitMine, the dynamics of ETH’s supply are changing.

The subsequent liquidity squeeze, persistent validator queues and increasing participation of corporate treasuries suggest a new market regime and role for protocol participation.

And this rally openly shows not just confidence in Ethereum’s security, but the continued evolution of institutional strategies treating ETH as a productive yield asset instead of a speculative token.

Glossary

Beacon Chain: Base layer of Ethereum staking that maintains validator involvement and proof of stake consensus.

Staked ETH: Ethereum tokens deposited for validation duties and earning protocol rewards but temporarily illiquid.

Validator Entry Queue: ETH backlogged in queue to be onboarded as active validator; long queues imply delayed activation.

Usable Float: The total of cryptocurrency readily available for trading purposes; this number decreases as a result of staking.

Yield: The rewards earned from staking ETH, allocated according to protocol economics.

Frequently Asked Questions: Ethereum Staking Surge

What’s Fueling the Ethereum Staking surge?

Institutional interest and corporate treasury strategies, spearheaded by companies such as BitMine as they lock up huge amounts of ETH for staking yield and network participation, continue to fuel the boom.

How much ETH is staked at the moment?

More than 36 million ETH is being staked on the Beacon Chain, equivalent to approximately 30% of the total supply in circulation.

Why is ETH locking liquidity down?

The staked ETH will not be tradable until activated and exited, thus reducing the volume of liquid ETH for immediate trade.

What is the validator entry queue indicate?

It indicates the amount of ETH waiting to be bonded as a validator; a longer queue implies greater staking interest and slower activation time.

Is the staking yield high?

Current staking yields are low to mid single digits annualized and that income is very valued by institutional holders.