Just after the Pectra upgrade, Ethereum price has been on fire and is up nearly 50% in a week. The network’s latest upgrades combined with institutional demand and macro tailwinds have positioned Ethereum not just as a top crypto but one of the world’s most valuable financial instruments right now.

- From Tariff Turbulence to Technical Triumph: What’s Behind the Ethereum Price Rally?

- What the Pectra Upgrade Actually Did

- Institutional Capital is Betting Long on Ethereum

- Ethereum Surpasses Coca-Cola and Alibaba in Market Capitalization

- Analysts Weigh In: Can Ethereum Hit a New All-Time High?

- Conclusion: Next Chapter for Ethereum

- FAQs

- What’s behind the Ethereum price surge?

- What is the Pectra upgrade?

- How much ETH did Abraxas Capital buy?

- How does Ethereum’s market cap compare to big companies?

- Can Ethereum hit new all-time highs in 2025?

- Glossary

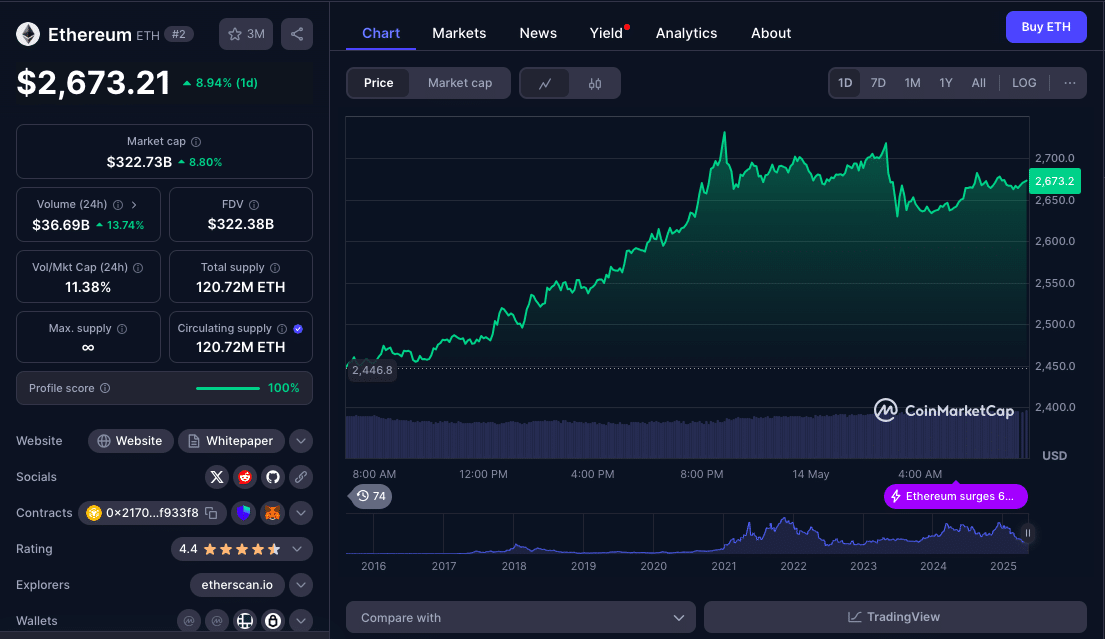

As of May 14th, Ethereum is trading at $2,673, just 6% off its early February high when Eric Trump tweeted about it. According to TradingView data, this is Ethereum’s strongest rally since the November 2023 recovery.

From Tariff Turbulence to Technical Triumph: What’s Behind the Ethereum Price Rally?

The current Ethereum price bounce follows months of volatility caused by macroeconomic concerns, including trade disputes and inflation risks. When Eric Trump tweeted about Ethereum on February 3rd, just days after a market-wide selloff caused by the President’s tariff proposal, ETH was trading at $2,300. According to sources, the tweet briefly boosted sentiment but was later edited to tone down the promotional language.

Throughout February and April, Ethereum fought through major headwind, including a deep selloff that took it below $1,400 on April 7th. The price stagnation mirrored investor caution as trade breakdowns and monetary tightening loomed. But several positive developments have since reversed that trend.

Based on recent data, the key driver behind the current Ethereum price surge is the activation of the Pectra upgrade on May 7th which has been met with industry wide positivity.

What the Pectra Upgrade Actually Did

Pectra brings a bundle of Ethereum Improvement Proposals (EIPs) focused on usability and scalability. It enables better staking, simplifies smart contract interactions and improves Layer 2 efficiency. According to Ethereum core developer Tim Beiko, Pectra reduces friction for developers and node operators, making it easier for everyone to stake and deploy applications.

Market sentiment has responded accordingly. In the 5 days since the upgrade went live, Ethereum has surged over 40% outpacing nearly every other altcoin. This isn’t just retail speculation, it has institutional backing.

Institutional Capital is Betting Long on Ethereum

One of the biggest signs of Ethereum’s growth is institutional interest. UK based investment firm Abraxas Capital has reportedly bought 211,030 ETH worth approximately $477 million since the Pectra upgrade according to Arkham Intelligence.

This large purchase is a sign of confidence in Ethereum’s post-upgrade and long-term value. Abraxas Capital’s allocation fits into the trend of capital rotating into high-performing digital assets during macro uncertainty.

Analysts have also pointed out a big increase in Ethereum exchange outflows and said it’s a sign of whales and institutions going long-term.

Ethereum Surpasses Coca-Cola and Alibaba in Market Capitalization

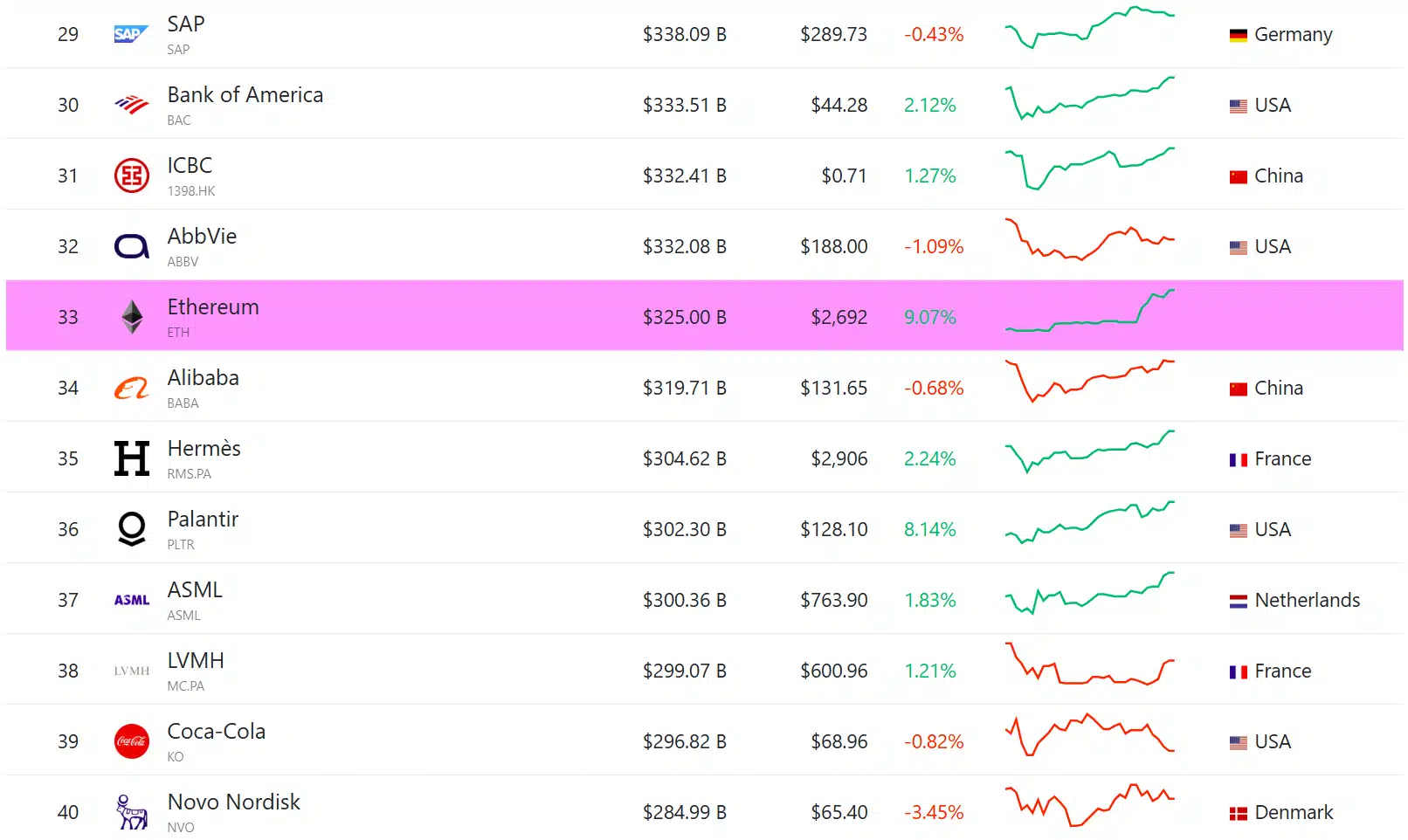

According to CompaniesMarketCap and MarketWatch data, Ethereum’s market capitalization reached around $325 billion as of this week, beating out global giants like Coca-Cola ($297 billion) and Alibaba ($320 billion).

This is not only a testament to Ethereum’s price recovery but also its growing influence outside of crypto. Ethereum is now the 33rd most valuable asset in the world, behind only Walmart and Samsung.

On Monday, Ethereum briefly surpassed Alibaba before the Chinese company’s stock rebounded. But ETH’s top 30 status is clear as it’s getting mainstream recognition.

Analysts Weigh In: Can Ethereum Hit a New All-Time High?

As Ethereum approaches the top of its current price channel, analysts are cautiously optimistic. The combination of upgrades and macro relief is perfect for Ethereum to challenge previous highs.

Some think we could see a return to the $3,000–$3,200 zone in the coming weeks if the Fed holds rates steady at the June FOMC meeting. CME FedWatch has markets pricing in a 66% chance of that.

The Ethereum price is finally responding to fundamentals again. We’re seeing improving network metrics, lower gas fees post-Dencun, and capital inflows post-Pectra. If demand holds, this could sustain momentum.

Conclusion: Next Chapter for Ethereum

Ethereum is still the second-largest cryptocurrency by market cap. Despite higher throughput, many Layer 1s are struggling to attract institutional-grade DeFi protocols or developer loyalty at the same scale.

Data from the Artemis Terminal shows Ethereum still dominates developer activity and has the highest total value locked (TVL) across DeFi platforms. Additionally, its Layer 2 scaling ecosystem, led by Arbitrum and Optimism, is absorbing more and more user volume, reducing mainnet congestion.

Ethereum’s post-Pectra rally is more than just a price bounce, with staking improved, fundamentals stronger, and mainstream interest rising. Now the question is, can Ethereum build on this momentum to retest the all-time highs above $4,800?

FAQs

What’s behind the Ethereum price surge?

The Ethereum price surge is due to the ‘Pectra upgrade, improving macro and institutional interest.

What is the Pectra upgrade?

Pectra is a big Ethereum upgrade that brings staking, user experience and Layer 2 scalability through a set of EIPs.

How much ETH did Abraxas Capital buy?

According to Arkham Intelligence, Abraxas Capital bought around 211,030 ETH, worth nearly $477 million.

How does Ethereum’s market cap compare to big companies?

Ethereum’s market cap is now around $325 billion, bigger than Coca-Cola and Alibaba.

Can Ethereum hit new all-time highs in 2025?

Analysts think Ethereum could retest $4,800 ATH if conditions remain bullish, especially with institutional demand and spot ETF speculation.

Glossary

Pectra Upgrade: A network upgrade that brings staking, scalability, and usability improvements.

Institutional Accumulation: Big financial firms or professional investors buying and holding large amounts of a crypto asset.

EIP (Ethereum Improvement Proposal): A design document that outlines potential upgrades or features for the Ethereum network.

Layer 2: Secondary frameworks or protocols built on top of the Ethereum blockchain to increase scalability and transaction speed.

Sources

CompaniesMarketCap – Ethereum Market Cap

Ethereum Foundation – Pectra Upgrade Overview

Disclaimer: This article is for information purposes only and not financial advice. Cryptocurrency investments are high risk. Do your own research or consult a financial advisor.