According to analyst Ted Pillows, Ethereum has been in an ascending channel since 2017. Touch points on the lower band of this channel have triggered big moves in the past, including a 300x move in 2017 and a 50x move in 2021. While those kinds of moves are less likely at a $292 billion market cap, Pillows says $10,000 is still feasible, provided Ethereum breaks above key resistance and demand metrics line up.

- Historic Channel Points to Big Upside But Resistance Must Break

- Whales Are Quietly Accumulating

- Network Activity Surges, Yet Price Still Lags

- Ethereum Price Prediction: $10K Really in Sight?

- Conclusion

- FAQs

- What’s the current Ethereum price prediction?

- Why is $2,800 a key resistance?

- What does the long-term channel mean for Ethereum?

- Are whales buying ETH now?

- Glossary

With a historic technical pattern and increasing whale interest, more and more analysts are revisiting a bold Ethereum price prediction of $10,000 in this cycle.

Historic Channel Points to Big Upside But Resistance Must Break

Pillows isn’t the only one pointing to Ethereum’s long-term channel as a roadmap for price action. He says Ethereum’s resilience across multiple cycles proves the structural bull case is still intact.

But for any breakout to happen, Ethereum must break above $2,800, a level that has rejected price action twice in June. Analyst Crypto Patel says a daily or weekly close above $2,800 would be a major technical shift, and would open the door for Ethereum to $6,000 and higher in the channel.

“The structure is clean, the range is tight, and resistance is obvious. Once $2,800 flips, the market reopens,” Patel wrote on X.

Whales Are Quietly Accumulating

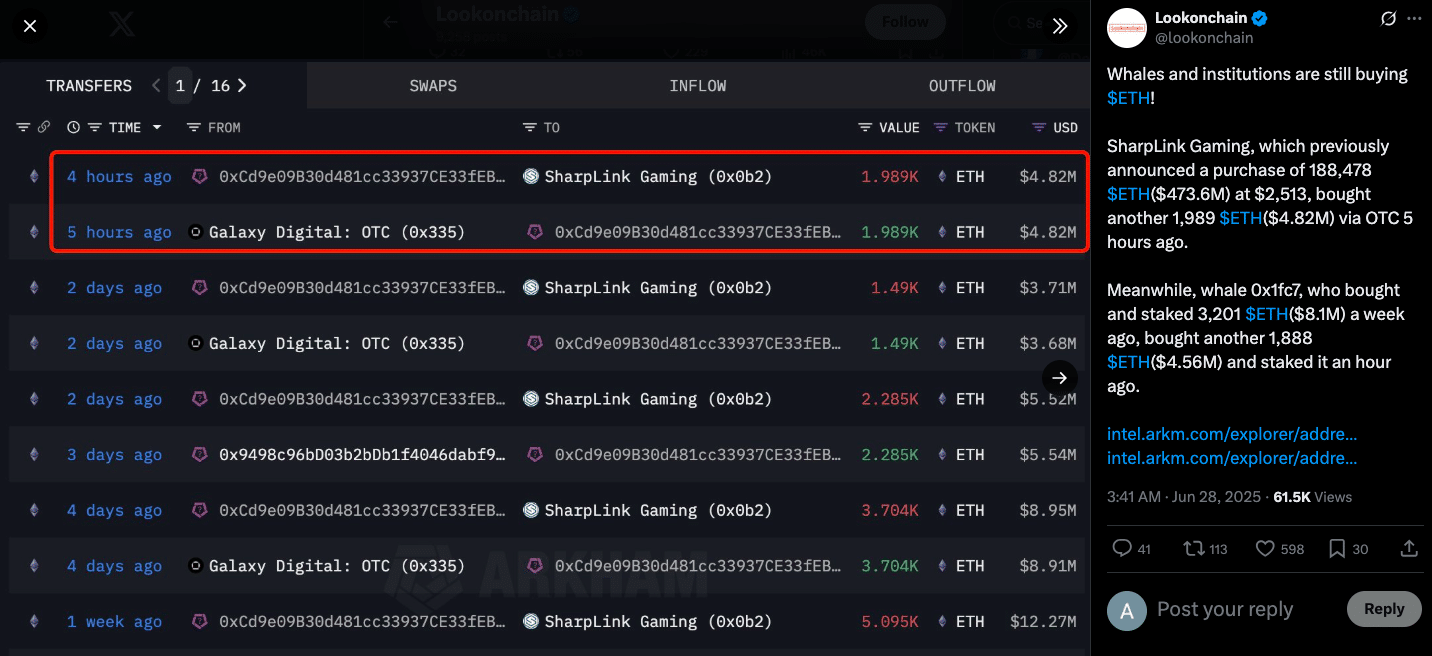

Beyond the charts, on-chain data shows institutional investors and crypto-native whales are accumulating Ethereum ahead of a big move. According to Lookonchain, they recently increased their exposure:

SharpLink Gaming bought $4.82 million worth of ETH OTC, bringing their total ETH holdings to $478 million. $4.56 million in ETH was deposited into Ethereum’s Beacon Chain, meaning more staking.

$293 million in ETH was withdrawn from exchanges, most of which is likely going into cold storage. This and low volume big transactions means whales are not speculating short term but long term.

Network Activity Surges, Yet Price Still Lags

Ethereum’s network performance paints a picture of a blockchain in high demand:

| Metric | Current Value | Market Implication |

| Daily Transactions | Over 1.5 million | Network use highest since early 2023 |

| Active Wallet Addresses | 356,000+ | User base growth supports underlying demand |

| Weekly Gas Fees | $10.26 million (+130%) | Increased DeFi and NFT activity on-chain |

| NVT Ratio | 2,044 | Potential overvaluation relative to transaction volume |

| MVRV Z-score | Negative | Implies ETH holders are currently at a loss (buying zone?) |

High gas fees and transaction spikes suggest increasing usage but NVT ratio and MVRV Z-score show a disconnect between price and fundamentals. NVT ratio implies market cap is ahead of utility and MVRV Z-score shows many holders are in unrealized losses, a sign of undervaluation.

Ethereum Price Prediction: $10K Really in Sight?

To hit $10,000 multiple catalysts need to align. Analysts are watching for: Break above $2,800 to confirm trend continuation; Whale accumulation and long-term staking; On-chain demand translating into price gains.

If these conditions are met, Ethereum could reclaim $4,000 and enter the higher leg of its multi-cycle channel. XForceGlobal analysts think a Wyckoff-style rally is forming. They predict an initial breakout to $3,600-$4,000 and possible continuation to $9,400-$10,000 if momentum accelerates.

But skepticism is warranted. Failure to reclaim resistance could trap Ethereum in the $2,400-$2,800 range and delay any big moves.

Conclusion

Ethereum’s structure, whale accumulation and growing network activity support a $10,000 Ethereum price prediction. But without a clean break above $2,800, that’s just theory.

As more long-term investors stake their ETH and on-chain demand builds, the conditions are forming for a rally. Whether that happens in Q3 or stalls again will depend on resistance flips, volume surges and continued inflows. Either way Ethereum is at a crossroads and its next move will define the rest of the 2025 cycle.

Summary

Analysts are revisiting the $10,000 target based on the long-term channel since 2017. Technical analysts like Ted Pillows and Crypto Patel say a break above $2,800 is the next leg up. On-chain data supports this: whale accumulation, staking and exchange outflows show long-term conviction. If ETH clears resistance and inflows continue, $10K is possible.

FAQs

What’s the current Ethereum price prediction?

Analysts are saying $10,000 if ETH breaks $2,800 and demand holds.

Why is $2,800 a key resistance?

ETH has been rejected twice in June at this level. A clean breakout would confirm the uptrend.

What does the long-term channel mean for Ethereum?

It shows ETH has been in an uptrend since 2017. If the structure holds, the next leg could be $10K.

Are whales buying ETH now?

Yes, millions of ETH have been bought OTC, staked and withdrawn from exchanges.

Glossary

Ascending Channel – A price pattern of higher highs and higher lows.

NVT Ratio – Market cap to transaction volume.

MVRV Z-score – How over or undervalued an asset is based on holder profitability.

Beacon Chain – Ethereum’s staking backbone.

Wyckoff Pattern – An accumulation distribution model to track smart money before big moves.