The Ethereum price prediction 2025 points to a year that could bring both ups and downs for $ETH. Ethereum isn’t just another cryptocurrency anymore. It’s at the heart of decentralized finance, powers NFTs, and supports a lot of apps people use every day. Traders and investors are keeping a close watch on its price, because how $ETH moves often shows what’s happening in the rest of the crypto market.

- What Are the Short-Term Price Expectations for Ethereum?

- How Do Analysts View Ethereum’s Long-Term Outlook?

- What Are the Main Drivers Shaping Ethereum’s 2025 Price?

- Are There Risks and Conservative Perspectives?

- Conclusion

- FAQs

- 1. What is the Ethereum price prediction 2025?

- 2. Can Ethereum reach $8,000 in 2025?

- 3. Could Ethereum experience price drops in 2025?

- 4. How does institutional interest affect Ethereum in 2025?

- 5. Is Ethereum still considered a major asset for investors in 2025?

- 6. How do technical analysts view the Ethereum price prediction 2025?

- Glossary

- Sources

What Are the Short-Term Price Expectations for Ethereum?

Market predictions for the rest of 2025 show that August and September could be important for Ethereum’s short-term movement.

CoinDCX says that if $ETH goes above $4,800, it could go up to $5,500–$6,000 by the end of August. But if it falls below $4,000, it might drop to about $3,800. In September, the price could rise slightly to $5,240–$5,417.

Traders are paying close attention because the market and investor feelings will decide if Ethereum keeps rising or goes down a little.

Changelly gives a month-by-month view that adds more detail to the Ethereum price prediction 2025. In August, $ETH could go as low as $4,651.62 and as high as $5,584.78, with an average around $5,118.20.

September could be quite unpredictable, with $ETH possibly going as low as $3,198.92 and as high as $5,277.14. October and November might be steadier, averaging $3,502.39 and $3,052.75.

December may see a rise, with an average of $4,079.87 and a possible high of $5,366.56. This shows that Ethereum might fall sometimes, but overall, it could keep growing, especially with ongoing network upgrades.

How Do Analysts View Ethereum’s Long-Term Outlook?

Institutional analysts are more positive about Ethereum as 2025 goes on. Standard Chartered predicts that $ETH could reach $7,500 by the end of the year.

This is because more institutions are interested, ETFs are expected to have an impact, and new rules like the GENIUS Act could help stabilise cryptocurrencies and increase Ethereum transactions.

Tom Lee from Fundstrat is even more optimistic, saying Ethereum might go past $7,500 and could reach $15,000 by December if ETF buying continues and U.S. Fed interest rates drop.

He notes that these factors could make Ethereum a major asset for institutions, bringing in more money and activity.

Flitpay looks at different technical analyses and gives a balanced view of Ethereum. They think $ETH could drop to $6,200 or go up to $9,345, with an average near $4,567.

In the past, Ethereum usually rose after Bitcoin halving events. With new technology upgrades, $ETH could see strong growth in 2025.

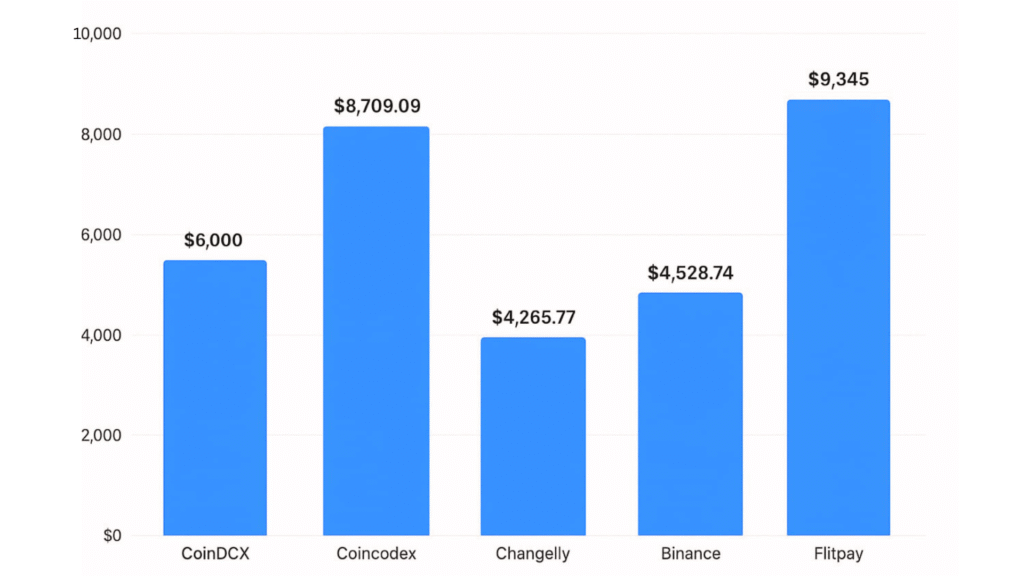

| Analysts | 2025 Bullish Price Target |

| CoinDCX | $6,000 |

| Coincodex | $ 8,709.09 |

| Changelly | $4,265.77 |

| Binance | $4,528.74 |

| Flitpay | $9,345 |

| Coinpedia | $6,925 |

What Are the Main Drivers Shaping Ethereum’s 2025 Price?

Experts say some key things will affect the Ethereum price prediction 2025. Technology upgrades are very important for Ethereum.

It’s working to process up to 100,000 transactions per second, making it cheaper and easier to use. More developers and apps may join, which could help the Ethereum price prediction 2025 go up.

Institutional adoption is an important factor for Ethereum price prediction 2025. More interest in Ethereum ETFs and other financial products brings stability and liquidity to the market.

Standard Chartered and Fundstrat say that when institutions invest, prices often rise because professional investors lower volatility and boost confidence.

Clear rules, like the GENIUS Act, also help by reducing uncertainty, encouraging more people to invest, and making Ethereum more widely used as a financial asset.

Market mood and the overall economy will affect the Ethereum price prediction for 2025. If the U.S. Federal Reserve lowers interest rates, more people may want to keep $ETH, which could bring in extra investment.

The performance of Bitcoin and other big altcoins can affect Ethereum’s price. For Ethereum price prediction 2025, investors should watch both short-term market changes and the wider economy.

Are There Risks and Conservative Perspectives?

While many predictions are positive, some analysts are more careful. Zebpay gives a conservative view for Q4 2025, suggesting Ethereum could move between $2,500 and $5,500.

They note that network upgrades: Surge, Verge, Purge, and Splurge,will be important for whether $ETH can beat its previous highs.

If these updates aren’t fully completed, transactions could be slower and fees higher, which could push prices down. This shows why it’s important to follow Ethereum’s development along with market trends.

Conclusion

Looking at the Ethereum price prediction 2025, the year could bring many changes for $ETH. Prices might start steady, then rise if upgrades, more investors, and clear rules support the network.

Even with possible dips, these challenges are part of normal market movements. Growth will depend on how well technology improves and how much confidence both individual and institutional investors have.

Ethereum’s growth will depend on technology upgrades and how much trust investors have. Using $ETH in apps, finance, and new projects can help it grow. Overall, 2025 could be an important year for $ETH, with both risks and opportunities in the crypto market.

Summary

The Ethereum price prediction for 2025 shows that $ETH could go up or down a lot, possibly between $4,000 and $10,000.Its future depends on how well Ethereum’s upgrades work, how many apps and projects use it, and how much interest big investors and ETFs show. Some people think it could pass $8,000, while others warn it might fall if things don’t go as planned. Overall, its price will follow technological progress and user trust.

Stay updated on $ETH price move and acknowledge expert-supported Ethereum price prediction 2025 on our platform

FAQs

1. What is the Ethereum price prediction 2025?

Analysts forecast $4,000 to $10,000, depending on market trends.

2. Can Ethereum reach $8,000 in 2025?

Yes, bullish forecasts indicate it’s possible with upgrades and ETF inflows.

3. Could Ethereum experience price drops in 2025?

Yes, short-term dips are possible, especially if it falls below key support levels.

4. How does institutional interest affect Ethereum in 2025?

Increased institutional activity may push $ETH prices higher.

5. Is Ethereum still considered a major asset for investors in 2025?

Yes, its role in DeFi, NFTs, and apps keeps it a key market indicator

6. How do technical analysts view the Ethereum price prediction 2025?

They predict $ETH could fluctuate between $6,200 and $9,345.

Glossary

Pectra Upgrade – Ethereum’s update to make transactions faster and cheaper.

DeFi– Blockchain-based finance without banks, for lending, borrowing, and trading.

Resistance Level – A price point where selling may slow Ethereum’s rise.

Institutional Investors – Big organisations like banks or funds putting money into Ethereum.