Ethereum price analysis shows that the asset has moved into a critical phase after a sharp sell-off over the weekend pushed prices into a level closely monitored by both long-term holders and active traders. The drop occurred alongside a wider market slowdown, increasing caution across the crypto sector rather than pointing to a standalone failure in Ethereum.

- What defines the current Ethereum market setup?

- How did futures liquidations intensify selling pressure?

- Does the weekly chart still support a bullish structure?

- What technical area is Ethereum approaching now?

- How are analysts framing this correction?

- What should long-term holders and swing traders do now?

- What risks could invalidate the bullish outlook?

- Conclusion

- Glossary

- Frequently Asked Questions About Ethereum Price Analysis

Increased volatility in derivatives markets and a clear shift in investor sentiment have changed how participants view the short-term outlook. Price behavior around key support zones is now expected to play a major role in shaping the next market move.

What defines the current Ethereum market setup?

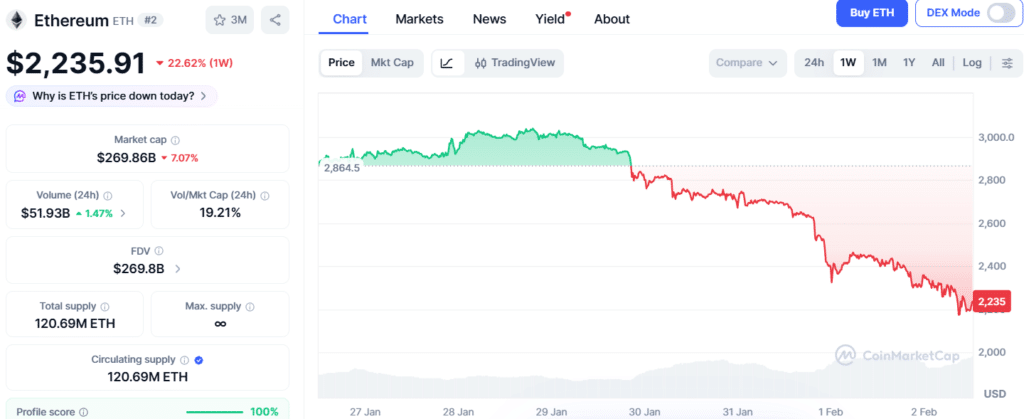

This phase of Ethereum price analysis focuses on a sharp weekend decline that reshaped the market’s short-term structure. Ethereum dropped 17.38% from its January 31 opening price of $2,702 and is currently trading at $2,228.58.

The move points to sustained selling pressure building over time rather than a sudden, isolated event. Market sentiment weakened alongside the price action. The Fear and Greed Index stood at 16 for Ethereum, signaling extreme fear, while Bitcoin registered a reading of 17, also reflecting extreme fear.

Bitcoin further intensified pressure across the market, falling sharply from its January 31 open near $84,126 to a February 1 low around $75,699. Data from CoinMarketCap shows BTC trading near $76,294.95 after losing 2.75% in 24 hours and 13.27% over the week, reinforcing a risk-off environment that continues to weigh on Ethereum.

How did futures liquidations intensify selling pressure?

A key part of the current Ethereum price analysis is tied to derivatives market positioning. Ethereum futures traders saw liquidations totaling $266.53 million, with long positions accounting for $204.38 million of that amount.

This suggests bullish leverage had become heavily concentrated before the sell-off gained speed. Large liquidation events often deepen short-term losses. At the same time, they clear excess leverage from the market, pushing traders to reassess risk instead of rushing into quick rebound trades.

Does the weekly chart still support a bullish structure?

From a higher-timeframe view, Ethereum price analysis still highlights a bullish swing structure on the weekly chart. This structure formed during the rally from $1,383 to the 2025 peak near $4,955, a period when digital asset treasuries accumulated large amounts of ETH.

Institutional interest has not faded. Bitmine (BMNR) added 132,813 ETH to its holdings over the past month, even while sitting on a 42.5% drawdown. This activity points to continued long-term confidence, despite rising short-term price volatility.

What technical area is Ethereum approaching now?

Another focal point in Ethereum price analysis is the technical area Ethereum is now approaching after months of decline. Price action has moved close to the 78.6% Fibonacci retracement near $2,147, measured from the $4.9k peak. This zone is widely watched because it often attracts strong trading activity during deep corrections.

Market participants see the possibility of a brief liquidity sweep below this level, where remaining bids could be cleared before direction becomes more defined. Despite this risk, many investors are treating the pullback as a buying opportunity rather than clear evidence of a trend breakdown, provided a recovery follows.

How are analysts framing this correction?

Within this Ethereum price analysis framework, analyst commentary continues to treat the recent decline as a correction rather than a breakdown. Crypto analyst Leo Lanza said Ethereum’s move from the August 2025 high near $5,000 represents a pullback toward a higher low, keeping the broader uptrend intact.

He noted that price is approaching a long-term trend channel that dates back to March 2020, a structure that remains technically clean but still needs confirmation. Lanza also highlighted volume profile data, explaining that Ethereum is currently trading within a high-volume node.

Such areas typically reflect strong market participation and periods of consolidation. He added that these zones are often where positions are built before the next directional move.

What should long-term holders and swing traders do now?

From a positioning standpoint, Ethereum price analysis clearly separates long-term investors from short-term traders. For long-term holders, the view remains straightforward and accumulation is reasonable as long as a possible decline toward $1,300 per ETH is acceptable.

The broader weekly structure remains bullish and would only be invalidated by a weekly close below $1,383. Swing traders, however, face a more difficult setup. The daily chart shows bears firmly in control, with On-Balance Volume reaching new lows and the DMI pointing to a strong downtrend.

Traders are encouraged to assess risk and remain patient. Entering trades too early in a falling market can lead to deeper losses, and strength needs to appear in the $2,000 to $2,200 range before new long positions are considered.

What risks could invalidate the bullish outlook?

A decisive risk marker remains in play. Ethereum price analysis highlights that a sustained move below $2,000 would serve as an early warning signal for the market.

Such price action would suggest that bullish demand is weakening and that buyers are not yet prepared to defend key levels. In that scenario, the probability of a deeper decline toward $1,300 would increase before any meaningful recovery attempt takes shape.

Conclusion

Ethereum price analysis underscores a market at a critical inflection point. The weekly structure remains bullish despite significant recent losses, while short-term indicators continue to signal downside risk.

Both long-term opportunity and short-term caution are present for investors and traders. Price behavior around key support levels will determine whether this phase leads to a recovery or extends into a deeper corrective move.

Glossary

Futures Liquidations: Automatic closing of risky trades that move the price.

Fibonacci Retracement: Tool showing key price levels from past movements.

Swing Structure: Up-and-down chart pattern revealing market trends.

High-Volume Node: Price area with heavy trading acting as support/resistance.

Fear and Greed Index: Measures if investors feel extreme fear or greed.

Frequently Asked Questions About Ethereum Price Analysis

How much did Ethereum drop recently?

Ethereum dropped about 17.38% from its January 31 opening price of $2,702.

Why did Ethereum’s price fall so much?

The price fell due to heavy selling, extreme fear in the market, and $266 million in futures liquidations.

What technical level is Ethereum approaching now?

Ethereum is approaching the 78.6% Fibonacci retracement level near $2,147, which is an important area for traders.

What does the Fear and Greed Index show for Ethereum?

The Fear and Greed Index for Ethereum is 16, showing extreme fear among investors.

How did Bitcoin’s price affect Ethereum?

Bitcoin also fell sharply over the same period, adding pressure and creating a risk-off environment that affected Ethereum.