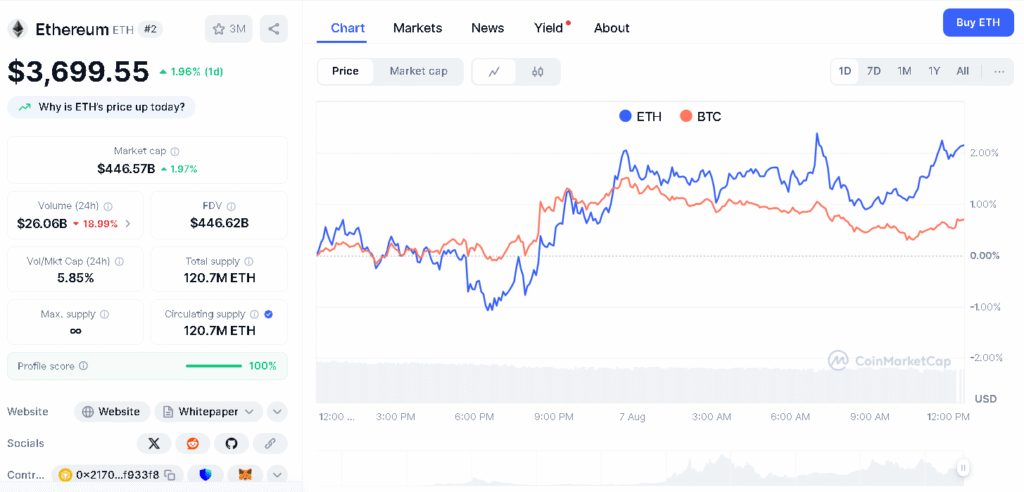

According to sources, Ethereum outperforming Bitcoin is now a noticeable pattern in recent institutional flows within the crypto space. In the last three months, Ethereum has made a strong comeback, jumping from $1,808 to $3,684, a gain of over 64%.

- Why Are Institutions Now Favouring Ethereum Over Bitcoin?

- What Role Does the ‘Digital Oil’ Narrative Play in Ethereum’s Rise?

- How Does Recent Price Performance Support Ethereum Outperforming Bitcoin

- What Are the Risks and Forecasts?

- Conclusion

- Summary

- 1. Why is Ethereum outperforming Bitcoin in 2025?

- 2. How much has Ethereum gained?

- 3. Which asset are institutions now favoring?

- 4. How much ETH did BitMine buy?

- 5. What is Bitcoin struggling with technically?

- 6. What helps Ethereum resist bigger market drops?

- Glossary

- Sources

Bitcoin also moved up, but at a slower pace, rising about 10% from $94,748 to $115,375. This isn’t just a price difference; it reflects how investors are starting to treat Ethereum more seriously. It’s no longer just seen as a platform for developers, but as something worth holding long-term.

Bitcoin still holds the top spot as digital gold, but Ethereum is quickly catching up, helped by growing interest from institutions and changing views on what it can offer. One example is BitMine, which recently became the biggest corporate holder of ETH after collecting $2.9 billion worth of Ethereum in only five weeks. This shows how the crypto market is starting to change.

Why Are Institutions Now Favouring Ethereum Over Bitcoin?

Big institutions are realigning their crypto strategies, and Ethereum is now taking the spotlight. Shawn Young, Chief Analyst at MEXC Research, says Ethereum outperforming Bitcoin is due to a major shift in how public companies manage their crypto assets.

“We’re no longer in a time where companies only hold Bitcoin in their reserves”, he explained, noting that listed companies have increased their ETH holdings by almost ten times since late 2024. BitMine,, collecting $2.9 billion worth of Ethereum in just a few weeks, is a clear example.

The jump in investment shows that more people are starting to believe in Ethereum’s future, especially with DeFi becoming more popular and widely used.

What Role Does the ‘Digital Oil’ Narrative Play in Ethereum’s Rise?

Ethereum’s importance goes beyond just its price. The idea of it being “digital oil” has been around for some time, but more people are starting to believe in it now. Unlike Bitcoin, which is known for its limited supply and role as a store of value, Ethereum runs the biggest DeFi ecosystem.

This makes it more useful, and big investors are starting to take that seriously. “Ethereum’s role as the backbone of blockchain technology is clearer than ever. From smart contracts to dApps, big investors aren’t just buying ETH, they’re investing in the whole ecosystem,” said Irene Carter, an analyst at CryptoVerse Insights.

| Metrics | Ethereum | Bitcoin |

| Price Gain (Last 90 Days) | +64.4% | +10.7% |

| ETF Inflows | $2.2B – $5.4B | Small and flat |

| Institutional Interest | Rapidly growing, major buys | Stable, fewer recent large buys |

| Market Role | Smart contracts, DeFi, Web3, innovation | Digital gold, store of value |

| Current Momentum | Strong bullish momentum | Consolidating, facing resistance |

| Market Cap | $446.57B | $2.28T |

| Long term Target | $4,000 | $200,000 |

How Does Recent Price Performance Support Ethereum Outperforming Bitcoin

The numbers clearly show that momentum is moving strongly in Ethereum’s favour. Ethereum is gaining a lot of ground in the crypto space. In the last three months, it jumped by over 64%, rising from $1,808 to $3,684.

In comparison, Bitcoin only went up by about 10%, moving from $94,748 to $115,375. Many experts believe this isn’t just a temporary win for Ethereum. They say it shows a bigger shift in how the market sees both coins.

While Bitcoin is still struggling to move past the $119,000 mark, Ethereum is attracting strong buying interest and showing clear signs of strength. Part of this push comes from more trading activity and steady investments from large firms into Ethereum.

What Are the Risks and Forecasts?

Not everyone is sure Ethereum will reach a new all-time high right away. Some predictions of ETH hitting $10,000 still seem far off. But Ethereum’s recent lead over Bitcoin isn’t based on hype.

It’s backed by real progress, big investors are paying attention, its technology keeps improving, and its ecosystem keeps growing. Still, crypto is known for sudden changes. If too many traders start selling, Bitcoin could fall back toward the $95,000 range, according to RSI signals.

If that happens, Ethereum might strengthen its lead and hold on to its recent gains. According to CoinMarketCap data, $BTC’s trading volume fell by 8%, showing a shift in short-term market mood. On the other hand, Ethereum’s expanding uses, like staking and powering DeFi apps, could help protect it from bigger market drops.

Conclusion

Based on the latest research, Ethereum outperforming Bitcoin is not just a short-term trend, it marks the start of a bigger shift by institutions. Companies like BitMine buying large amounts of ETH and Ethereum’s growing role in DeFi show how crypto strategies are changing.

Bitcoin still leads in market size and popularity, but Ethereum’s strong performance and wider use are drawing more serious attention. Analysts view Ethereum outperforming Bitcoin in 2025. Ethereum may not just keep outperforming Bitcoin; it could change how big investors view crypto altogether.

Summary

Ethereum outperforming Bitcoin in 2025 is becoming clear as more big investors choose Ethereum. In the last 90 days, Ethereum jumped 64.38%, while Bitcoin rose only 10.72%. Companies like BitMine bought a lot of ETH, and $5.4 billion flowed into Ethereum ETFs. People now see Ethereum as more than just a tech project; it’s useful for things like DeFi and smart contracts. If this trend continues, Ethereum outperforming Bitcoin could change how investors look at the crypto market

Get the latest news on crypto price action and know more about Ethereum outperforming Bitcoin in 2025 on our platform

FAQs

1. Why is Ethereum outperforming Bitcoin in 2025?

Because of strong institutional inflows, rising demand, and wider ecosystem use.

2. How much has Ethereum gained?

It jumped 64.38% in 90 days

3. Which asset are institutions now favoring?

Institutions are increasingly favoring Ethereum over Bitcoin.

4. How much ETH did BitMine buy?

BitMine bought $2.9 billion worth of Ethereum in five weeks.

5. What is Bitcoin struggling with technically?

Bitcoin is failing to break past the $119,000 resistance.

6. What helps Ethereum resist bigger market drops?

Ethereum’s staking use and DeFi adoption help support its price.

Glossary

BitMine – A corporate investor that became the largest ETH holder in 2025.

Smart Contracts – Code on Ethereum that runs automatically when conditions are met.

Resistance Level – A price point Bitcoin is struggling to move above, like $119,000.

DeFi – Decentralized apps and services running on Ethereum, without middlemen.