This article was first published on Deythere.

- Why Lending Activity Keeps Flowing Toward Ethereum

- How Layer 2 Networks Changed the Game

- Crypto Lending Is Growing Beyond Speculation

- Risks Still Shape the Conversation

- What Comes Next for Ethereum and Lending

- Conclusion

- Glossary of Key Terms

- FAQs About Crypto Lending

- 1. What is crypto lending?

- 2. Why is Ethereum king of the crypto loans?

- 3. Is it safe to lend on Layer 2 networks?

- 4. Is lending and borrowing in cryptos only for traders?

- Sources / References

Ethereum has become the engine room of modern crypto lending, shaping how digital money moves, earns, and grows. While price charts often steal headlines, the real story sits beneath the surface. Lending activity, once niche, now generates serious revenue, and Ethereum sits firmly at the center of it.

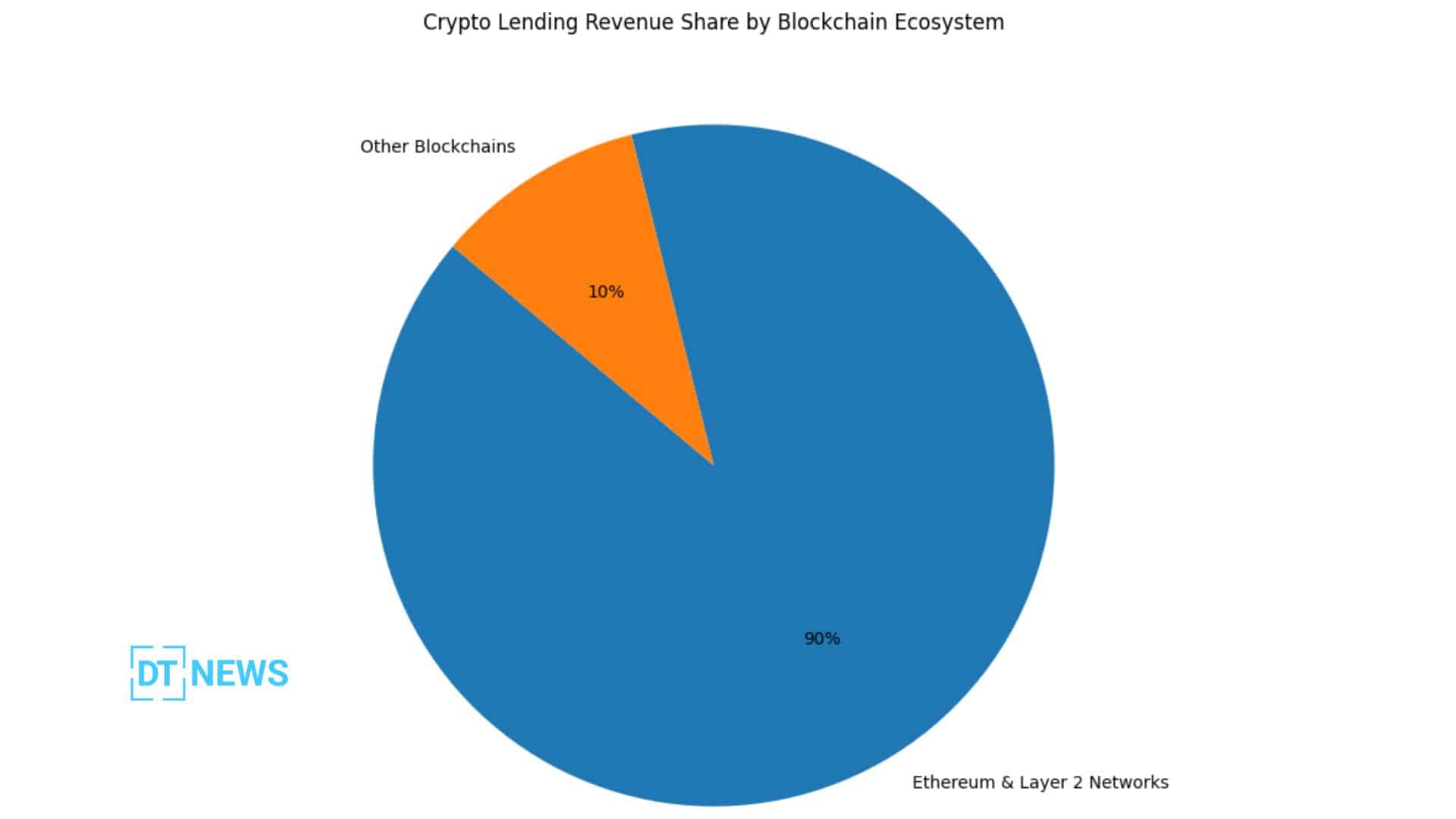

The rise did not happen overnight. According to the source, data shared by a senior Ethereum Foundation researcher shows that Ethereum and its Layer 2 networks now account for close to 90 percent of all crypto lending revenue. That figure highlights a more profound truth. Decentralized finance has chosen its base layer, and it keeps coming back to Ethereum.

Why Lending Activity Keeps Flowing Toward Ethereum

The building blocks of crypto lending are trust, liquidity and automation. And Ethereum provides all three at scale. On Ethereum, smart contracts make loans possible with no banks, paperwork or approvals. Rules are coded, not negotiated. Once deployed, they execute without bias.

Major lending platforms built their foundations here for that reason. Aave, Compound, and MakerDAO continue to anchor most lending volume. Their contracts sit on Ethereum because developers trust its security and users trust its history. That trust translates directly into revenue.

According to market data, Ethereum is the innovative contract network with the highest throughput in terms of daily transaction value even during price wild days. It’s that reliability that matters for crypto lending, where a sudden dropped connection can set off liquidations and losses.

How Layer 2 Networks Changed the Game

High fees once threatened Ethereum’s dominance. That problem forced evolution. Layer 2 networks now handle a growing share of lending activity by processing transactions faster and cheaper, while still settling on Ethereum for security.

Arbitrum, Optimism, and Base have turned Ethereum into a multi-lane highway rather than a single-lane road. Borrowers can manage positions without worrying about gas spikes. Lenders can rebalance capital more often. Platforms earn more because users stay active.

As one widely shared industry comment noted, scaling did not weaken Ethereum’s role. It expanded it.

Crypto Lending Is Growing Beyond Speculation

Crypto lending today looks different from early DeFi experiments. It is no longer just traders chasing leverage. Stablecoins now dominate lending pools, offering predictable value and steady yield. CoinMarketCap data confirms that USDC and DAI remain among the most used assets in lending contracts.

This shift attracts analysts and institutions who want exposure without extreme volatility. Studies published by global financial organizations show that decentralized lending markets now mirror traditional money markets in structure, but operate without intermediaries.

That blend of familiarity and automation keeps capital flowing in.

Risks Still Shape the Conversation

No lending system is risk-free. Sharp price drops can still trigger mass liquidations. Research papers analyzing DeFi stress events show that liquidity gaps can widen during market shocks. Yet Ethereum-based platforms have survived multiple cycles, each time adjusting risk models and collateral rules.

That resilience strengthens confidence. Developers keep refining safeguards. Analysts keep watching the data.

What Comes Next for Ethereum and Lending

Upgrades focused on data efficiency and scaling aim to reduce costs further. If successful, Ethereum could extend its lead further as more assets move on-chain. For crypto lending, that means deeper pools, smoother execution, and broader participation.

The market message is clear. Infrastructure matters more than hype.

Conclusion

Ethereum is no longer just a platform for crypto lending. It is shaping how digital credit works at scale. It is changing how digital credit operates at scale. As the majority of lending-related income draws on its ecosystem, Ethereum is now underpinning decentralized lending. As more and more finance becomes on-chain, the infrastructure built atop Ethereum will probably shape how trust, yield, and liquidity transform in the digital era.

Glossary of Key Terms

Smart Contract: A widely used term to describe financial rules and code that is self executing.

Layer 2: A network that helps make transactions fast and cheap without sacrificing Ethereum-level security.

Stablecoin: A type of crypto asset pegged to stable value, generally the dollar.

Liquidation: Sale of assets under orders when collateral loses value.

FAQs About Crypto Lending

1. What is crypto lending?

Crypto lending enables users to earn interest or borrow against blockchain-based contracts.

2. Why is Ethereum king of the crypto loans?

It has deep liquidity, robust security and mature infrastructure.

3. Is it safe to lend on Layer 2 networks?

Yes. They settle on Ethereum, and their security is powered by Ethereum.

4. Is lending and borrowing in cryptos only for traders?

No. Lending stablecoins appeals to the longer-term investors and institutions.