This article was first published on Deythere.

- Surge in Contract Deployments

- Drivers Behind the Record Numbers

- Network Usage Shows Adoption

- Conclusion

- Glossary

- Frequently Asked Questions About Ethereum Smart Contracts

- What does the 8.7 million contract deployment mean for Ethereum mean?

- Why is Layer-2 such a big deal for Ethereum activity?

- Is high contract activity influencing the price of ETH, directly?

- Are these launches tokens or actual applications?

- Is Ethereum still leading development compared to other chains or not?

- References

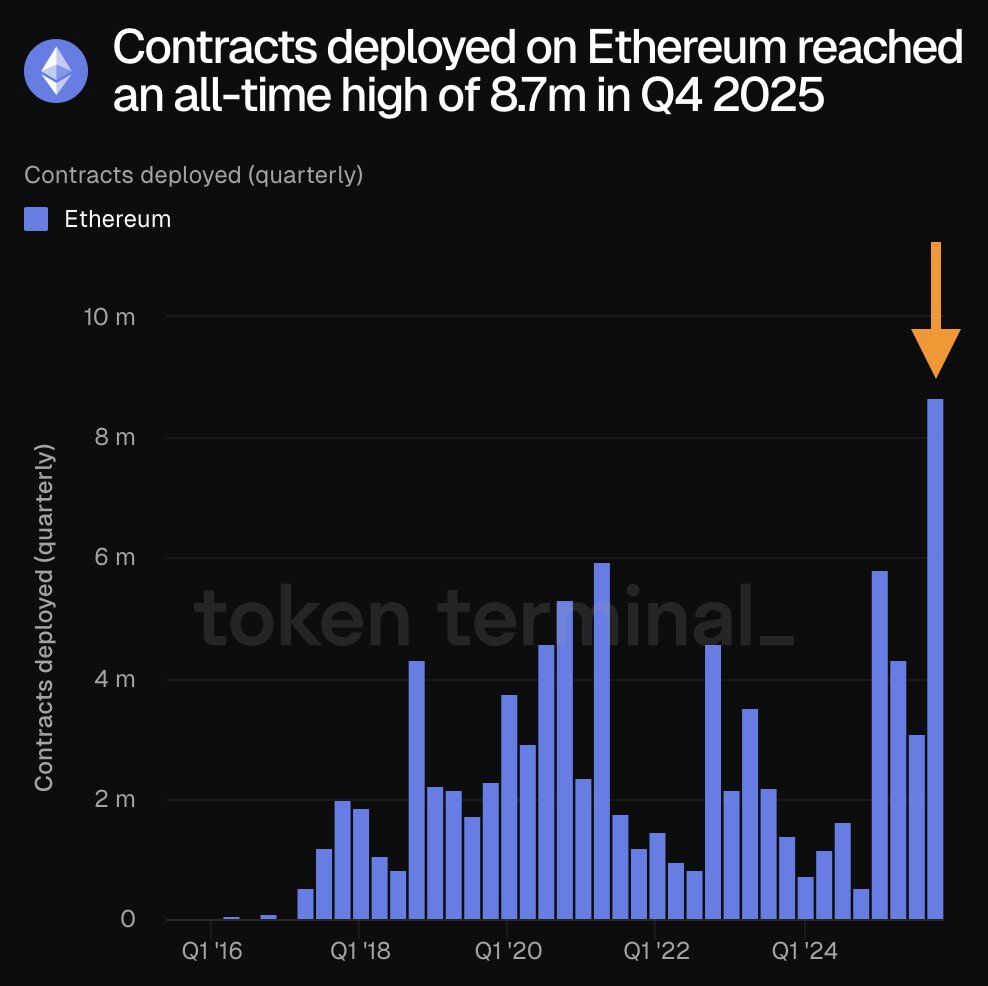

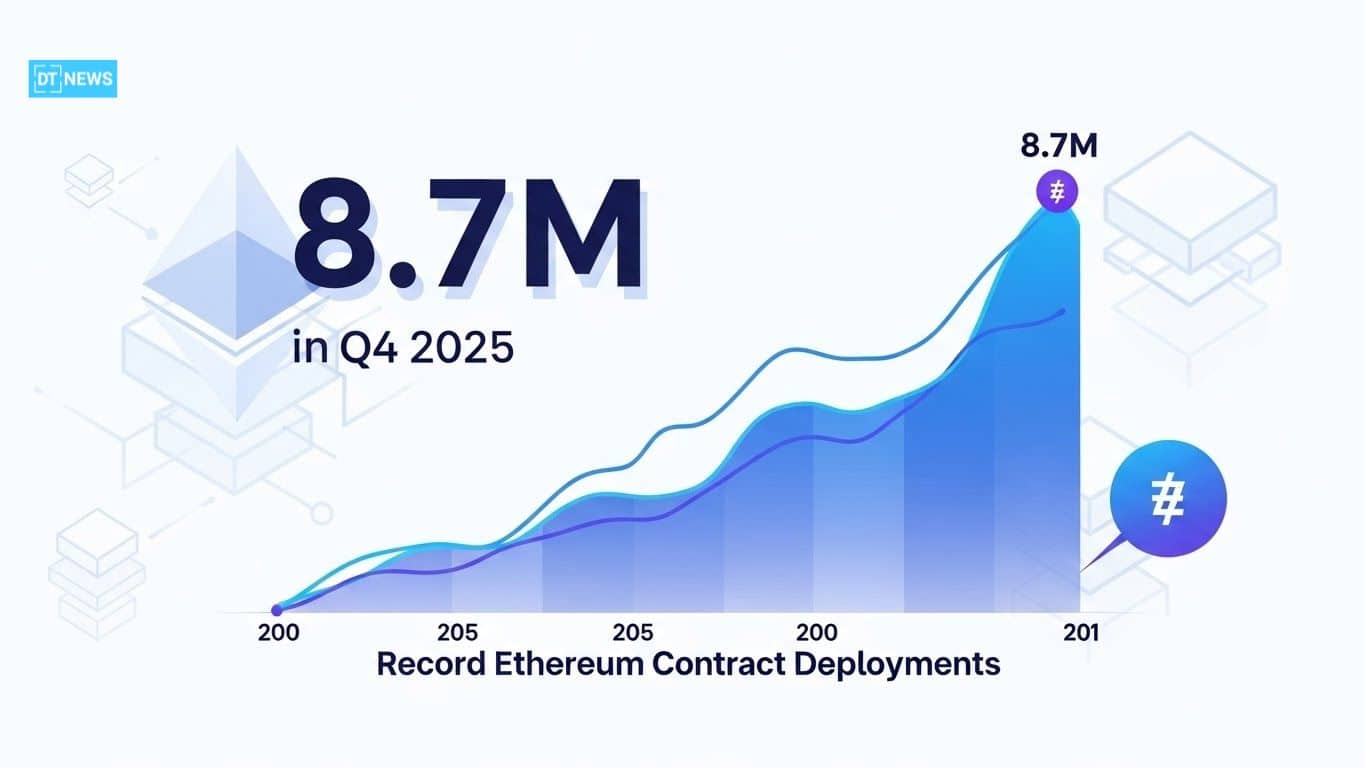

Ethereum smart contract usage hit an all-time high in Q4 2025, with over 8.7 million smart contracts launched on the network.

This peak is the highest quarterly number to date, and it shows growing on-chain development, increased layer-2 usage as well as decentralized finance (DeFi), and decentralized applications (dApps) built on Ethereum.

Amid fluctuations across the market, it appears developers are still attracted to Ethereum as their preferred development platform for blockchain projects, indicating continued momentum in its ecosystem and innovation.

Surge in Contract Deployments

Deployments of Ethereum smart contracts rocketed up to 8.7 million this Q4 2025, which broke a new all-time high for network activity.

This figure isn’t average transactions that users make; it’s unique contracts that developers deploy on the chain, a gauge for how many new protocols, tokens, applications and tools are being launched or updated.

The scale of this increase is a continuation which began with the start of 2025 with network engagement rising not just in deployments but also other on-chain metrics like active addresses and transaction volumes which have risen to multi-year highs.

A wide spectrum of smart contracts are being used by developers and projects ranging from decentralized exchanges and automated market makers to token contracts, NFT platforms, DeFi protocols.

Hence, Ethereum is still serving as a building hub in the blockchain world; even with newer chains rising.

Drivers Behind the Record Numbers

A handful of factors have helped drive the explosion in activity around Ethereum contracts.

Layer-2 Scaling Solutions like Arbitrum, Optimism and Base have significantly lowered transaction fees and increased throughput making it cheaper and faster for developers to deploy contracts onto layer 2.

These solutions are using Ethereum as the settlement layer with execution off-chain or via rollups to reduce fees and increase velocity.

DeFi Polycentering Decentralized finance remains one of the largest use cases, with DeFi protocols releasing new products and tools that are spurring deployments.

Fresh demand for NFT minting, gaming (GameFi) and decentralized identity projects has been another driver of deployment growth.

Better developer tooling and grant programs, plus ecosystem support from the Ethereum Foundation and third-party tool providers, have also made it possible for builders to iterate quickly, prototype and get new contracts live.

Network Usage Shows Adoption

Ethereum’s on-chain metrics continue painting a positive picture of the network, including continued adoption even after contracts are deployed.

Daily transactions and active addresses have been hitting all-time highs this year, while gas fees are generally down as layer-2 solutions are picking more of the transaction load off the mainnet.

Stablecoin transfer volume on Ethereum in Q4 2025 also reached record highs. Furthermore, stablecoins were transferred more than ever on Ethereum during Q4 2025 and close to the $6 trillion mark which exceed settling volume of traditional payment networks such as Visa and Mastercard.

This spike was cornered mainly by stablecoins like USDT and USDC on the Ethereum network.

Conclusion

Ethereum’s 8.7 million smart contract deployment record in Q4 of 2025 is a testament to the network’s continued leadership in providing a platform for decentralized applications and blockchain advancement.

Propelled by layer-2 uptake, DeFi expansion, improved tooling and continued developer interest, the spike in contract deployments demonstrates an ecosystem that is maturing with myriad use cases.

Despite advanced competition from other blockchains, Ethereum’s infrastructure, network effects and extensive developer base still lead significant activity.

Overall, late 2025 Ethereum contract activity suggests that its role in decentralized finance and web3 development is still important as blockchain space matures.

Glossary

Ethereum: a decentralized blockchain network that is based on a cryptographically-secure technology known as distributed ledger.

Smart contracts: self-executing code on a blockchain automatically enforcing terms.

Layer-2 solutions: additional protocols that sit atop Ethereum to help scale and reduce fees.

DeFi: short for decentralized finance, which are financial services based on blockchain technology.

Frequently Asked Questions About Ethereum Smart Contracts

What does the 8.7 million contract deployment mean for Ethereum mean?

It indicates that the developers have created or made more than 8.7 million unique smart contracts on the network during Q4 2025, thus, setting a new usage record for the network.

Why is Layer-2 such a big deal for Ethereum activity?

Layer-2 solutions lower costs and increase throughput, allowing many more developers to deploy contracts.

Is high contract activity influencing the price of ETH, directly?

Number of contracts is a use metric, showing ecosystem growth; price moves are the sum of many factors such as market sentiment and macro conditions.

Are these launches tokens or actual applications?

Deployments consist a variety of new tokens, DeFi, tools, NFT platforms, utilities and experimental contracts.

Is Ethereum still leading development compared to other chains or not?

Yes. Despite competition, Ethereum’s total deployments and developer ecosystem are indeed among the strongest in blockchain.

References

ChainCatcher

AInvest

MEXC

CryptoRank

MEXC