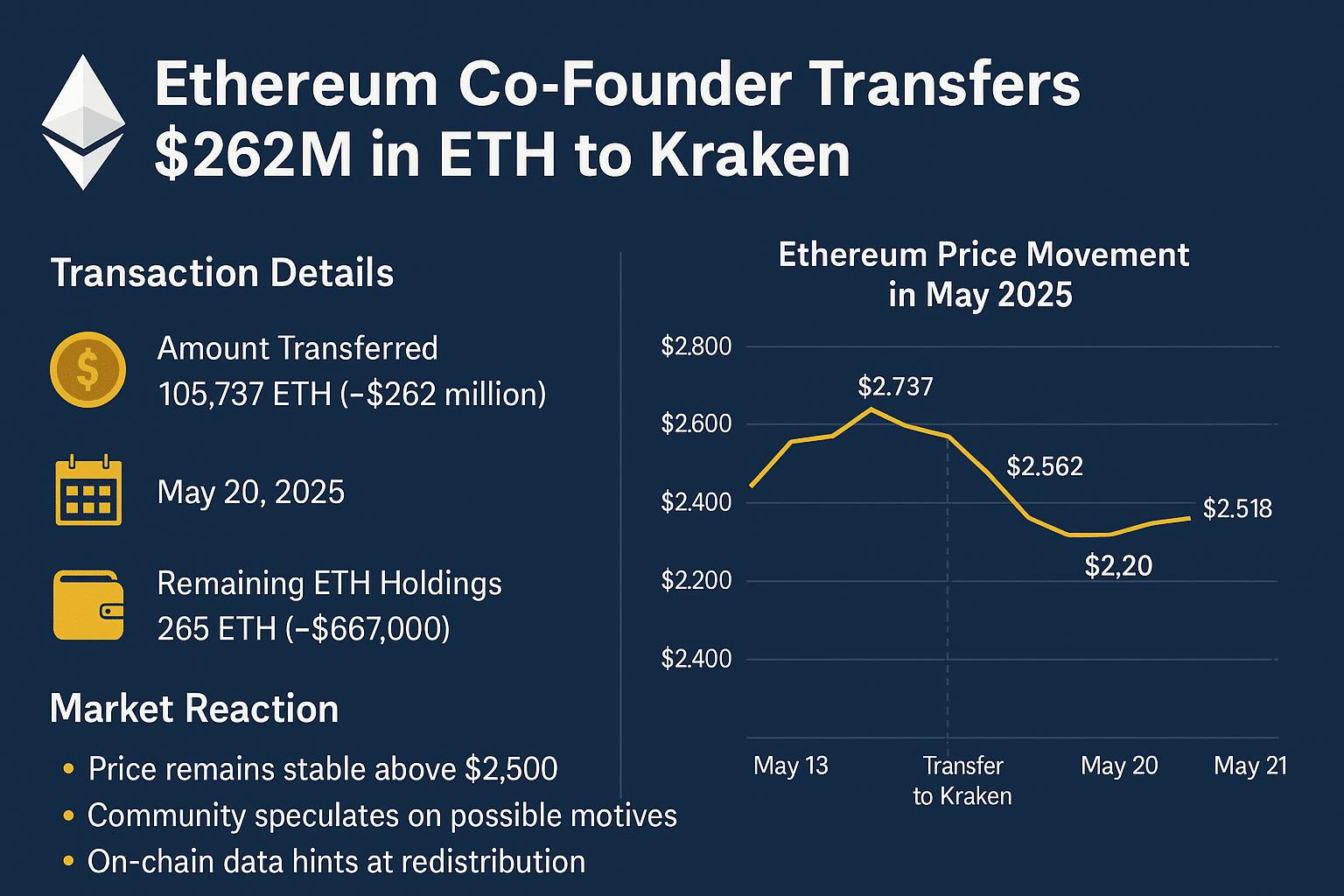

Ethereum co-founder Jeffrey Wilcke has transferred an eye-popping 105,737 ETH, valued at approximately $262 million, to crypto exchange Kraken. The transaction, which occurred on May 20, 2025, stunned the market and immediately triggered speculation about a potential large-scale selloff.

- Ethereum Price Holds Steady Above $2,500

- Community Puzzled by Silent Move and On-Chain Patterns

- Historical Context: Not Wilcke’s First Major Transfer

- Whale Activity and Market Outlook Remain Bullish

- Ethereum Price Table

- Conclusion: Redistribution or Warning Sign?

- FAQs

- Who is Jeffrey Wilcke?

- How much ETH did Wilcke transfer?

- Did this transfer crash the market?

- What’s next for Ethereum?

- Glossary of Key Terms

According to on-chain data, Wilcke’s wallet now holds just 265 ETH, worth around $667,000, marking one of the largest single withdrawals of Ethereum by a co-founder in recent history.

Ethereum Price Holds Steady Above $2,500

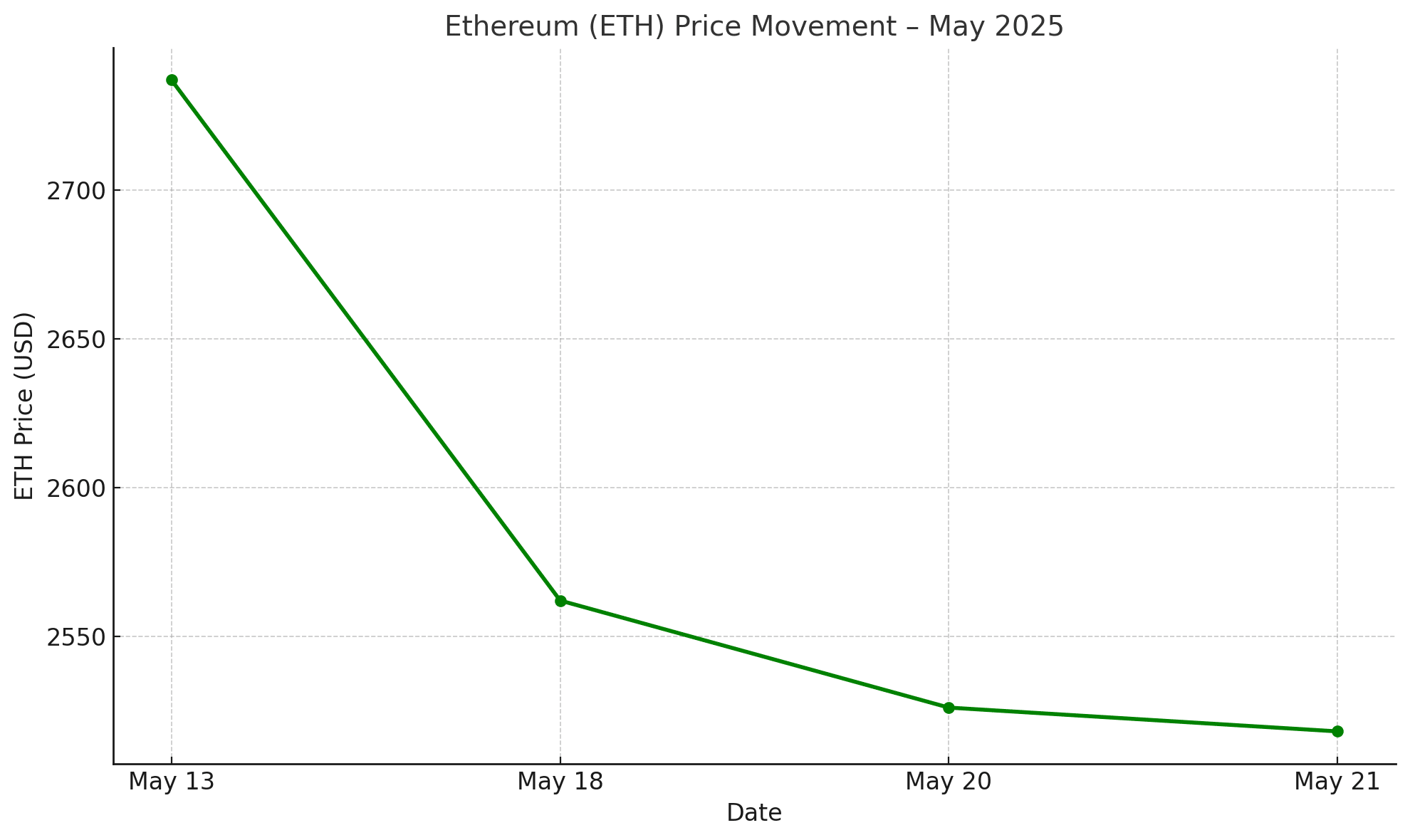

Despite the massive transfer, Ethereum (ETH) is trading at $2,518, down only 0.5 percent over the past 24 hours, based on CoinMarketCap data as of May 21.

ETH reached a monthly high of $2,737 on May 13, rallying nearly 72 percent from its April lows. The current pullback is being viewed by some traders as healthy consolidation, especially in light of broader macro uncertainty and ETF anticipation.

Community Puzzled by Silent Move and On-Chain Patterns

The lack of communication from Wilcke has only deepened the mystery. The Ethereum co-founder retweeted coverage of the transfer but offered no explanation, leaving room for widespread interpretation.

Adding a twist to the narrative, on-chain analytics show that shortly after Wilcke’s deposit, eight newly created wallets withdrew nearly the same amount of ETH from Kraken. Analysts suggest this could be an internal reshuffle or OTC-style redistribution rather than a direct dump on the market.

“It looks more like a fund repositioning than a panic sell,” said one DeFi analyst on X. “If it were a straight liquidation, we would’ve seen price volatility spike. That hasn’t happened.”

Historical Context: Not Wilcke’s First Major Transfer

Wilcke has previously made large ETH transfers to Kraken. In November 2024, he moved 20,000 ETH, coinciding with a 4.5 percent price dip that triggered a wave of retail selling.

This historical precedent has some market watchers concerned that a delayed price reaction could still occur, particularly if market liquidity thins or if sentiment weakens due to macro or regulatory events.

However, Wilcke’s legacy and technical contributions to Ethereum often lend more credibility than concern to his actions.

Whale Activity and Market Outlook Remain Bullish

According to Santiment and Whale Alert, Ethereum whales continue to accumulate ETH quietly. Over the past week:

Wallets holding over 100,000 ETH increased by 2.1 percent

Exchange outflows remain higher than inflows, signaling holding sentiment

ETH’s supply on exchanges is at a two-year low

The broader outlook for Ethereum remains positive, particularly as the community awaits a final decision on Ethereum staking ETF proposals expected later this quarter.

Ethereum Price Table

| Date | ETH Price | 24h Change | Volume (24h) | Trend |

|---|---|---|---|---|

| May 13 | $2,737 | +3.2% | $16.8 Billion | Bullish |

| May 18 | $2,562 | -1.4% | $14.7 Billion | Neutral |

| May 20 | $2,526 | -0.8% | $13.5 Billion | Mixed |

| May 21 | $2,518 | -0.5% | $12.9 Billion | Stable |

Conclusion: Redistribution or Warning Sign?

While a $262 million ETH transfer by a co-founder naturally raises eyebrows, the lack of volatility and whale tracking data suggest that the move was more strategic than alarming. Whether it signals an internal treasury reallocation, OTC deal, or a prelude to new market developments remains unknown.

For now, the Ethereum network remains fundamentally strong, and the market response indicates that confidence outweighs fear, at least for now.

FAQs

Who is Jeffrey Wilcke?

Jeffrey Wilcke is one of Ethereum’s original co-founders and developers. He played a crucial role in Ethereum’s early technical architecture and client implementation.

How much ETH did Wilcke transfer?

He transferred 105,737 ETH worth approximately $262 million to the Kraken exchange.

Did this transfer crash the market?

No. Ethereum’s price remained relatively stable, hovering around $2,500, suggesting the transfer may not have been a direct sell.

What’s next for Ethereum?

The market is closely watching for the SEC’s decision on Ethereum staking ETFs and broader DeFi integration trends, both of which could be bullish catalysts.

Glossary of Key Terms

On-Chain Data: Public blockchain data showing wallet activity, transfers, and smart contract interactions.

Whale: An entity or individual holding large amounts of a cryptocurrency, often capable of influencing price action.

Kraken: A major U.S.-based cryptocurrency exchange used by retail and institutional traders.

OTC (Over-the-Counter): Private transactions conducted outside of centralized exchanges, often used by institutions.

Liquidity: The ease with which assets can be bought or sold without impacting the price.