Binance listing brings Ethena’s USDe into the spotlight

In a spectacular move that rattled the stablecoin market, Ethena’s USDe surpassed $13 billion in circulating supply within hours of being listed on Binance.

This achievement solidified its status as the third-largest stablecoin, with a market share of around 5% in a $287 billion ecosystem. According to market experts, the quick increase indicated both investor hunger for alternatives and the confidence generated by regulatory certainty.

The listing provided traders with quick access to a variety of trading pairings, including USDe/USDC and USDe/USDT, while also incorporating the asset into lending and futures markets. Analysts remarked that liquidity and exposure to the world’s largest exchange fueled the fast increase.

Yield Incentives Increase the Stablecoin’s Popularity

Ethena’s USDe attractiveness is partly due to its excellent yield structure. With rates hovering around 10%, the synthetic stablecoin provides returns that outperform traditional safe investments such as US Treasury securities. Rewards tied to Binance’s ecosystem fueled further growth, making the asset an obvious appeal for investors seeking bigger profits.

One X observer described the attitude, saying, “Ethena’s USDe demonstrates how DeFi innovation and centralized exchange access can coexist.” This is not hype; it is growth supported by utility.” Ethena’s competitive returns and institutional integrations have caught the attention of both retail traders and professional investors.

Institutional Support and Growing Ecosystem

The fast rise of Ethena’s USDe was not only a result of market speculation. The stablecoin concept has received institutional backing through fundraising rounds and treasury alliances, bolstering its legitimacy.

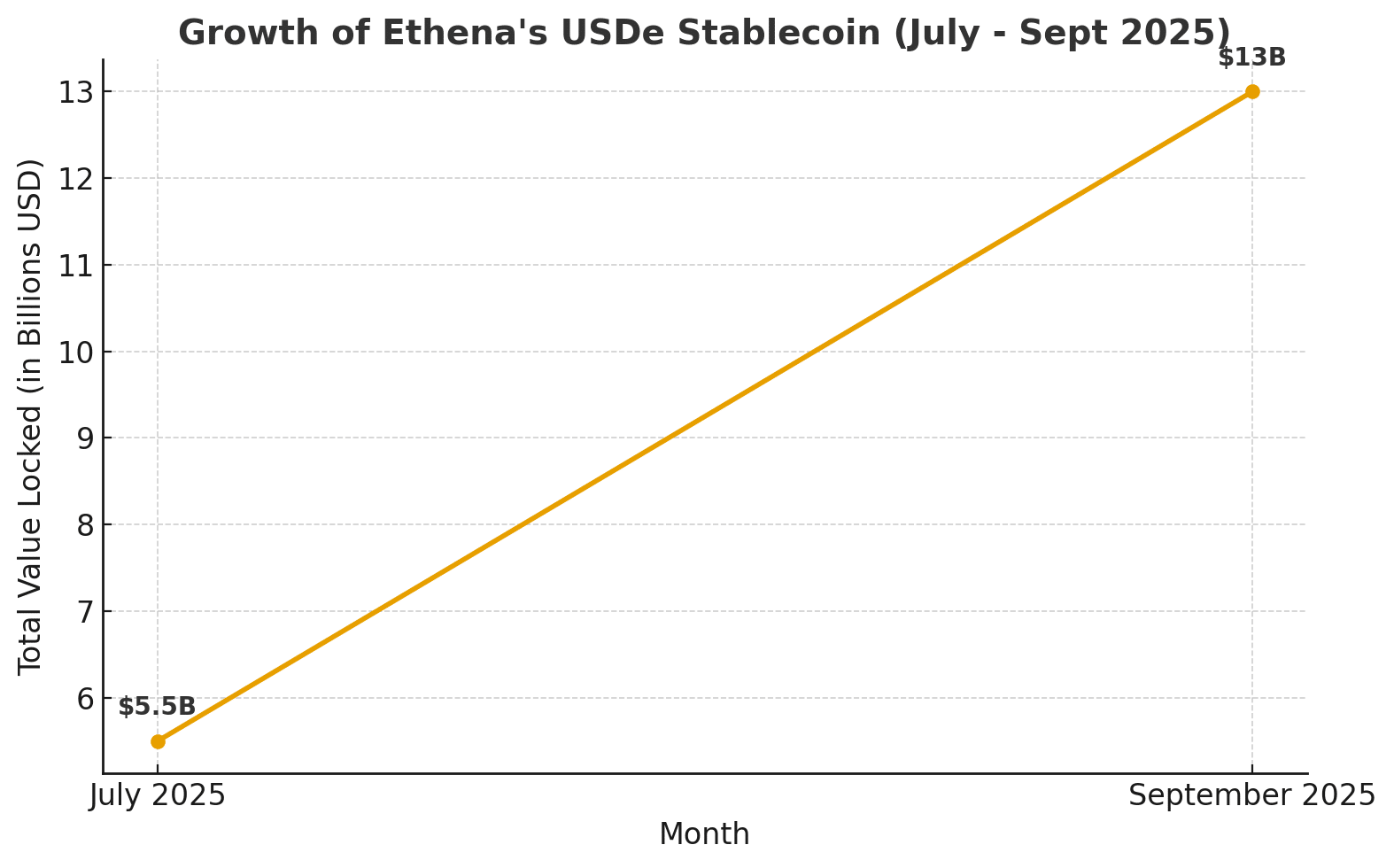

Over the last three months, total value locked in the ecosystem has increased from $5.5 billion in July to more than $13 billion in September, demonstrating the speed of adoption.

Observers note that this increase demonstrates not just trust in Ethena’s process, but also a larger thirst for alternative stablecoins that can diversify market concentration. With heavyweights like USDT and USDC prevailing, Ethena’s ascent demonstrates investors’ readiness to explore novel models that mix synthetic strategies with collateralized security.

Regulatory Climate Adds Tailwinds

The timing of Ethena’s USDe breakthrough is consistent with a more favorable regulatory environment. The GENIUS Act, passed into law earlier this summer, established a more defined structure for stablecoin issuance. By resolving long-standing compliance concerns, the Act helped new issuers acquire market share.

High yields, however, raise concerns about their long-term viability. Experts warn that derivatives and hedging techniques may be put to the test if market financing rates fluctuate drastically. A financial commentator warned that “Ethena’s USDe has momentum, but regulatory oversight and market stress will ultimately determine its staying power.”

Conclusion

The rise of Ethena’s USDe to $13 billion demonstrates how swiftly innovation may transform the stablecoin industry. Supported by returns, liquidity, and exchange integration, the asset has carved itself a significant place among the sector’s titans.

Investors are positive, but long-term viability will be determined by Ethena’s ability to adapt to changing markets. For the time being, the stablecoin’s stratospheric surge indicates that the struggle for the digital dollar is far from finished.

FAQs for Ethena’s USDe

Q1: What is Ethena’s USDe?

Ethena’s USDe is a synthetic stablecoin designed to maintain a dollar peg using innovative financial strategies and hedging mechanisms.

Q2: Why did Ethena’s USDe surge past $13B?

The surge followed its listing on Binance, which boosted liquidity and exposure, alongside attractive yields and institutional support.

Q3: Is Ethena’s USDe regulated?

The stablecoin benefits from the regulatory clarity provided by the GENIUS Act, though its synthetic model may attract further oversight.

Q4: What risks does Ethena’s USDe face?

Key risks include sustainability of yields, regulatory pressure, and potential volatility in derivative markets used for hedging.

Glossary

Stablecoin: A cryptocurrency pegged to a stable asset like the U.S. dollar.

Synthetic Stablecoin: A stablecoin backed by derivatives and hedging strategies rather than direct fiat reserves.

Liquidity: The ease with which an asset can be bought or sold without impacting its price.

Yield: The return earned from holding or investing in an asset, expressed as a percentage.

Market Cap: The total value of a cryptocurrency, calculated by multiplying supply with price.

Total Value Locked (TVL): The amount of capital held in a DeFi protocol, showing adoption and trust.