According to sources, Ethena Labs Hyperliquid USDH withdrawal has shifted the balance of the contest. It is clearing the way for rival teams such as Native Markets to move forward with greater momentum.

- Why did Ethena Labs step back from the USDH contest?

- What does this mean for Native Markets?

- How did the market respond to Ethena’s decision?

- What were Ethena’s original plans for USDH?

- What are Ethena’s next steps after leaving the contest?

- How does this shape the stablecoin race?

- Conclusion

- Glossary

- FAQs for Ethena Labs Hyperliquid USDH withdrawal

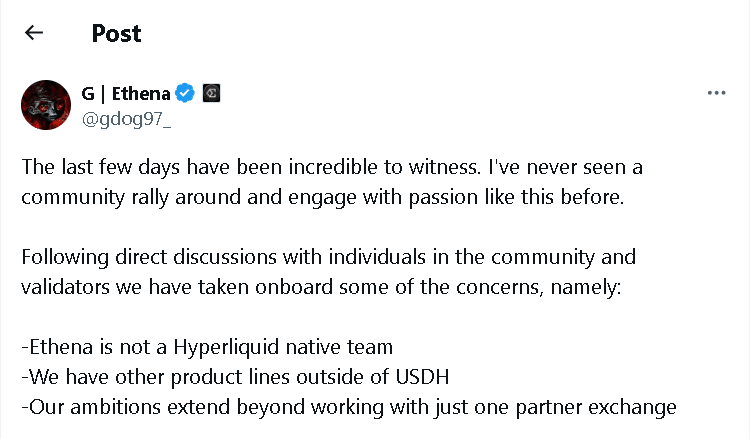

The announcement was made by Ethena founder Guy Young. He cited community and validator concerns as the deciding factor.

Why did Ethena Labs step back from the USDH contest?

Ethena Labs Hyperliquid USDH withdrawal happened after validators questioned the team’s place in the ecosystem. Some said Ethena was not a native Hyperliquid project and was focused on bigger plans outside USDH.

Instead of fighting this feedback, the team chose to step back. Guy Young said the choice was about fairness and respect for the community, adding that they listened and decided to step aside.

Also read: Ethena’s USDe Hits $13B Milestone, Overtaking Rivals in Stablecoin Race

What does this mean for Native Markets?

The Ethena Labs Hyperliquid USDH withdrawal has cleared an important hurdle for Native Markets, allowing the team to move ahead with fewer challenges in the contest. Native Markets is now seen as the leading contender, as it continues to gain strong support from validators and members of the wider community.

Although there were earlier doubts raised about the team’s credibility, Native Markets has been able to gather momentum by presenting itself as a project that truly belongs within the Hyperliquid ecosystem. Guy Young also congratulated the team, noting that their rise is proof of how a community-driven model can create success inside Hyperliquid.

How did the market respond to Ethena’s decision?

Following the news of Ethena Labs Hyperliquid USDH withdrawal, the $ENA token fell by almost 3%. The drop showed short-term doubts among traders, but many still trust Ethena’s future plans and products.

At the same time, BitMEX co-founder Arthur Hayes bought nearly $1 million worth of ENA tokens before the withdrawal. This showed that he has faith in the project’s long-term growth.

What were Ethena’s original plans for USDH?

Ethena’s first plan was to back the stablecoin completely with USDtb, a token tied to BlackRock’s BUIDL fund. The team also promised to give back almost all reserve earnings to the Hyperliquid community, cover the costs of moving from USDC, and add at least $75 million in rewards.

These offers made Ethena look like a strong competitor. But doubts from the community about it not being a native Hyperliquid team became stronger than these benefits, leading to the Ethena Labs Hyperliquid USDH withdrawal.

What are Ethena’s next steps after leaving the contest?

Ethena Labs made it clear that leaving the USDH contest does not mean it is leaving Hyperliquid. The team plans to focus more on its synthetic dollar hUSDe, USDe-based savings and card products, and hedging tools built for Hyperliquid markets.

They are also looking into HIP-3 ideas, including modular prime broking, reward-bearing collateral, and perpetual equity swaps. Guy Young said the team will continue doing what it has always done from the start, to outcompete others by building better products.

Also read: Stablecoins Can Support Financial Safety: A New Era of Digital Stability

How does this shape the stablecoin race?

With Ethena Labs Hyperliquid USDH withdrawal, the competition becomes smaller and the focus moves to Native Markets, Paxos, and other teams. Analysts say that the result will have a big impact on Hyperliquid’s role in the global stablecoin market.

Venture partner Haseeb Qureshi mentioned that the process still brings up questions about fairness. At the same time, Phoenix Labs co-founder Sam MacPherson said that Native Markets could be the right choice if it continues to have strong support from the community.

Conclusion

Based on the latest research, the Ethena Labs Hyperliquid USDH withdrawal shows how important community-driven decisions are in the digital asset space. While Native Markets is gaining momentum, Ethena is still growing its range of products.

The Ethena Labs Hyperliquid USDH withdrawal may have changed the contest, but it has not slowed the team’s long-term plans. This decision marks a point where the community’s voice strongly shapes the direction of major crypto ecosystems.

Summary

Ethena Labs Hyperliquid USDH withdrawal has changed the stablecoin race, giving Native Markets a clearer path to lead. The decision came after validators and the community questioned Ethena’s role in Hyperliquid, prompting the team to step aside.

Following the withdrawal, $ENA dropped slightly, but traders and investors like Arthur Hayes still trust the project’s long-term potential. Ethena plans to focus on products like hUSDe and other Hyperliquid tools. The move shows how much influence the community has in guiding decisions in the crypto space.

Stay ahead in the DeFi race with the latest news like Ethena Labs Hyperliquid USDH withdrawal and Native Markets’ stablecoin push, only on our platform.

Glossary

Community-driven model – Project growth guided by user and validator support.

Stablecoin race – Competition among projects to dominate digital-dollar adoption.

HIP-3 – A set of proposals to improve Hyperliquid’s market features.

USDtb – A token backed by BlackRock’s BUIDL fund.

Paxos – A competitor team in the stablecoin market.

Validators – Participants who verify and approve network activities.

USDH – A digital stablecoin in the Hyperliquid ecosystem.

hUSDe – Ethena’s synthetic dollar designed for digital finance.

FAQs for Ethena Labs Hyperliquid USDH withdrawal

1. Who announced Ethena Labs’ USDH withdrawal?

Ethena founder Guy Young announced it.

2. Why did Ethena Labs quit?

Validator and community concerns about fairness.

3. What happened to ENA price?

ENA token dropped by nearly 3%.

4. What will Ethena build now?

hUSDe, savings products, card services, and hedging tools.

5. Which teams remain in the stablecoin race?

Native Markets, Paxos, and others.

6. What were Ethena’s original USDH plans?

Full backing with USDtb, rewards, and cost coverage