Ethereum’s price momentum slowed in June after a sharp rally in April and May lifted it from $1,400 to $2,800. Although ETH ETF inflows surged past $1 billion in June, speculative interest failed to match. Meanwhile, Ethereum Futures and Options data reflected cautious mid-term sentiment, even as some short-term indicators remained positive.

ETH ETF Inflows Surge, But ETH Stalls Below $2,800

Institutional appetite for Ethereum remained strong through Q2, with ETH ETF inflows jumping sharply in May and June. In May, ETH ETF inflows reached $564 million and rose past $1 billion by late June. Yet, Ethereum’s price declined from its Q2 peak of $2,800 to nearly $2,100 before rebounding slightly.

The inflows did not result in a sharp rise in ETH, as the coin was in a range between $2,800 and $2,300 most of June, with not too much interest in the speculative section. There was visible resistance when the price was above 2500, and there was no strong momentum to ensure a retest of the May highs. This denoted that prices were not being pushed by institutional demand.

Low retail activity and profit-taking pressure were also cited as reasons by traders for the performance to remain low. Despite the flow of capital into ETH ETFs, analysts observed that the general market sentiment was neutral. This lack of correlated flows in the inflows and price movement puts doubts on the sustainability of the rally.

Derivatives Market Shows Waning Demand

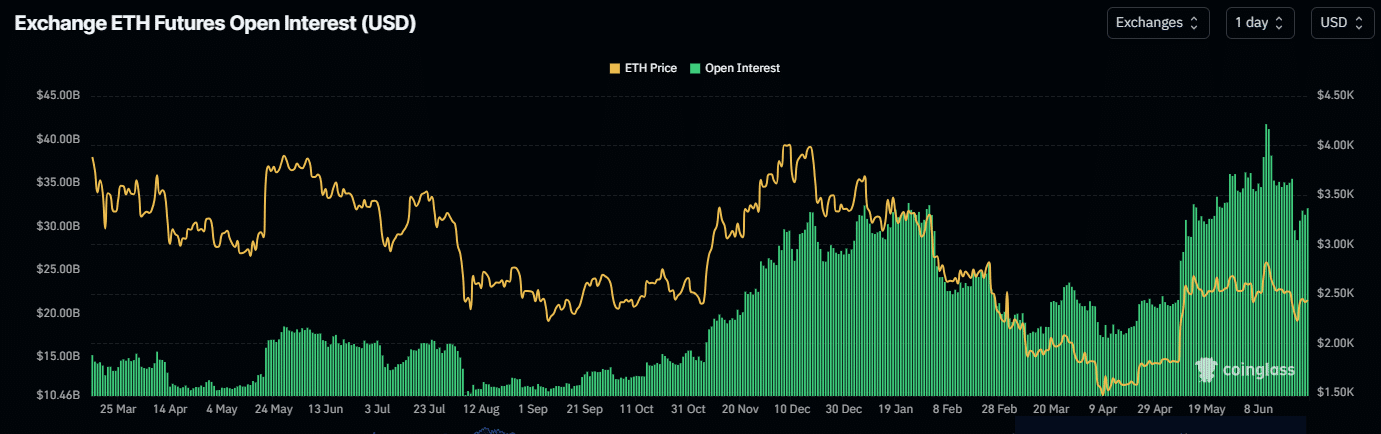

The Futures Open Interest (OI) also indicated comments on the pace of the Q2 rally, with the value increasing by the amount of $17 billion to a value of $41 billion when the price value of ETH soared by a factor of 2. However, since mid-June, the OI has fallen by $10 billion to $31 billion, and future demand has been validated. This decline was accompanied by ETH falling to a value of $2,100, which is in line with the lower level of speculation.

While ETH ETF inflows surged, Futures traders trimmed exposure, suggesting caution ahead of Q3. This action indicates that there was a difference between institutions on long-term bets and the short-term sentiment of trade. The flows of ETFs were still increasing, but the derivatives operations were hesitating.

The change in leverage was seen solely by Open Interest, which showed that traders cut leverage as ETH market volatility reentered the scene. Although some short-term buying in the call areas took place early in June, this disappeared rapidly when the options market reversed. Overall, the decline in OI also verified the dissipating of speculative fever after the rally.

Options Market Signals Bearish Q3 Bias

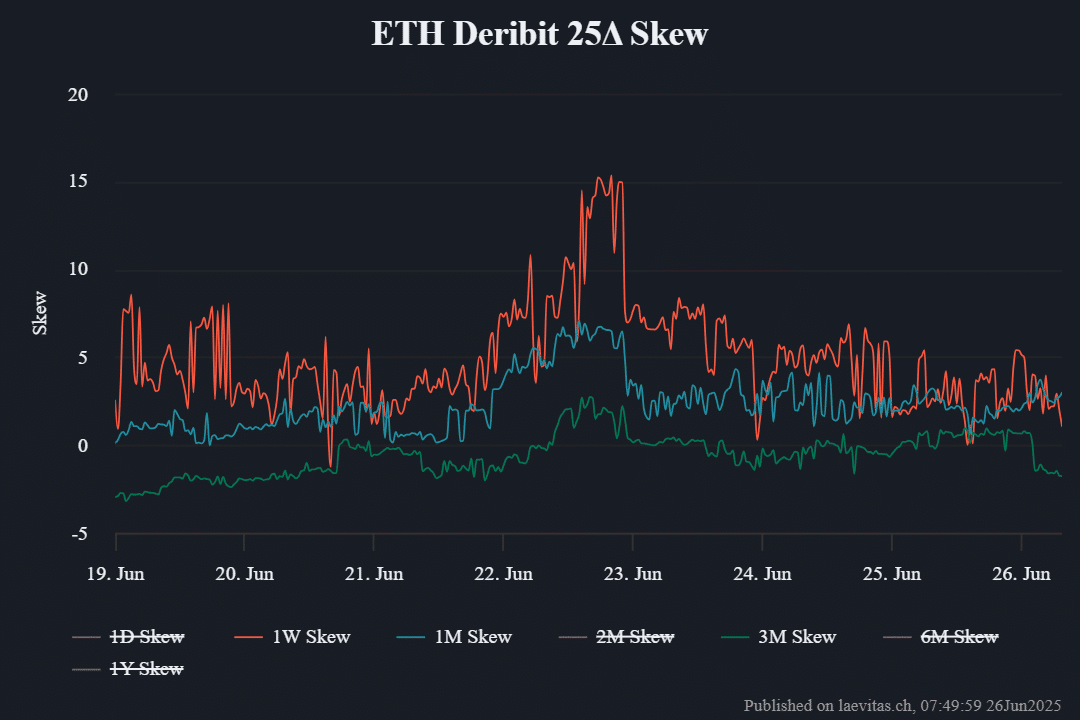

Short-dated Options showed brief optimism in early June, with call premiums pushing 25 Delta Skew to 6% and 15%. This activity supported ETH’s bounce from $2,100 to $2,500 in a matter of days. However, the sentiment didn’t last long as the Skew values fell back to 1% and 3%.

The correction in short-term optimism contrasted with the 3-month skew, which slipped to -2%, favoring puts over calls. This shift indicated a growing bias toward downside protection heading into Q3. Traders priced in more risk, despite the ongoing ETH ETF inflows.

Such shifts in the Options market typically reflect cautious positioning rather than immediate panic. Yet, this behavior suggests that traders aren’t entirely buying into the ETH ETF narrative. Mid-term positioning clearly indicated skepticism about the strength of any further rally.

Conclusion

ETH ETF inflows climbed past $1 billion in June, driven by strong institutional demand and long-term optimism. The Futures and Options markets, however, displayed a feeling of caution as traders scaled back and priced in intermediate risk. Despite inflows supporting Ethereum’s long-term case, short-term traders seem hesitant to follow the rally without broader confirmation.

Summary

Ethereum surged in early Q2 but lost steam as speculative demand waned in June. Despite over $1 billion in ETH ETF inflows, Futures Open Interest dropped by $10 billion, and Options markets signaled mid-term bearishness. This pessimistic standpoint is opposed to higher levels of institutional inflows, which points towards a discrepancy between the long-term investment mood and a short-term trading psyche.

FAQs

What are ETH ETF inflows?

ETH ETF inflows refer to the total amount of capital entering Ethereum-backed exchange-traded funds.

Why are ETH ETF inflows important?

They reflect institutional interest in Ethereum and can impact long-term price outlooks and market sentiment.

How did Ethereum perform in Q2?

Ethereum doubled from $1,400 to $2,800 in April and May, then corrected back to around $2,100 in June.

What does Open Interest indicate?

Open Interest tracks the total number of outstanding derivative contracts and helps gauge market activity and sentiment.

Why are Options traders cautious?

Options data suggests traders expect limited upside, as 3-month skew turned negative, indicating more demand for protective puts.

Glossary of Key Terms

ETH ETF inflows: The amount of investment flowing into Ethereum-based exchange-traded funds.

Open Interest (OI): Total number of outstanding Futures contracts that have not been settled.

25 Delta Skew: A measure showing the relative demand for call vs. put options; often signals sentiment shifts.

Call Option: A financial contract that gives the holder the right to buy ETH at a certain price.

Put Option: A contract that gives the holder the right to sell ETH at a specific price, typically used as downside protection.

References: