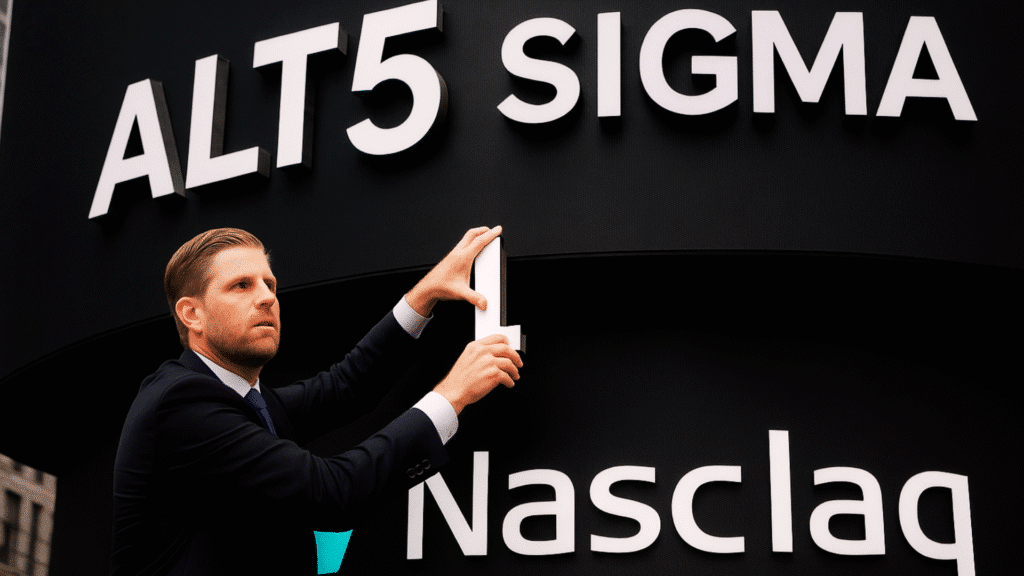

According to sources, the Eric Trump ALT5 Sigma board removal has created ripples in both corporate and crypto circles. It highlights Nasdaq’s influence over governance decisions and the company’s ongoing legal challenges.

Instead of joining the board as originally announced, Trump has been assigned the role of board observer. This adjustment followed weeks of consultations with Nasdaq regulators and was quietly disclosed in a revised SEC filing.

Why did Nasdaq push back on Eric Trump’s role?

The Eric Trump ALT5 Sigma board removal took place after Nasdaq stressed that the company must follow its listing rules. While the specific rule was not mentioned, legal experts explained that Nasdaq usually reviews board appointments closely when they involve well-known political or financial figures.

In August, Trump was first announced as a director as part of a $1.5 billion deal with World Liberty Financial (WLFI). However, this original plan has now been reshaped by the company.

Also read: NASDAQ Plunges, S&P 500 Drops 3%, Crypto Markets Crash

Who replaces Trump on the Alt5 Sigma board?

In place of the Eric Trump ALT5 Sigma board removal, WLFI’s co-founder and COO, Zak Folkman, has been put forward as a nominee for director. His role still needs to be approved by shareholders before it becomes official.

For now, Trump will only continue as a board observer without any voting power. The SEC filing confirmed this change, but the company’s website still listed Trump as a director during the transition, which raised concerns about clear communication.

What legal troubles surround Alt5 Sigma?

The Eric Trump ALT5 Sigma board removal happened while the fintech firm was already facing serious legal battles. A court in Rwanda shut down its Canadian branch and took $3.5 million after declaring its former head guilty of money laundering and unlawful gains.

Alt5 Sigma explained that it only learned about this decision in late August and has already filed an appeal. Some analysts believe this extra pressure could have played a role in Nasdaq’s review of the case.

How does World Liberty Financial factor into the deal?

Even with the Eric Trump ALT5 Sigma board removal, World Liberty Financial continues to play a central role in shaping the company’s direction. The $WLFI token reached $0.2039, reflecting an 11% decline from the previous week and about 38% below its peak.

Alt5 Sigma holds 7.3 billion tokens purchased at $0.18, with the total stake increasing in value by more than $200 million, reaching nearly $1.5 billion despite recent leadership changes.

Also read: World Liberty Financial Mints $205M USD1 as Stablecoin Supply Climbs to $2.4B

What do experts say about the decision?

Market watchers believe the Eric Trump ALT5 Sigma board removal shows Nasdaq is being very careful about how companies are managed. A corporate governance expert on X said that when well-known figures are involved, regulators act with more caution.

They pay attention to how things look as well as to the rules. On Reddit, traders pointed out that WLFI’s token staying strong suggests investors are more focused on the project’s core value than on board changes.

Conclusion

Based on the latest research, the Eric Trump ALT5 Sigma board removal highlights the ongoing tension between corporate strategy and regulatory demands. Even though Trump no longer has a full board role and is only an observer, his link to the project continues through World Liberty Financial.

Investors are now watching whether Nasdaq’s intervention stabilizes Alt5 Sigma’s governance. They are also considering if the move sparks further uncertainty.

Summary

The Eric Trump ALT5 Sigma board removal happened after Nasdaq raised questions about how the company is managed in a $1.5 billion deal with World Liberty Financial. Trump will no longer be a director and will only act as a board observer without voting power.

WLFI’s $WLFI token reached $0.2039, while Alt5 Sigma’s tokens, which were bought at $0.18, have grown in value to nearly $1.5 billion. Ongoing legal issues, including a case in Rwanda, have added pressure, and investors are now unsure if Nasdaq’s move will bring stability or more problems.

Stay informed on Nasdaq developments and ALT5 Sigma board changes only on our platform

Glossary

Nasdaq – The rule-checker of big U.S. companies.

SEC Filing – Official paperwork that keeps companies honest.

Board Observer – Attends meetings without voting rights.

Ripple Effect – Small action causing broader impact.

Shareholder Approval – Consent from company owners.

Director – Board member with decision authority.

FAQs for Eric Trump ALT5 Sigma board removal

1. What happened to Eric Trump at ALT5 Sigma?

He was removed from the board and is now only a board observer.

2. Why did Nasdaq get involved?

They wanted to make sure rules were followed for board appointments.

3. Who is replacing Eric Trump?

Zak Folkman, WLFI’s co-founder and COO.

4. Any legal problems for ALT5 Sigma?

Yes, its Canadian branch was shut down over money issues.

5. What is World Liberty Financial’s role?

They are part of the $1.5B deal and own many ALT5 Sigma tokens.

6. What do experts say?

Nasdaq is being careful with famous people on boards.