This article was first published on Deythere.

- Epstein’s $3 Million Bet on Coinbase in Its Early Days

- Where Blockstream Fits In Epstein Crypto Web

- Industry Response and Context

- Why This Matters Now

- Conclusion

- Glossary

- Frequently Asked Questions About Epstein Crypto Involvement

- Did Jeffrey Epstein directly own cryptocurrency?

- Did Coinbase know Epstein was investing?

- Does Blockstream have financial ties to Epstein today?

- Is there any dirt on Coinbase or Blockstream?

- References

Recently released documents from the U.S. Department of Justice have revealed shocking information about both cryptocurrency personalities, and their connections to Epstein as an investor.

The convicted financier Jeffrey Epstein, who died in 2019, appears in emails and asset lists indicating he funded a 3 million USD investment to Coinbase in 2014, and that he had links with early Bitcoin infrastructure discussions at Blockstream.

Epstein’s $3 Million Bet on Coinbase in Its Early Days

Emails and asset records from the Epstein Files indicate that in December 2014, Jeffrey Epstein put nearly $3 million into the cryptocurrency exchange Coinbase when it was still very much in an early phase.

The documents show that the injection was conducted through Epstein’s U.S. Virgin Islands entity, IGO Company LLC, and that the deal was organized by some of venture’s biggest names, including Brock Pierce, a co-founder of Blockchain Capital and early crypto adopter.

Coinbase was worth about $400 million at the time, so Epstein’s stake came to less than 1% of the company. Internal emails indicate that Coinbase’s co-founder Fred Ehrsam was aware of “Jeff” participating, and even spoke about arranging to meet with him though it is unclear if that meeting materialized.

In 2018, Epstein reportedly sold about half his stake in Coinbase back to Blockchain Capital, one of its early investors, for roughly $11 million when the company had not yet gone public, securing a hefty return on his original investment.

The fate of the rest of the stake is less clear in the records but what appears to be a partial exit shows how early venture capital flows quietly staked claim over ownership as one of crypto’s most valuable platforms began to hold grounds.

Where Blockstream Fits In Epstein Crypto Web

The Epstein Files also connected him to early Bitcoin infrastructure investors, essentially Blockstream, a company built around enhancing the functionality of Bitcoin.

In documents from 2014, Blockstream co-founder Austin Hill e-mailed Epstein and others, including then-MIT Media Lab director Joi Ito, about fundraising for a seed round and its allocations.

In one of them, Hill wrote to Ito and Epstein that the seed round was “10x oversubscribed” and that another investor had driven him to increase their allocation.

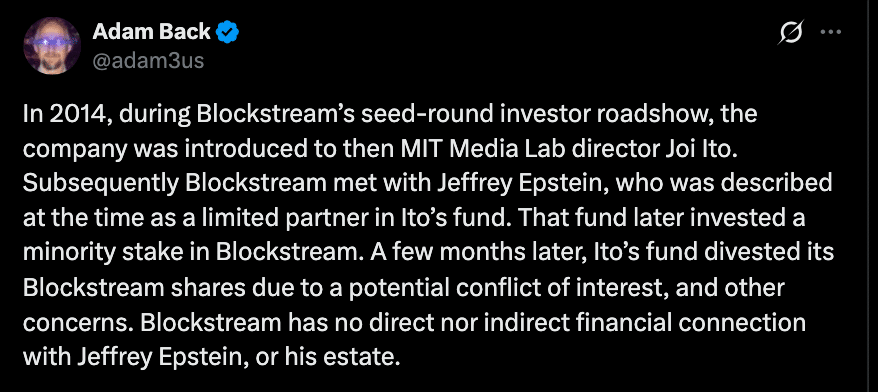

Responding to the release of the Epstein files, Blockstream’s current CEO (Adam Back) denied that his company had any financial connections with Epstein or his estate.

Back confirmed that Blockstream met Epstein once, and that Epstein was described at the time as a limited partner in Ito’s fund. The fund later took a minority stake in Blockstream, which was sold off a few months afterward amid concerns of conflict of interest.

These are explanations for part of the story that surrounded Epstein crypto footprint, to be sure, but based on the files, hundreds of pages of emails and notes, he was far more tethered to personal networks than formal corporate alliances.

The Blockstream interaction, though limited in direct financial commitment, verifies that Epstein was involved early on in discussions around influential teams shaping Bitcoin’s future

Industry Response and Context

Epstein’s connections to early crypto capital have some industry participants looking back on due diligence and reputational risk.

Coinbase, which went public in 2021 and now boasts a multibillion-dollar valuation, has not publicly explained how it reconciles having a convicted criminal on its early cap table with company policies on compliance today. Coinbase leadership has not publicly commented on these specific files at the time of publication.

Blockchain Capital has also not made a detailed public comment beyond the documents themselves, and Pierce’s own role in crypto after years spent as an identifiable early investor and a former presidential candidate himself has also cast more attention on how some early venture funds operated unchecked.

Epstein crypto connections seem to have been through the personal vehicles and networks, rather than broad fund allocations, and there is nothing in the DOJ’s documents indicating ongoing influence or control over platforms such as Coinbase or Blockstream after these early engagements.

Why This Matters Now

The revelations are happening when the cryptocurrency industry is pushing for more legitimacy and regulatory clarity. Investors, regulators and platforms are all becoming more mindful that past capital flows, particularly those involving opaque intermediaries, can tell on governance practices today.

The Epstein Files, released under the Epstein Files Transparency Act, consist of millions of pages of emails, financial statements and back-channel communications which give context to where the early digital asset development funding came from.

The focus on early investors has reminded stakeholders such as Coinbase, which bills itself as a public company that celebrates compliance and transparency, that venture capital roots still matter.

However minute the financial impact may have been, the story speaks of crypto’s wild transition days when growth trumped reputational management and regards for checks on capital were secondary.

For Blockstream, the files clarify that while Epstein entered the orbit through contemplative investor circles, the company’s direct financial separation from Epstein’s estate has been affirmed.

Conclusion

The recently released Epstein Files is another fascinating chapter in the story of early cryptocurrency progress.

Jeffrey Epstein’s $3 million investment in Coinbase, arranged through venture intermediaries in 2014, and his proximity to Bitcoin infrastructure discussions via Blockstream’s seed round, show that crypto’s early funding was far more intertwined with traditional finance networks than often acknowledged.

These records do not necessarily suggest wrongdoing by the companies themselves, but they do shed light on how personal networking and elite circles influenced the sector’s early development.

With new crypto companies now doing their best to embrace institutional respectability and regulatory oversight, and investors facing demands for much more transparency about their identities and backgrounds, this episode would serve as a necessary caution for transparency, vetting of investors, and how fast various norms in digital finance can change.

Glossary

Coinbase: a well-known cryptocurrency exchange that went public in 2021 and caters to both retail and institutional traders worldwide.

Blockchain Capital: an early crypto venture firm co-founded by Brock Pierce, involved in initial funding of various blockchain startups.

Blockstream: a company dedicated to enhancing Bitcoin technology and moving it forward.

Frequently Asked Questions About Epstein Crypto Involvement

Did Jeffrey Epstein directly own cryptocurrency?

The Epstein files do not indicate that he was a holder or operator of crypto wallets; instead, his involvement came through early venture investments.

Did Coinbase know Epstein was investing?

Emails indicate that Coinbase co-founder Fred Ehrsam was aware of Epstein’s role in the 2014 investment.

Does Blockstream have financial ties to Epstein today?

No. Blockstream CEO Adam Back explained there are no direct or indirect financial ties with Epstein’s estate.

Is there any dirt on Coinbase or Blockstream?

There are no official documents that establish these companies as engaging in illegal behavior; the files primarily document investment history and correspondence.