This article was first published on Deythere.

- DOGE Suffers from Underwhelming January Price Action

- Bull, Base and Bear Cases for DOGE Price

- What’s Driving Dogecoin Now?

- Experts Dogecoin Price Prediction

- Conclusion

- Glossary

- Frequently Asked Questions About Dogecoin Price Prediction

- Why is Dogecoin’s price falling recently?

- What are key levels to watch?

- Can Dogecoin recover soon?

- Is institutional interest helping DOGE?

- References

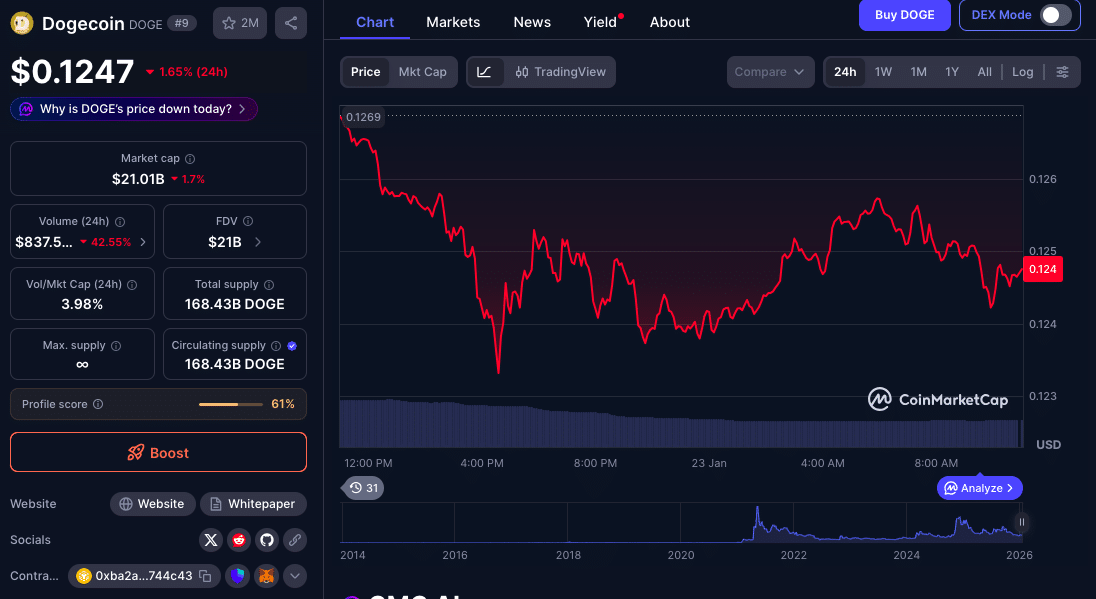

Dogecoin dipped again this January as price action gets pulled down while crypto markets slump and meme coins face aggressive selling. DOGE price has recently experienced another 2% dip as traders took protection off high-beta assets. This has taken the cryptocurrency below key short-term support, putting stress and caution on its trading.

DOGE Suffers from Underwhelming January Price Action

The price of Dogecoin has been slumping since early 2026. DOGE just fell below the $0.125 support on heavy trading volume. Analysts pointed out that this breakdown validates a bearish structure, as the short-term chart is mapping lower highs and lows.

Weakness across crypto markets generally has helped to fuel that pressure. During the sale, the token was briefly traded at $0.12.

Newer data shows a growing volume of trades, suggesting that market participants are still engaging despite its falling prices.

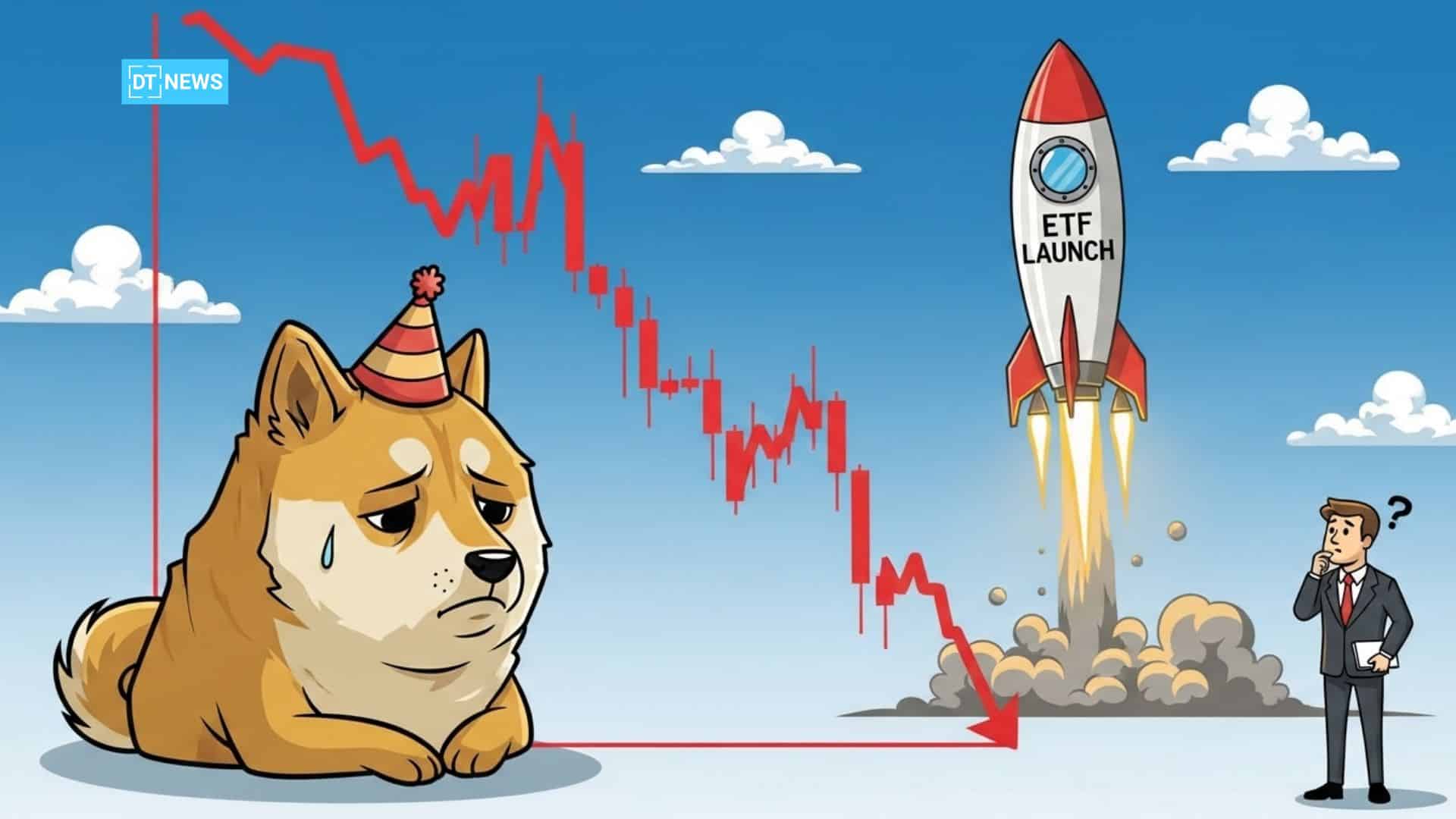

In between these moves, new developments like the US launch of a Dogecoin ETF by 21Shares have brought institutional legitimacy to the asset.

However, the ETF’s debut fell flat in early trading, failing to usher in a strong break in price.

Bull, Base and Bear Cases for DOGE Price

In the bullish case, some technical analysts say that sideways consolidation around current levels may create a base from which further upside can develop. Near-term targets for DOGE is expected to be in the $0.16-$0.175 range by the end of January 2026 if resistance from the $0.13 area gives way.

In the base case, Dogecoin remains choppy between $0.12 and $0.14. On this basis, small countertrend rallies could continue to meet with resistance until a stronger market and support develops. This scenario paints the pattern that has been seen throughout January, where tentative bounces failed to hold above key resistance zones.

In the bearish case, continued selling could push DOGE below the critical $0.12 support level.

Technical reports indicate that mid-sized whale holdings have been falling and exchange reserves remain high, which may end up amplifying downward moves if demand fades.

A drop below $0.12 intensifies the pressure towards lower levels and could carry downside continuation potential.

What’s Driving Dogecoin Now?

Dogecoin price is influenced by two important forces. First is market sentiment. When Bitcoin and big altcoins are under pressure, assets like DOGE tend to experience outsized selling.

According to analysis from mid-January, meme coins, such as DOGE were some of the heaviest hit during the liquidation and risk-off periods.

Second is the internal trading structure. DOGE has continued to struggle to rally and climb above the resistance at $0.126-$0.127, reinforcing a sell-on-rally pattern. Previous attempts to bounce back were short lived, reversing quickly into tight consolidations, pointing to cautious positioning from both short and long term holders.

On the development front, projects like the 21Shares Dogecoin ETF provide institutional context but still have not resulted in continued inflows or price strength.

Experts Dogecoin Price Prediction

| Source | Time Frame | Price Target / Range |

| Blockchain.News | End of Jan 2026 | $0.16 – $0.175 |

| DigitalCoinPrice | Throughout 2026 | Average $0.18 |

| ChangeHero Forecast | 2026 Full Year | $0.12 – $0.16 average |

| CoinLore | Mid- to Late 2026 | Around $0.29 |

| Gemini AI | End of 2026 | Up to $0.70 |

Conclusion

As Dogecoin price is sitting at $0.12-$0.127 in late January 2026, the token is demonstrating a subdued level structure.

Recent breakdowns beneath support and high-volume sell moves indicate general market fear, although the technical outlook leaves three reasonable outcomes: range-bound; a modest rally towards $0.16-$0.175 if resistance is overcome, or a strong collapse if $0.12 fails to hold.

Dogecoin price today is being influenced by liquidity, market sentiment, and trading actions more than a single factor.

Glossary

Support: A level where buying interest is strong enough to prevent the price from falling further.

Resistance: A price level where selling pressure overcomes buying interest, often capping upside moves.

Liquidation: An involuntary closing of a leveraged position when the market is moving against traders, sometimes accelerating price movements.

Frequently Asked Questions About Dogecoin Price Prediction

Why is Dogecoin’s price falling recently?

DOGE has encountered selling pressure due to weakness in the overall market, sell volume and resistance just above key levels that has prevented up moves from being sustained.

What are key levels to watch?

Keep an eye on the resistance at $0.126-$0.127 and support around the $0.12 level for a potential springboard into future moves.

Can Dogecoin recover soon?

On the technical front, if resistance is broken, targets are in the range of $0.16-$0.175, yet consolidation or deeper pullbacks are also realistic.

Is institutional interest helping DOGE?

The debut of a Dogecoin ETF lends credibility but hasn’t led to sustained buying or price strength.