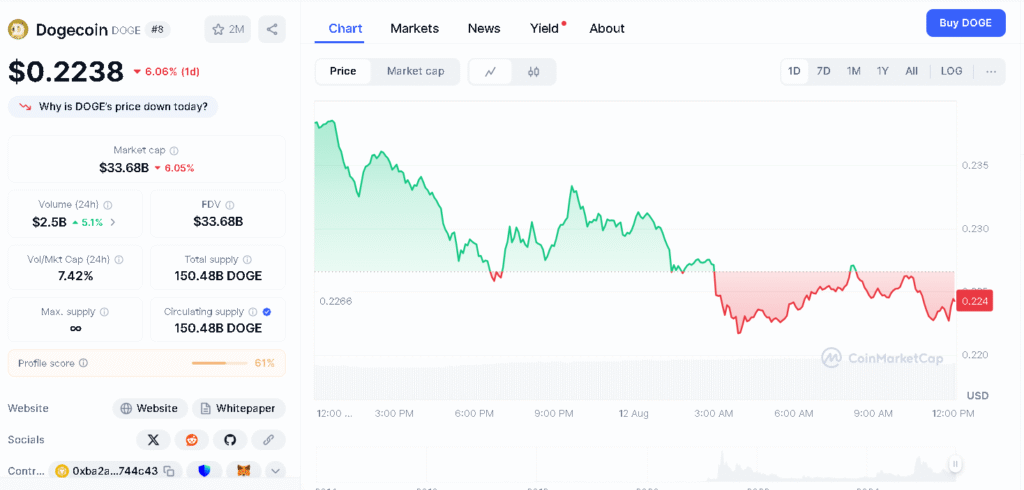

According to sources, the Dogecoin price dropped nearly by 7%, bringing it dangerously close to its key 22-cent support level and sparking fresh worries among both traders and long-term holders.

- Why did Dogecoin price dropped so sharply?

- Where is the strongest support now?

- How are global market conditions adding pressure?

- What is the Dogecoin price prediction?

- Conclusion

- FAQs

- 1. How much did the Dogecoin price drop?

- 2. What triggered the Dogecoin price drop?

- 3. What was the recent resistance level?

- 4. How did global markets impact $DOGE price?

- 5. What price could trigger a $DOGE price rally?

- Glossary

- Sources

$DOGE slid from $0.24 to $0.22, making it one of the bigger drops seen recently. The fall came as the overall crypto market faced heavy selling, with price charts breaking down and global economic troubles adding to the pressure.

Market experts say the drop wasn’t caused by just one reason but by a mix of big profit-taking, large investors avoiding risk, and a negative mood in global markets. Early in the fall, the $0.238 level acted as a strong barrier, and several failed tries to move above it only pushed prices down further.

Why did Dogecoin price dropped so sharply?

The Dogecoin price drop picked up speed after buyers failed to break past the $0.238 mark. Soon after this rejection, the price fell to $0.233, with trading volume jumping 31% above the daily average, showing strong selling pressure.

Analysts at FlitPay said that once the $0.238 level was broken, it triggered a chain reaction as both big investors and regular traders started selling.

This reduced liquidity and sped up the fall until strong buying appeared near $0.226. Even though there was a brief recovery, confidence stayed weak.

Traders were cautious about pushing the price up, knowing that a failed rebound could lead to further selling. Since there hasn’t been strong and steady buying, the price is still stuck near the lower end of its range.

Where is the strongest support now?

Charts show that $DOGE’s first strong support is around $0.226, where a lot of buying has stepped in, along with an intraday floor between $0.2247 and $0.2253.

Most of the selling was held back in these price zones, stopping $DOGE from dropping further. Still, the $0.22 level remains an important point, both for how traders think and for what the charts are showing.

If $DOGE falls firmly below $0.22, it could drop much faster since there wouldn’t be many strong support levels to slow it down.

A Binance market analyst said that losing this level might trigger stop-loss orders from short-term traders, which could cause a quick slide. For now, holding above $0.22 is the market’s best hope for a short-term recovery.

| Aspect | Details |

| Price Movement | Nearly 7% drop from ~$0.24 to ~$0.22 |

| Critical Support Level | $0.22 |

| Immediate Support Zone | $0.2247 |

| Resistance Level | $0.238 |

| Volume Activity | 31% above daily average |

| Potential Downside | $0.20 or $0.18 |

| Price Prediction Range | $0.223 to $0.266 |

| Bullish Extreme Scenario | $1.58 |

| Bearish Scenario | $0.14 |

How are global market conditions adding pressure?

The Dogecoin price drop also reflects how unstable the overall market has become. Rules for crypto are still unclear in big markets, and tensions between the U.S. and China are adding pressure.

Because of this, big investors are avoiding risky assets, causing money to move out of cryptocurrencies like $DOGE. According to CoinCodex data, some of the biggest Dogecoin holders have been cashing out, likely because the market is too unpredictable.

On top of that, worries about inflation and changes in central bank policies have made investors in regular markets uneasy, which has also hurt demand for risky assets like crypto.

What is the Dogecoin price prediction?

Experts have different views on the Dogecoin price prediction, depending on market conditions and timeframes. CoinStats suggests $DOGE may stay between $0.22 and $0.2397 for now, but if it rises past $0.2455, it could aim for around $0.2668.

Meanwhile, Changelly estimates that in August 2025, $DOGE might trade between $0.223 and $0.266, averaging close to $0.245. FlitPay’s outlook for 2025 is more expansive, suggesting a possible high of $1.58 under bullish conditions, although it warns that bearish market sentiment could send prices as low as $0.14.

Benzinga gives a more cautious outlook, expecting the 2025 average to be around $0.341, with a possible peak near $0.731 if adoption grows and influencer interest stays strong.

CoinCodex thinks $DOGE could slowly rise to about $0.256 by August 2025 if things keep going the same way. Binance, on the other hand, expects it to stay almost flat, between $0.233 and $0.234, meaning little to no big price changes in the short term.

Conclusion

Based on the latest research, the Dogecoin price drop to around 22 cents has put $DOGE at a key turning point. Most Dogecoin price prediction reports suggest the price may stay stable for now, with a chance to rise if it breaks important resistance levels.

Global economic troubles and new rules could hold back any rise in price, making $0.22 the key level to watch for what happens next.

Summary

Dogecoin price dropped to $0.22 following a loss of earlier strength. This level is seen as key by traders, as staying above it may support a bounce back, while falling below could cause bigger losses.

Global economic worries and unclear crypto rules are also adding pressure. For now, most Dogecoin price prediction outlooks suggest it may stay between $0.22 and $0.2397, with a chance to rise if it can break past resistance levels.

Track every crypto price and real-time $DOGE like price prediction updates only on our platform

FAQs

1. How much did the Dogecoin price drop?

It fell nearly 7%, from $0.24 to $0.22.

2. What triggered the Dogecoin price drop?

Failed breakout above $0.238 and heavy selling pressure triggered the fall.

3. What was the recent resistance level?

The $0.238 mark acted as strong resistance before the fall.

4. How did global markets impact $DOGE price?

Negative global sentiment and economic headwinds added pressure and caused Dogecoin price drop.

5. What price could trigger a $DOGE price rally?

Breaking above $0.2455 could lead to a move toward $0.2668

Glossary

Stop-Loss Order – A preset order to sell an asset when it reaches a specific price.

Intraday Floor – The lowest price reached within a single trading day.

Chart Breakdown – A price drop caused by technical support failing.

Profit-Taking – Selling assets to lock in gains after a price rise.

Support Level – A price zone where buying interest prevents further decline.