The arrival of the first Dogecoin ETF has ignited a storm of discussion in financial and crypto circles. Market watchers are split on whether this development signals true adoption or simply packages speculation in a regulated shell.

- A Meme Coin Wrapped in Wall Street’s Finest Clothes

- First-Day Trading Volumes Show Serious Interest

- Does an ETF Make Dogecoin More Legitimate?

- The Meme Economy and Social Media Influence

- Regulatory Winds Are Shifting

- Price Action and Market Outlook

- Lessons for Crypto Enthusiasts and Developers

- Conclusion: A Turning Point in Speculative Finance

- Glossary

- Frequently Asked Questions

For blockchain developers, and seasoned investors, this event represents more than a quirky milestone. It forces a deeper look into how cryptocurrencies, including those born as memes, evolve within traditional finance.

A Meme Coin Wrapped in Wall Street’s Finest Clothes

Dogecoin began in 2013 as a lighthearted internet joke. With an unlimited supply and no clear utility beyond community-driven enthusiasm, few expected it to earn a place on regulated exchanges. Yet, the new Dogecoin ETF has transformed this once-dismissed coin into an asset tracked by institutional products.

The ETF structure approved under the Investment Company Act of 1940 avoids the complexity of the Securities Act of 1933, which usually governs single-asset securities. This legal detail matters. It allows the Dogecoin ETF to trade under a diversified framework, even though its essence remains tied to one digital asset.

First-Day Trading Volumes Show Serious Interest

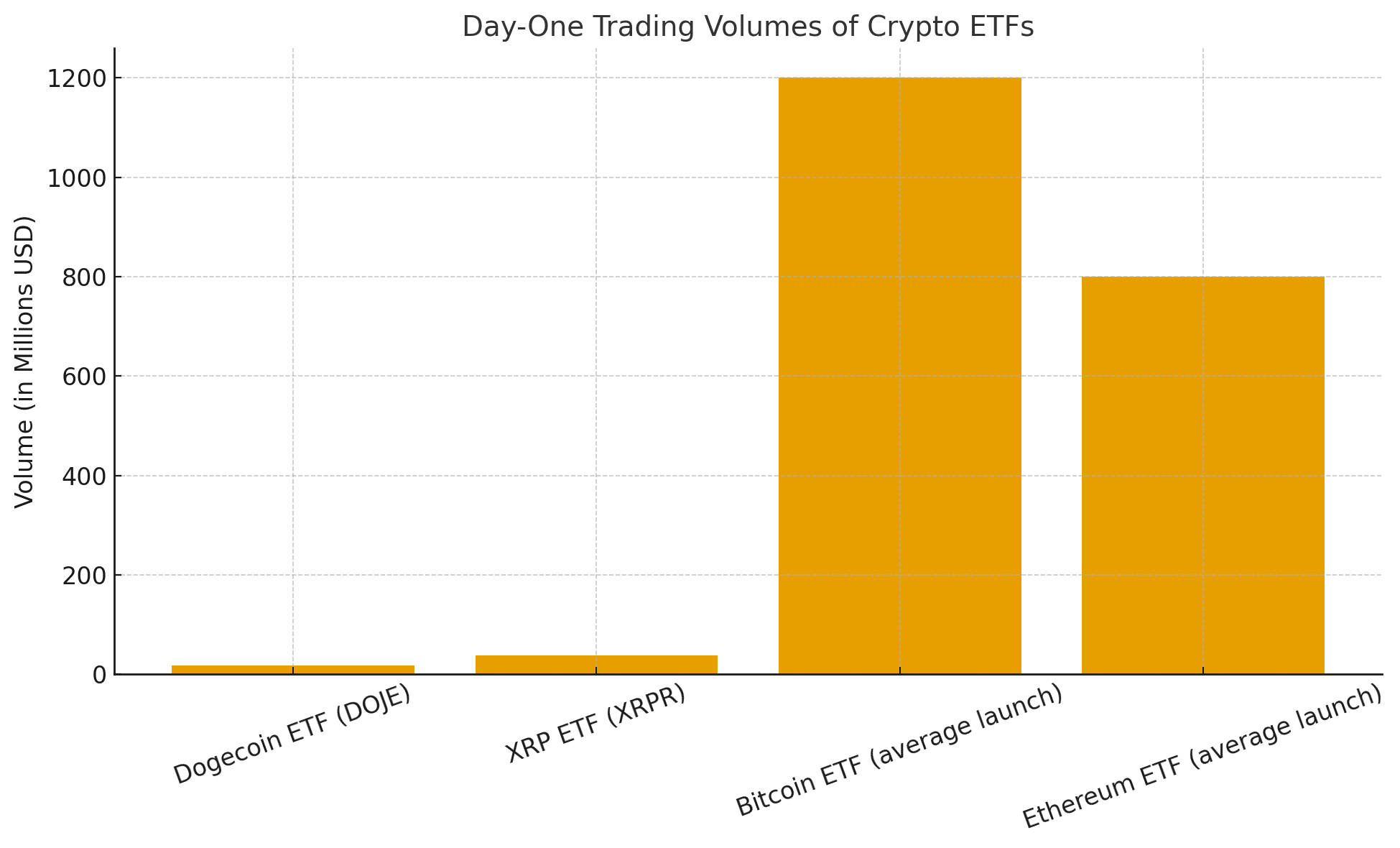

When the Dogecoin ETF launched, it recorded approximately $17 million in day-one volume. Analysts had predicted far lower interest. The event revealed a curious trend: investors who once avoided holding crypto directly appear more comfortable using regulated financial wrappers.

According to blockchain market data compiled, Dogecoin itself trades billions of dollars daily. While the ETF’s slice looks small in comparison, its regulated format opens the door for retirement funds, asset managers, and institutions that require strict custody rules.

Does an ETF Make Dogecoin More Legitimate?

Supporters argue that the Dogecoin ETF provides legitimacy. By subjecting the meme coin to SEC oversight, custodial standards, and reporting requirements, it now sits beside Bitcoin and Ethereum ETFs. This brings potential exposure to investors who have never downloaded a digital wallet.

Critics see it differently. They argue that wrapping Dogecoin in an ETF does not change its fundamentals. Its uncapped supply, lack of advanced smart contract features, and speculative nature remain. For skeptics, the ETF only institutionalizes risk while encouraging retail investors to overlook volatility.

The Meme Economy and Social Media Influence

Dogecoin’s price has long been linked to social media trends. Communities on X and Reddit amplify rallies, often turning jokes into market-moving events. Analysts note that the same hype culture has migrated to discussions around the Dogecoin ETF. Some social traders even compare Dogecoin’s potential price trajectory to Solana, pointing out how Solana’s social-driven hype and developer activity fueled its breakout.

A blockchain strategist quoted in Investopedia observed, “The Dogecoin ETF is not just about financial engineering. It’s about translating internet culture into regulated products that Wall Street cannot ignore.”

Regulatory Winds Are Shifting

The Dogecoin ETF is not an isolated case. The SEC has already approved multiple crypto ETFs, including those tied to XRP and Bitcoin. By approving Dogecoin under the 1940 Act, regulators signaled a willingness to expand access beyond top-tier assets.

However, risks remain. Future scrutiny could target meme-based ETFs if regulators perceive them as misleading to retail investors. FATF guidelines and MiCA regulations in Europe also highlight the importance of preventing risky products from overwhelming financial systems.

Price Action and Market Outlook

Since the ETF announcement, Dogecoin’s price has shown steady momentum, moving from around $0.26 to near $0.28. Technical analysts argue that the ETF could provide a long-term anchor for institutional interest. Bullish scenarios suggest $1 remains achievable if inflows persist.

Yet, price volatility cannot be ignored. Memecoins often swing by double digits in days. For students of finance, the Dogecoin ETF illustrates the intersection of speculative assets and regulatory endorsement, showing both opportunity and risk.

Lessons for Crypto Enthusiasts and Developers

For blockchain developers, the Dogecoin ETF highlights how utility is not the sole driver of institutional adoption. Community strength, cultural impact, and liquidity matter just as much. For crypto enthusiasts, it demonstrates how meme culture can influence even the most traditional corners of finance.

Analysts warn that while ETFs make crypto more accessible, they do not protect against losses. Investors should still consider tokenomics, custody risks, and the broader regulatory climate before embracing these products.

Conclusion: A Turning Point in Speculative Finance

The Dogecoin ETF is more than a financial product. It is a cultural signal that meme-driven assets can gain a seat in traditional finance. Whether it leads to sustainable adoption or inflates speculative bubbles will depend on how institutions, regulators, and communities navigate this new era.

For now, the Dogecoin ETF stands as both a triumph of innovation and a cautionary tale. It legitimizes a meme but also magnifies the questions of value, risk, and trust in the digital economy.

Glossary

Dogecoin ETF: An exchange-traded fund tracking Dogecoin, offering regulated exposure without direct ownership.

Investment Company Act of 1940: U.S. law governing pooled investment funds, including ETFs.

Tokenomics: Economic design of a cryptocurrency, including supply limits, rewards, and inflation rates.

Volatility: The degree of variation in price, especially frequent in cryptocurrencies.

Custodian: A regulated entity that securely holds assets on behalf of investors.

Memecoin: A cryptocurrency created for fun or satire, often driven by community culture and hype.

Frequently Asked Questions

1. What is the Dogecoin ETF?

It is an exchange-traded fund offering exposure to Dogecoin through regulated financial markets.

2. Why is the Dogecoin ETF significant?

It represents the first time a meme coin has entered U.S. ETF markets, signaling greater institutional adoption.

3. Does the ETF make Dogecoin safer?

The ETF adds regulatory oversight but does not remove volatility or risks tied to Dogecoin’s tokenomics.

4. How did the ETF perform on launch?

It traded around $17 million in volume on day one, far exceeding initial expectations.

5. How could the ETF affect Dogecoin’s price?

Analysts suggest it may support long-term demand, but price swings remain likely due to Dogecoin’s speculative nature.

6. Should investors buy the Dogecoin ETF?

This article does not provide financial advice. Investors should conduct their own research before making decisions.