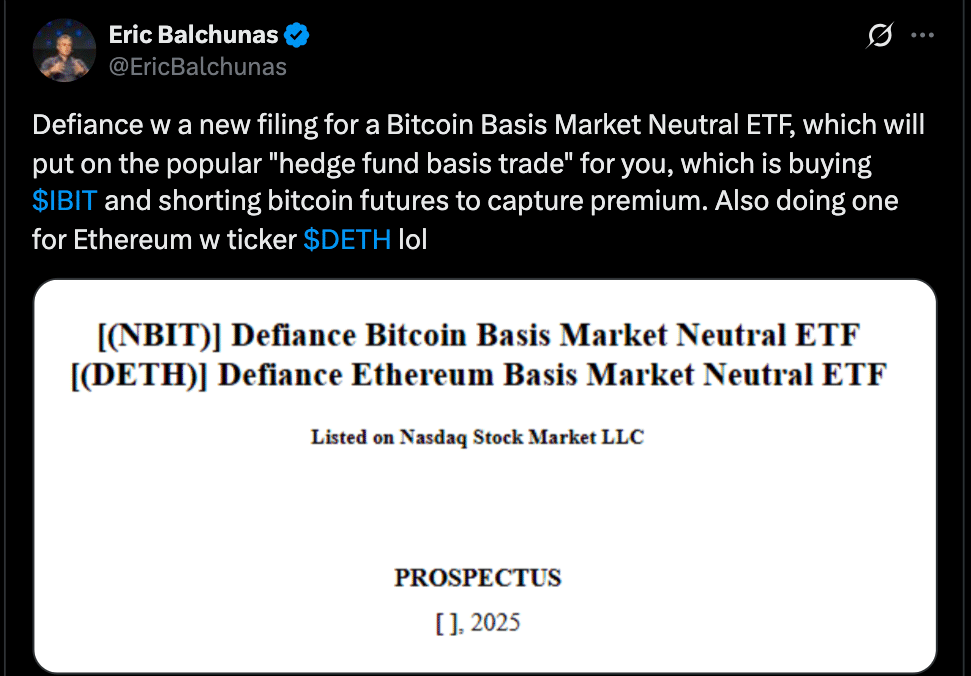

According to latest reports, Defiance ETFs just filed for two new market-neutral funds, NBIT (Bitcoin Basis Market Neutral ETF) and DETH (Ethereum Basis Market Neutral ETF), which combine long positions in spot ETFs with short positions in futures contracts.

These Defiance ETF filings show growing institutional demand for yield in crypto markets, especially through basis trades. Eric Balchunas and James Seyffart have outlined the strategy, performance and risks, and new data shows basis trade returns for Ethereum averaging 10% under stable conditions, while Bitcoin has recently delivered 11% annualized yields.

What are the New Defiance Funds

Defiance ETFs filed for two funds, one for Bitcoin (NBIT) and one for Ethereum (DETH). The strategy is market-neutral. The funds will take long exposure to spot Bitcoin or Ethereum ETFs (e.g. IBIT for Bitcoin, ETHA for Ethereum) and simultaneously hold a short futures position, with the expectation that futures premiums will converge to spot over time.

The registration statements show the funds will invest in ETFs or ETPs for the spot leg, derivatives (futures or swaps) for the short leg and hold collateral in cash and cash equivalents. Each fund will be managed to rebalance daily to maintain neutrality in directional exposure.

Also read: New SEC Rule Lets Crypto ETFs Redeem in Bitcoin and Ether, Not Cash

Performance History for Basis Trade Strategies

Analysts have been tracking Bitcoin and Ethereum basis trades since 2025. For Ethereum, gross annualized returns have been around 10% during stable market conditions. For Bitcoin, the performance has recently been up to 11% annualized, especially during more volatile periods when futures premiums widen.

But there have been times of negative or near-zero returns, especially during market stress, like December 2024 to mid-March 2025.

Additional basis trade support comes from reports like VanEck’s mid-August 2025 market commentary which notes CME basis funding rates surged to 9% in some cases, meaning derivatives markets are pricing in premiums.

Risks and Considerations

While the funds look good, there are some structural risks and implementation details to consider. The funds are new and have no long-term track record. Futures contracts have roll risk (costs when futures approach expiration) and during periods of high volatility, convergence between futures and spot can be interrupted and result in negative returns.

Liquidity in derivatives markets, counterparty risk, and regulatory risk, especially around derivatives trading, are real. The daily rebalancing can also generate trading costs. The prospectus states these funds have not been approved by the SEC or CFTC yet, which is normal but worth noting.

Also read: SEC Eyes 72 Crypto ETFs—A New Era for Digital Asset Investing?

Conclusion

Based on the latest research, the recent Defiance ETF filings for basis trade ETFs show a maturing crypto market where institutional players are looking beyond price speculation to yield and arbitrage opportunities.

However, these are early-stage products that come with risk, and they rely on derivatives markets behaving as expected. NBIT and DETH success will depend on regulatory approval, cost efficiency and ability to manage futures premiums and roll costs without drag.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Defiance ETF Filings cover two funds, NBIT and DETH, for Bitcoin and Ethereum. Data through 2025 shows 10% average returns for Ethereum basis trades in stable periods and up to 11% for Bitcoin during volatile times. Risks include futures roll cost, derivatives liquidity and regulatory oversight.

Glossary

Basis trade ETF – An ETF that seeks returns by exploiting the difference (premium) between spot and future prices, typically going long spot and short futures.

Spot ETF / ETP – An exchange-traded fund or product that holds the actual asset rather than derivatives.

Futures Contract – An agreement to buy or sell an asset at a predetermined future date and price.

Roll Cost / Roll Risk – Expense and risk incurred when a futures contract is replaced (rolled) as it nears expiry.

Market-Neutral Strategy – An investment approach designed to offset or minimize directional market risk.

FAQs about Defiance ETF Filings

What are NBIT and DETH?

Defiance ETFs: NBIT for Bitcoin basis trade; DETH for Ethereum basis trade.

Where do returns come from in a basis trade ETF?

Returns come from the premium futures contracts command over spot price, assuming convergence to expiry, minus costs like roll, trading and collateral.

Have the Defiance ETf filings been approved?

No. Filed (Form N-1A for both) September 16, 2025. Still pending SEC approval and possibly CFTC oversight.

Are these risk-free?

No. Risks include volatility, futures behaving badly, funding/collateral constraints, regulatory scrutiny, trading friction and market liquidity.