This article was first published on Deythere.

Decentralized stablecoins are at the core of the growing decentralized finance (DeFi) ecosystem, but they still face several unresolved issues that affect their long-term reliability. These assets make it possible to move funds, place deposits, and use collateral across different protocols.

- What Are Decentralized Stablecoins?

- Why Is the USD Peg a Limitation for Decentralized Stablecoins?

- How Do Oracles Affect Decentralized Stablecoin Security?

- Why Do Staking Yields Compete With Stablecoin Design?

- What Does This Mean for DeFi Protocols?

- Conclusion

- Glossary

- Frequently Asked Questions About Decentralized Stablecoins

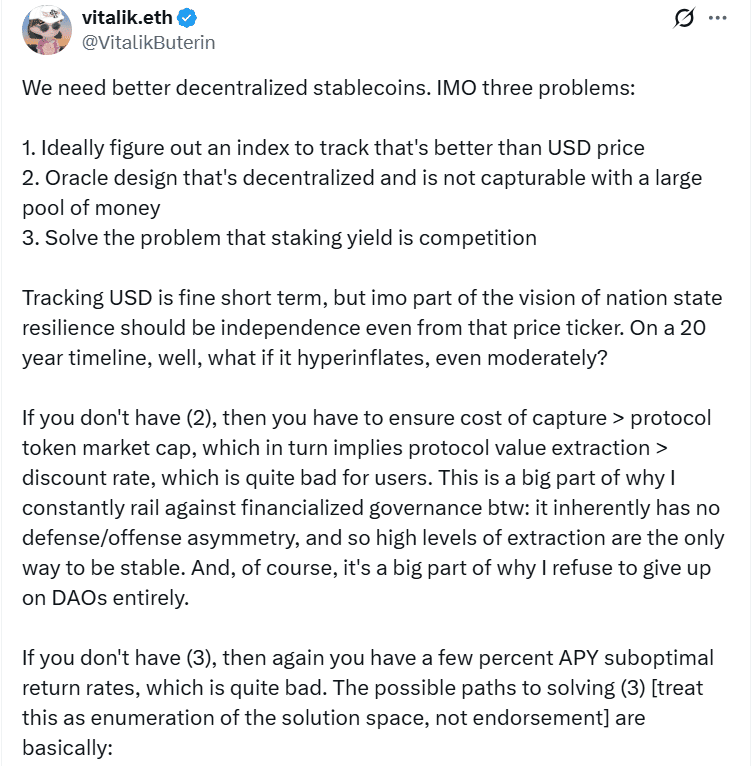

However, heavy dependence on a single currency benchmark, along with weaknesses in oracle systems and competition from staking yields, creates bigger structural risks. Vitalik Buterin’s analysis points to a clear need for decentralized stablecoins that focus more on durability, independence, and strong governance, rather than short-term ease of use.

What Are Decentralized Stablecoins?

Decentralized stablecoins are digital assets designed to keep a stable value without depending on a central authority. Unlike traditional stablecoins that are backed by fiat reserves held and managed by a company, decentralized stablecoins run through on-chain smart contracts and governance systems.

They play an important role in DeFi by being used as collateral, supporting transfers between protocols, and helping maintain liquidity across the ecosystem. Buterin has stressed that although USD-pegged tokens like MakerDAO’s DAI, which aims to stay at $1, can offer stability in the short term, true long-term resilience depends on moving beyond a single reference point.

In an X post, he noted that relying only on the U.S. dollar may not be enough to handle long-term currency changes or inflation, and he argued for stablecoin designs that can remain reliable over many decades.

Why Is the USD Peg a Limitation for Decentralized Stablecoins?

Buterin’s first concern centers on how stability itself is defined. Most decentralized stablecoins are tightly linked to the U.S. dollar. This makes them easy to use and understand in the short term, but it also leaves protocols exposed to long-term currency risks.

To reduce this dependence, Buterin suggested looking at broader price indexes or combined currency baskets, such as the IMF’s Special Drawing Rights or Consumer Price Index-style measures. Bringing these alternatives onchain is not simple, as it raises challenges around governance and accurate measurement, showing the need for strong and reliable systems to update benchmarks over time.

How Do Oracles Affect Decentralized Stablecoin Security?

Oracles provide decentralized protocols with external data, including price feeds and indexes. Buterin warned that the safety of decentralized stablecoins depends heavily on how these oracles are designed. If a powerful and well-funded actor is able to influence an oracle, the system can face problems such as incorrect minting, forced liquidations, or even insolvency.

MakerDAO’s median-based oracle structure, which relies on approved data sources and quorum requirements, shows how complex it is to keep data feeds both decentralized and secure. Maintaining strong oracle integrity is critical because, without it, protocols may be pushed to extract high value from users simply to protect stability, a dynamic Buterin links to financialized governance.

Why Do Staking Yields Compete With Stablecoin Design?

Ethereum’s staking yield creates another important challenge for decentralized stablecoins. When staking returns are high, they compete directly with stablecoin incentives and draw capital away from stablecoin-based systems. This makes it harder for protocols to maintain adoption without offering weaker or less efficient returns on collateral.

In an X post, Buterin discussed several possible ways to manage this tension, including lowering staking yields to hobbyist levels of roughly 0.2% or introducing new staking categories with reduced slashing risk. He also pointed to the difficulty of making slashable staking work smoothly alongside collateral use in stablecoin systems. Each option involves trade-offs, and none offers a simple solution, making careful incentive design critical for long-term stability.

What Does This Mean for DeFi Protocols?

Buterin’s insights have important implications for DeFi protocol designers and investors. Projects need to decide what defines stability beyond the U.S. dollar, how oracle data is protected and governed, and whether collateral and liquidation systems can function during extreme market conditions.

Incentives also need to be managed carefully so they are not distorted by competing yields or short-term subsidies. If these issues are not addressed, systemic risk can build up, allowing oracle manipulation or sudden sell-offs to spread instability across multiple protocols.

Conclusion

Decentralized stablecoins are at a crucial stage in their development. Buterin’s analysis shows that long-term stability depends on several closely connected factors. These include setting meaningful benchmarks beyond the U.S. dollar, protecting decentralized oracles from capture, and aligning incentives with staking yields.

In the near term, progress is likely to focus on stronger benchmarks, clear approaches for handling oracle failures, and designs that favor resilience over constant incentives. While USD-pegged tokens remain useful in practice, the next generation of decentralized stablecoins must be able to withstand currency shocks, market volatility, and changing incentives, creating a durable and trustless foundation for DeFi.

Glossary

USD Peg: A system that keeps a stablecoin equal to one U.S. dollar.

Oracle: A tool that brings real-world price data to blockchain systems.

Staking Yield: The return earned for locking crypto to support a network.

Decentralized Stablecoins: Stable-value tokens managed by code instead of a company.

Decentralized Finance: Blockchain services for trading and lending without banks.

Frequently Asked Questions About Decentralized Stablecoins

What warning did Vitalik Buterin give?

Vitalik Buterin warned that decentralized stablecoins still have major risks that could affect their long-term stability.

Why is using the U.S. dollar a problem?

Using only the U.S. dollar can expose stablecoins to long-term currency and inflation risks.

What did Buterin suggest instead of a dollar peg?

He suggested using broader price indexes or currency baskets instead of only the U.S. dollar.

How do staking yields affect stablecoins?

High staking yields can pull users away from stablecoins by offering better returns elsewhere.

What do decentralized stablecoins need to improve?

They need stronger benchmarks, secure oracles, and better incentive design for long-term stability.