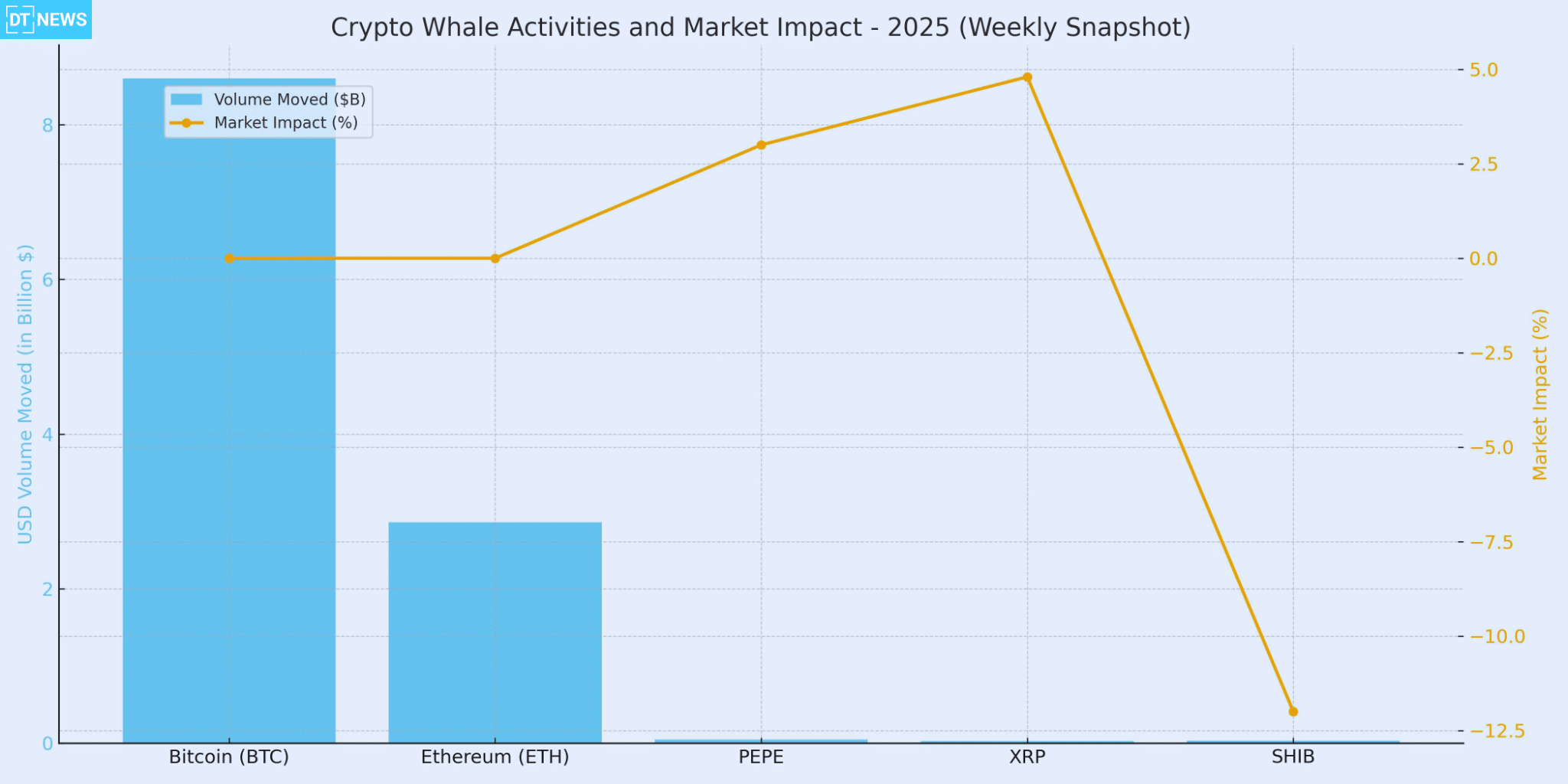

This week saw big whale action across Bitcoin, Ethereum, and top alts. Crypto whales have been repositioning and the market is responding. Bitcoin broke near $112K just recently as whales were actively moving their positions. Markets saw big Bitcoin holders upgrading their wallets for security, Ethereum whales were also buying and selling huge ETH stacks and altcoin giants like XRP and SHIB experienced big swings as whales piled in or dumped tokens.

Bitcoin Whale Moves

On-chain data showed Bitcoin wallets with 1,000+ BTC buying more as BTC was near $109K. CoinDesk reports large holders are “in accumulation mode” while smaller investors are selling. As BTC approached $112K, sources revealed that whales were buying more.

A dormant Satoshi-era whale moved 80,000 BTC ($8.6B) from old addresses to new SegWit addresses this week. Arkham and Ledger’s CTO confirmed this was a security upgrade, not a sale. The move followed “legal notice” OP_RETURN messages sent to the old wallets, likely prompting a precautionary move.

Another crypto whale moved 6,000 BTC ($647.8M) to a new bc1q (SegWit) address. This large transfer from 1J3B2 to a bc1q wallet caught the community’s attention. It looks like a security-driven move as there’s no sign of the whale selling any BTC.

A whale from 2019 moved 17,283 BTC ($1.88B) and 9,000 ETH ($977M) in 24 hours. The 17,283 BTC alone was worth $1.52B at the time.

The source transaction was traced to addresses receiving coins from Xapo Bank in 2019. Such a reactivation after 4-6 years indicates large holders are again positioning themselves.

Overall, Bitcoin whales have been net accumulators this week. Many large transactions weren’t sales but internal moves or security upgrades. This behavior, combined with crypto whales buying at current prices, has kept Bitcoin near all-time highs.

Ethereum Whale Moves

Ethereum whales have been active, with buying and selling happening simultaneously. A whale reportedly deposited 120,918 ETH ($317M) into exchanges. This crypto whale had unstaked 155,837 ETH ($408M) earlier and had sent $317M to exchanges.

At the same time, other whales were accumulating. Sharplink Gaming (an ETH-centric firm) added 5,072 ETH to their stash, bringing their total to 210,700 ETH ($584.5M). Abraxas Capital withdrew 29,741 ETH ($81M) from Binance/Kraken over this period. Another whale (0x35fa) took 32,566 ETH ($89.3M) off Kraken. Those are accumulation signals.

One whale (0xd8d0) however sold 30,003 stETH ($81.4M) in early July after buying 132,536 ETH ($333M) earlier and still holds 70,004 ETH ($194M). Another whale bought 9,188 ETH ($25M) at $2,721/ETH.

Despite big sell-offs, Ethereum was up 4-5% this week as whale buying offset the selling. ETH whales are rebalancing but staying long.

Altcoin/ Meme Whale Moves

XRP whales have been piling in: XRP went up 4.8% to $2.44 just recently as whale interest surged. On-chain data shows wallets holding over 1 million XRP hit a 7-week high and Santiment reports steady accumulation by large holders. Whales are betting on XRP to go up, reducing volatility as supply tightens.

Meanwhile, Shiba Inu (SHIB) saw whale-led selling. SHIB reportedly dropped 12% after major token holders moved trillions of SHIB to exchanges. The sell-off was reportedly due to “whales losing confidence” and halted SHIB’s rally.

The meme coin PEPE, had a different story: Sources reported that whales increased their PEPE holdings by 1.75% (to 303 trillion tokens) while exchange supply fell 2.9%. PEPE reportedly went up 3% during this accumulation. Lower supply on exchanges and higher whale holdings are bullish demand signals.

Top Crypto Whale Activities this week

| Asset | Whale Action | Volume Moved | Impact on Market |

| Bitcoin (BTC) | Wallet from 2010 moved coins after 14 years | 80,000 BTC ($4.8B) | Sparked security speculation, no sell-off noted |

| Separate whale transferred assets for upgrade | 6,000 BTC ($360M) | No signs of liquidation | |

| Dormant wallet reactivated | 14,000 BTC ($840M) | Analysts see strategic repositioning | |

| Ethereum (ETH) | Whale moved diversified assets | 17,283 BTC + 9,000 ETH | Large-scale reallocation, not sent to exchanges |

| Pepe (PEPE) | Accumulation by multiple wallets | Undisclosed | Helped PEPE surge 3% despite market tension |

| XRP | Whale activity pushing token towards $2.50 | Estimated multi-million USD | Added to XRP’s weekly climb |

| Shiba Inu (SHIB) | Trillions of tokens sold by whales | Estimated $35M+ | Caused 12% price decline |

Market Impact and Analysis

Crypto whale activity has generally been supportive of the market. As big holders buy BTC and ETH, they withdraw from exchanges, creating upward pressure. Sources note whales buying at all-time highs means a bullish outlook. Whale accumulation on Bitcoin explains why it almost hit $112. Ethereum’s strength is largely due to institutional buying and staking withdrawals.

But whale selling can cause sharp dips. SHIB crash shows how concentrated holdings amplify moves: thousands of trillions of SHIB hitting exchanges caused a double-digit drop. Ethereum also saw volatility: big deposits (120k ETH) sent early sell signals. When whales dump to exchanges, markets tremble as other traders expect a drop.

This week’s crypto whale action has both fueled and tested the rally.

Conclusion

Bitcoin whales transferred 80,000 BTC to SegWit addresses for security and continued buying near all-time highs. Ethereum whales were selling and buying aggressively. Big whales also triggered large transfers in XRP, SHIB and PEPE that moved those markets. In short, whale trades caused the week’s volatility but mostly fueled the rally.

Most of these big moves weren’t panic sells but planned re-allocations for wallet upgrades, portfolio rebalances. This means whales are positioning for the long-term rather than cashing out. For traders and investors, Always Do Your own research.

Summary

Crypto whales made headlines with multi-billion-dollar moves. Bitcoin whales moved 80,000 BTC ($8.6B) to secure addresses and 6,000 BTC to new wallets, while other dormant whales reactivated 14,000–17,000 BTC (worth $1.5B–$1.9B). On Ethereum, whales stacked and sold ETH. Altcoin whales made big moves too; XRP whales hit a 7-week accumulation high while Shiba Inu whales sold trillions of tokens, causing a 12% drop.

FAQs

What is a crypto whale?

A crypto whale is an individual or entity holding a very large amount of a cryptocurrency.

How do whales affect crypto prices?

Crypto Whales can cause big volatility. When a whale sells a big position, it can push prices down due to increased supply. When whales accumulate or hold coins, they reduce supply and can drive prices up.

Why are whales moving coins to new addresses?

Sometimes whales move funds within their own wallets for security or efficiency. For example, a recent whale moved 80,000 BTC from older addresses to SegWit (bc1q) addresses. Analysts confirmed this was a security upgrade, not a sale.

Do whale moves always mean a market move?

Not always. Sometimes whales just shift assets (like wallet upgrades) without selling, so the price impact is minimal. Other times whales trade big, which can move markets.

Glossary

SegWit Address: A newer Bitcoin address format (starting with “bc1q”) that enables more efficient transactions. Whales are moving coins to SegWit addresses for security.

stETH: Tokenized form of ETH earned from staking (e.g. on Lido). Treated like ETH in transfers.

Liquidate: Sell. When whales send tokens to exchanges, they may liquidate (sell) them.

On-Chain Analytics: Analysis of blockchain transaction data. Firms like Arkham and Glassnode provide on-chain insights on whale moves.

OP_RETURN Message: Data attached to a blockchain transaction. E.g., “legal notice” messages sent to dormant wallets, prompting security moves.

Exchange Supply: Amount of a coin held on exchanges. Whale accumulation reduces this, which affects price.