Many big holders moved large amounts of main tokens this week as crypto whale activity was on the high side. On-chain trackers like Whale Alert flagged many big transactions. Notably, Ethereum whales net bought 818,000 ETH ($2.5 billion) on June 15, the largest single day accumulation since 2018.

- Bitcoin Whale Activity

- Ethereum Whale Activity

- Stablecoin, Memes and Institutional Flows

- Summary of Major Whale Transfers

- Analyzing this Week’s Crypto Whale Moves

- Conclusion

- FAQ

- What is a crypto “whale”?

- Why do whale transactions matter?

- Did these crypto whale moves affect crypto prices?

- What do stablecoin mints/burns mean?

- Glossary

Multiple 6 and 7 figure transactions occurred across Bitcoin, Ethereum, stablecoins and altcoins. These big transfers from dormant wallets and institutional addresses, can be a sign of changing market sentiment.

Bitcoin Whale Activity

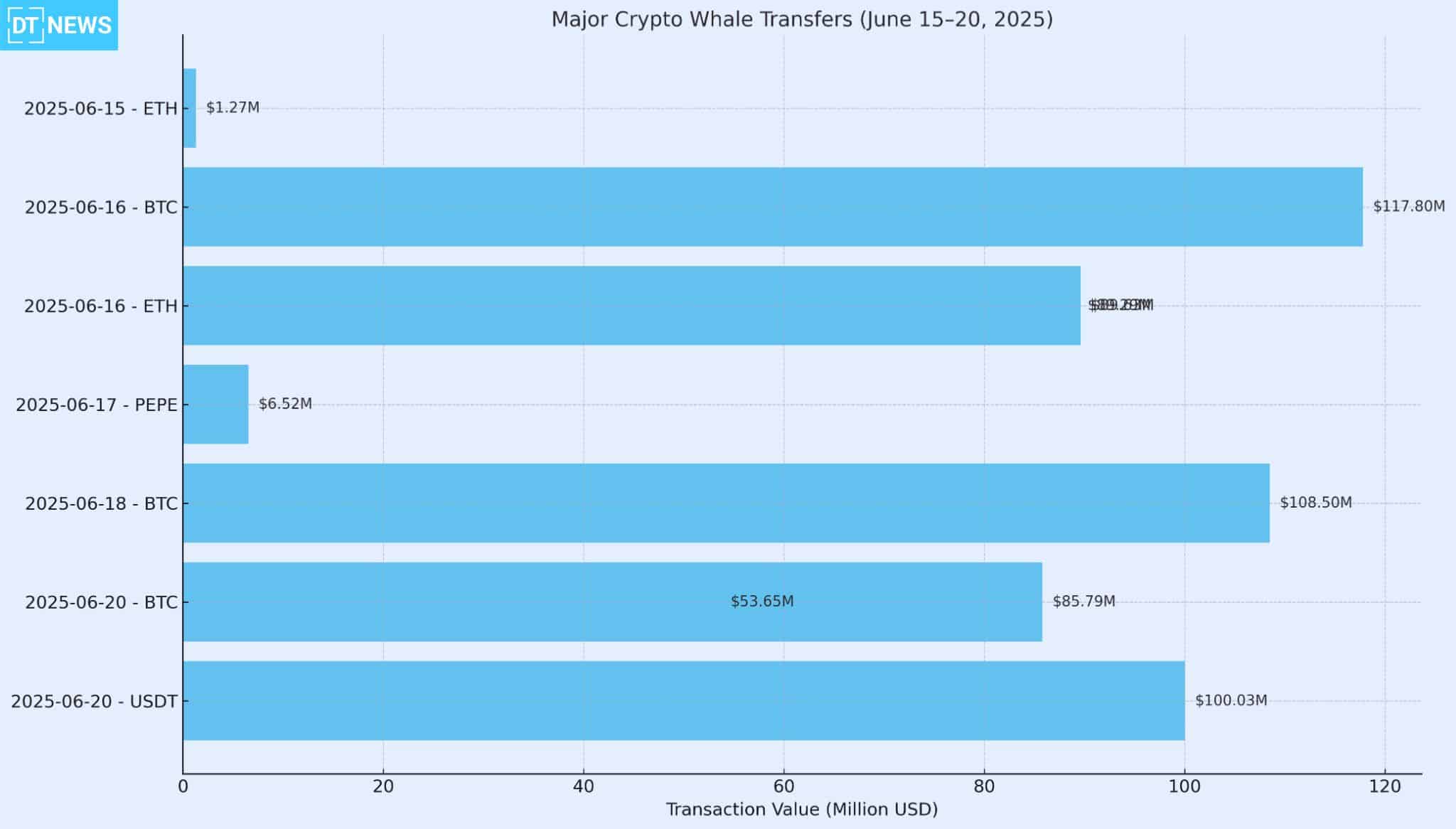

Several big Bitcoin transfers were recorded this week. A very notable crypto whale transaction happened on June 16. Whale Alert reported 1,111 BTC ($117.8 M) moved between anonymous wallets which was later reported to be part of Metaplanet’s accumulation. Moving forward to June 18, 1,028 BTC ($108.5 M) was also transferred between unknown addresses.

By June 20, Coinbase’s and Kraken’s wallets were involved: 815 BTC ($85.8 M) from an unknown source to Kraken and 514 BTC ($53.65 M) from Kraken to an external wallet. According market experts and analysts, these moves, some between major exchange addresses (Kraken, Coinbase), are institutional rebalancing.

Ethereum Whale Activity

Ethereum also saw big whale transactions. On June 16, two huge transactions totaling 68,000 ETH occurred in hours: 34,108 ETH ($89.63 M) from an unknown address to Binance and 34,000 ETH ($89.29 M) from a CeFi-identified address (“Ceffu”) to another wallet.

Additionally, reports also showed that a dormant genesis wallet (0xcF264) that had held 2,000 ETH since Ethereum’s launch reactivated on June 15 and moved 500 ETH ($1.27 M) to a new address. This “sleeping” wallet still reportedly has 1,500 ETH. Activity from legacy addresses often sparks market chatter even though the whale still holds most of their tokens.

Stablecoin, Memes and Institutional Flows

Stablecoin whale transfers were also big. On June 20, 100,000,000 USDT ($100.03 M) was also reportedly moved from an unknown Ethereum wallet into Binance. Large stablecoin inflows to exchanges can precede selling pressure. Base on reports, the USD Coin (USDC) treasury minted about 69.8 million USDC ($69.78 M) on Ethereum and burned a nearly equal amount on Solana, cross-chain capital flows.

Meme coins also saw crypto whale activity. On June 17, a single wallet “qianbaidu.eth” reportedly moved 595.2 billion PEPE tokens ($6.52 M) into Binance. The whale had bought PEPE earlier at lower prices and made 32% on this position. The whale still held 104.4 billion PEPE ($1.15 M) in another wallet. Large meme token deposits to exchanges often cause volatility.

Summary of Major Whale Transfers

The table below summarizes the key whale transactions from June 15–20, 2025:

| Date (UTC) | Crypto | Quantity | USD Value | From | To |

| 2025-06-15 23:50 UTC | ETH | 500 ETH | $1,270,000 | 0xcF264 (genesis wallet) | 0x2C12 (new wallet) |

| 2025-06-16 08:11 UTC | BTC | 1,111 BTC | $117,797,259 | Unknown (anon) | Unknown (anon) |

| 2025-06-16 08:09 UTC | ETH | 34,108 ETH | $89,630,066 | Unknown (anon) | Binance (exchange) |

| 2025-06-16 07:27 UTC | ETH | 34,000 ETH | $89,289,910 | “Ceffu” (CeFi label) | Unknown (anon) |

| 2025-06-17 07:27 UTC | PEPE | 595.2 billion PEPE | $6,520,000 | qianbaidu.eth | Binance (exchange) |

| 2025-06-18 05:02 UTC | BTC | 1,028 BTC | $108,498,473 | Unknown (anon) | Unknown (anon) |

| 2025-06-20 14:27 UTC | BTC | 815 BTC | $85,786,470 | Unknown (anon) | Kraken (exchange) |

| 2025-06-20 15:08 UTC | BTC | 514 BTC | $53,651,358 | Kraken (exchange) | Unknown (anon) |

| 2025-06-20 13:49 UTC | USDT | 100,000,000 USDT | $100,034,950 | Unknown (anon) | Binance (exchange) |

Analyzing this Week’s Crypto Whale Moves

Exchange Flows: Many transactions involve centralized exchanges (e.g., Binance, Kraken, Coinbase). Large inflows to exchanges (BTC 815 from unknown to Kraken, USDT 100M to Binance) often indicate potential selling or liquidity provisioning. Conversely, large outflows from exchanges (Kraken 514 BTC out) may signal strategic reserve moves or preparation for OTC sales.

Dormant Whales: The awakening of the decade-old ETH genesis address (500 ETH moved) is notable. Such moves by long-inactive crypto whales can influence sentiment even if most funds remain untouched.

Meme and Altcoin Whales: While ETH and BTC are dominated by value, meme coin whales remain active. The 595B PEPE transfer on June 17 shows meme coin volatility driven by single holders.

Stablecoin Protocols: USDC minting/burning by the treasury (on Ethereum and Solana) reflects cross-chain stablecoin management and can transiently affect liquidity. Whale Alert logs (e.g. 69.8M USDC minted) signal supply adjustments.

Conclusion

This just-concluded week was a big one for crypto whale transactions. Many big on-chain moves, most involving exchanges or known whale addresses, mean capital is rotating. Ethereum whales bought a record amount on June 15 and institutional-like trades (Metaplanet’s 1,111 BTC) on June 16. Stablecoin flows and meme coin deposits also showed the market is active.

Not all whale moves mean immediate market impact; some moves (e.g. dormant wallet transfers) mean portfolio rebalancing. Overall it was a big week for crypto whale trading and as a result, traders and analysts watch are advised to watch closely.

FAQ

What is a crypto “whale”?

Crypto whales are individuals or entities that hold large amounts of crypto. Their trades (millions in value) can move the market. Whales are exchanges, institutions or early adopters.

Why do whale transactions matter?

Big transfers mean strategic moves, selling large positions, moving funds between exchanges or making institutional investments. Big inflows of BTC/ETH to exchanges could be bearish, big purchases or withdrawals could be bullish or mean long term holding.

Did these crypto whale moves affect crypto prices?

The impact varies. For example, the Metaplanet BTC transfer coincided with Bitcoin going above $106k, signifying that it is institutional demand. But some crypto whale moves (e.g. dormant addresses waking up) may not move the market immediately.

What do stablecoin mints/burns mean?

Big mints or burns of stablecoins (USDT, USDC) means the issuers are adjusting supply based on demand.

Glossary

Whale: A crypto holder with a huge amount of tokens. Whale moves can move the market.

Wallet Address: A public identifier on a blockchain. Whales often watch or tag large wallet addresses (e.g. exchange deposit addresses).

Exchange Wallet: Addresses belonging to cryptocurrency exchanges (e.g. Binance, Coinbase, Kraken). Big transfers usually go through these.

Stablecoin: A crypto pegged to a stable asset (often USD). Examples: USDT, USDC. Whale moves in stablecoins can mean shifting between crypto and fiat stability.

Mint/Burn (Stablecoin): To mint is to create new tokens, increase supply; to burn is to destroy tokens, decrease supply. Companies like Circle (USDC) burn/mint based on customer demand.

Genesis Wallet: Original wallets from a blockchain’s launch (e.g. Ethereum’s first pre-mine addresses). Activity from these old wallets is rare and noteworthy.

On-Chain Analytics: Tools and services that read blockchain data (transactions, addresses). Whale Alert, Glassnode, Arkham are used for whale tracking.