This article was first published on Deythere.

- Difference Between Bitcoin and Metals Performance

- AI Infrastructure Appetite and Metals Outperformance

- Precious Metals as Safe Havens in Market Rotation

- Tendencies for Capital Allocation and Institutional Behavior

- Conclusion

- Glossary

- Frequently Asked Questions About Crypto vs Metals AI Demand

- Why are investors moving from crypto to metals?

- How has Silver done relative to Bitcoin?

- What is the role of AI demand in metals markets?

- Is Bitcoin still a hedge asset?

- References

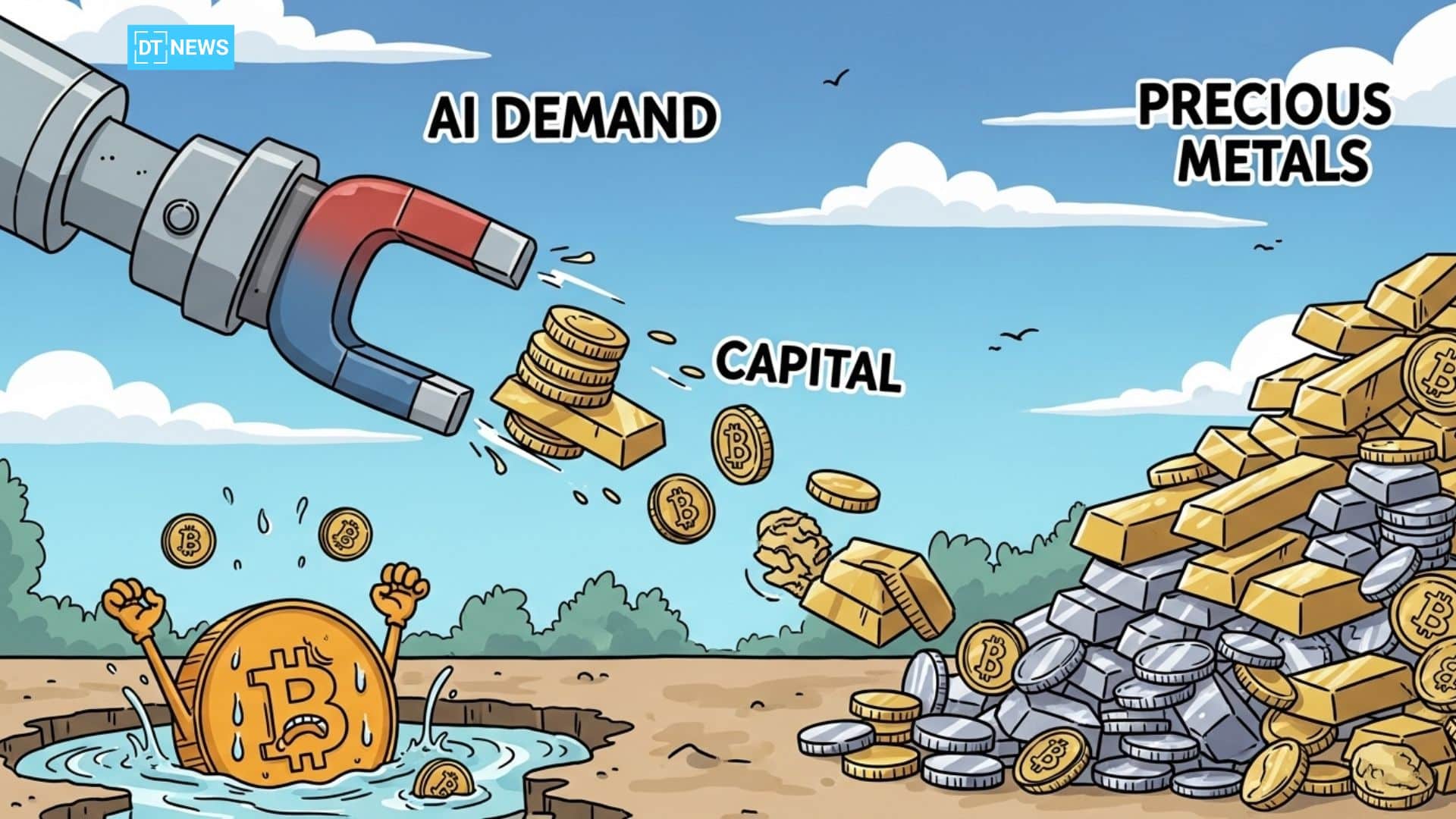

A very striking curve seems to be playing out currently in the market: capital seems to be moving from cryptocurrencies like Bitcoin and into old metals such as silver, gold, and even copper.

This ongoing move from crypto to metals is telling of a change in investor behavior brought about by AI demand, macroeconomic conditions and the changing role of digital and physical assets.

Just as Bitcoin once rode waves of liquidity and dollar weakness to new highs, metals, especially those linked to industrial demand, are outperforming in ways that many analysts deemed impossible.

Difference Between Bitcoin and Metals Performance

In 2025, rare divergence between Bitcoin and major metals persisted in capital markets.

According to recent analysis, silver prices surged approximately 270% over a 13-month period, while Bitcoin declined about 11% over the same time frame.

Gold also beat Bitcoin in performance and the BTC/Gold ratio fell to multiyear lows. This was an indication of huge capital rotation out of risky digital assets into metals that serve as hedges or industrial inputs.

The U.S. dollar which has been weak as a result of the Federal Reserve’s rate cuts and liquidity injections since 2025, would have been positive for risk assets like Bitcoin. But this time around, capital showed that it preferred metals and this indicated that investors may still be willing to direct funds into commoditized real assets that both benefit from the macroeconomic environment and support strategic industrial roles.

AI Infrastructure Appetite and Metals Outperformance

Analysts say the AI boom is among the primary forces behind the change. In 2025, global spending on artificial intelligence, particularly data centers, exceeded $270 billion, as a result of surging demand for computational power and infrastructure.

This growth needs a stunning amount of industrial metals, most notably copper, which is needed for electrical distribution, networking, and cooling in data centers.

AI-related copper demand could exceed 127% by 2040, reaching around 2.5 million tonnes, bearing the size of future demand needs, according to reports.

The demand for such infrastructure is what supports copper as an essential commodity for technological expansion and investors interested in gaining exposure to the real economy over the long-term.

AI-driven demand is also particularly benefiting silver. Silver, which is traditionally a byproduct of other metals, is needed in electronics and the hardware used in data centers because it conducts electricity very efficiently.

Supply constraints and increased demand have helped propel strong price increases as industrial usage outpaces the ability of miners to respond with output.

Precious Metals as Safe Havens in Market Rotation

Gold’s performance from 2025 to early 2026 also shows more of that move into crypto vs metals.

In several markets, gold is soaring sharply, showing both safe-haven demand in terms of macro uncertainty, coupled with investor preference for tangible alternatives. Even central banks joined in the move to accumulate more gold.

Unlike Bitcoin whose price can still be very volatile in response to liquidity and public sentiment, gold’s appeal strengthened with geopolitical tension and fiscal uncertainty.

Tendencies for Capital Allocation and Institutional Behavior

The move away from Bitcoin and into metals is evident inflows, from institutional investors and ETFs. New products like the Bitwise Proficio Currency Debasement ETF hold a large portion of gold and other metals as well as Bitcoin and palladium, showing investor appetite for assets that are resistant to inflation and tangible.

These funds are a result of wider questions about diversification strategies given the geopolitical noise and fears of currency debasement.

These institutions also now see metals as linked to AI and electrification.

Chinese investors, for example, have pulled capital from AI-chip creators and pushed it into metal and utility firms that will help the infrastructure of artificial intelligence.

Conclusion

The crypto vs metals rotation that’s happening in 2025–26 exposes a reallocation of capital into assets that are either base layer to the AI economy or reliable edges in complex macro environments.

Where Bitcoin’s digital reputation was once a magnet for institutional and retail enthusiasm, it has consistently underperformed metals, including silver, gold, and copper, which now benefit from both safe-haven values, as well as real industrial need.

Glossary

Bitcoin (BTC): the cryptocurrency with the largest market capitalization, widely considered a digital store of value or speculative vehicle.

Gold: a precious metal that has been previously known as an ornamental piece of adornment, but is also now an investment asset used for hedging against inflation and geopolitical risk.

Silver: both a precious and industrial metal used in a wide range of electronics, solar technology and AI hardware, with its price moved by industrial demand as well as investment flows.

Copper: a foundational industrial metal essential to electrical infrastructure and data center hardware, the demand for which has surged with AI and electrification trends.

AI infrastructure demand: the way in which computational and physical resources such as data centers as well as other hardware, are increasingly required for their operation due to the expansion of AI technologies

Frequently Asked Questions About Crypto vs Metals AI Demand

Why are investors moving from crypto to metals?

The allocation of capital to metals such as silver and gold from investors is caused by strong industrial demand coupled with safe-haven demand And this activity outperforms the moves seen in Bitcoin during past cycles.

How has Silver done relative to Bitcoin?

Over a roughly 13-month period through early 2026, silver surged by about 270% while Bitcoin declined roughly 11%, a notable divergence in investor preference.

What is the role of AI demand in metals markets?

AI infrastructure, especially data centers, sharply raises demand for metals such as copper and silver, used in electrical and electronic components, which has led to volatile prices capturing the attention of investors with long-term vision.

Is Bitcoin still a hedge asset?

While Bitcoin is still considered a top-tier digital property, the volatility can also make it less effective as a hedge than similar exposure to metals like gold, which have well-established roles as safe-havens.