As September 2025 winds down, crypto markets are under pressure. Bitcoin is testing multi-month support near $112,000, Ethereum is weakening below $4,300; and Dogecoin is battling resistance around $0.24-$0.25. “Red September” is once again circulating among traders, referencing the historical trend of losses in September.

Technical indicators, including RSI, ADX, and Exponential Moving Averages, signal eroding momentum; while prediction models and expert forecasts offer a range of possible outcomes.

Current Technicals and Key Support Levels for Each Coin

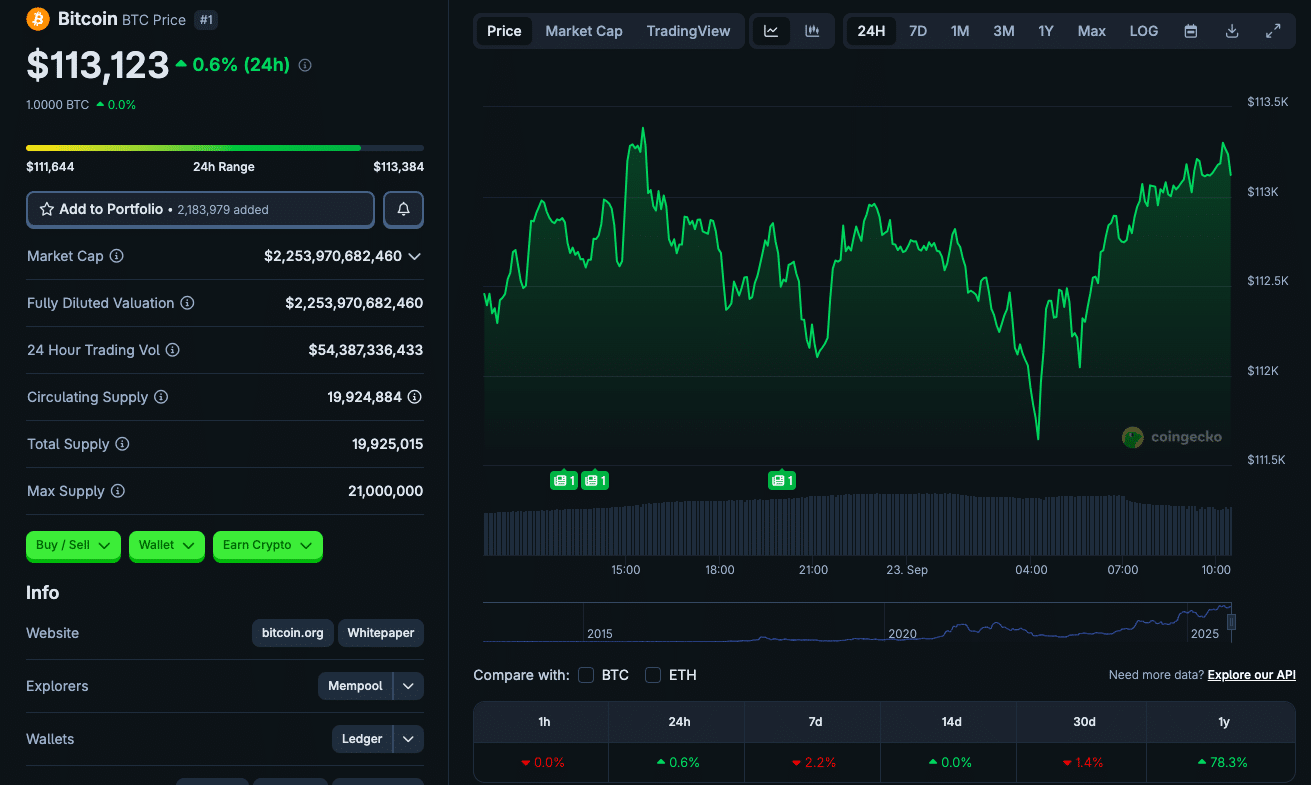

For Bitcoin; support has clustered around $112,000-$113,000. Prices recently dipped below $113,000, with intraday lows near $111,986. Resistance looms between $115,000 and $118,000; a zone Bitcoin must reclaim to avoid further downside pressure.

The Relative Strength Index (RSI) is 44; showing weakening momentum; the Average Directional Index (ADX) is 17, indicating trend strength is low. The 50-day EMA remains above the 200-day EMA; which retains a longer term bullish structure, but short-term price action is trading below EMA50. The Squeeze Momentum Indicator shows low volatility, suggesting indecision.

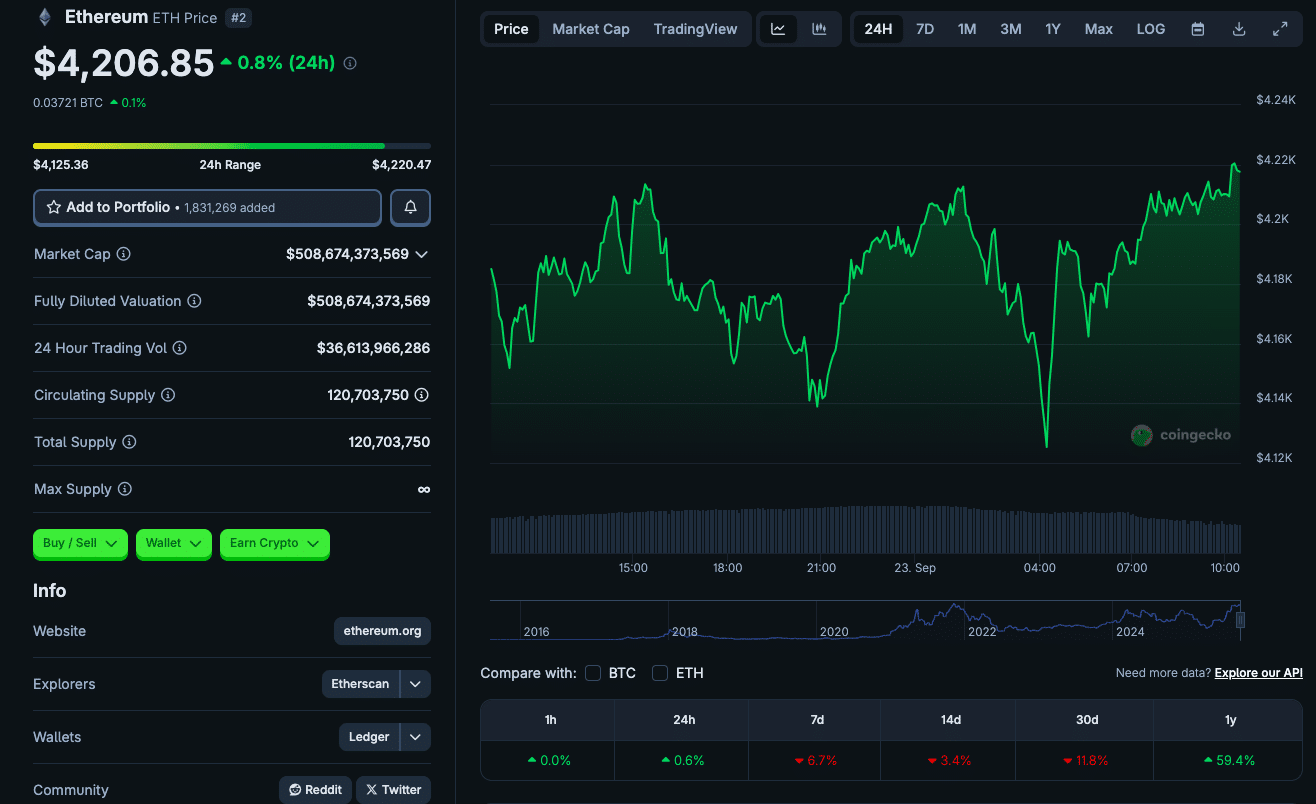

For Ethereum ; recent technicals show prices near $4,200-$4,300. Key resistance is around $4,600–$4,700, and support lies near $4,180–$4,200. If $ETH can hold that support; analysts believe it has room to move back toward resistance. A failure to hold it could drag $ETH lower.

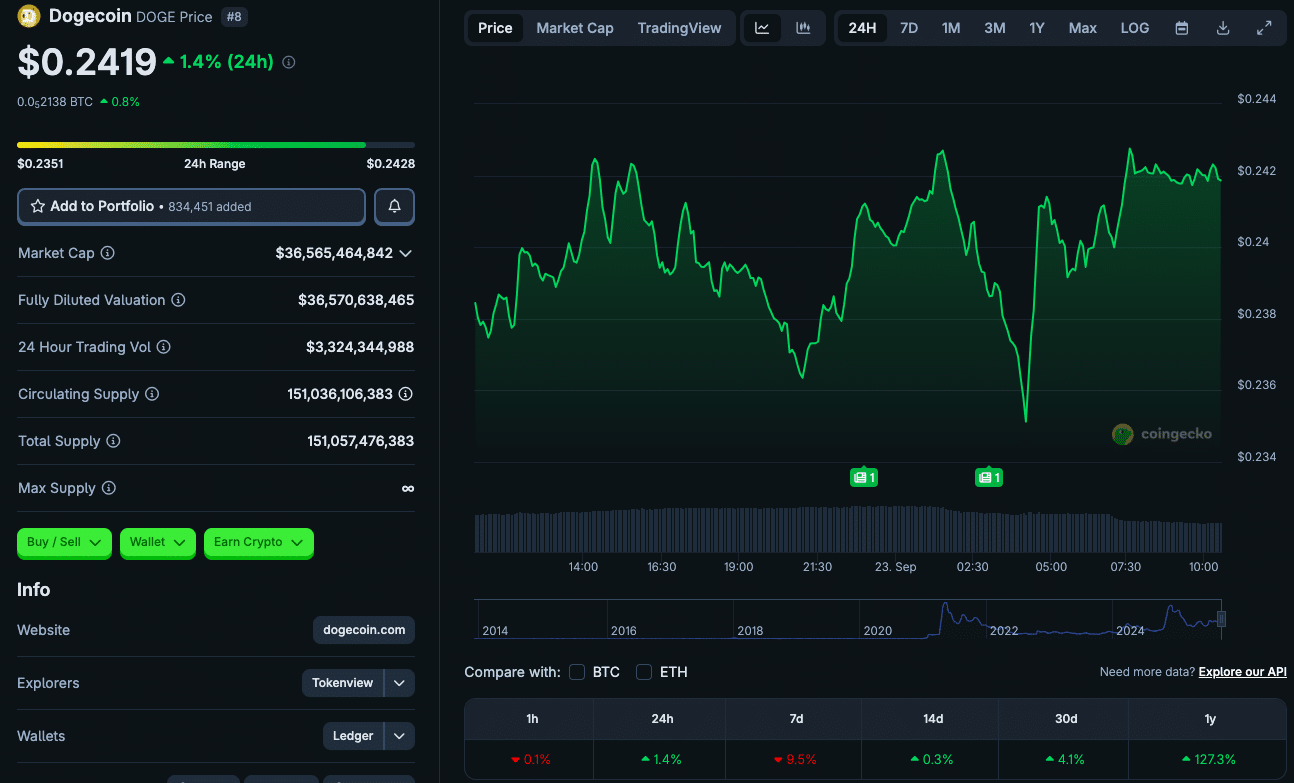

For Dogecoin; resistance is near $0.2455; with support zones around $0.23-$0.24. Breaking above resistance could open targets toward $0.30-$0.35; while a fall below support might expose levels closer to $0.22.

Also read: Crypto Market Catalysts September 2025: What Traders Need to Watch

Expert Predictions for Bitcoin, Ethereum and Dogecoin

| Coin | Expert / Source | Forecast / Predicted Range or Target | Time Frame and Conditions |

| Bitcoin | 99Bitcoins | Targets near $118,000 to $123,000 if resistance is reclaimed | By end of September 2025; depends on holding current support zones. |

| Bitcoin | Changelly | $126,391 average, with highs near $124,717 and lows near $115,773 | Expect this range through October 2025, assuming resistance holds. |

| Ethereum | Coindcx | Forecasts around $4,600-$4,700 if resistance is cleared; otherwise stuck in consolidation near $4,200 | Short term through early October 2025. |

| Ethereum | TokenMetrics | Longer-term possibility of $5,000-$10,000 over this cycle if conditions improve materially | Depends on institutional inflows, regulatory clarity. |

| Dogecoin | AInvest | If $DOGE breaks above $0.2455, targets in the $0.30-$0.35 range; otherwise fallback support at $0.23 | In September 2025; volatility and resistance behavior are key. |

| Dogecoin | Changelly | October could see $0.258-$0.300 | Next month, presuming resistance zones are breached. |

Bull, Base, and Bear Cases for Each Coin

Here are possible outcomes under varying market conditions for Bitcoin,;Ethereum, and Dogecoin

For Bitcoin In the Bull Case, Bitcoin reclaims between $115,000-$118,000. Macro signals and institutional flows push to $123,000 or higher.

In the Base Case, Bitcoin hovers between $110,000 and $118,000. Resistance is hard to break but support holds for now. Choppy sideways with occasional up tests.

In the Bear Case, $BTC goes below below $112,000 and retest deeper support, possibly $108,500 or lower. Resistance zones reject, market turns negative, risk of more downside.

For Ethereum, In the Bull Case, $ETH holds at $4,200, clears $4,600-$4,700. Rally to $5,000+ if institutional interest picks up, DeFi usage increases, network fees grow.

In the Base Case; $ETH stays between $4,200 and $4,700. Occasional up breaks to resistance, occasional down tests to support.

In the Bear Case; if $ETH fails at $4,200 support, possibly down to $4,000 or lower. Resistance is strong, sentiment breaks lower.

For Dogecoin, In the Bull Case, $DOGE goes above resistance at $0.2455, into $0.30-$0.35 range due to Meme coin interest, DOJE ETF, speculative flows.

In the Base Case; $DOGE stays between $0.23 and $0.28. Resistance holds, support is roughly stable. Moderate volume, no major move.

In the Bear Case; Resistance is too strong, $DOGE goes below $0.23 support. Broader market weakness (especially in speculative assets) drags $DOGE down, possibly to $0.20.

Also read: September Crypto Rally 2025 Could Flip Fear Into Opportunity

Market Sentiment, Macro Factors and Catalysts

Across all three coins, several common factors will decide if Red September scenario plays out or not. Federal Reserve policy and interest rate guidance is key. Markets are reacting to rate cuts or hints of future easing. Liquidity flows such as crypto ETF inflows, institutional treasury allocations, retail investment, can amplify any move.

Sentiment indices (Fear & Greed) are neutral to slightly fearful. High leverage in derivatives, large liquidations, or weak macro data can trigger downside.

On the other hand, continued adoption in payments, DeFi, staking, and stablecoins can support or boost $ETH and $DOGE.

Conclusion

Crypto support levels are getting squeezed as Red September threat looms. Bitcoin, Ethereum, and Dogecoin are all near critical zones. Expert predictions range from bullish near-term upside if resistance is reclaimed, base case for range-bound movement, bear case if supports fail.

Given current technicals and macro sentiment, base case seems most likely for many traders, but upside is possible especially for $ETH and $DOGE if catalysts emerge.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

Crypto Market Red September threat is looming. Bitcoin needs to reclaim resistance at $115,000-$118,000 to avoid deeper losses. Ethereum is at $4,200 support with resistance at $4,600-$4,700; Dogecoin resistance is $0.2455 with support at $0.23.

Glossary

Relative Strength Index (RSI) – indicator showing momentum; values below 50 means sellers are in control.

Average Directional Index (ADX) – measures trend strength; values below 20 means weak or no trend.

Exponential Moving Average (EMA) – moving average that gives more weight to recent prices.

Support / Resistance – price zones where buying (support); or selling (resistance) pressure accumulates.

ETF (Exchange-Traded Fund) – regulated fund; that allows exposure to an asset without owning it directly

Frequently Asked Questions About Crypto Market Red September

Will Bitcoin, Ethereum, and Dogecoin end September in the red?

Bitcoin is close to that unless support holds; Ethereum and Dogecoin are more volatile; and could suffer more if sentiment worsens.

What levels are most important for each coin to avoid downside?

Bitcoin must hold above $112,000; Ethereum around $4,180-$4,200; Dogecoin above $0.23.

How high could these coins go in a bullish scenario?

$BTC could go to $123,000+; $ETH to $5,000+; $DOGE to $0.30-$0.35 in near term.

What could trigger the bear case?

Support failure; macro tightening (rates; regulation); large liquidations, sentiment shift.