The crypto market is off to a wild start this week. A combination of easing trade tensions, political theatrics and growing inflation optimism has led to a crypto rally, pushing Bitcoin to the brink of $110,000 and Dogecoin up 6%, outspacing top tokens. But the biggest headline of the week came from Elon Musk whose new political party; the America Party, has officially endorsed Bitcoin and got a public rebuke from Donald Trump.

- Bitcoin Rises as Tariff Delay Eases Pressure From Global Markets

- Dogecoin Leads Large-Cap Gainers With 6% Gain

- Elon Musk’s “America Party” Endorses Bitcoin: “Fiat Is Hopeless”

- Metaplanet’s Massive Bitcoin Purchase Adds to the Rally

- Trump Escalates Trade War Against BRICS Nations

- Conclusion: Can the Crypto Rally Last Through July?

- FAQs

- Why did Bitcoin surge towards $110K today?

- What made Dogecoin go up 6%?

- What did Elon say about Bitcoin?

- How much Bitcoin does Metaplanet own now?

- Will inflation data affect the crypto rally?

- Glossary

Bitcoin Rises as Tariff Delay Eases Pressure From Global Markets

Bitcoin’s rise today wasn’t just speculative. The catalyst came from clarity around Trump’s tariffs, which will now take effect on August 1 instead of July 9. This three-week window gives global trade partners more time to negotiate and ease fears of economic disruption.

At the time of this publication, Bitcoin was trading at $108,851, according to CoinMarketcap, up 0.56% in 24 hours. The crypto rally was further boosted by hopes that U.S. CPI data later this week will show a softening inflation trend and, therefore, earlier Fed rate cuts.

Markets are reacting positively to both the macro flexibility from the tariff timeline and renewed political interest in digital assets. The combination is helping to fuel the rally.

Dogecoin Leads Large-Cap Gainers With 6% Gain

While Bitcoin was the main headline, Dogecoin (DOGE) stole the show among large-cap coins rising over 6% in 24 hours. This makes it top among majors like Solana (+3%), XRP (+2.7%) and ADA (+2.3%).

Analysts attribute Dogecoin’s rise to two things: speculative flows reentering meme coins and the growing social buzz around Elon Musk’s public political moves especially his endorsement of Bitcoin. Although DOGE wasn’t mentioned in Musk’s tweets, his name always brings it into the spotlight. The crypto rally around DOGE again shows how sentiment trumps fundamentals in the short term.

Elon Musk’s “America Party” Endorses Bitcoin: “Fiat Is Hopeless”

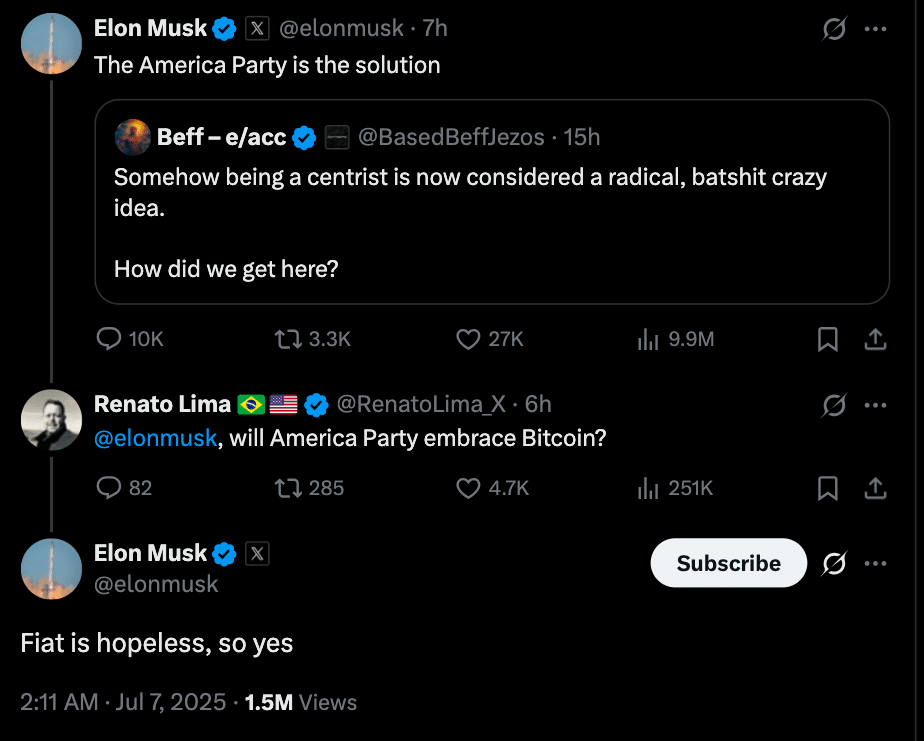

To add to the market excitement, Elon Musk officially confirmed via X that his new America Party will support Bitcoin. When a user asked if BTC would be part of the party he replied,

“Fiat is hopeless, so yes.”

The tweet went viral and is now one of the top crypto related tweets of the day and also escalated the public feud between Musk and Trump.

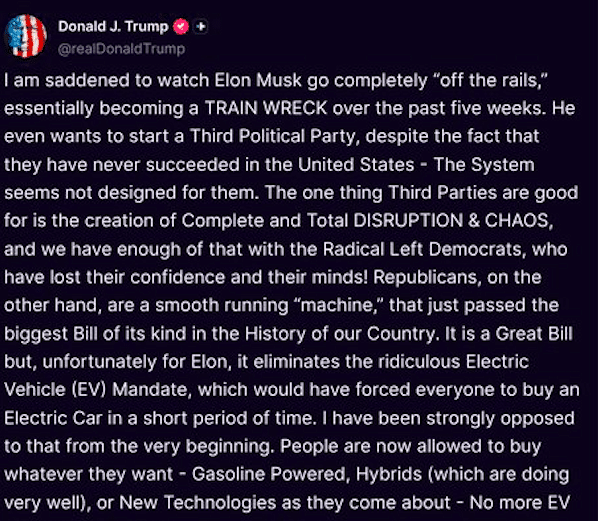

Over the weekend, Trump reportedly went after Musk for his recent criticism of the “Big Beautiful Bill” which Trump signed last week. On Truth Social Trump called Musk a “train wreck” who has “gone off the rails” and mocked his plans to start a third party. The political drama added fuel to the crypto rally, giving traders another reason to get back in.

Metaplanet’s Massive Bitcoin Purchase Adds to the Rally

Another boost to sentiment came from Metaplanet, a Japan based tech firm that announced they bought an additional 2,205 Bitcoin worth $240.8 million. That brings their total to 15,555 BTC or $1.68 billion. Metaplanet is now one of the largest corporate holders of Bitcoin, ahead of Tesla and Coinbase and just behind MicroStrategy and Block.

They have publicly stated their goal to hold 210,000 BTC by 2027 which would be 1% of the total Bitcoin supply. These institutional purchases are the quiet backbone of the crypto rally as they provide structural support to the rising prices.

Trump Escalates Trade War Against BRICS Nations

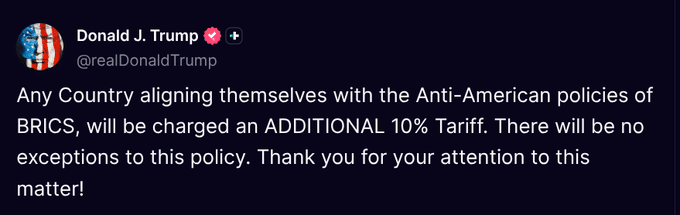

Meanwhile, reports have shared that Trump also announced a 10% tariff on countries he claims are “supporting BRICS,” saying they are “anti-American”. The timing of this was coincidental with the BRICS summit in Brazil where new members like Indonesia, Egypt, Ethiopia, Iran, Saudi Arabia and the UAE have joined to challenge Western economic dominance.

While the announcement got a lot of headlines, it had limited immediate market impact as the tariff is delayed and no details were given.

Conclusion: Can the Crypto Rally Last Through July?

With inflation data this week and geopolitical tensions building, crypto is primed towards for volatility. However, the indicators suggest the bullish pressure may continue. The August 1 tariff delay gives the markets some breathing room.

Elon Musk’s Bitcoin endorsement has retail sentiment fired up. Institutional flows from Metaplanet are backing up the long term thesis. Much will depend on the CPI report on Thursday. A soft print could increase the chances of a Q3 rate cut and give this crypto rally more fuel.

Summary

The crypto rally accelerated as Bitcoin approached $110,000, Dogecoin led altcoin gains with 6%, and the American Party endorsed Bitcoin. Musk’s “fiat is hopeless” comment caused a stir and Trump fired back at Musk’s third party plans. The tariff delay took some macro pressure off and Metaplanet’s $240M Bitcoin buy gave institutional confidence.

FAQs

Why did Bitcoin surge towards $110K today?

Bitcoin went up as the US delayed Trump’s new tariffs to August 1, the trade war concerns eased and the broader crypto rally kicked in.

What made Dogecoin go up 6%?

Dogecoin went up on retail interest, altcoin momentum and Elon’s public support of Bitcoin.

What did Elon say about Bitcoin?

He said on X that his new party; the America Party, will support Bitcoin, “Fiat is hopeless, so yes”.

How much Bitcoin does Metaplanet own now?

Metaplanet holds 15,555 BTC, worth $1.68 billion, and aims to hold 210,000 BTC by 2027.

Will inflation data affect the crypto rally?

Yes. Traders are waiting for the CPI report. A softer number could boost risk assets and take crypto higher.

Glossary

Crypto Rally – A rapid increase in digital asset prices, usually caused by good news, macro trends or investor sentiment.

CPI (Consumer Price Index) – A key US inflation indicator, watched by markets for monetary policy signals.

BRICS – An economic bloc of Brazil, Russia, India, China and South Africa—recently expanded to include new countries.

Fiat – Government issued currency not backed by a physical commodity like gold.

Altcoin – Any cryptocurrency other than Bitcoin.

Sources

Coindesk – Elon Musk America Party Quote

Business Insider – Trump vs Musk